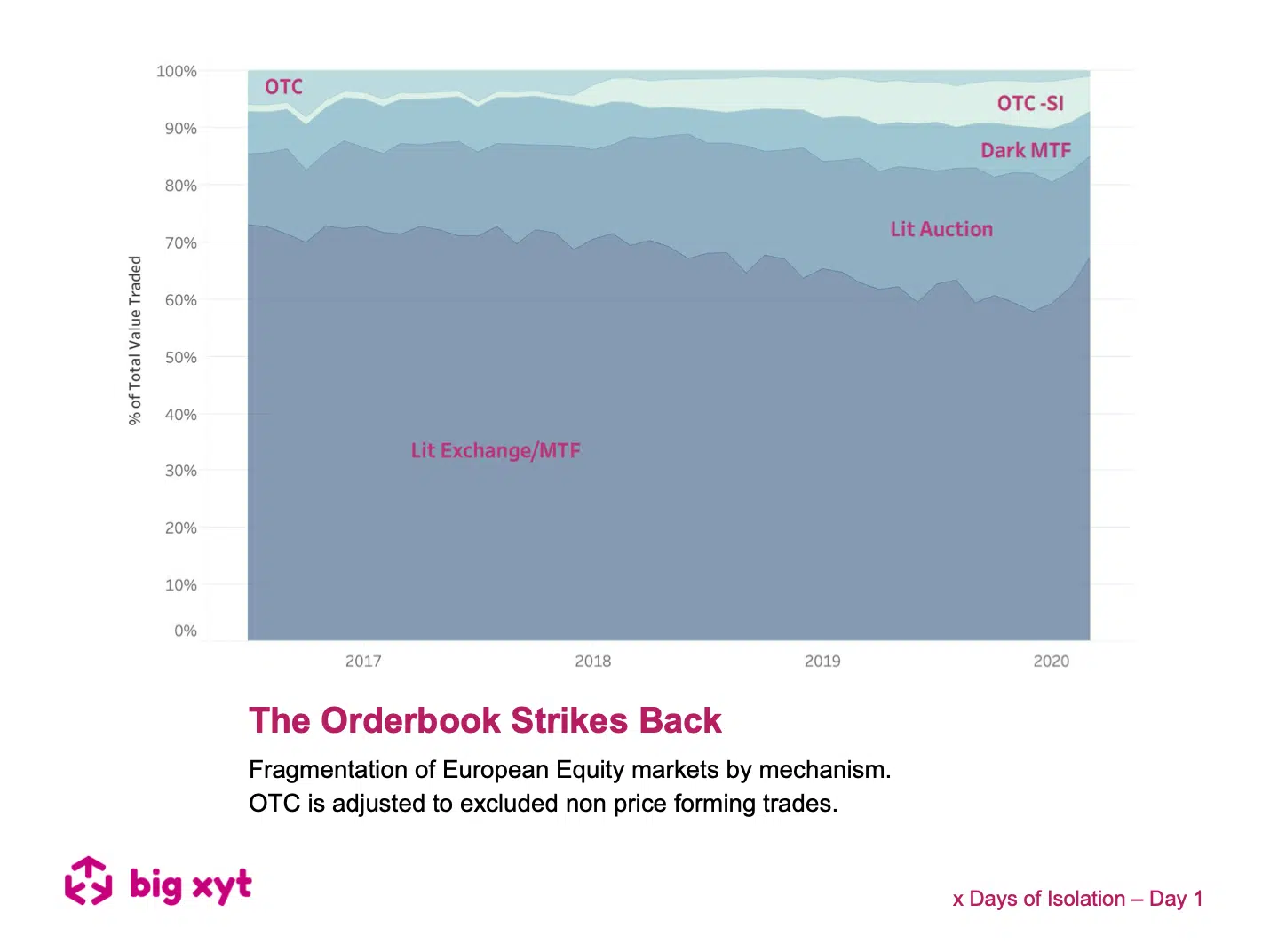

It is not news to anyone that trading volumes have simply exploded this month to record levels. We put some eye watering facts and figures on this in a historical context and look at one surprising finding; the distribution of volumes throughout the trading day has hardly changed at all. Do we detect the cool hand of trading algorithms behind this remarkable observation ? We ask some questions as to why this might be, and reflect on how far we have come with electronic trading. Article We mentioned earlier in the week that volume was returning to the lit order books from other types of trading venue – such as the end of day auctions. Just taking trades executed electronically on lit markets, we find that volumes increased from an

