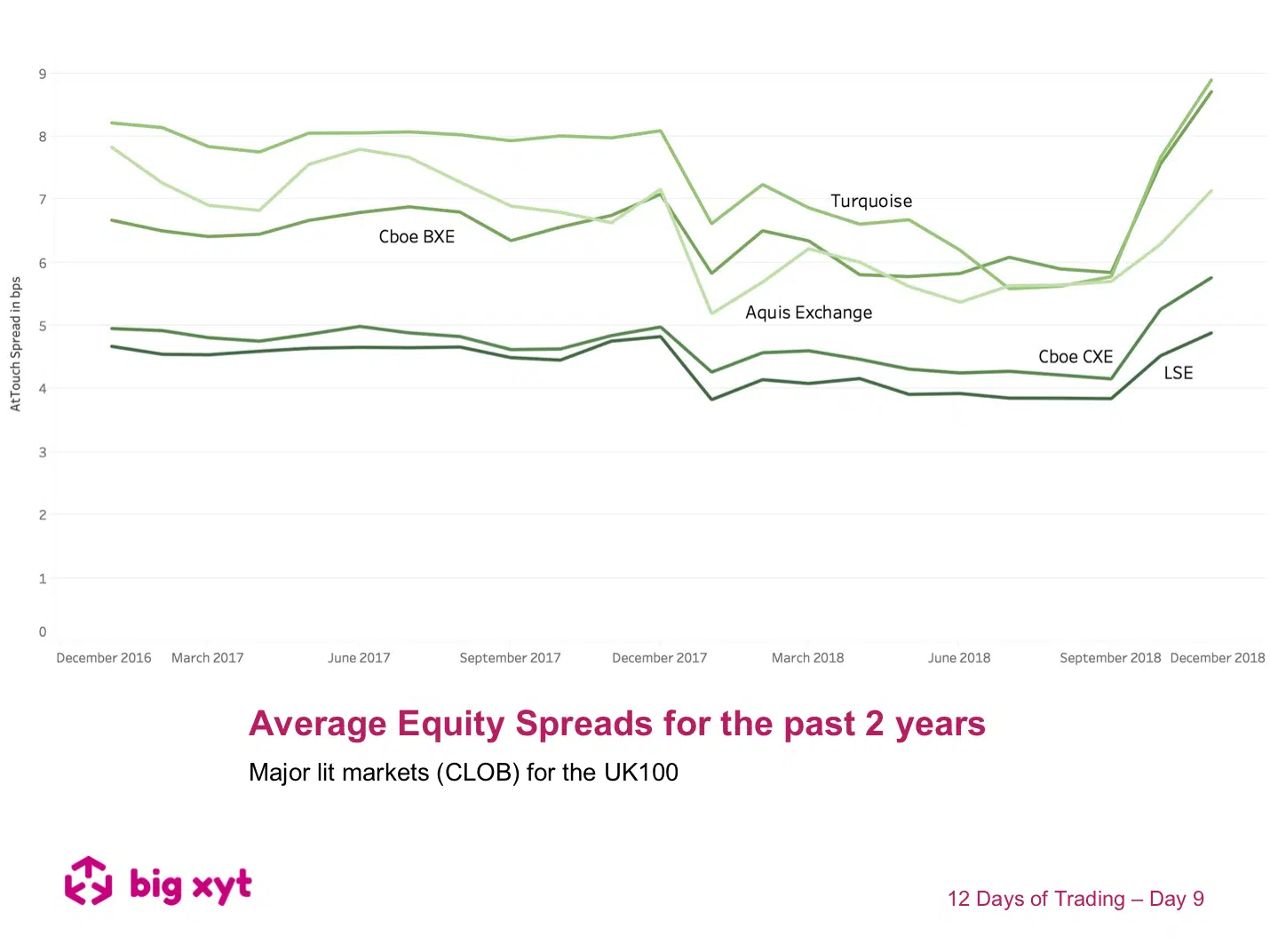

The chart shows at touch time-weighted average spreads for blue chip UK stocks since December 2016 Some observations: There was observed impact of MiFID II with a new tick size regime and an increasingly competitive market. The influence of macro-economic uncertainty on volatility during February 2018 and Q4 2018. It is possible to look at Presence in parallel with spreads to establish how often a given venue has the best price either uniquely or along with other venues – an important measure when considering PBBO or EBBO referencing or other benchmarking. — Do you want to receive future updates directly via email? Use the following

