Technology enables firms to leverage artificial intelligence and machine learning in many new areas. These new applications require cost-effective compute platforms and seamless access to large datasets. Learn how the Banking, Finance and Insurance sector is managing these challenges in the new issue of Financial Markets Insights: Powering Up – Handling high-performance computing to boost alpha and risk management The complexities surrounding the Banking, Finance and Insurance sector today have led to a significant growth in the use of grid computing and high-performance computing (HPC) for computationally-intensive tasks. These are many and varied, and include areas such as derivative pricing, risk analytics, quantitative modelling, portfolio optimisation, and bank stress testing.

Hamburg, 16th & 17th May 2017, big-xyt’s partner WKA Blade Service (Robur Group) will present at the German conference for Wind Turbine Maintenance. Learn how the big xyt Cloud Platform enabled WKA Blade Service to analyze sensor data and maintenance events for thousands of wind turbines over a period of 10 years. The initiative demonstrates the value of the big xyt Cloud Platform in new industries. Designed and optimized for use cases in capital markets, today the big xyt Cloud Platform offers capabilities that allow clients in various industries to mitigate challenges of big data analytics and to seize new business opportunities.

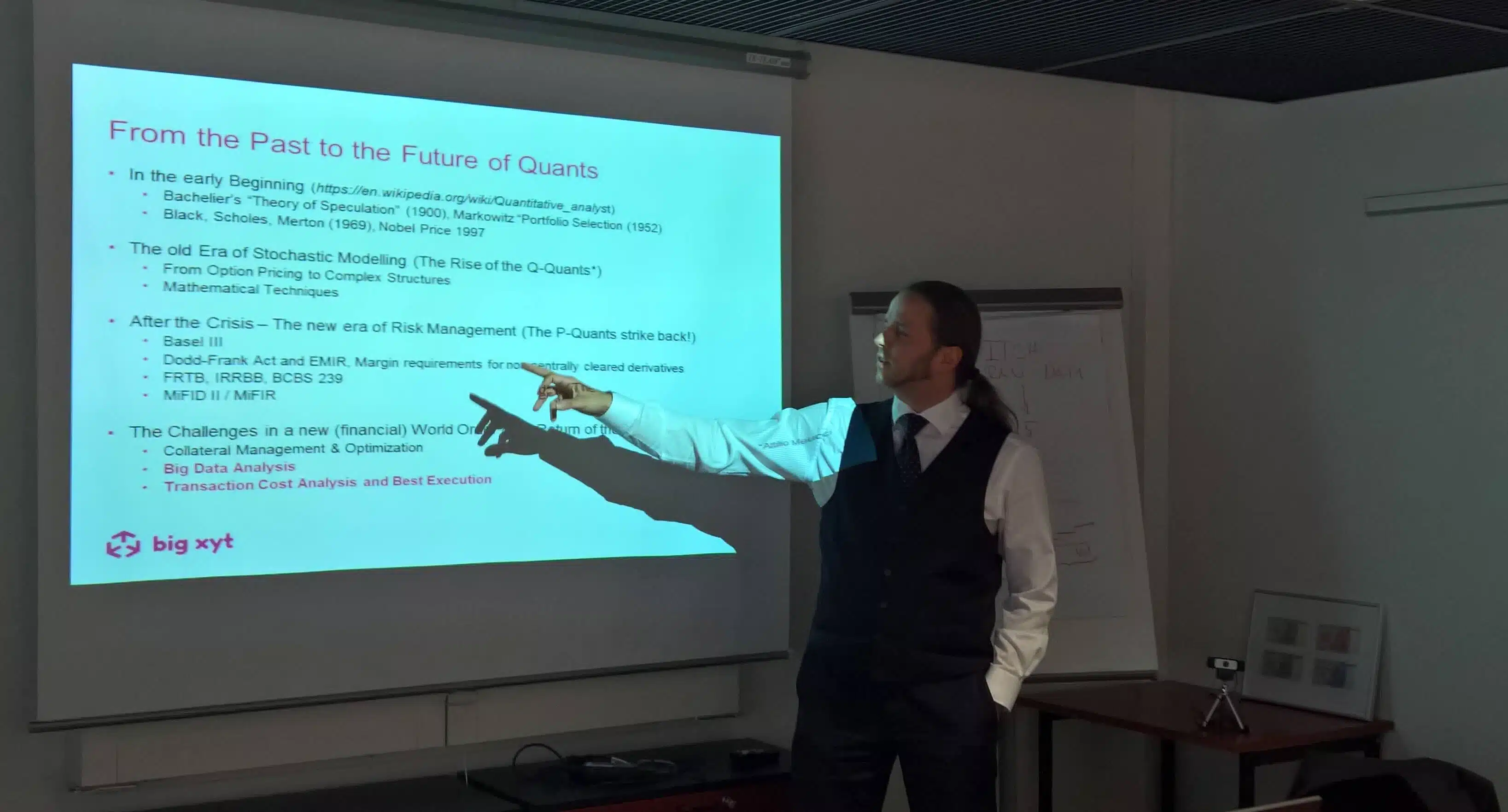

London, 26th, 27th & 28th April 2017, big-xyt’s Dr. Ulrich Nögel speaking at the QuanTech Conference about Challenges in Big Data Analysis (Thursday, 27th at 2:15pm), Stream “Machine Learning, Big Data, IoT & HPC Stream”. About QuanTech: These events have been built in collaboration with some of the world’s leading banks, financial institutions and technology companies to ensure that the most pressing and pertinent issues are covered. Topics ranging across trading, fixed income, derivatives, syndicated loans and trade finance, identity and payments. Discussion for leading figures on both the business and technology sides of the global banking industry. London Topics:

London, 1st & 2nd March 2017, big-xyt’s Dr. Ulrich Nögel speaking at the Artificial Intelligence and Data Science Conference. Learn how big xyt enables the growing AI community with analytics on very large datasets. Join our speaker slot about “Challenges for Big Data Analysis in the Post-Crisis Regulatory Environment”. About the event: Artificial intelligence and machine learning algorithms offer us a revolution in the way value can be derived from the vast amounts of data we produce every moment. As more of the financial world embraces AI and machine learning, questions arise about how best to implement this technology, and more broadly the impact it will have on existing market structure.

big xyt’s Data & Analytics Services now available via Colt PrizmNet The global trading community can now access all big xyt Services via Colt PrizmNet. Trading firms can immediately reduce complexity, TCO and time-to-market by leveraging big xyt’s smart data & analytics solutions in more than 28 countries around the globe. Selected services are Capture Tick Data (raw and normalized from any exchange or data vendor) Store Tick Data supporting all asset classes Data Cleansing and Gap Filling Real-time Analytics TCA Liquidity Analytics Find out more at

