To some people Christmas feels the same year after year, maybe because the favourite armchair in the corner of the room is comfortable, Grandpa’s view never changes too much and he probably likes it that way – he’s seen enough change over the years.

For kids, however, each year brings fresh festive excitement; as they grow older their perspective changes and they remain curious.

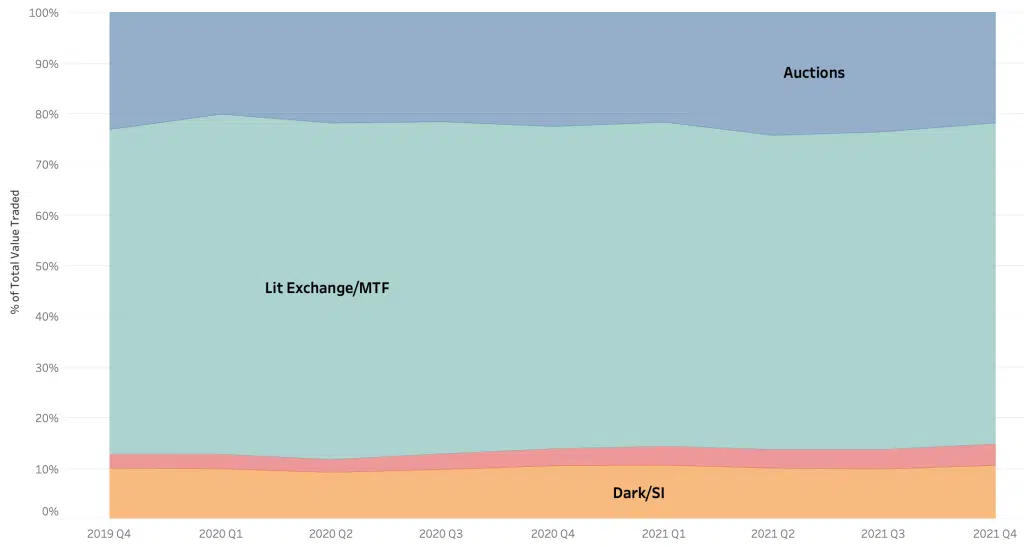

Electronic trading driven by data can result in trading patterns converging to the same view from the armchair in the corner of the room, so that even when something as dramatic as Brexit comes along, things don’t appear to change very much at all. From one point of view things have remained remarkably stable during the last two years; Chart 1 shows on book traded (lit and dark) large and mid cap activity since Q4 2019 by mechanism across pan-European securities.