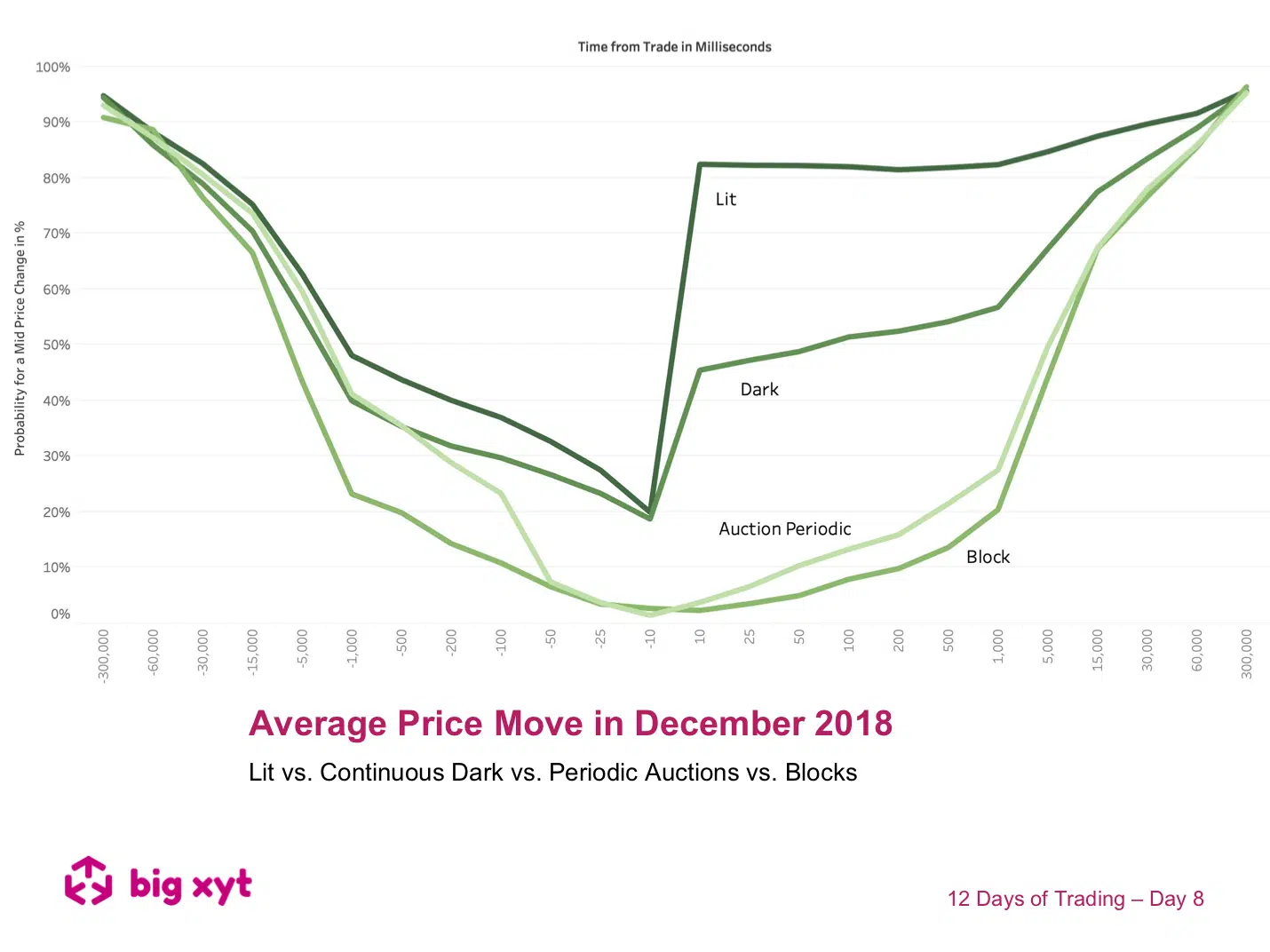

Day 8 of 12: Price movement as a proxy for market impact – A ripple before as well as after the pebble hits the water Measuring the movement of mid point prices before and after the time of every execution allows us to see some interesting patterns emerge. Some observations: Different execution mechanisms exhibit distinct trajectories. The patterns for lit markets, dark pools and blocks have been known for some time. Where do Periodic Auctions fit in? Up to 100 ms ahead of the trade, Periodic Auctions show a similar probability for a market move as Dark Pools. Closer to the execution time as well as after the trade, the probability for a price movement is very low and close to blocks (LIS). — Do you want to receive future updates directly via email? Use the following