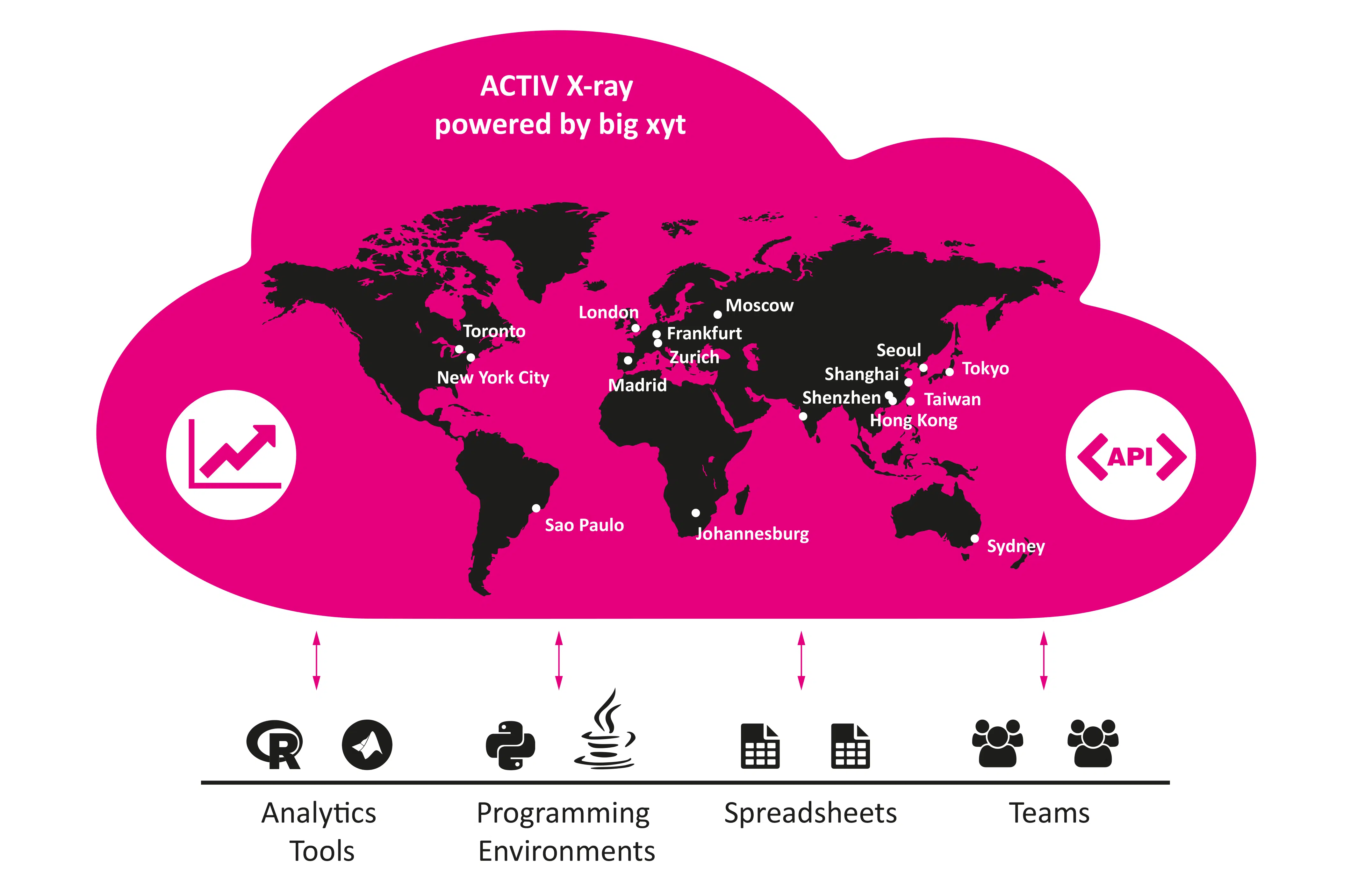

big xyt’s new ecommerce platform helps exchanges, brokers and data vendors to monetize their data assets. The new big xyt Store offers an unrivalled user experience with access to petabytes of historical data. Key features are a flexible pricing model supporting all asset classes including derivatives web-based user interface to access all feeds with smart search algorithms access to any data volumes including market depth convenient payment options like Paypal and Credit Cards Read how we enable ACTIV Financial to distribute historical data from more than 100 venues via API and web downloads to the trading community. The ACTIV X-ray Store is engineered and operated by big xyt. The joint product is featured in an article by Max Bowie from waterstechnology.

[featured-video-plus] Wednesday 4th October 2016, Frankfurt, Germany: As a sponsor of Deutsche Börse’s Open Day 2016, we have received broad interest in our solutions for convenient tick data analytics. Trading firms see great value in the big xyt Cloud Platform for cost effectively managing any number of data sources as well as in products offered by big xyt partners like ACTIV Financial. At the conference we have presented ACTIV X-ray, engineered and operated by big xyt, a tick data cloud that enables trading firms to instantaneously access historical tick data from 120+ feeds and 80+ trading venues. See the featured video for selected use cases introduced at the conference (video only, silent).

London — 13 July 2016 — ACTIV Financial announced today that RSJ has selected ACTIV X-ray to help identify trading opportunities as they expand their trading activity in new asset classes and trading venues. To successfully launch trading models on new trading venues, trading firms must perform a