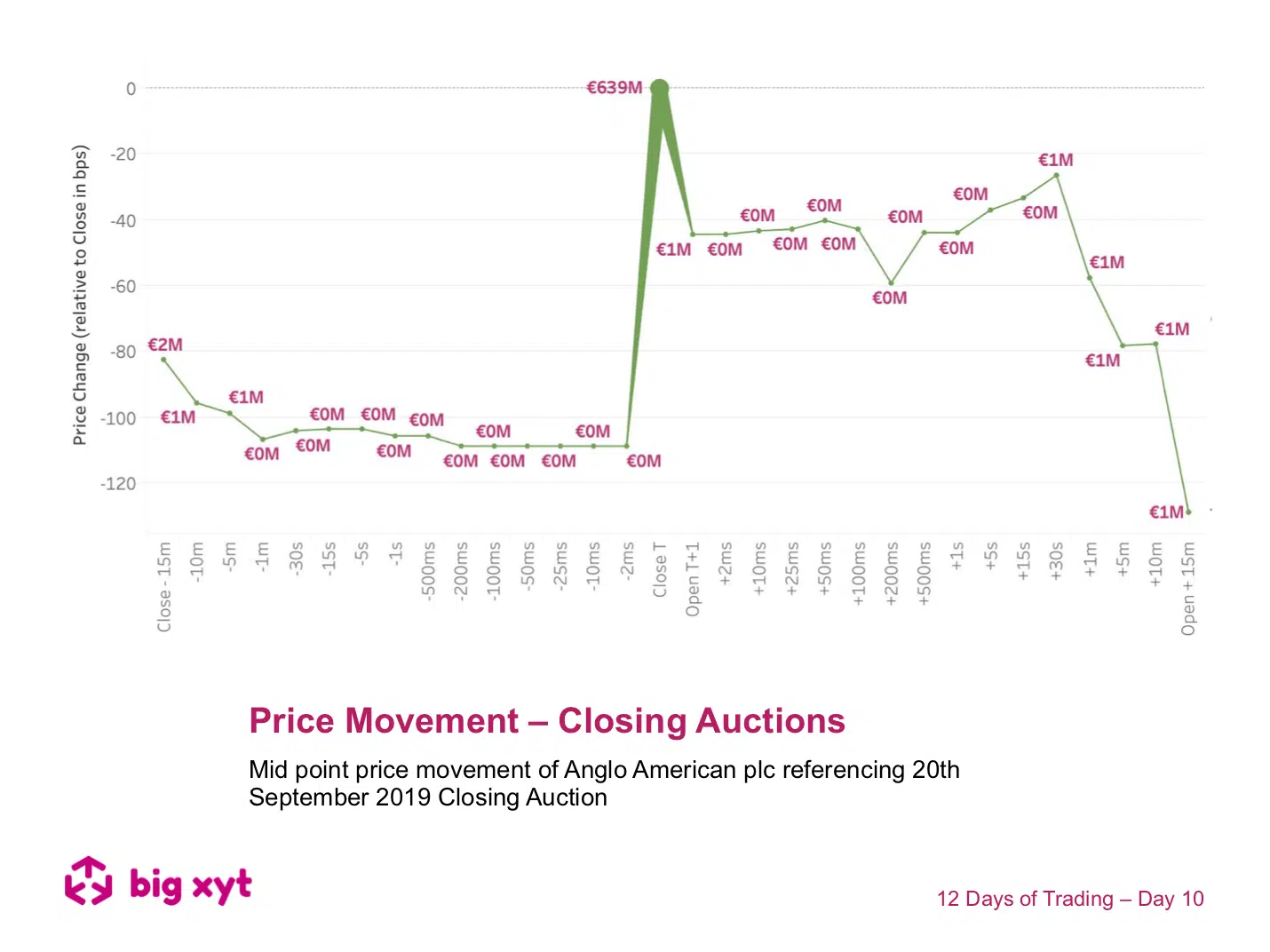

Following previous observations of the growing significance of the closing auction we felt curious as to whether a benchmark price should be the best driver of liquidity. As we saw yesterday, investors were quick to embrace the opening auction and trade more throughout the day when trader/fund manager conviction is higher such as last Friday 13th. So what happens on days when closing volumes are greater, such as index rebalance and derivative expiry days? As you may have seen, we have examined intraday price movement in the past to compare market mechanisms. Today we are introducing a view of movement around the closing price.