Chart 1

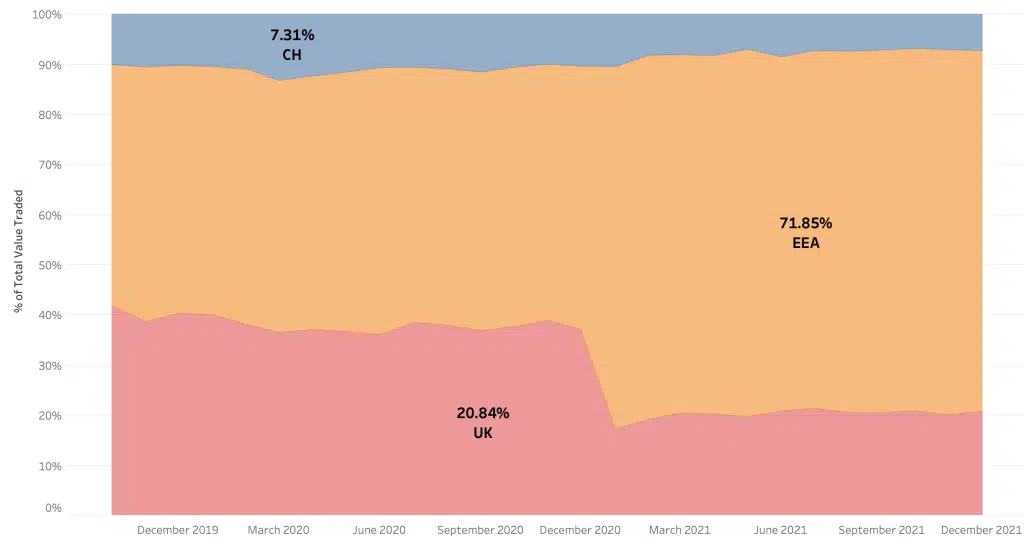

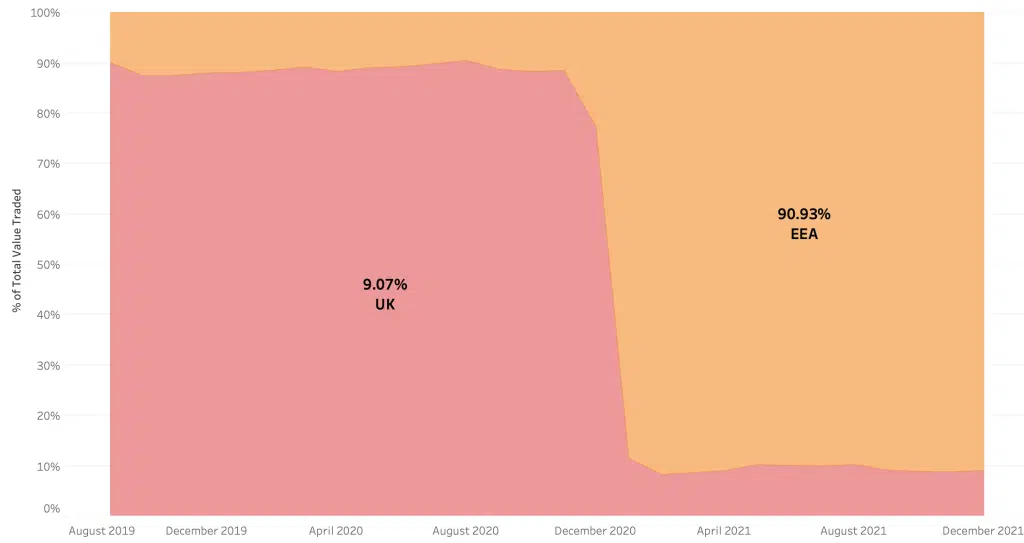

Back in Grandpa’s house, the doorbell rings, the windows are ventilating the room and all the kids arrive (with their masks only partly covering their faces, typical!), and they all ask Grandpa excitedly why the presents have been laid out so differently this year. Their perspective is different – they’re looking at the view by venue legislation and that world (where we mapped each venue to its legislative authority) is shown in Chart 2. This view sees significant changes in the landscape over Brexit for the same stock universe and trade categories.

Chart 2

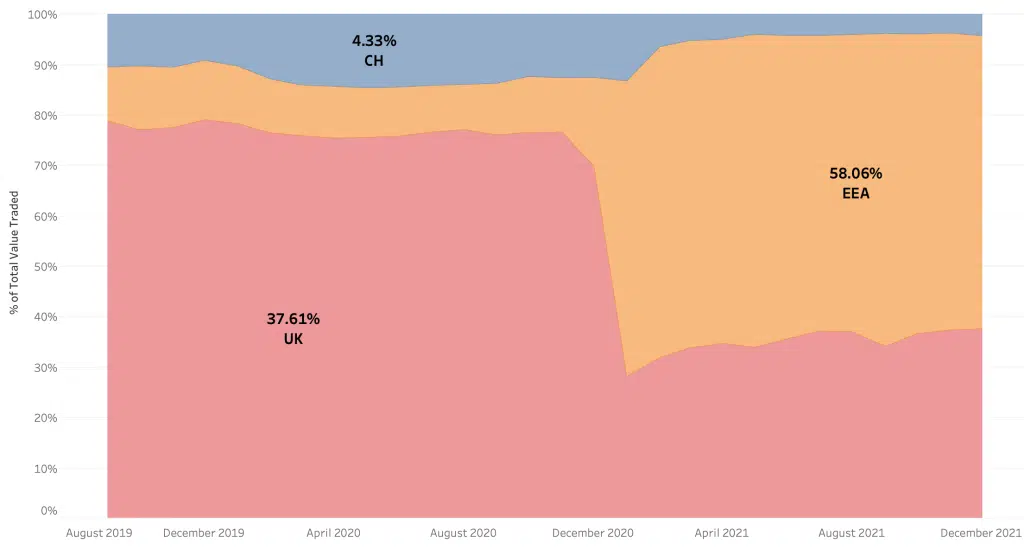

Later in the day, after a fine festive feast, everyone notices how dark it has become, and once again the view changes. Chart 3 isolates dark volumes, viewed once again by venue legislation.

Chart 3

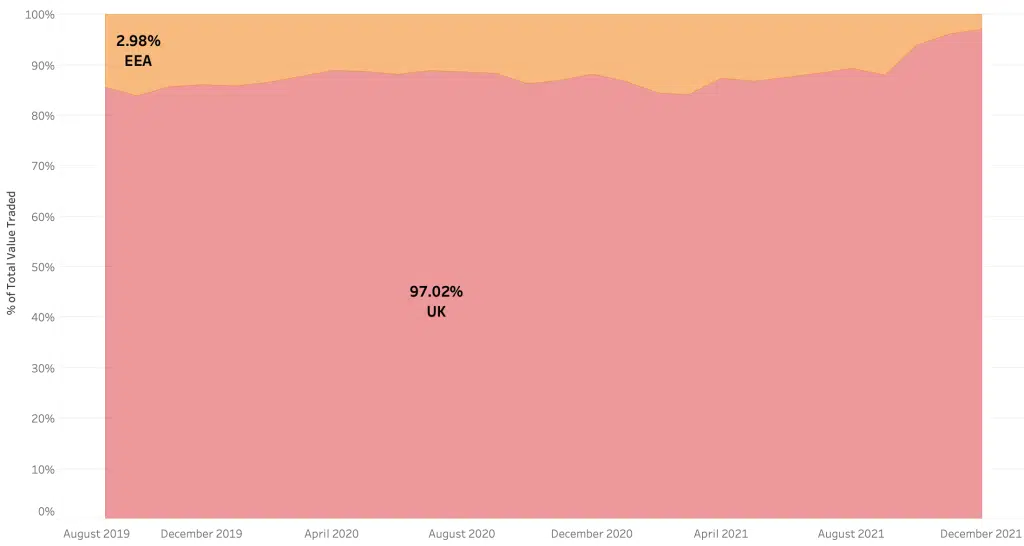

In this family, the British kids have been visited by their European cousins, and depending on who you ask, the view in the dark is different to their combined perception. The UK kids see Chart 4 (UK stocks only).

Chart 4

Whilst the European kids see Chart 5 (no UK or Swiss stocks).

Chart 5

So, there you have it – the story of evolving European market structure over Brexit, all in the shadow of a Christmas tree. Note, for those of you sensing an undercurrent of increased trading of EU stocks on UK dark pools… we don’t see it yet.

If you leave out a mince pie and a glass of sherry, you might get your wish and Santa may bring you a Liquidity Cockpit all of your own so you can monitor all these trends for yourself, and much more.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe 2022, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.