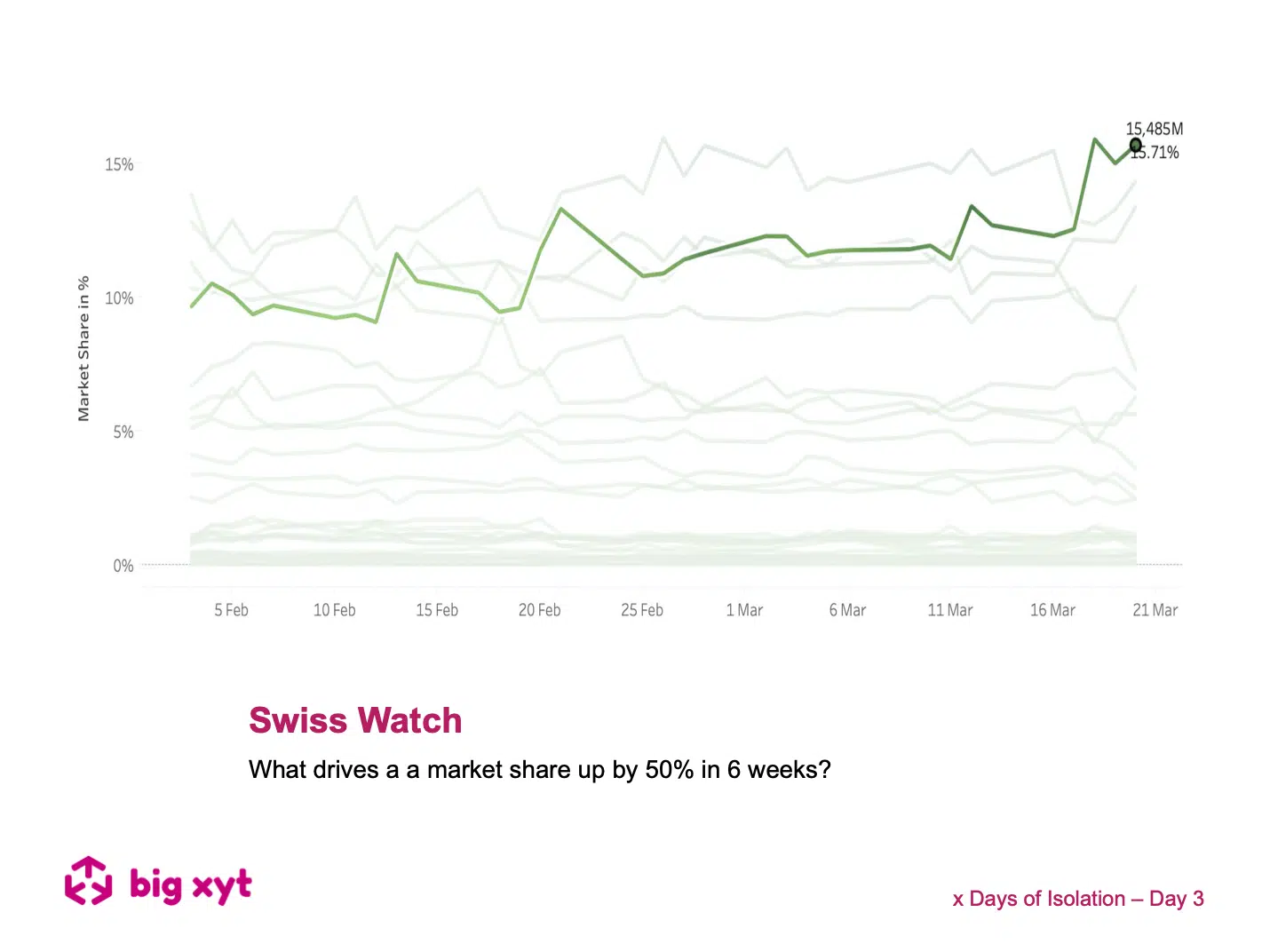

The chart today shows the changing market share of European Equity trading venues during 2020.The highlighted line is the focus of the following observations. Last Summer when Swiss non equivalence was announced, overnight competition from MTFs was outlawed and the SIX Swiss exchange saw a 25% increase in share from 8% to 10% of European equity turnover. Without any legislative announcements, something even more dramatic has transpired since the beginning of February. The same venue has just grown its share by a further 50%. At the beginning of February the Swiss market was the fourth largest European venue by turnover with just under 10% market share.