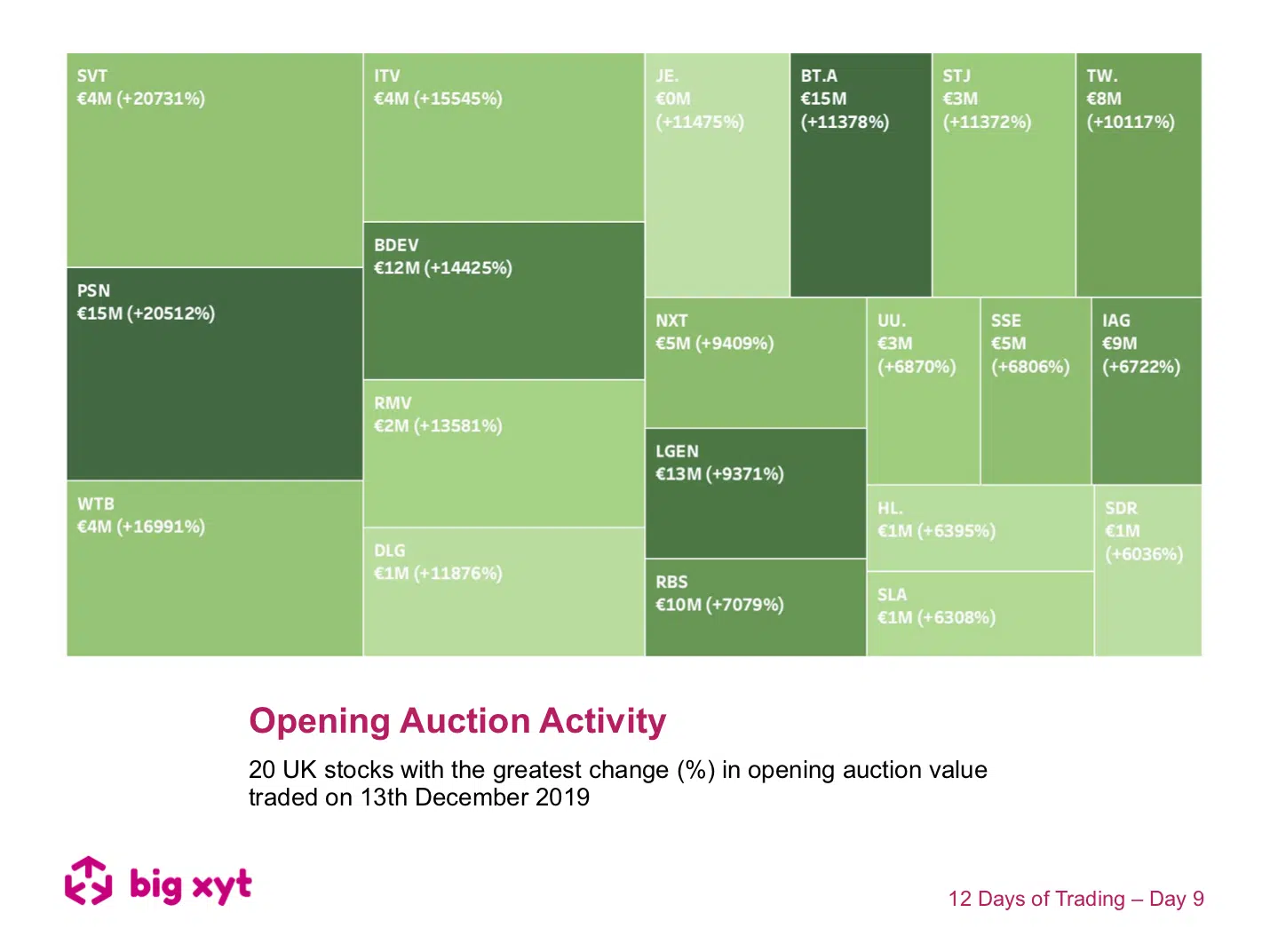

On the morning after the General Election, the chart shows the 20 stocks with the greatest percentage change in opening auction turnover. This could be taken as a proxy for company sensitivity to the political implications as investors acted with both speed and size. This sample is limited for ease of view and the full universe can be viewed and normalised by block size, for example, or absolute value traded. Let us know if you would like to see similar results for block trades during the rest of the same day as investors scrambled to adjust their exposure. Liquidity Cockpit users are able to look at any stock this way and see the venues broken down. Clients using our