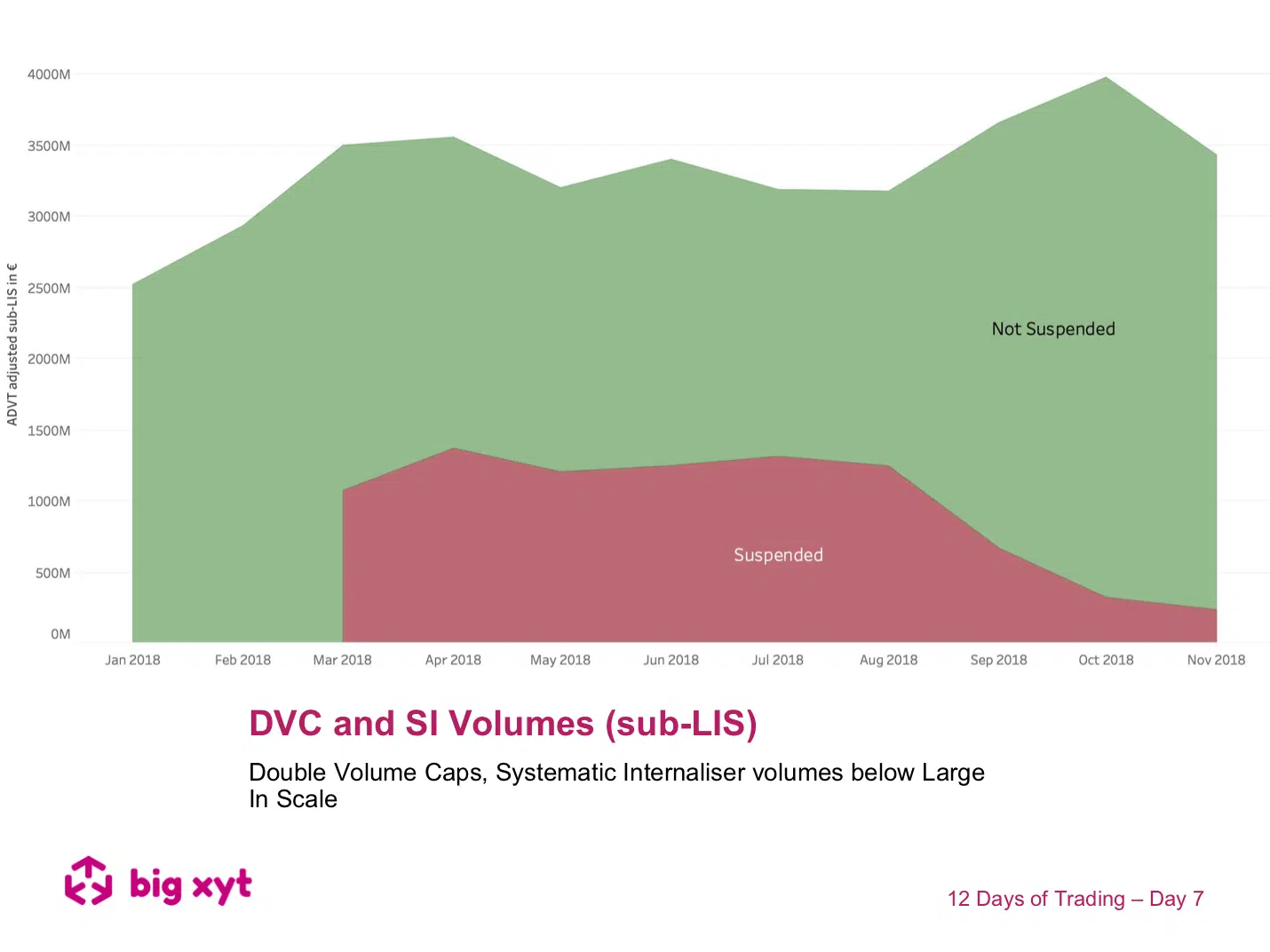

Day 7 of 12: Today we look further at SI volumes to see if the imposition of Double Volume Caps resulted in any observable change in Systematic Internaliser volumes either above or below Large In Scale (LIS) As shown yesterday Pan European average reported volumes by Systematic Internalisers now total around €30bn per day. Of this SI volume, approximately 50{a77189467baebe99d0d59363c4c17c76ac761b303fd809242b1d06b2b931be6c} can be removed by identifying condition codes or trade flags that indicate the transaction was non-price-forming. If we then identify trades reported outside market hours, we are left with a further reduction. Today’s charts provide a further breakdown of adjusted SI volumes, i.e. excluding non-price-forming condition codes and ignoring trades reported outside market hours. Some observations:

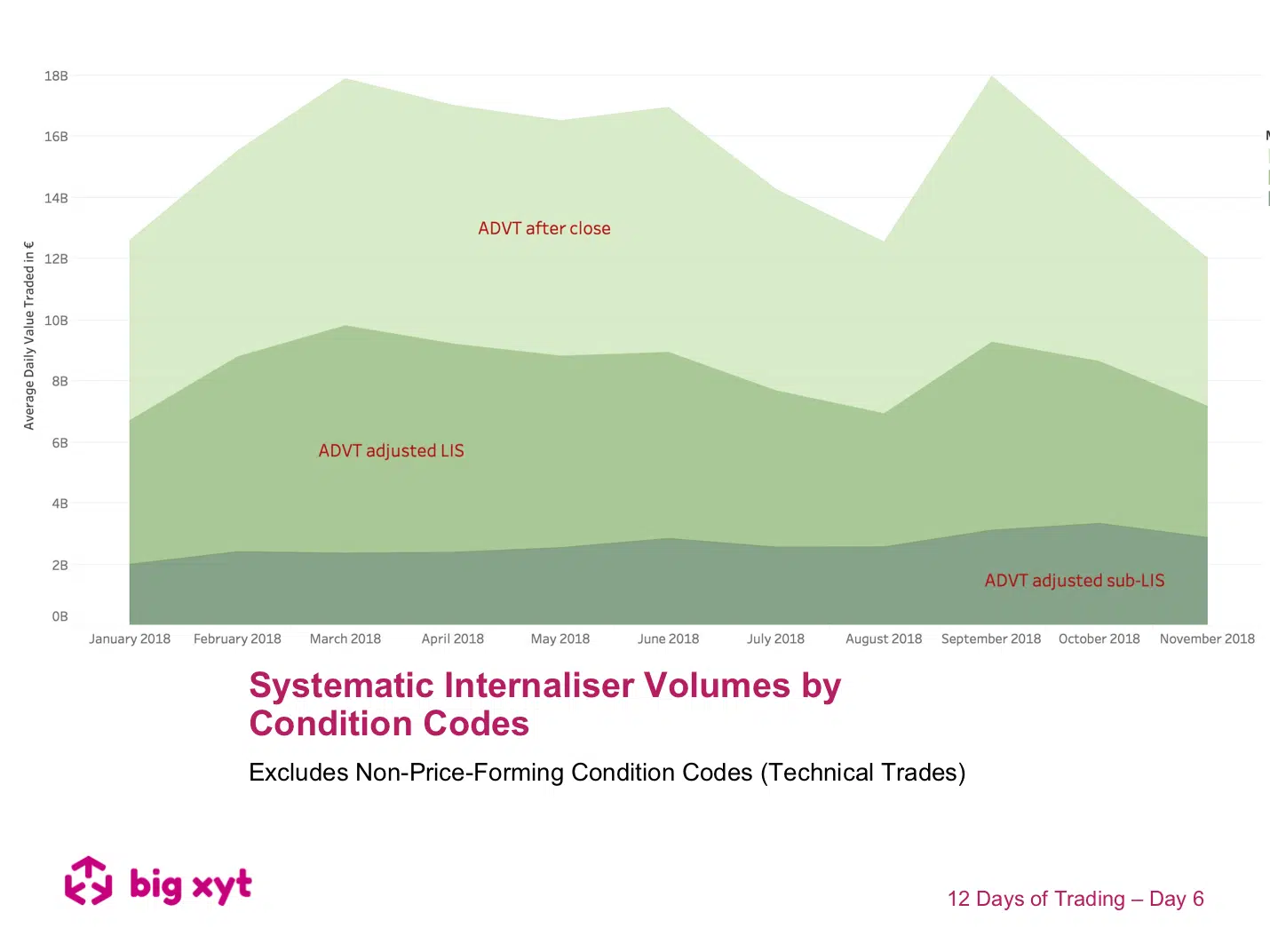

12 Days of Trading – Day 6 of 12: Systematic Internaliser Volumes Day 6 of 12: Breaking Down Systematic Internaliser Volumes by Condition Codes Some observations: Pan European average reported volumes by Systematic Internalisers now total around €30bn, representing 30% of equity turnover. Of this SI volume, approximately 50% can be removed by identifying condition codes or trade flags that indicate the transaction was non-price-forming ( we can provide a long list of these that we have identified for exclusion). If we then identify trades reported outside market hours, we are left with a further reduction (see chart). Many observers see Large In Scale trades reported by Systematic Internalisers as representative of a bilateral negotiation and therefore not representative of liquidity available to all at that price.