broad range of analytics and tests. In addition, trading firms need the ability to access in-depth market information allowing them to understand specific market mechanics of each venue. High quality data, coupled with big xyt’s ultra-fast cloud platform, helps trading firms to gain relevant insight in a convenient way. By subscribing to ACTIV X-ray, RSJ is able to test models accurately and to reduce project risks.

big xyt enables ACTIV Financial to launch ACTIV X-ray, an innovative tick data cloud ACTIV Financial leverages big xyt’s Cloud Platform to enable immediate access to high-quality tick data and scalable testing of trading models. FRANKFURT — 17 July 2016 — ACTIV Financial, a global provider of real-time, multi-asset financial market data and solutions, and big xyt, the leading provider for data and analytics solutions on large datasets, today announced the launch of ACTIV X-ray, a cloud-based tick data repository which will enhance the way trading firms discover and test new venues or meet ever growing regulatory requirements.

Thursday 26th May 2016, Tampere, Finnland: As the first event of the research collaboration between the Technical University of Tampere, Fraunhofer ITWM Kaiserslautern and big xyt, Dr. Ulrich Nögel (Co-Founder, Analytics big xyt) was presenting on “Challenges for Big Data Analysis and TCA in the Post Crisis Regulatory Environment” in Tampere, Finland. The audience included members of the Big Data Research Cluster as well as members of Prof. Dr. Juho Kanniainen’s group. In June this research collaboration will conduct a stay of guest researcher Mrs. Milla Siikanen at the Fraunhofer ITWM in Kaiserslautern where she will intensify her research on liquidity measures derived from order book data across asset classes (including cash equities and FX spot).