When navigating through the complexities of European equity liquidity, one could be forgiven for wondering whether, for many market participants, the changes in regulation brought about since January 2018 through MiFID II have been a help or a hindrance. MiFID II was designed to introduce more transparency. But have aspects of it made the markets more opaque? One example is around the proliferation of Systematic Internalisers (SIs). Although this category of market participant was actually introduced under MiFID I, it has only really seen greater adoption since MiFID II outlawed Broker Crossing Networks (BCNs) and in so doing blocked the systematic matching of client to client orders. The SI regime created an alternative way for investment banks to match proprietary

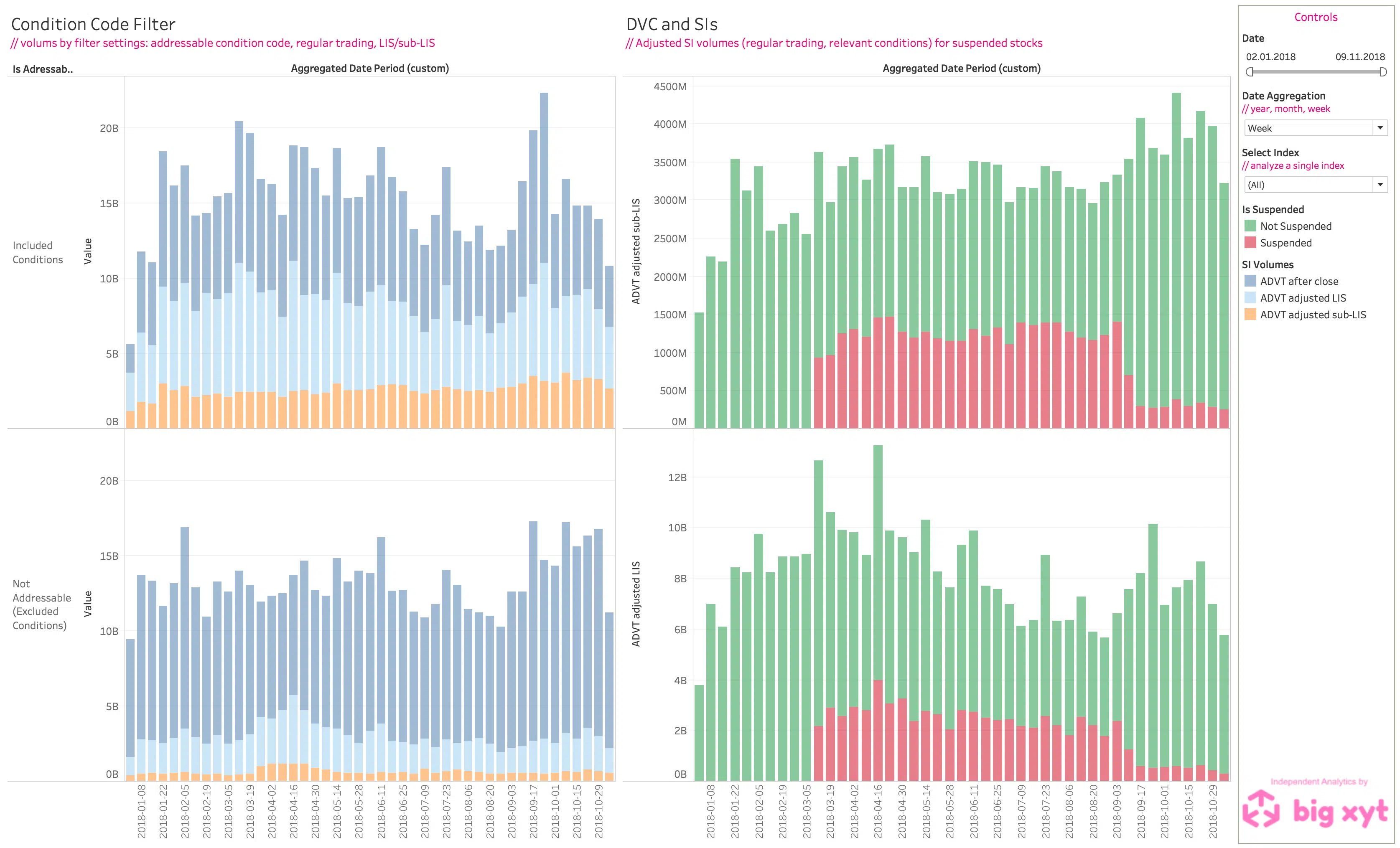

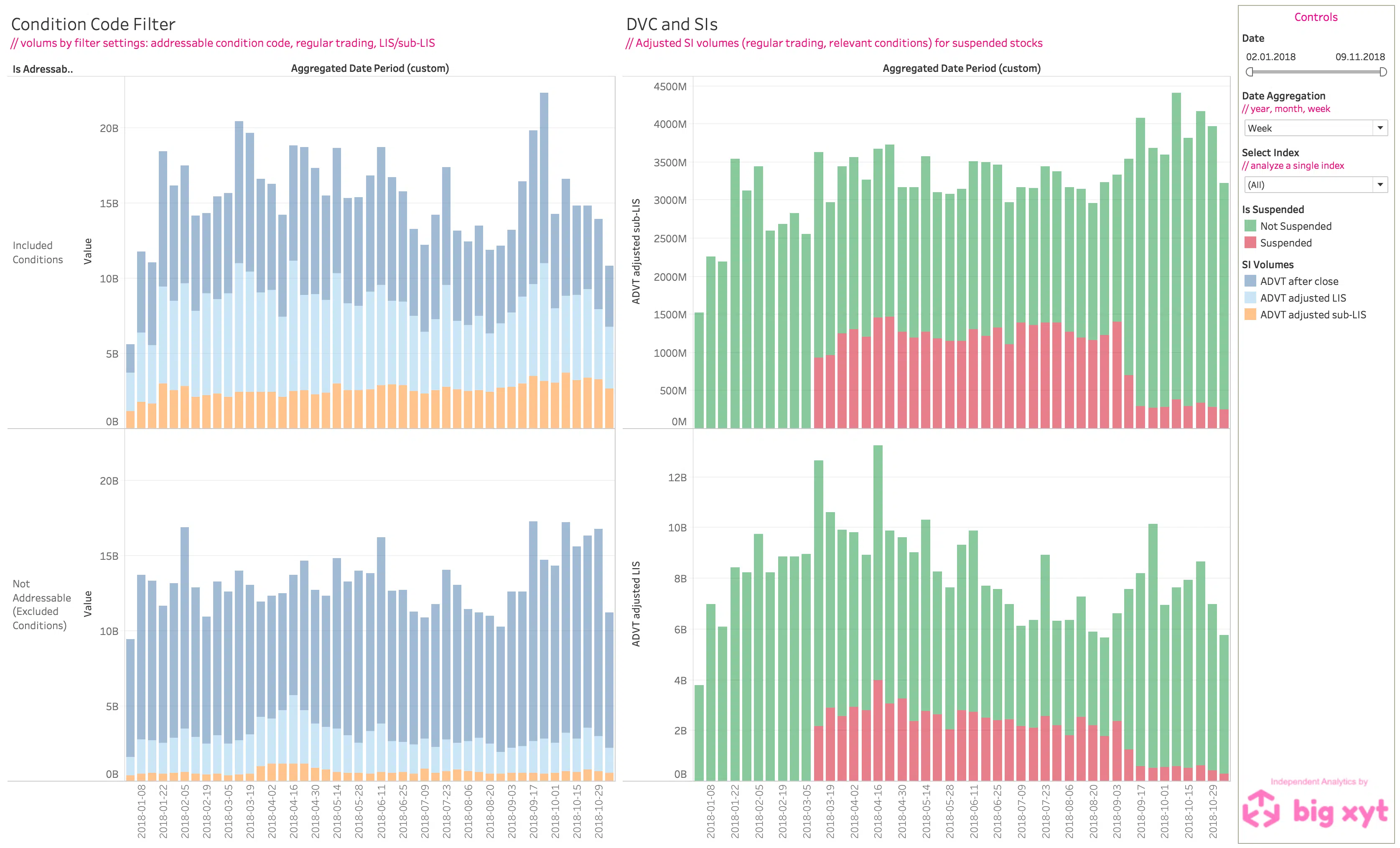

London, Frankfurt, 15 November 2018 big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce further client driven enhancements to its Liquidity Cockpit. With the introduction of a dedicated dashboard for analysing SI volumes, eligible users have the option to view and compare the reported SI volumes filtered by adjusted conditions, analysed by time, by region or by symbol. This new dynamic visualisation leverages the recent release extending the adjustment of SI volumes and the range of enquiry options and filters available. Users are now able to better understand the component parts of total SI flow reported. Furthermore, this additional value added functionality introduces comparisons to other market activity such as Large In Scale (LIS) trades and the impact of Double Volume Caps on liquidity dispersion over time.