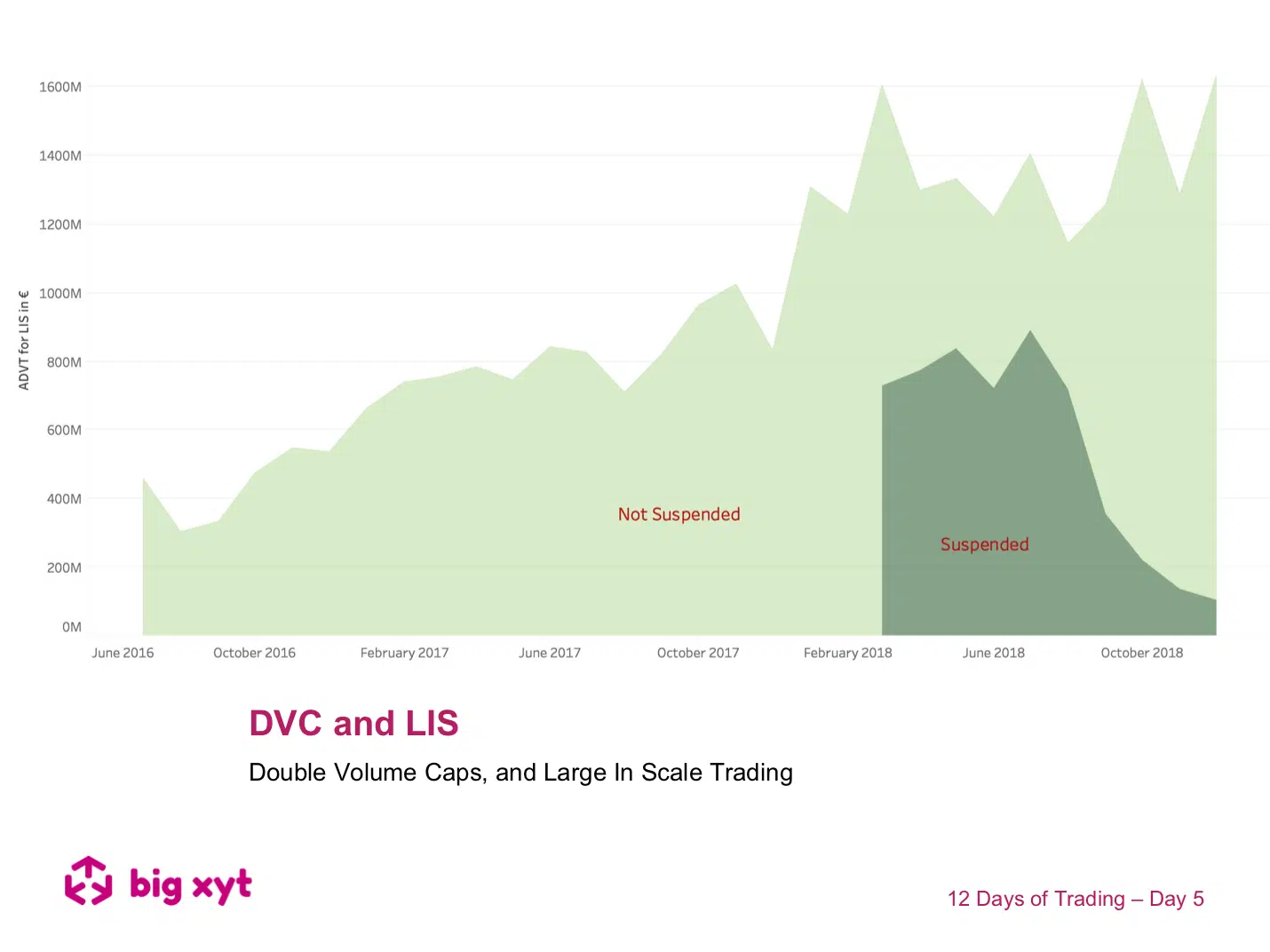

Day 5 of 12: As mentioned yesterday, block trading, represented by Large In Scale (LIS) executions, has been growing steadily over the last 2 years. Some observations: Trading behaviour has adapted to seek out blocks and advances in technology have created better tools to identify and match block trading opportunities. This is illustrated by the chart which seems to infer a greater appetite for block trading whilst DVC suspensions were in place and then a continued acceleration when the suspensions ceased. This surprised some observers who expected the jump in block volumes to be temporary as dark pools regained lost ground. In the second slide today we show the top 10 stocks trading LIS in the dark over the course of the year:

