In the search for liquidity, particularly whilst minimising market impact, a means to identify large trades and where they take place is key for the investing community.

The regulatory changes in MiFIDII introduced the concept of Large In Scale (LIS). No, not not a post-Brexit way to limit fishing quotas, rather a means to identify large transactions in financial instruments. In the equity landscape this has resulted in some confusion post-Brexit.

Depending on the activity in each individual stock, an LIS threshold was set, above which the trade could be classed as a block trade. As Broker Crossing Networks were abolished at the same time, this LIS threshold was applied as one of the permissible justifications of many venues supporting dark trading.

With the onset of Brexit, activity in the majority of continental European stocks (excluding Swiss) shifted away from UK venues to existing and newly formed EU venues.

As a consequence of the reduced turnover in the UK, the FCA observed continental European stocks as, by definition, illiquid. A dramatically different LIS threshold is applied to illiquid stocks, generally €15,000, instead of the typical liquid block threshold ranging from €200,000- €1,000,000.

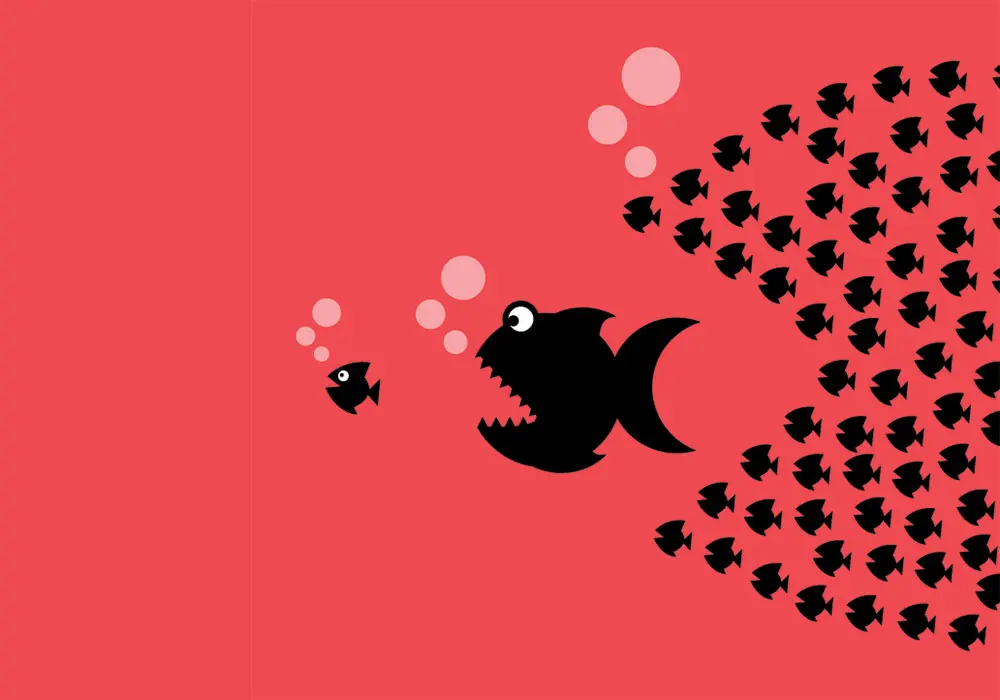

This has opened the door for UK-based dark venues to match much smaller trades in EU stocks and see them classified as blocks if they are above €15,000 notional, in effect, Small In Scale!

At big xyt, in an effort to provide greater transparency, we have decided to address the issue by removing the dilutive effect of the noisy “SIS” trades which represent a tiny 2-5% of dark trading. In our analysis we are revising the application of block thresholds to mean BLOCK thresholds.

To do this we will be applying the threshold calculation based on each stock’s primary listing venue. That way, results will meet the higher threshold rather than the lower ones. We record (and can still identify) the small “LIS” executions for those who wish to review these trades, however we believe that the community needs to be able to see true block activity.

This is the rationale behind the latest changes to our LIS dashboards in the Liquidity Cockpit upgrade this weekend, and if you’re a data scientist, this is all available through our API.