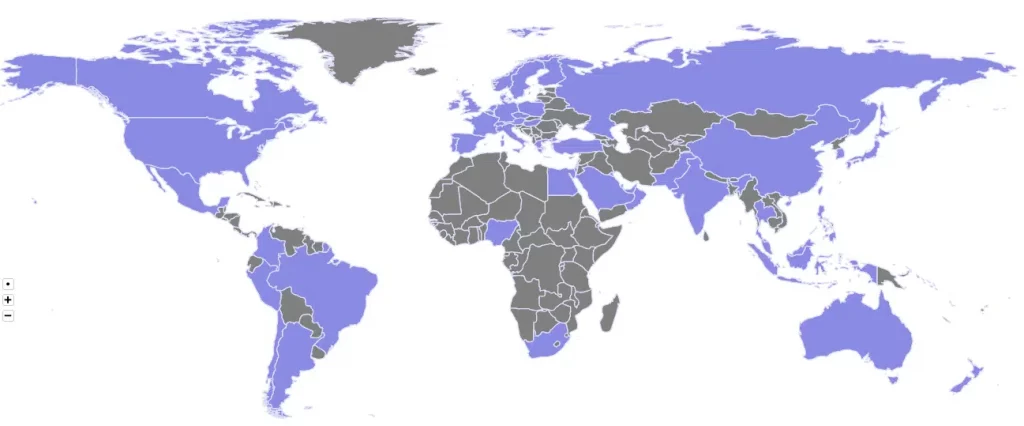

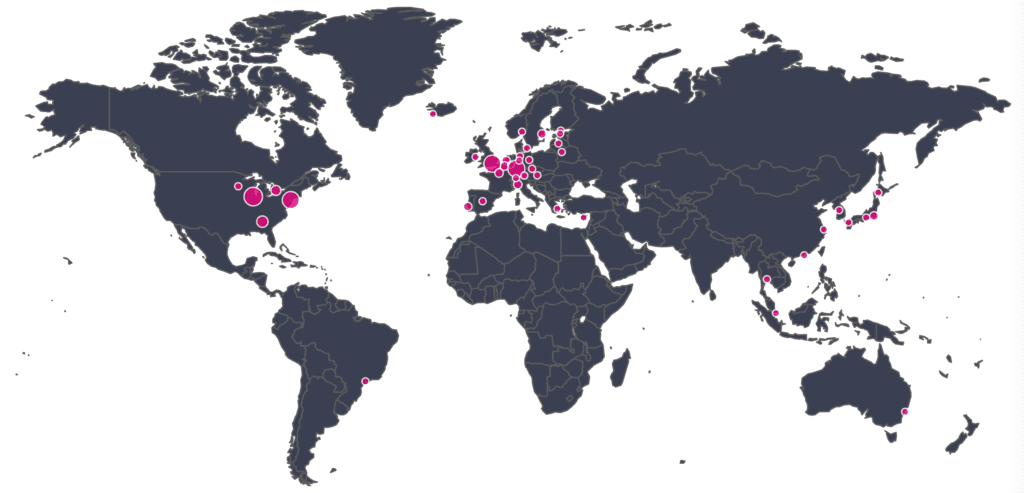

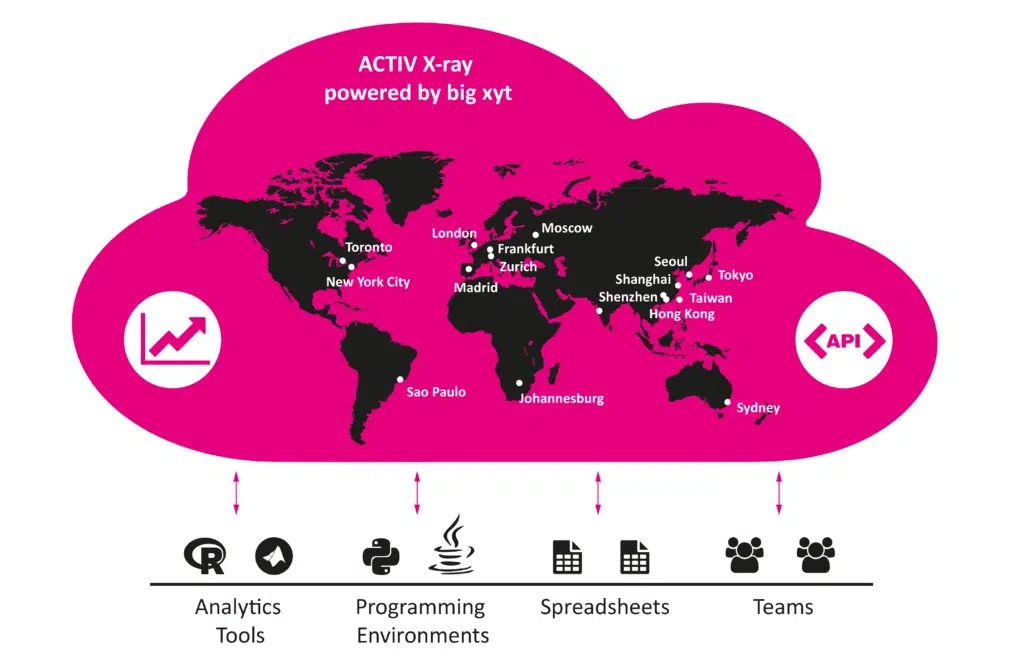

London, 14 September 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, today announced the launch of big xyt hub to enable the global trading community to integrate tick data and analytics in a more convenient and cost-effective way, via a single API. The xyt hub allows trading firms to consume, analyse and visualise all the data they require through cloud-based technologies, featuring Data-as-a-Service and Analytics-as-a-Service functionalities.