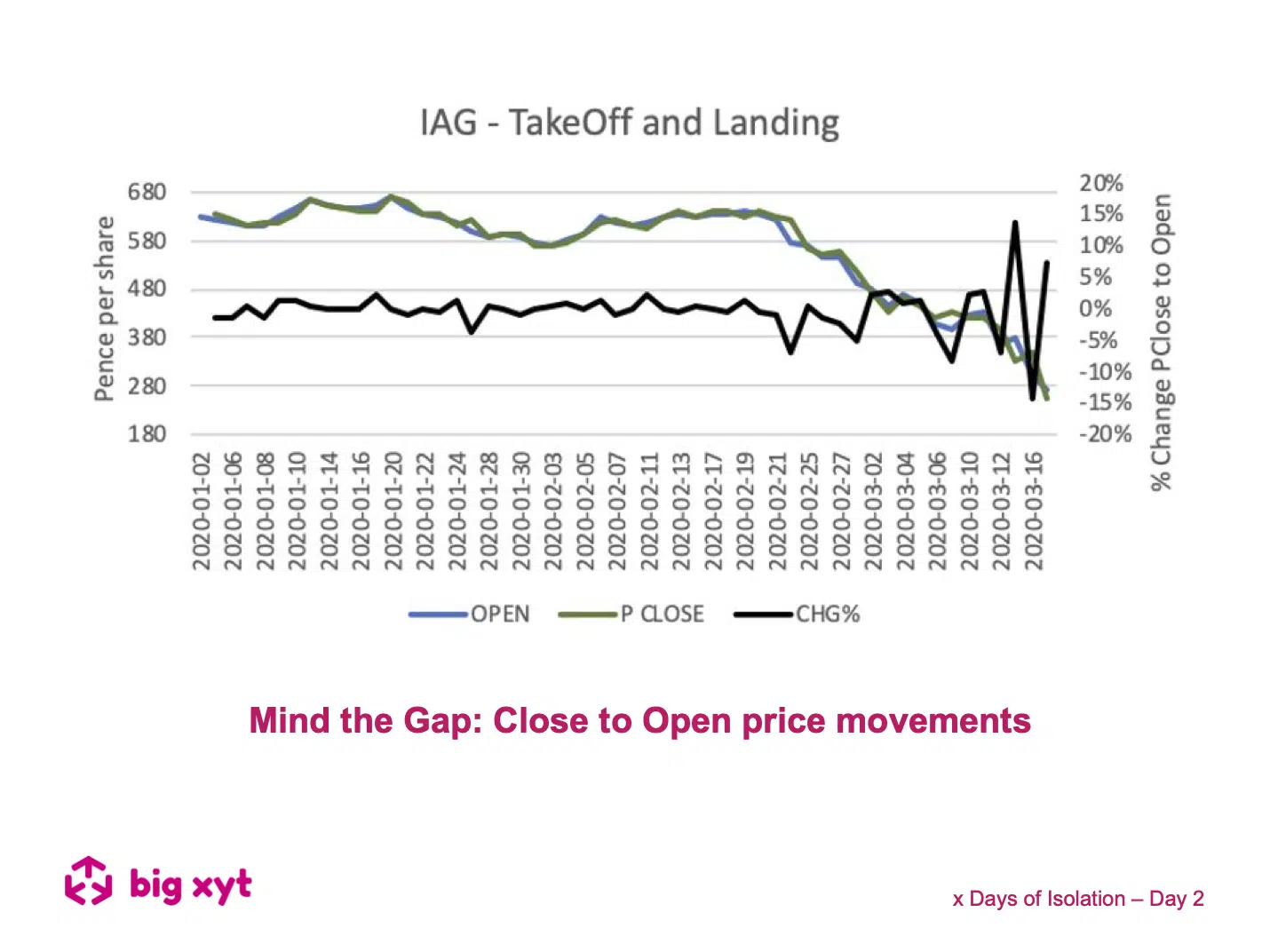

In this article, we look at the difference in price between two major benchmarks, the Previous Close and the Open – the ‘overnight gap’. The equities market is only open for around 8 hours a day 5 days a week, or just under 24% of the time, leaving 16 hours (more at the weekend) for investors to absorb news from around the world and decide what to do next. The market Open can be thought of as a catch up on price formation. By keeping an eye on the volatility of this gap over time, we get a feel for whether the market is stabilising or destabilising and it can be a useful barometer of whether a consensus is forming. At the moment, there is no sign of that happening.

London, Frankfurt 24th March 2020 – big xyt, the independent provider of market data analytics, is pleased to announce Richard Hills has joined their executive team as Head of Client Engagement. Working alongside Mark Montgomery, Head of Strategy and Business Development, Richard’s appointment will accelerate the implementation of big xyt’s 2020 strategic business plans. Based in London, Richard joins big xyt from Société Générale, where he launched and built the equities electronic trading business, going on to become Global Co-Head of Cash Equities Execution encompassing electronic, program trading and high touch execution.

During these unprecedented times we do not underestimate the professional and personal challenges that everyone is facing. There are far more important things to be doing in the community than looking at a screen. However, data and data analytics is playing a critical part in providing solutions to the current global crisis. Furthermore, the markets remain open and whilst they do, the trading community needs to be well informed in order to understand the changing market landscape. As a result, big xyt is receiving an increasing number of requests for observations of changing trends and behaviours in the equity markets. We are excited to have recently expanded our London team to enrich our content and support for clients seeking greater market insights from an independent source. Whilst many adjust to the new experience of working from home we plan to share some of these thoughts, observations and questions in the coming days & weeks.

Having a large international financial institution going live with our API for advanced execution analytics at the beginning of the year was a great way to start. Throughout 2019 we have on-boarded a record number of new clients and have been very pleased to be nominated and more importantly win a number of industry awards in recognition of our reputation for delivering independent analytic solutions. Becoming the de-facto reference for all major European exchanges has been the icing on the cake. What does 2020 hold in store for the business? We already see a growing trend for outsourcing data analytics. By delivering our solutions as a trusted and independent partner we are able to facilitate the business transformation our clients need by allowing them to concentrate on their own proprietary needs.