big xyt is the leading provider of independent analytics in Capital Markets for exchanges, brokers, buy-side clients and analysts. Our products cover market structure, algo development and execution analytics. In the webinar hosted by Tableau you can learn How we enable users in trading, portfolio management and sales to discover information quickly, e.g. understand the dynamics of market structure or changes in execution performance. How business users easily create their own reports without any programming skills (for internal and external use).

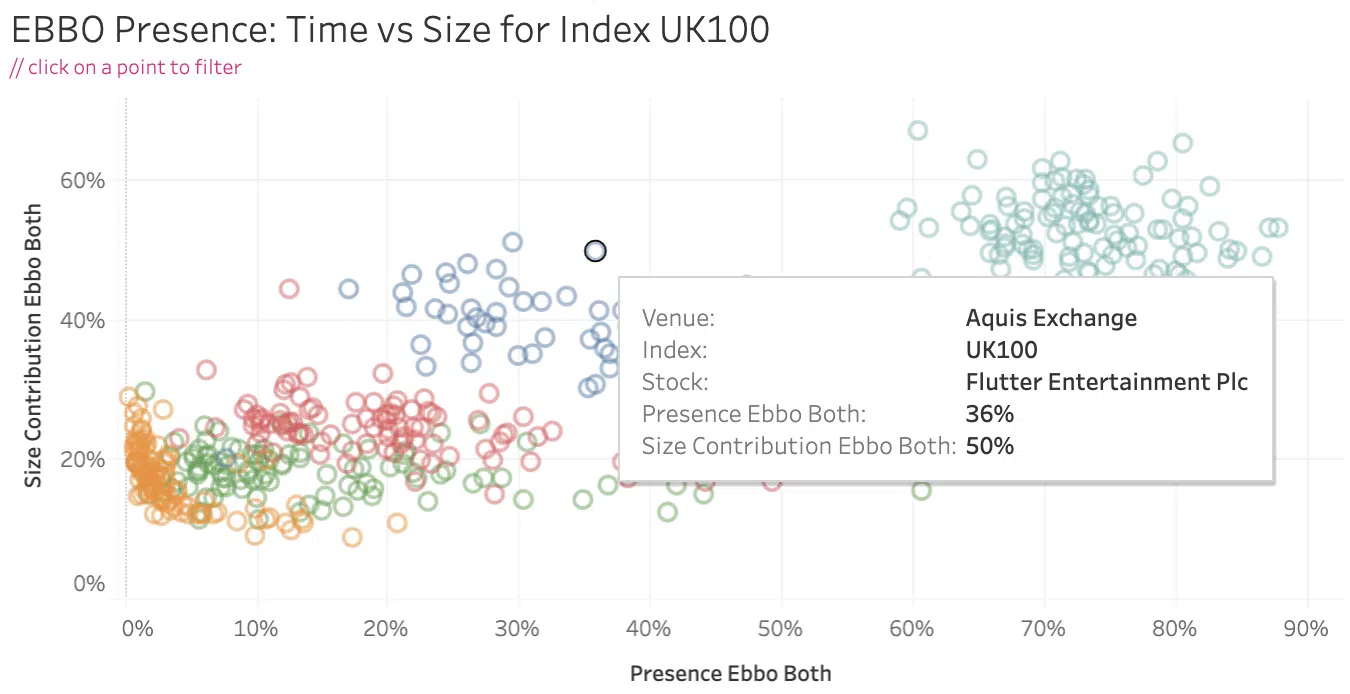

London, Frankfurt, 21st April 2020 – https://big-xyt.com/, the independent provider of market data analytics, is pleased to announce that Aquis Exchange, the subscription-based pan-European equities exchange, is implementing Liquidity Cockpit to support market structure analytics used internally by the exchange and for their clients. Award-winning big xyt solutions capture, normalise, collate and store trade data at a granularity that has not previously been available in the market. By applying data science and advanced techniques to execution analytics, Liquidity Cockpit delivers a unique range of market overviews and individualised comparison reports to the team at Aquis Exchange.