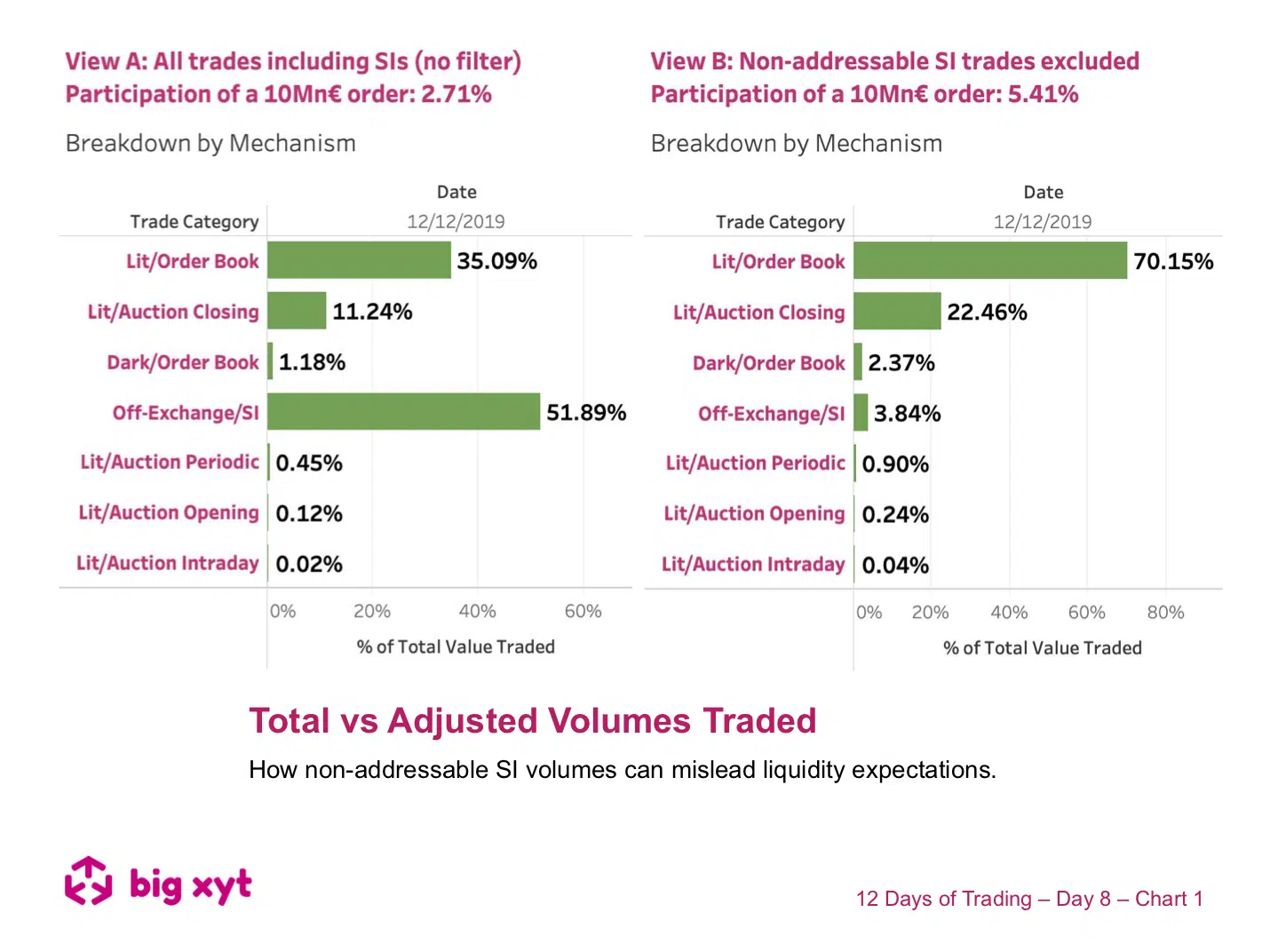

Understanding where the expected liquidity is available is key to any participation strategy. However, if your assumptions relating to expected liquidity include all reported trades, you could find yourself starting from the wrong place. This example looks at Munich Re shares traded on the 12th December (a relatively “normal” day before the UK General Election results were announced). A typical institutional sized order of €10Mn would need to be careful not to impact the market. In view A, on the left, the order represents 2.71% of the days total reported turnover in the stock. But how much of the Systematic Internaliser (SI) volume is unaddressable and gives an over optimistic picture of available liquidity?

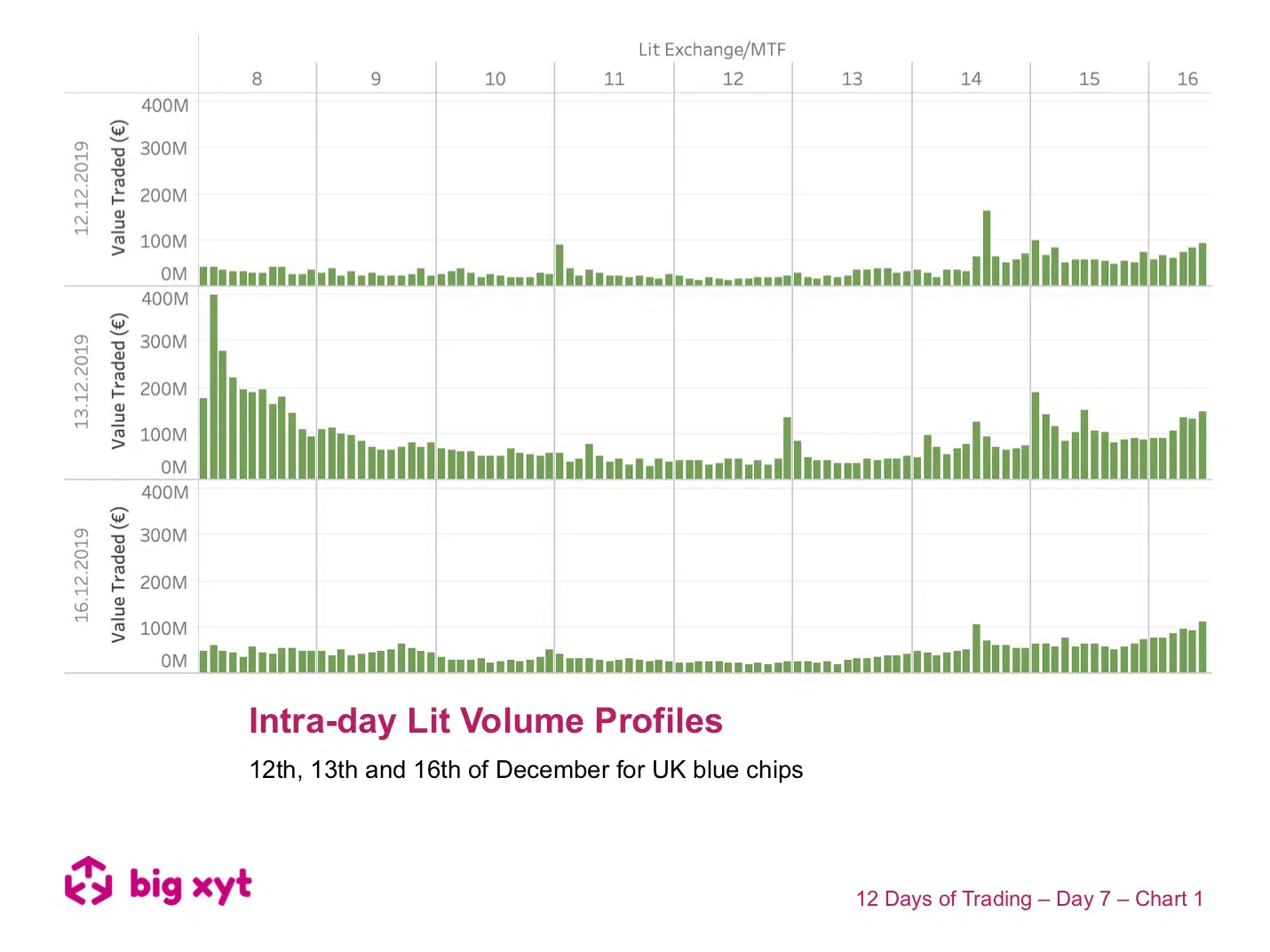

There was too much happening on Friday not to revisit how the General Election result shifted traders’ focus from liquidity based benchmarks to urgency of execution. Having seen the increased opening auction activity on Friday 13th, we wondered if it was unlucky for some router configurations as they did their best to navigate a non-standard day of liquidity profiles? Today we have two comparative sets of charts to introduce and examine the intraday volume profile (in this case for UK blue chips). If this was your crystal ball you would have used it on Friday, for example, to target the volume weighted average price (VWAP). In chart one we see how lit volumes, split into five minute buckets, vary through the continuous trading session (i.e. not including the open & closing auctions). The top chart is polling day (12th) the middle chart