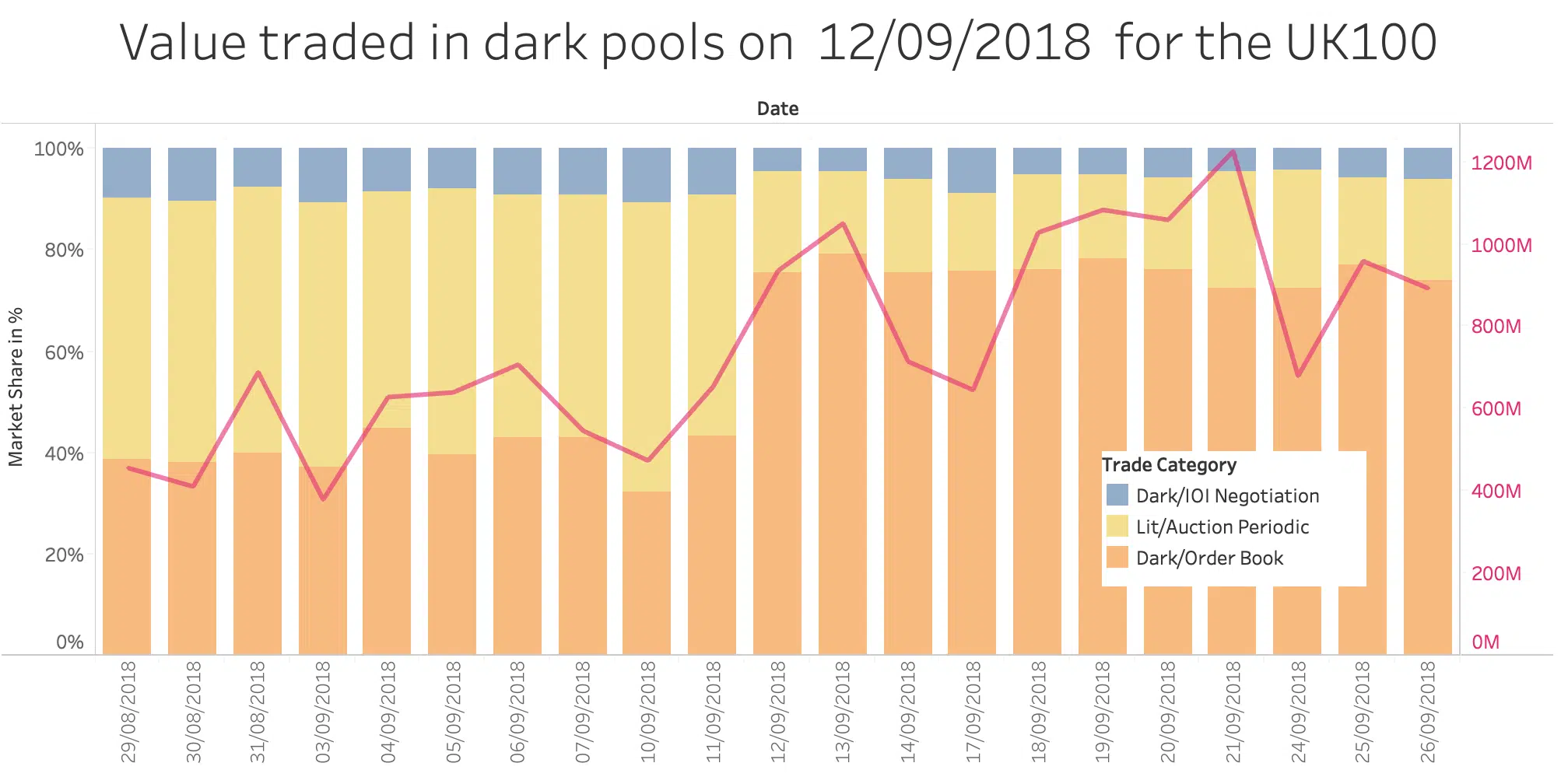

The introduction of the double volume cap (DVC) mechanism as part of MiFIR has heralded a new era in European equity trading, limiting for the first time the universe of securities that can be traded on dark pools. Nearly eight months on from the first DVC suspensions, we can begin to assess how the new regime is working and how the market is adapting. When it first kicked off the DVC framework in March 2018, the European Securities and Markets Authority (ESMA) acknowledged that data quality and completeness issues had delayed implementation by two months, but since then it has kept its public register regularly updated to give market participants full transparency on instrument suspensions.