Robin Mess, our CEO, will speak about navigation in a dynamic liquidity landscape (pre and post MiFID II) and how analytics helps to optimize trading performance. In the afternoon Robin will share thoughts on the dynamic liquidity landscape: Fragmented liquidity and the emergence of new venues and order types like periodic auctions, dark pools or LIS venues, are not new to Pan-European trading. With MiFID II we will see further changes with an increasing complexity (e.g. restricted dark pool trading, DVCs). In this dynamic liquidity landscape, trading firms have to overhaul their existing strategies. We show how technology and independent analytics can help the trading community to optimize execution and trading performance.

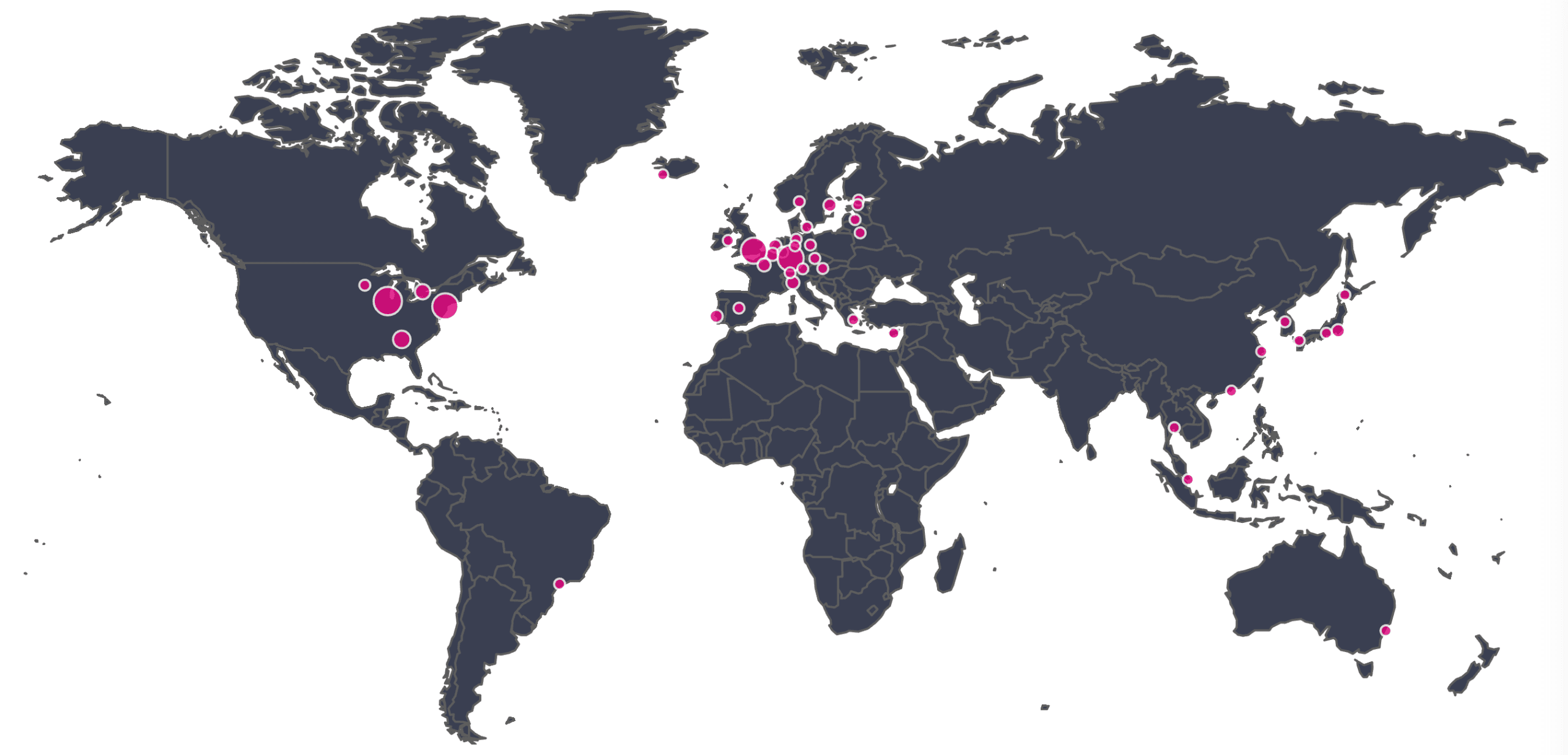

London, 25 September 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, announced today that SIX Swiss Exchange has joined the xyt hub to provide high quality tick data to its trading participants, enabling them to develop, evaluate and backtest new trading and execution strategies while providing greater transparency over trading activity. Connected to more than 100 venues globally and across asset classes, the xyt hub launched in September 2017 to enable the global trading community to integrate tick data and analytics in a more convenient and cost-effective way, via a single API. The xyt hub allows trading firms to consume, analyse and visualise all the data they require through cloud-based technologies, featuring Data-as-a-Service and Analytics-as-a-Service functionalities.

London, 14 September 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, today announced the launch of big xyt hub to enable the global trading community to integrate tick data and analytics in a more convenient and cost-effective way, via a single API. The xyt hub allows trading firms to consume, analyse and visualise all the data they require through cloud-based technologies, featuring Data-as-a-Service and Analytics-as-a-Service functionalities. Advances in algo development, testing and optimisation, transaction cost analysis (TCA) and regulatory reporting are increasing the demand for robust, independent data and analytics. With the big xyt hub, trading firms and exchanges can immediately access tick data and analytics, without costly investment into in-house data infrastructure and storage, technology capable of managing tick data with nanosecond precision and market-by-order granularity, or indeed additional staff.