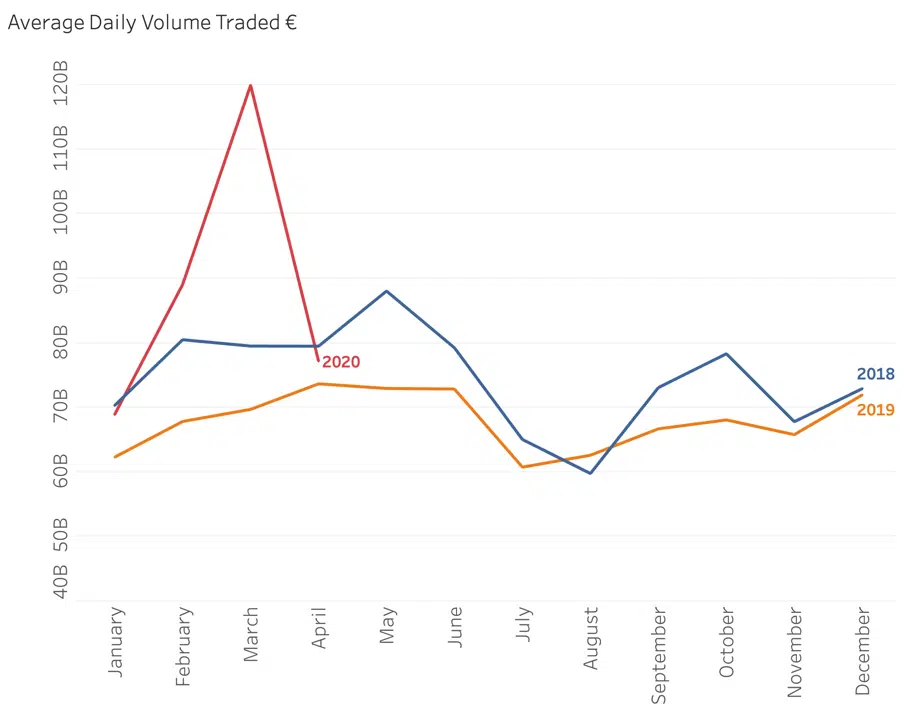

Following a bumper month for European Equity trading volumes during the Great Sell Off it seems that we may be reverting to type. Daily traded value broke through the four year record high of 148 B€ on no less than 7 days, peaking at a little under 180 B€. Then the March ADV of 120 B€ fell to just 77 B€ ADV in April, slightly above the average of 73 B€ for the full year of 2018 (67 B€ for 2019). This rally is based on much lower volumes than the crash, which are rapidly approaching the ever-decreasing long term average. Perhaps investors are not as convinced as prices imply, or maybe there is more cash to come back into the market to sustain its ascent. It would be more comforting to see a rally with some decent volumes behind it. Buyer beware.

For four hours on Tuesday liquidity dried up on the primary market in Germany (plus some other XETRA powered markets) due to a technical outage. Not for the first time we observed the importance of the primary exchange in a fragmented marketplace. The chart shows volume traded on all European venues across 5 minute bins from the opening auction through to the end of continuous trading for German Large Cap Stocks. We can see all trading mechanisms reduced to virtually zero activity when the the primary market is not available. The participants normally active in Dark Pools, Periodic Auctions, competing alternative Lit venues and Systematic Internalisers all lost their appetite for business when their reference prices evaporated.

Recent market volatility has created a domino effect of changing market behaviours as investors struggle to understand changing liquidity patterns. big xyt has received an increasing number of requests from the community for guidance on market quality as the exceptional trading conditions persist. As a result of these enquiries, additional content is being added to the unique Liquidity Cockpit which provides a consolidated view of the European Equity Market landscape.