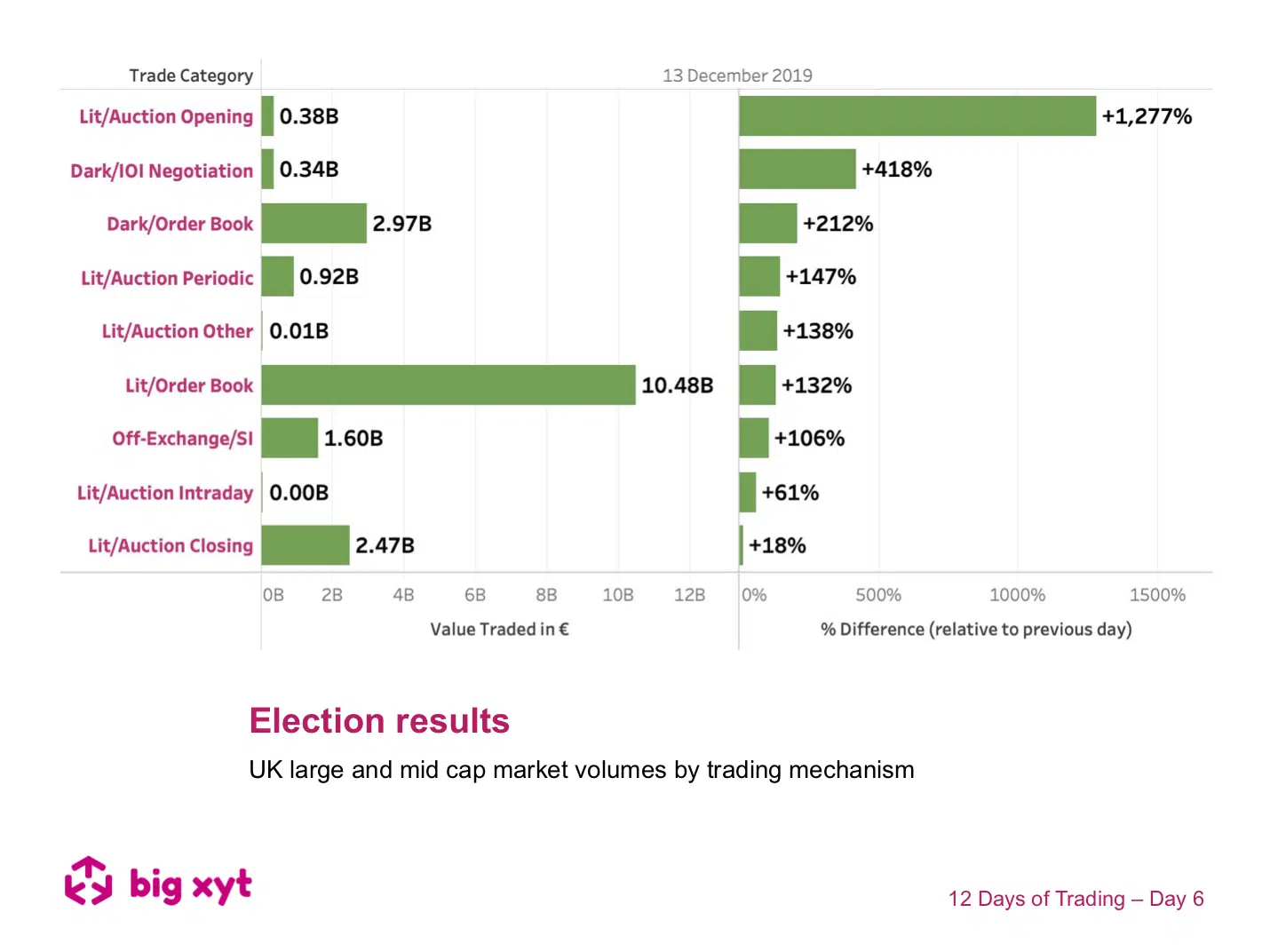

The impact of the results of the UK General Election on market volumes was dramatic, with UK volumes more than doubling. We looked more closely at how the underlying venues and mechanisms benefitted in relative terms. The left hand side of the chart shows the volumes traded on Friday by mechanism. The right hand side shows the percentage increase by mechanism compared to the previous day. Market participants needed to react quickly to position themselves. This can be clearly seen with the opening auction having the greatest change relative to the previous day. Second were the Large In Scale and dark venues. Under these conditions, different strategies are necessary for speed of implementation and access to significant blocks of liquidity. The mechanism least affected was the closing auction. This raises interesting questions about what has driven the growing popularity of the Closing Auctions at the expense of the rest of the trading day.

