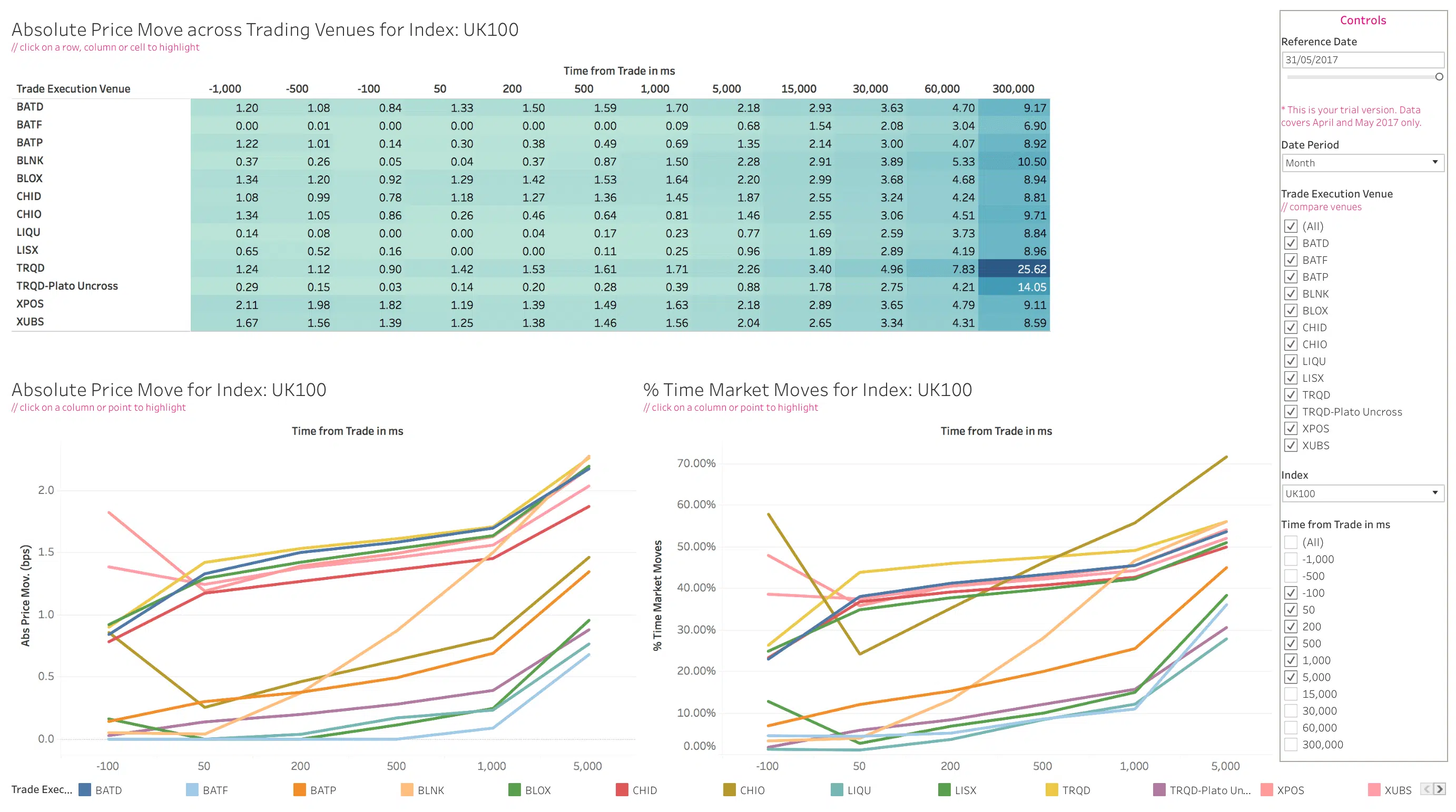

The market impact dashboard offers various measures to estimate expected transaction costs. It allows to investigate the price change before and after a trade. The measures are calculated on every single trade for all securities across venues and trading days. The interactive dashboard provides essential insight for trading firms as it helps to understand average market impact in dark pools. This information allows firms to reduce transaction costs by optimizing their trading and execution algos. The market impact analysis consists of the following two measures: Price Impact (prior and after the trade): the difference between the mid price (as-of-trade) and the mid prices preceding or following the trade during given time distances from the trade time. Ratio of Market Moves in % (number of trades with an observed price change>0 at a particular time point – prior and after each trade): the ratio of price changes>0 observed during given time distances from the trade time.

Monthly Archives: August 2017

Filter by:

Categories

-

In the Media

-

12 Days of Trading 2024

-

12 Days of Trading 2023

-

News

-

Views

-

European Equities Microstructure Survey

-

European Market Structure Microbites

-

12 Days of Trading 2022

-

12 Days of Trading 2021

-

12 Days of Trading 2020

-

12 Days of Trading 2019

-

12 Days of Trading 2018

-

X Days of Isolation

-

Uncategorized