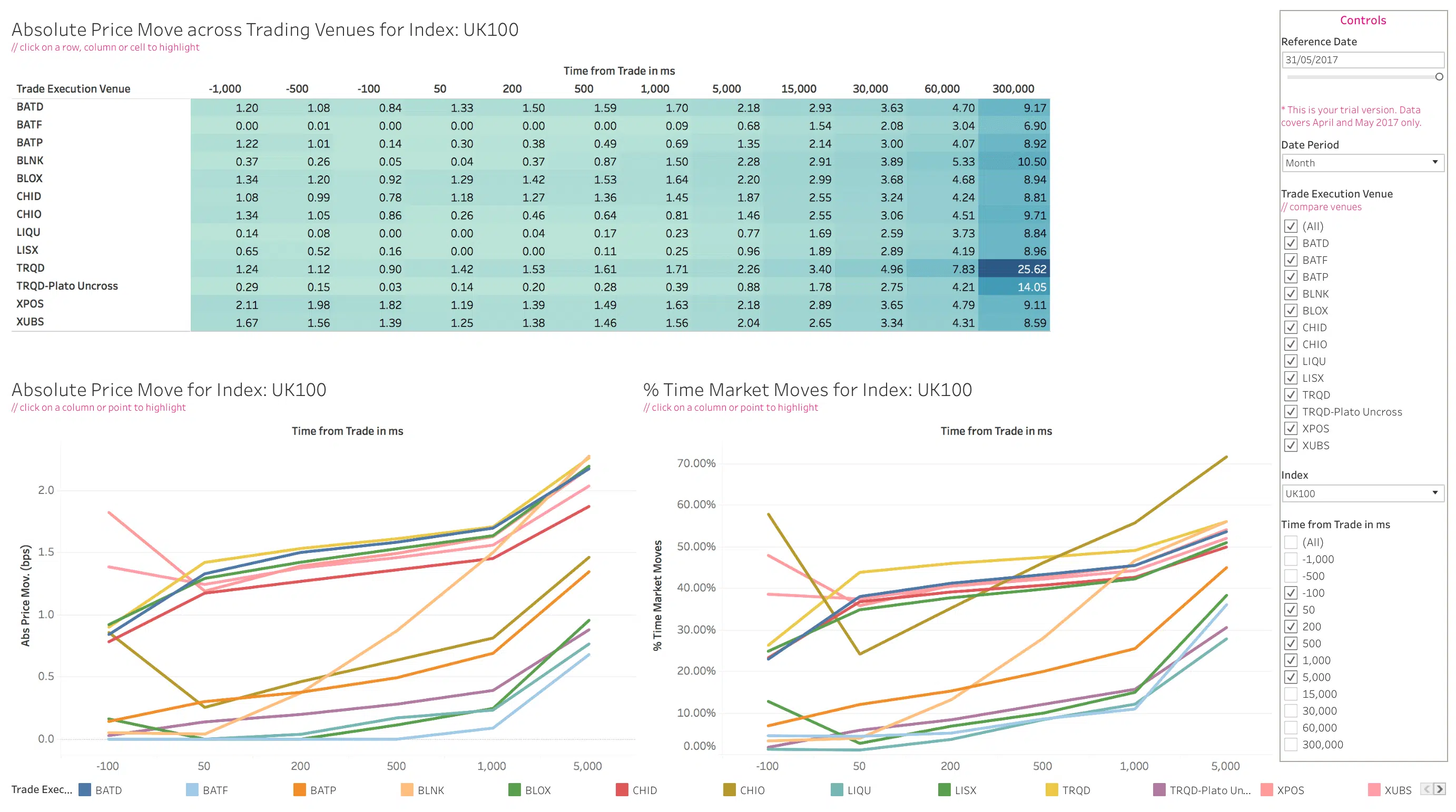

The market impact dashboard offers various measures to estimate expected transaction costs. It allows to investigate the price change before and after a trade. The measures are calculated on every single trade for all securities across venues and trading days. The interactive dashboard provides essential insight for trading firms as it helps to understand average market impact in dark pools. This information allows firms to reduce transaction costs by optimizing their trading and execution algos. The market impact analysis consists of the following two measures: Price Impact (prior and after the trade): the difference between the mid price (as-of-trade) and the mid prices preceding or following the trade during given time distances from the trade time. Ratio of Market Moves in % (number of trades with an observed price change>0 at a particular time point – prior and after each trade): the ratio of price changes>0 observed during given time distances from the trade time.

London, 27 July 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, today announced the launch of its Liquidity Cockpit, designed to give global trading and investment firms enhanced visibility over dark and lit liquidity, and the ability to navigate and analyse European market share across a fragmented and dynamic market landscape. With the anticipated MiFID II dark volumes caps coming into force and the rise in Large in Scale (LIS) trading activity, equity market participants need to recognise LIS classified trades, track market share and navigate interactions across different liquidity pools.

Tick Data API available for Quants, Traders and IT – Free Trials Update: big xyt extends the ACTIV X-ray platform to support tick data for more than 80 markets globally. ACTIV X-ray now offers seamless access to petabytes of historical tick data. Key features are Access to high-quality tick data for more than 80 markets with a single interface. Global coverage with trades, top-of-the-book and market depth (for selected markets). Attractive pricing with flexible models, e.g. per instrument, per market, pay-per-use. API access for Python, R, Java, C# and other programming environments. CSV download for normalized data including market depth. Customizable snapshots for tick data, e.g. n-minute bins. Unrivalled API performance to support back testing of algos or the development of advanced models like artificial intelligence.

Technology enables firms to leverage artificial intelligence and machine learning in many new areas. These new applications require cost-effective compute platforms and seamless access to large datasets. Learn how the Banking, Finance and Insurance sector is managing these challenges in the new issue of Financial Markets Insights: Powering Up – Handling high-performance computing to boost alpha and risk management The complexities surrounding the Banking, Finance and Insurance sector today have led to a significant growth in the use of grid computing and high-performance computing (HPC) for computationally-intensive tasks. These are many and varied, and include areas such as derivative pricing, risk analytics, quantitative modelling, portfolio optimisation, and bank stress testing.