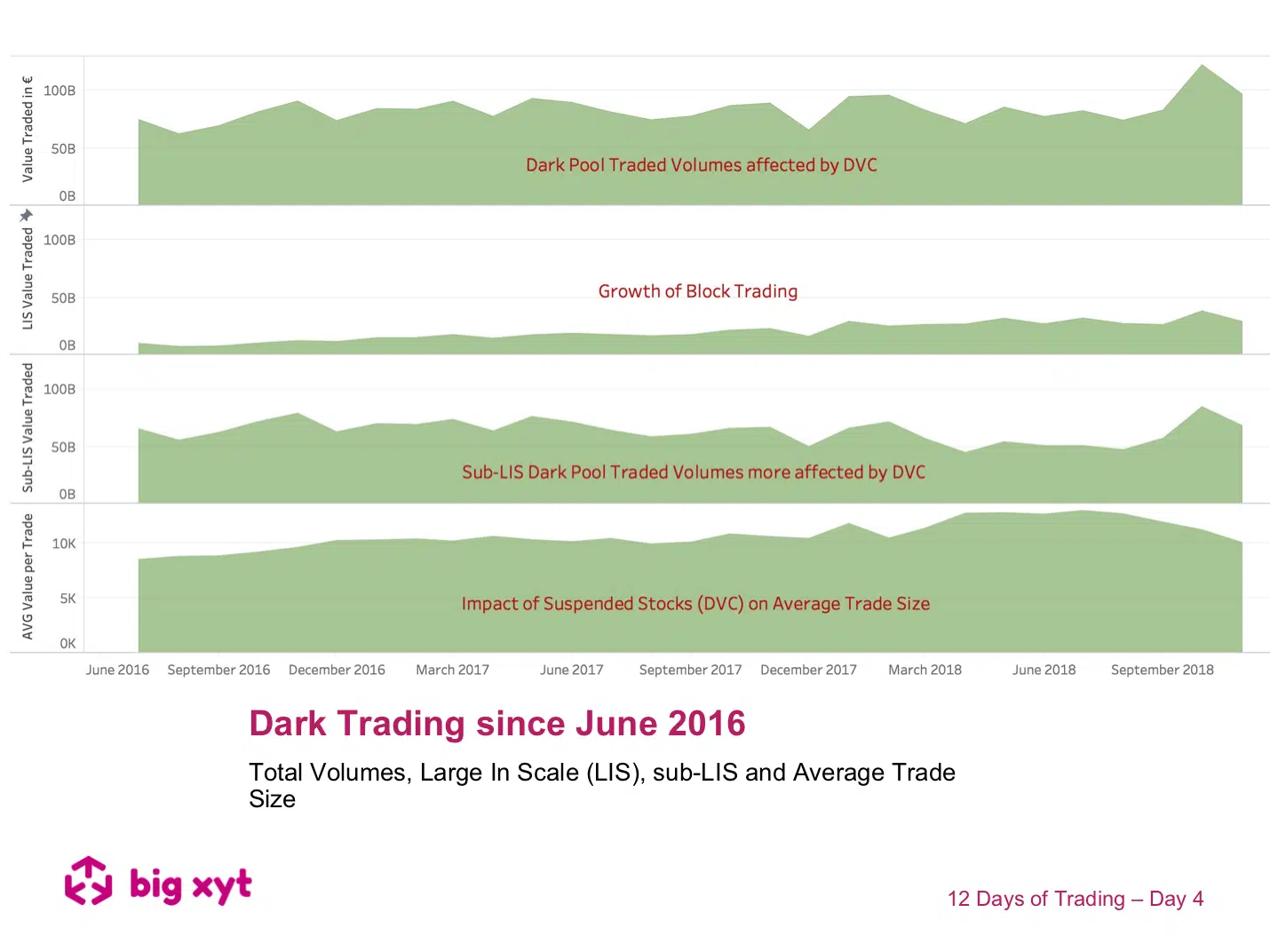

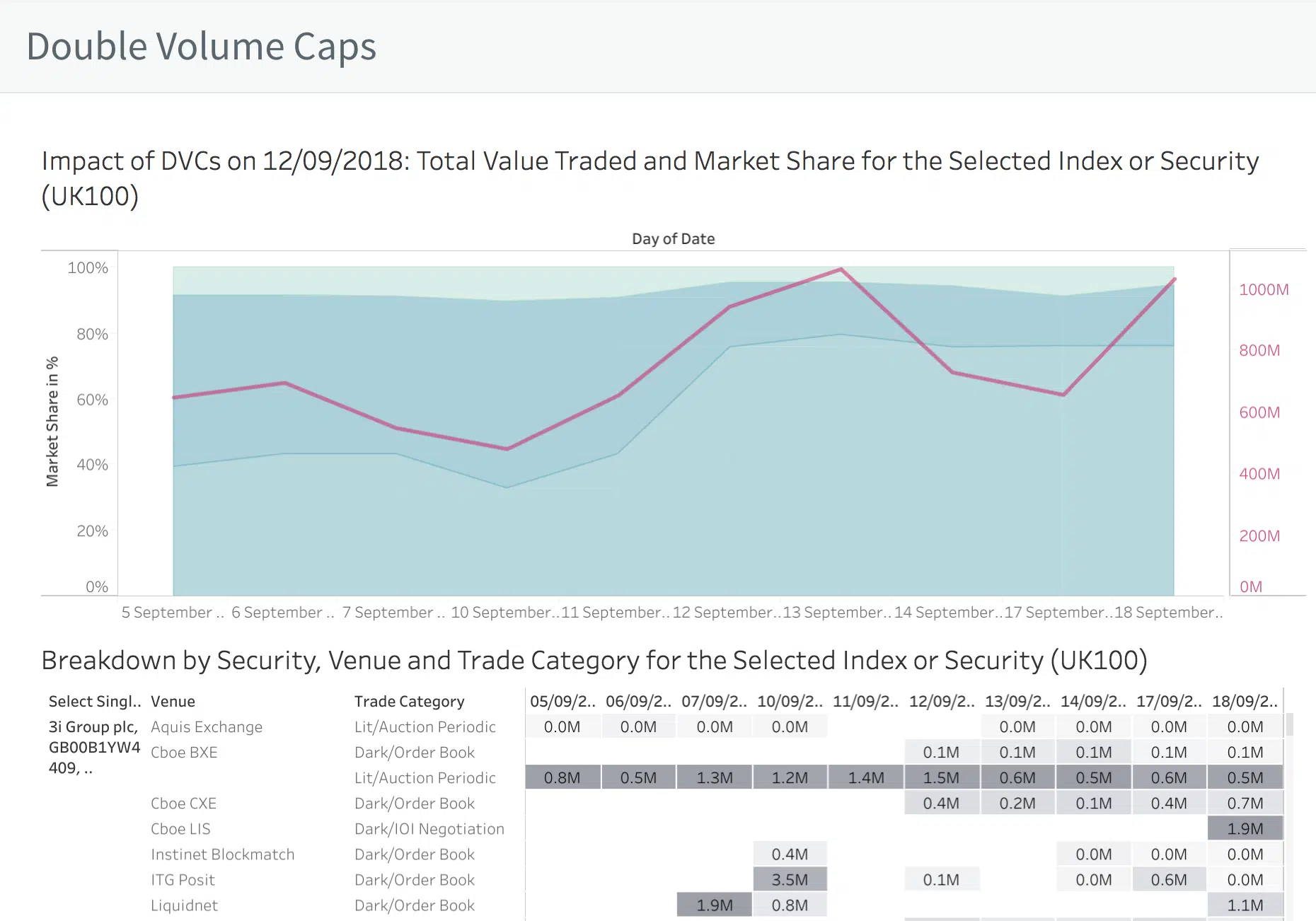

12 Days of Trading – Day 4 of 12: Dark Trading since June 2016 Day 4 of 12: In today’s view we take a look at some evolutionary themes in European Equity dark and block trading over the last 2 years. Some observations: As expected, DVCs had an impact on dark traded volumes particularly in trades below Large In Scale (LIS). In fact this reduction in sub-LIS during the DVCs resulted in average trade sizes temporarily increasing. Block trading represented by Large In Scale trades has continued to grow during the period and is something we look at more closely tomorrow. — Do you want to receive future updates directly via email? Use the following