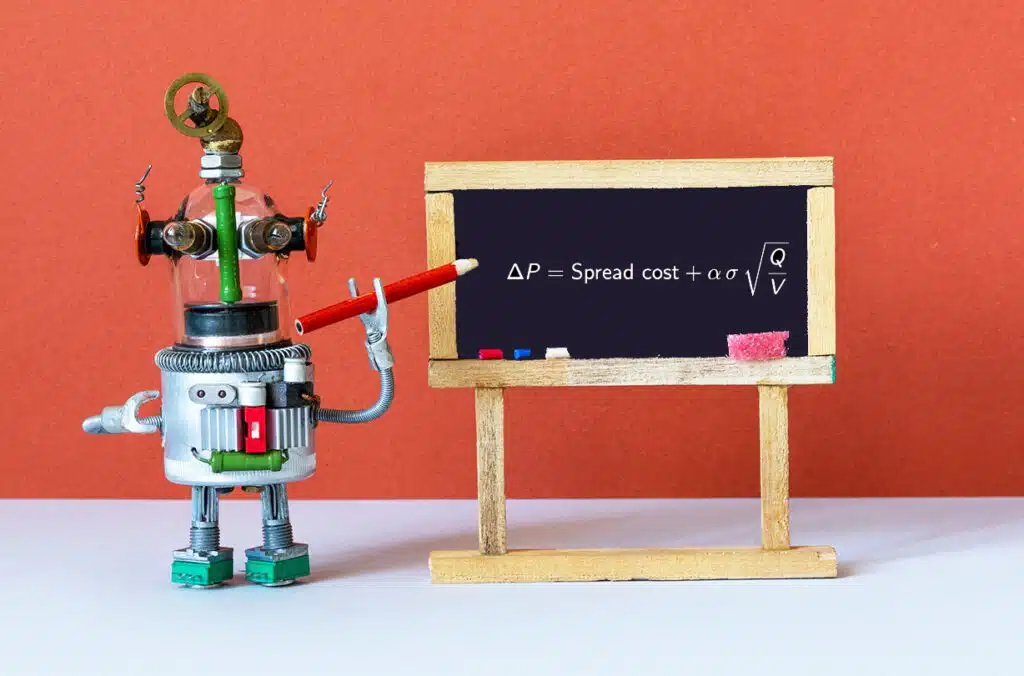

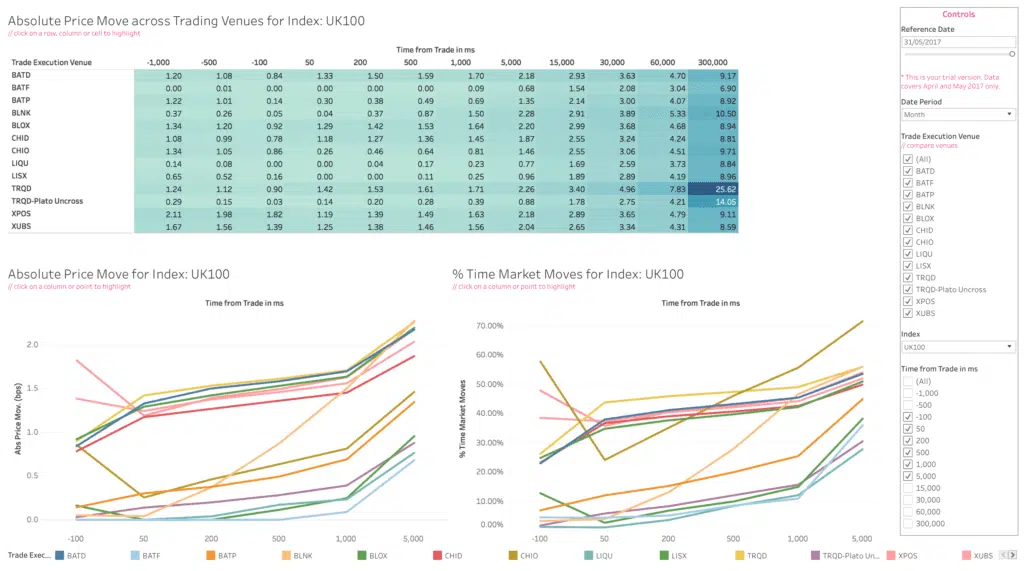

Advances in algo development, testing and optimisation, transaction cost analysis (TCA) and regulatory reporting are increasing the demand for robust, independent data and analytics. With the big xyt hub, trading firms and exchanges can immediately access tick data and analytics, without costly investment into in-house data infrastructure and storage, technology capable of managing tick data with nanosecond precision and market-by-order granularity, or indeed additional staff.

Read More