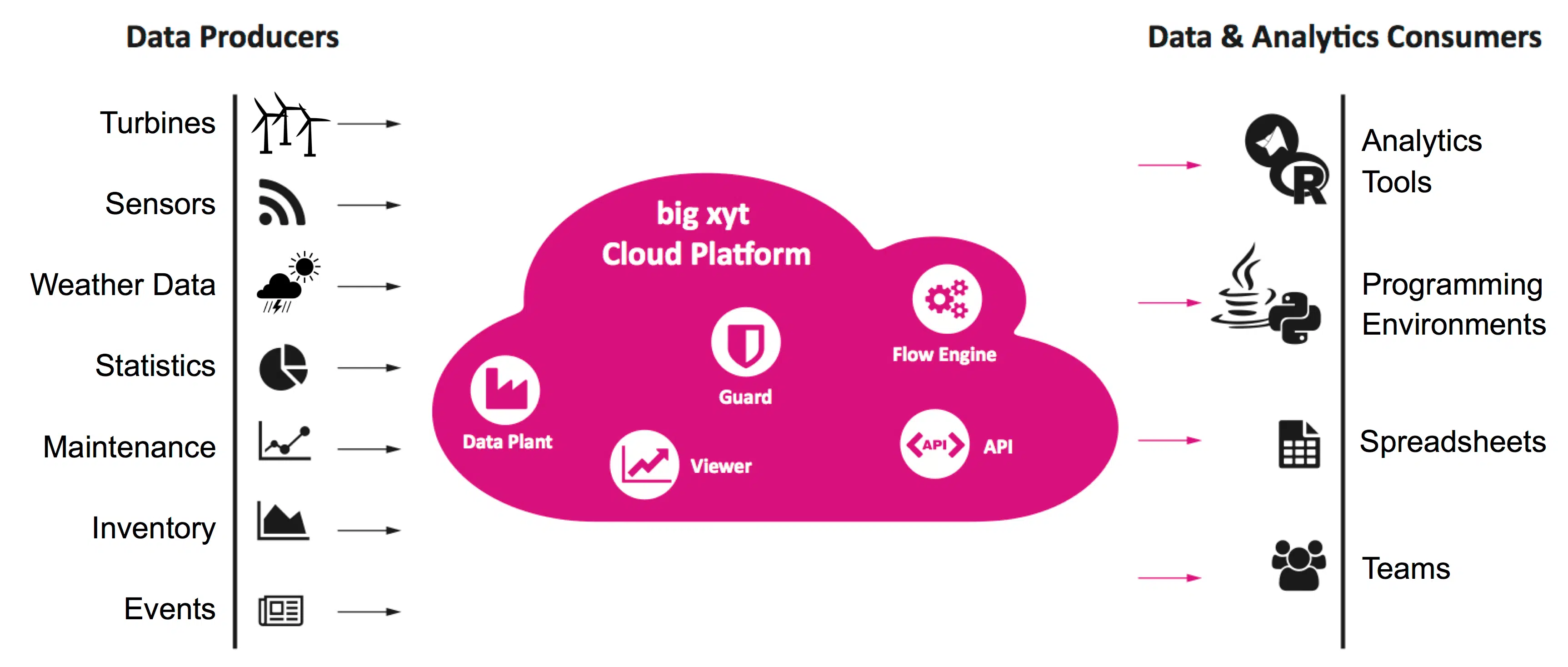

Hamburg, 16th & 17th May 2017, big-xyt’s partner WKA Blade Service (Robur Group) will present at the German conference for Wind Turbine Maintenance. Learn how the big xyt Cloud Platform enabled WKA Blade Service to analyze sensor data and maintenance events for thousands of wind turbines over a period of 10 years. The initiative demonstrates the value of the big xyt Cloud Platform in new industries. Designed and optimized for use cases in capital markets, today the big xyt Cloud Platform offers capabilities that allow clients in various industries to mitigate challenges of big data analytics and to seize new business opportunities.

London, 26th, 27th & 28th April 2017, big-xyt’s Dr. Ulrich Nögel speaking at the QuanTech Conference about Challenges in Big Data Analysis (Thursday, 27th at 2:15pm), Stream “Machine Learning, Big Data, IoT & HPC Stream”. About QuanTech: These events have been built in collaboration with some of the world’s leading banks, financial institutions and technology companies to ensure that the most pressing and pertinent issues are covered. Topics ranging across trading, fixed income, derivatives, syndicated loans and trade finance, identity and payments. Discussion for leading figures on both the business and technology sides of the global banking industry. London Topics:

London, 1st & 2nd March 2017, big-xyt’s Dr. Ulrich Nögel speaking at the Artificial Intelligence and Data Science Conference. Learn how big xyt enables the growing AI community with analytics on very large datasets. Join our speaker slot about “Challenges for Big Data Analysis in the Post-Crisis Regulatory Environment”. About the event: Artificial intelligence and machine learning algorithms offer us a revolution in the way value can be derived from the vast amounts of data we produce every moment. As more of the financial world embraces AI and machine learning, questions arise about how best to implement this technology, and more broadly the impact it will have on existing market structure.