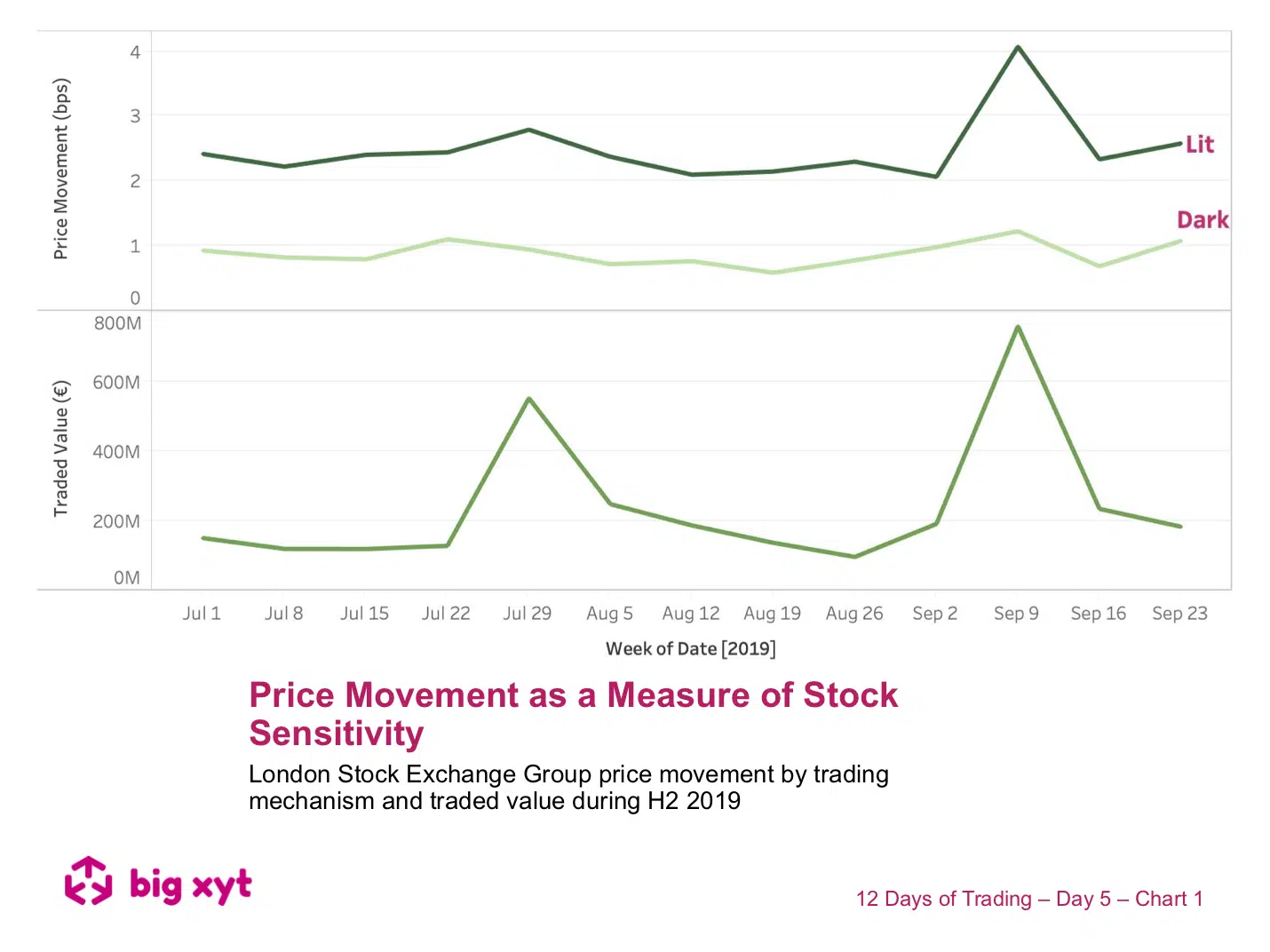

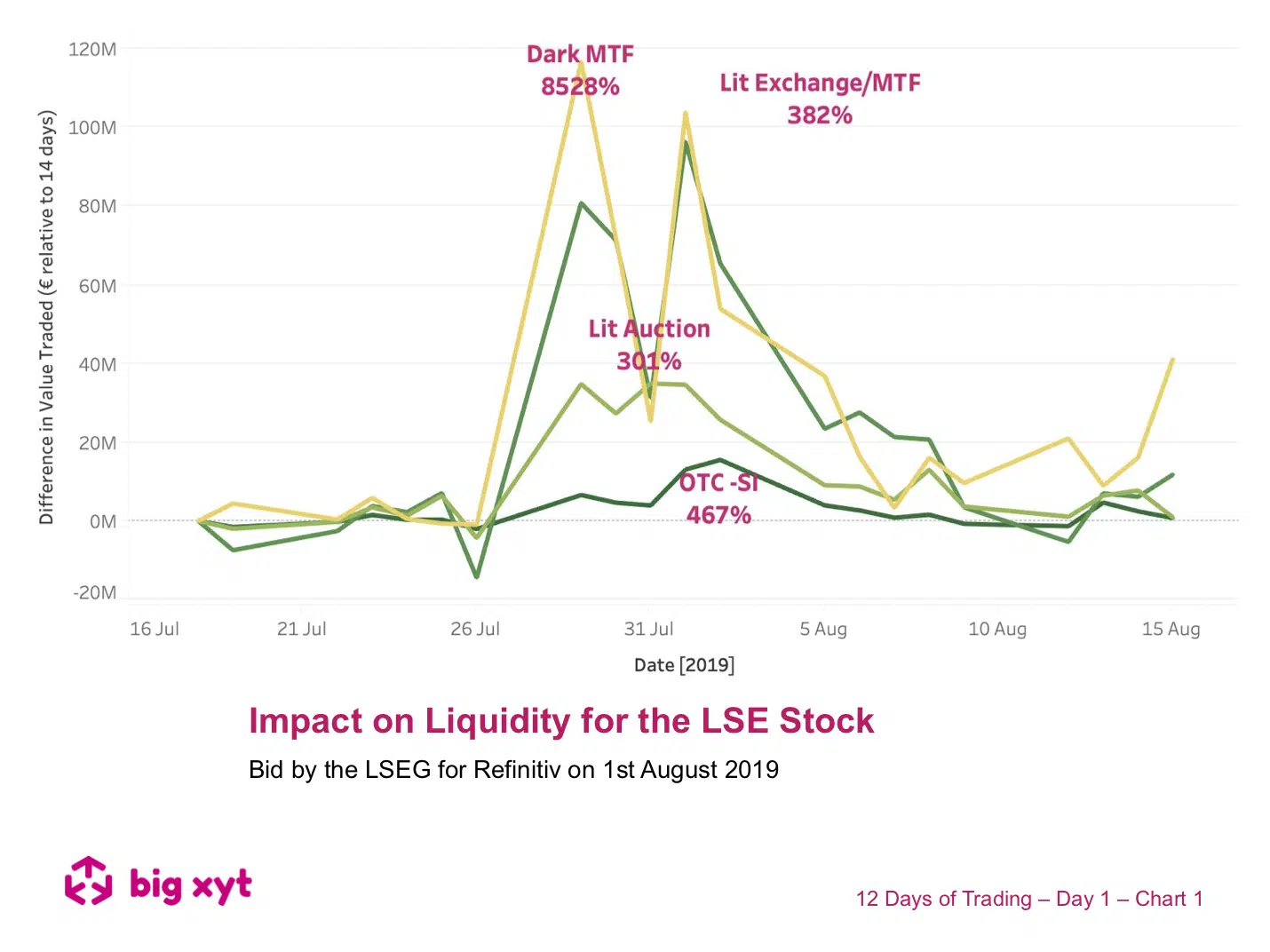

Price movement after a trade or reversion can be used as a measure of toxicity, aggression, or stock price sensitivity. Today we are returning to our example of LSEG both as a bidder and a target. The metrics we are using relate to price movement in two key trading mechanisms; lit & dark.The bottom chart shows traded value in the stock and helps us to pinpoint the days when the respective news stories broke. The top chart shows the price movement (absolute change of the mid price within 1ms) for every trade aggregated up as a daily average. This would seem to indicate greater stock sensitivity at times of increased turnover. However, look closer and when comparing lit and dark we see that the summertime Refinitiv announcement resulted in increased dark sensitivity in advance of the lit peak, whereas for the September HKSE approach the peaks are simultaneous.