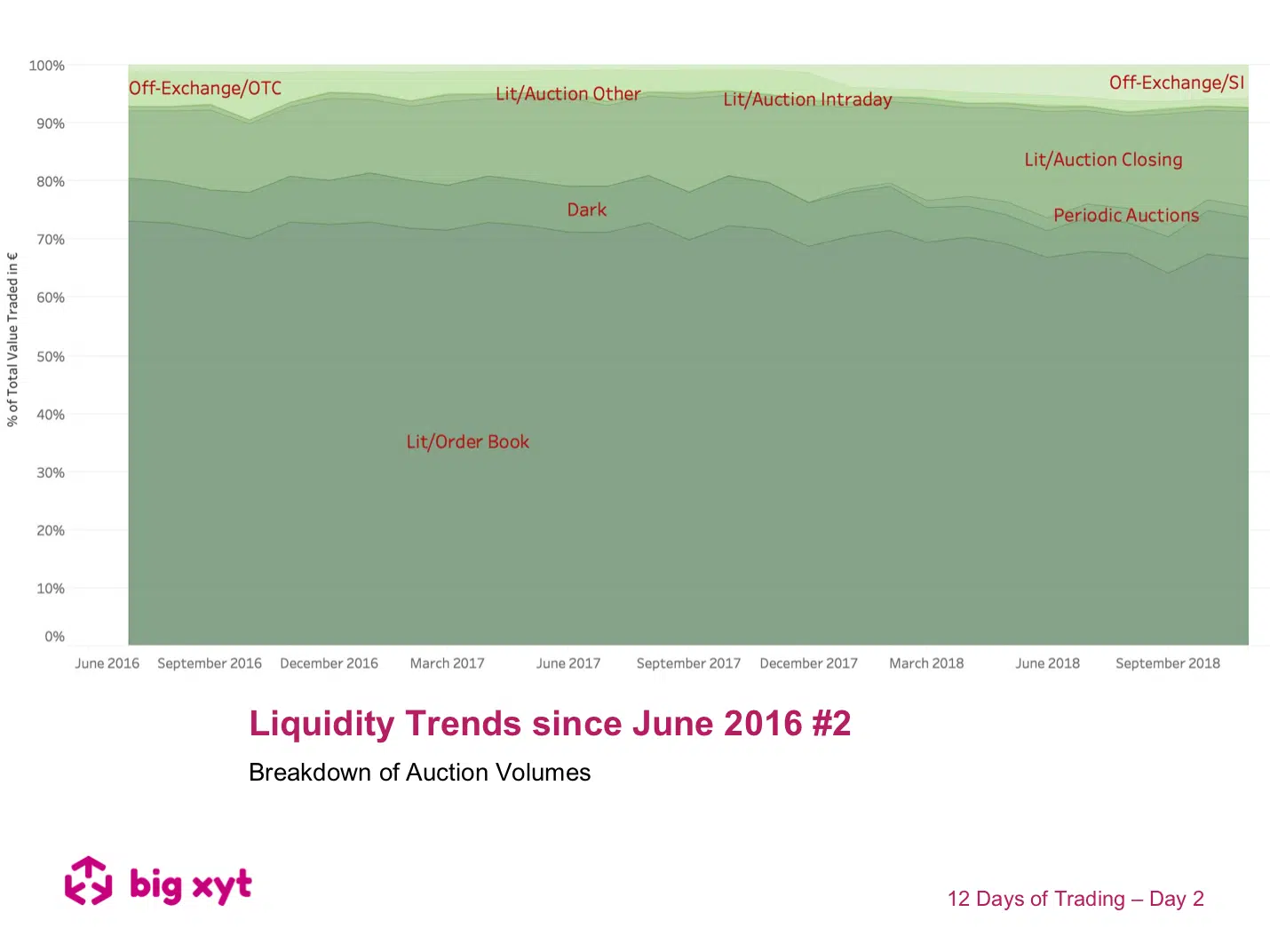

Day 2 of 12: After our initial market overview yesterday, today we take closer look at the development of auctions. Some observations: The two largest gainers appear to be the Closing Auctions and Periodic Auctions. Some have observed that more lit trading has moved to the closing auction as the benchmark drives index & ETF traders. The inference then for Periodic Auctions is that they have seen flow migrate from dark pools as Double Volume Caps took effect. It is difficult to be certain of the reasons for this dispersion from this chart alone so we plan to investigate further in subsequent days. — Do you want to receive future updates directly via email? Use the following form to subscribe. On our 12 Days of Trading As the year draws to a close we have been asked by clients to look and highlight 2018 trends since the introduction of MiFID II. We thought we might make this a festive exercise on the 12 days leading up to the holidays. As a result, you will find a post to a different 2018 big-xyt observation each day.