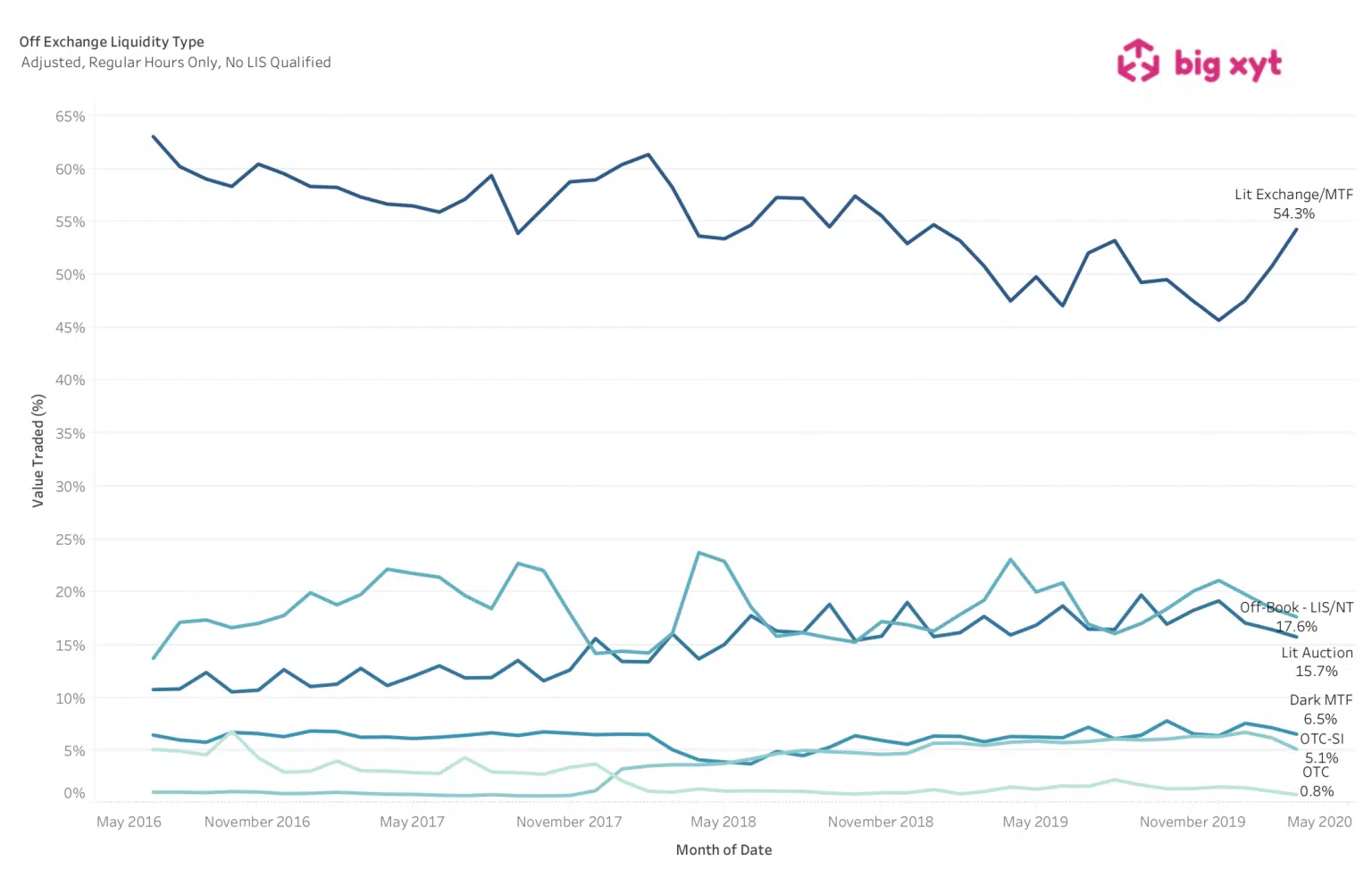

Following our first post in this series, a number of people have asked if the trend we observed has continued over subsequent days. The ingredients are consistent – uncertainty, volatile markets, and unpredictable liquidity leading to opportunity cost with other less immediate execution pathways. It is no real surprise to see lit markets continue to maintain market share at the expense of all other mechanisms. At big-xyt we can provide daily volume curves for users and algo developers in 12,000 instruments and all significant venues, as well as many other essential trading metrics. If you are interested in letting us do some of the heavy lifting for your algo infrastructure please get in touch.