Tolkien had them as tall, fast runners and excellent archers. The Grimm brothers portrayed them as short but benevolent shoemakers, and the Christmas tradition as hard working folk, who with the reindeer, form a magical team of the Fast and the Fairy-ous.

Talking of Odd Lots, plans are afoot in the US to implement many new rules governing NMS and the associated market data infrastructure. One such change relates to the reduction of the so-called ‘Round Lot’ size to which NMS protection applies. This size underpins the whole concept of the NBBO because it is the size at which a market maker must provide quotes, a venue must publish to the tape, and a broker must ensure execution. The new rule reduces this size from 100 shares to 40 shares for names with a price from $250 to $1000 and we estimate will affect around 200 of the most liquid names, representing some 30% of ADV. Here we examine the potential impact on trading costs.

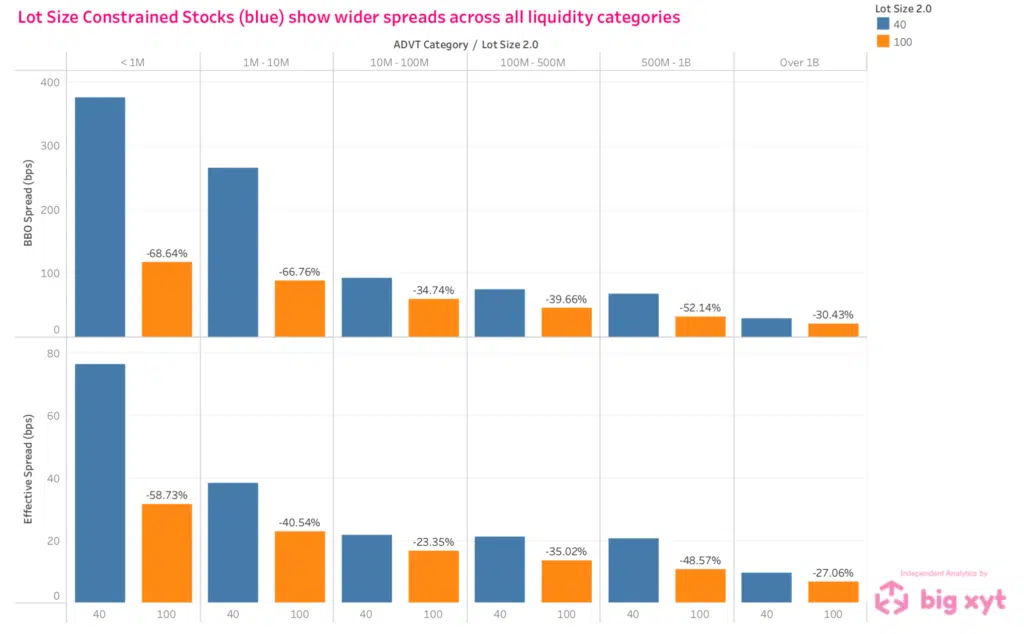

In our first chart, we show the current spreads (both quoted and effective) for shares that are priced above and below this $250 threshold, categorised into ADV buckets. The blue bar consists of shares that are priced above the threshold, and are therefore ‘constrained’ by the current Round Lot size of 100 shares but will become eligible for the new 40 share threshold. By moving to the lower threshold, the idea is that average quote sizes will become smaller and spreads will narrow. The orange bar represents the lower priced shares that already have narrower spreads that result from smaller quote sizes.

We can imagine that spreads in the higher priced shares will gravitate to those in the lower priced shares, providing anticipated benefits in the region of 30% to 50% improvement.

To get to grips with this, let’s take Mastercard. With a price of around $345 and a Round Lot size of 100 shares, NMS protection applies to orders of 34,500 USD or greater. The new rule reduces the Round Lot size to 40 shares, meaning that the market makers can quote in sizes of 13,800 USD or greater, and smaller orders will benefit from NMS protection. This means that less risk must be committed to making the NBBO on any given venue. It also means that, in theory, more orders that today are ‘Odd Lot’ orders could be placed directly onto Lit venue order books that will further enhance the price formation process.

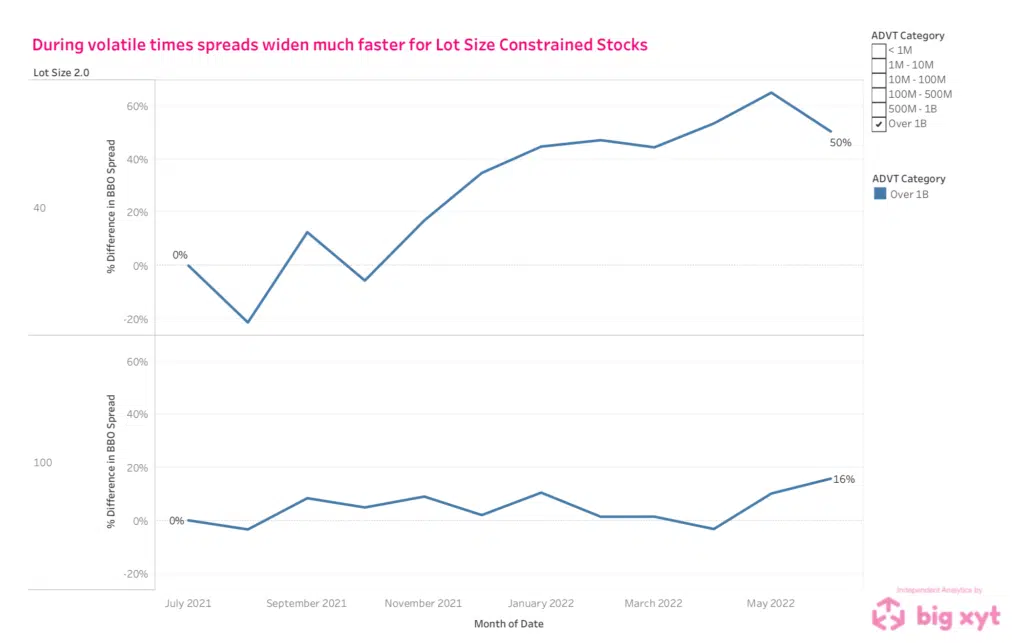

In our second chart we looked at how spreads have widened in the most liquid names in the US universe – those over $1bn ADVT – during the volatile conditions of 2022 and by comparison with July 2021. We noticed that spreads in the higher priced category (again, those that are eligible for the new round lot size of 40 shares) increased substantially faster and further than those in the lower priced category – by 50% to 16% – suggesting that the new Round Lot size could bring greater benefits of better price stability during volatile conditions.

There is much to be done, and there are differing opinions in the markets about the impact of the new changes. For this piece we have used our Liquidity Cockpit Global Edition that enables our clients to explore market microstructure rule changes and other matters all over the world. Please share your thoughts with us on these important changes in the US and follow us as we develop more interesting measures and statistics.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.