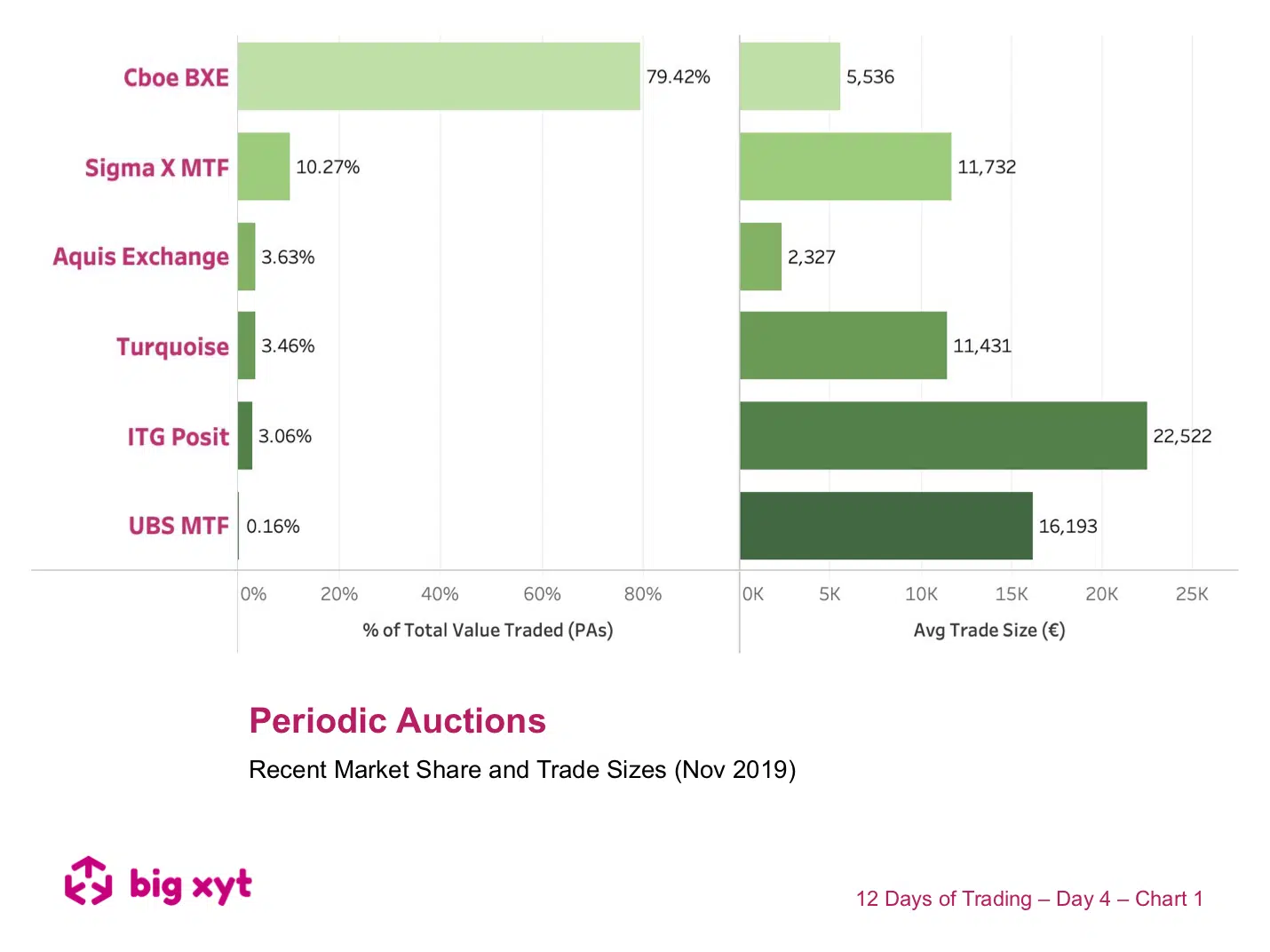

Just as market share and trade size give us measures of market quality for lit markets, similar metrics can be applied to periodic auctions. The overall share of periodic auctions as a mechanism has been remarkably stable over the last year but the share and average size amongst the various operators have been changing. Today we take a snapshot of the most recent monthly picture. Note that in this example we have excluded on-demand auctions, offered by some primary venues. Our Liquidity Cockpit allows the identity of these venues to be revealed to enable you to ask if you are sourcing the best liquidity, at the best price, by market, by venue, by index or at stock level. — Do you want to receive future updates directly via email? Use the following

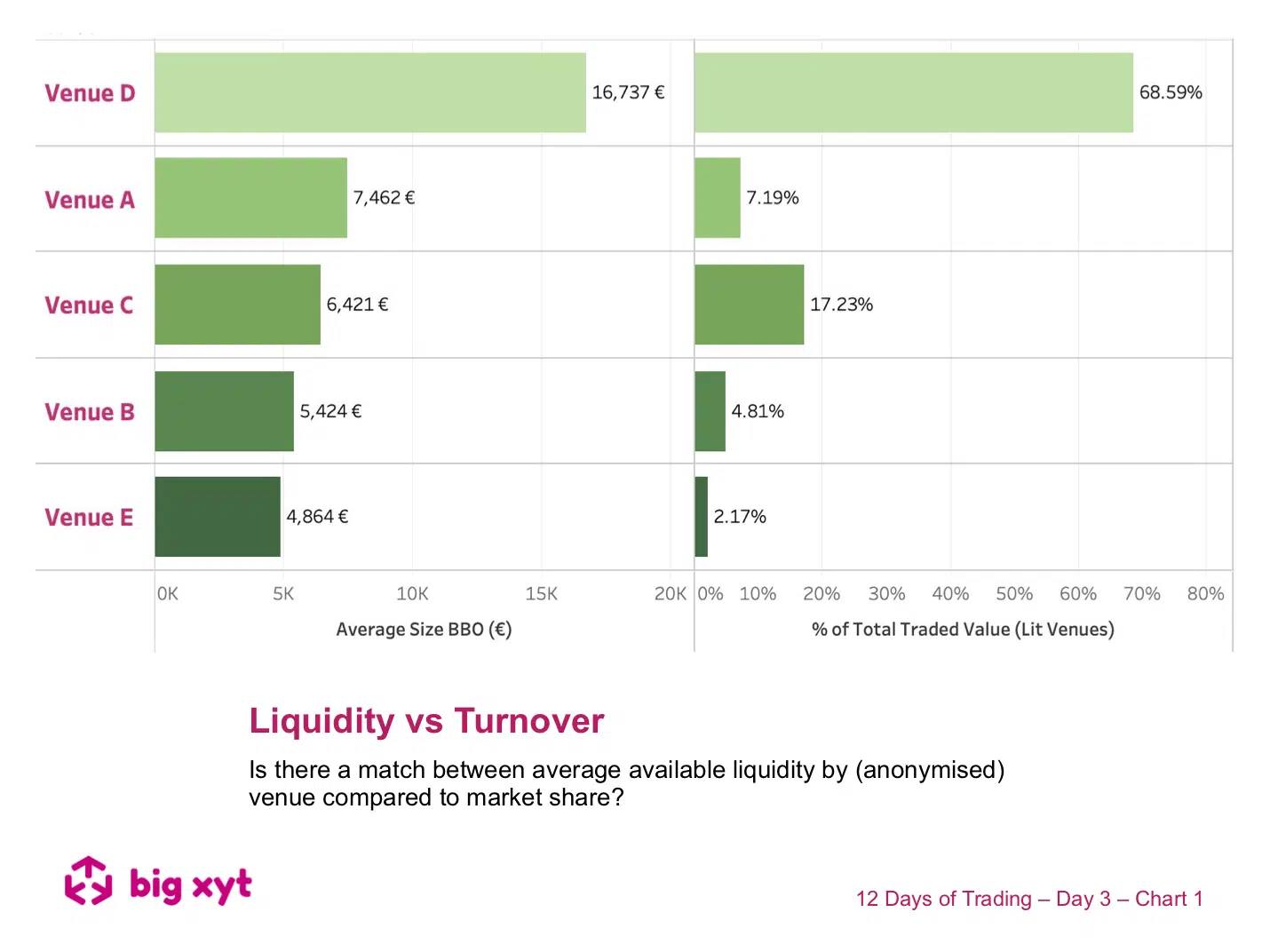

We have demonstrated in previous posts that there is a correlation between spreads and market share. The venue with the highest turnover tends to have the best prices. However, as the regulators keep reminding us, best execution should factor in liquidity as well as price. In the chart today we take a look at one European market and find that the rankings for turnover do not always match the rankings for available liquidity at the touch across the anonymised venues. Our Liquidity Cockpit allows the identity of these venues to be revealed to enable you to ask if you are sourcing the best liquidity, at the best price, by market, by venue, by index or at stock level. — Do you want to receive future updates directly via email? Use the following

