big xyt

About Us

The Trade Verification Tool enables users to quickly verify suspicious trades without being exposed to the complexity of a fragmented market across more than 30,000 listings in Europe alone.

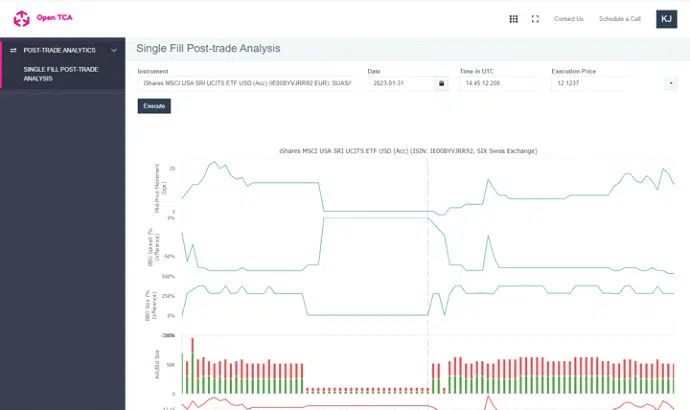

The big xyt Trade Verification Tool (an extension to our Open TCA solution for pre and post-trade execution analytics) provides transparency on ETF execution quality.

Take any trade or order and our analytics engine returns the verification of orderbook characteristics, price reversion and execution performance instantaneously.

Verify any trade of a product at any point in time with the following metrics:

This new service is available free of charge to registered users.