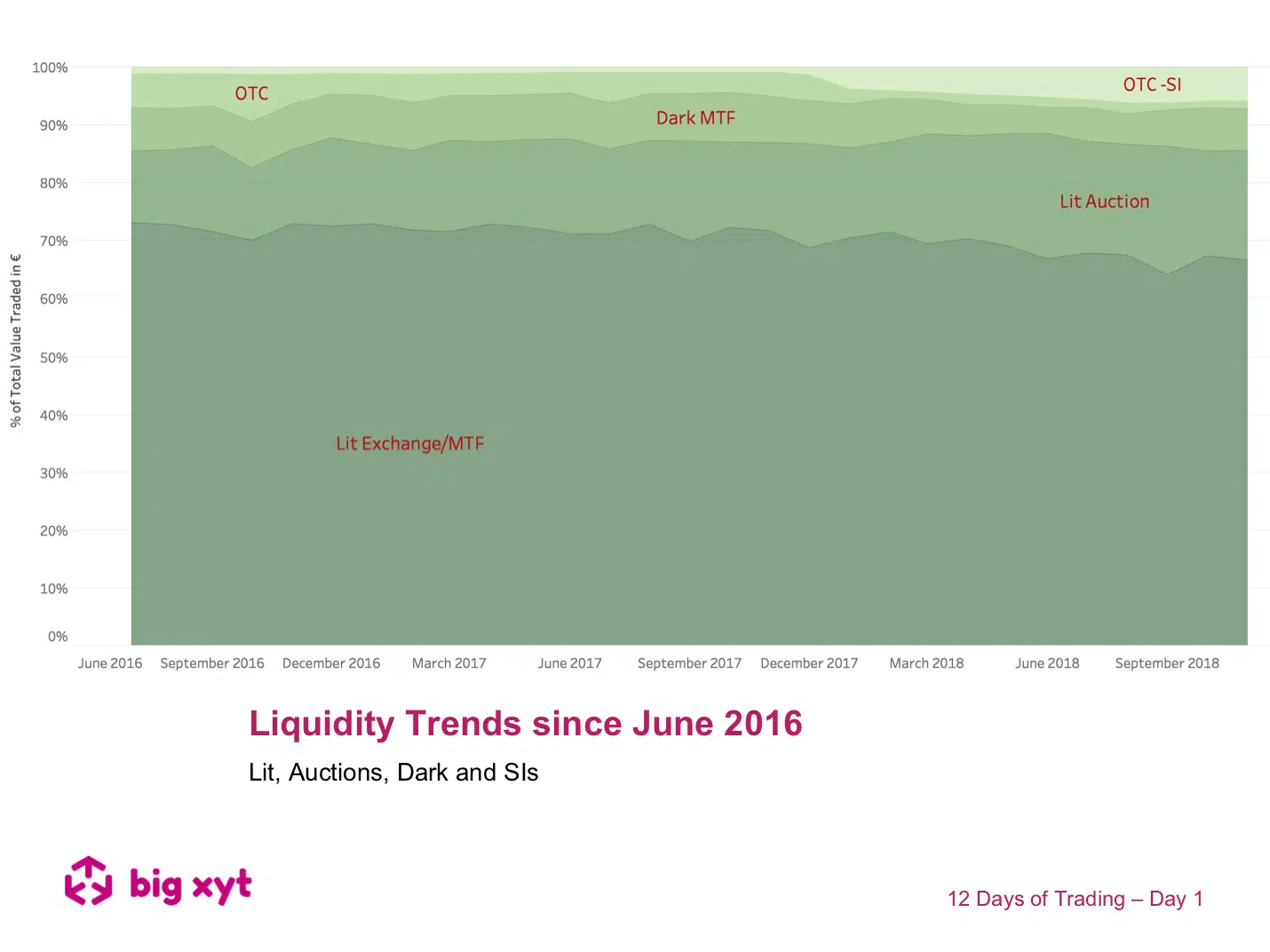

As the year draws to a close we have been asked by clients to look and highlight 2018 trends since the introduction of MiFID II. We thought we might make this a festive exercise on the 12 days leading up to the holidays. As a result, you will receive a link to a different 2018 big-xyt observation each day. With the countdown to the holidays underway, here’s our festive first (of twelve) post MiFID II, pre Brexit reviews of European Equity Markets. We hope you enjoy them. Day 1 of 12: How has European Equity Liquidity fragmented when faced with new trading mechanisms over the last 2.5 years? Some observations: Lit Market Share has seen continuous declines. Dark trading was impacted by DVCs.

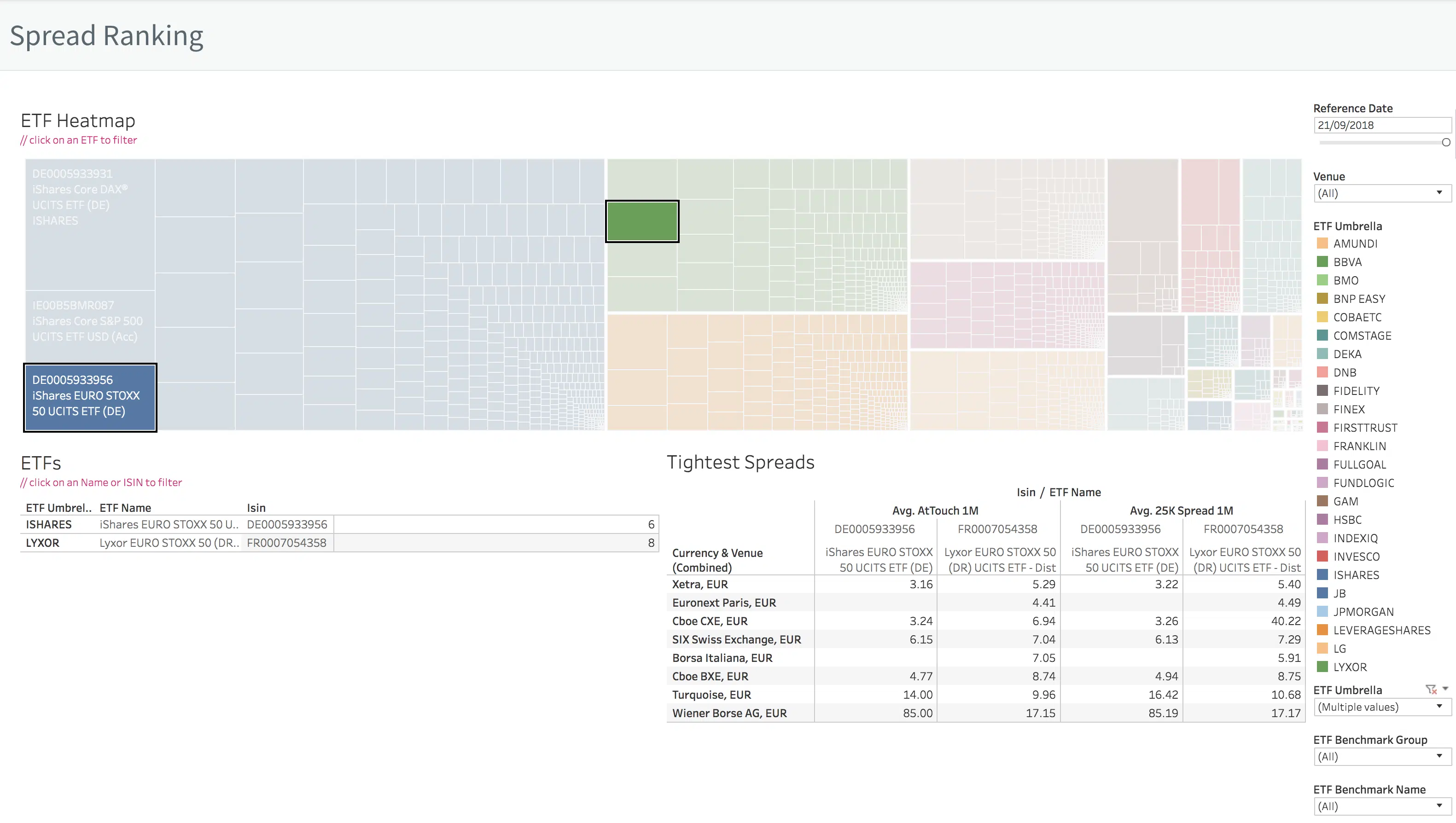

London, Frankfurt, 25th September 2018. big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce the launch of the ETF Liquidity Cockpit introducing liquidity metrics for ETFs with new navigation tools enriched with reference data from Ultumus, the specialist distributor of ETF composition data. The new ETF Liquidity Cockpit maintains the flexible access offered with existing Equity dashboards and includes key metrics for market share and market quality. The ETF Liquidity Cockpit further integrates reference data sourced from Ultumus to enable additional data aggregations.

Press Release Understanding liquidity shifts triggered by double volume caps London, Frankfurt, 20th September 2018. big xyt, the independent provider of high-volume, smart data and analytics capabilities, is delighted to