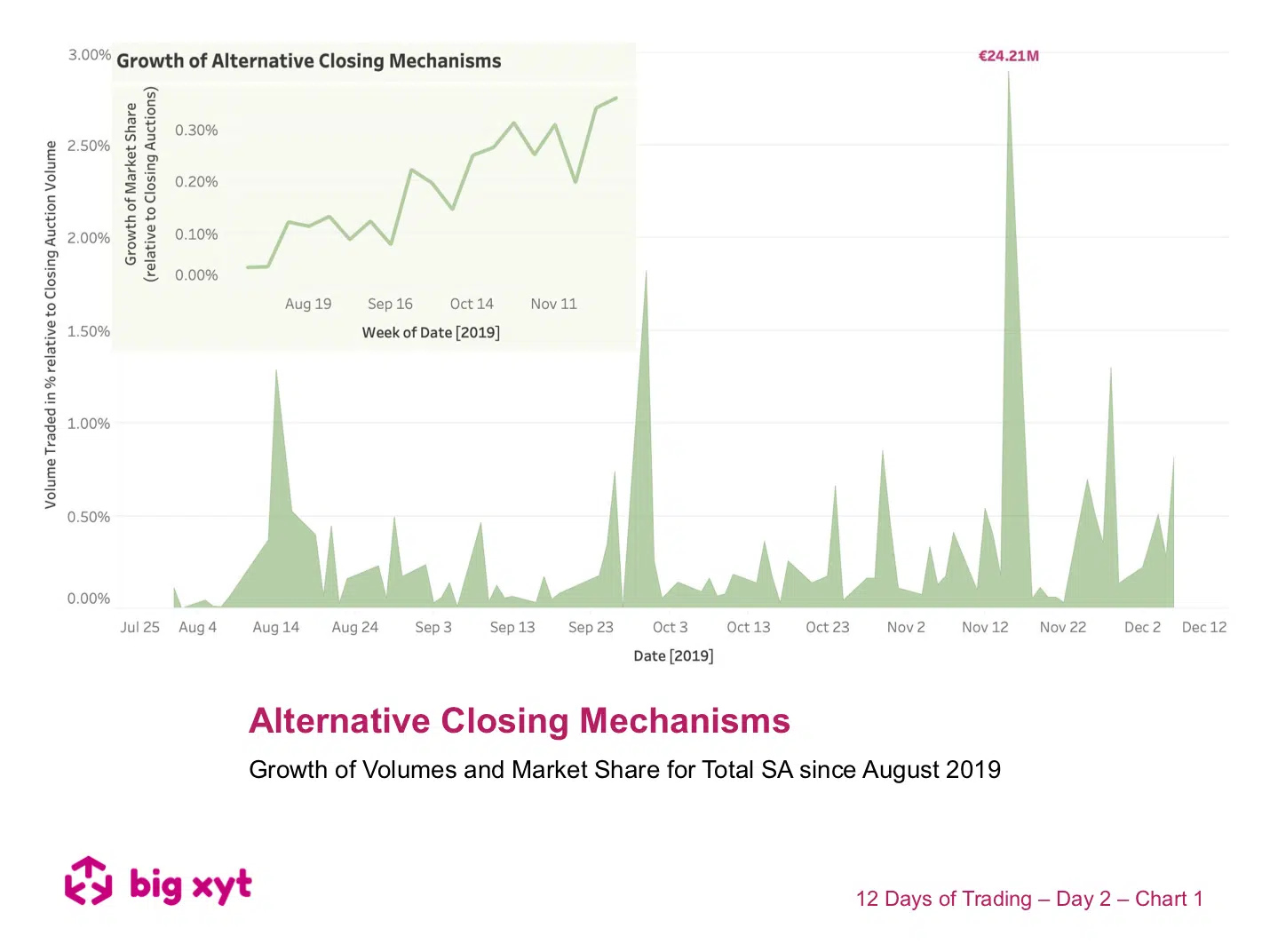

MiFID I opened the door to exchange competition in Europe. Whilst the central limit order books of the exchanges have seen their monopolies challenged, one area has remained the domain of the primary exchanges. However, with increasing focus on closing auctions driven by passive investing and ETFs, it is not surprising to see innovative attempts to provide alternative means to deliver execution at the closing price. Many exchanges already support a post trade phase (Trading at Last) sweeping up remaining interest once the price has been established. Aquis and Cboe have recently introduced their own twist on the Primary mechanisms. Today’s chart shows that investors looking for liquidity at the closing price need to be aware of the growth of alternative mechanisms (shown in the inset), and taking the example of Total we see growth overall and in the monthly peaks traded

Liquidity on lit order books is driven by pre-trade transparency. Therefore, tighter spreads or deeper visible liquidity can lead to market share growth on one venue at the expense of another. Alternative mechanisms also play their part in particular circumstances. Take the example here where major news on two occasions throughout the year caused a basis change in the price of the London Stock Exchange Group (ironically the owner of three major European Equity venues). Traders noting a new price level wanted to trade and trade in size. With the news leading, to increased activity, the fragmentation of liquidity changed in a somewhat unexpected way. Market Share in lit books and block volumes increased dramatically compared to other mechanisms. Of further note was that this increase persisted in block venues, not just for the duration of the day of the announcement but for subsequent days until matched block liquidity was exhausted at that price level.