During these unprecedented times we do not underestimate the professional and personal challenges that everyone is facing. There are far more important things to be doing in the community than looking at a screen. However, data and data analytics is playing a critical part in providing solutions to the current global crisis. Furthermore, the markets remain open and whilst they do, the trading community needs to be well informed in order to understand the changing market landscape. As a result, big xyt is receiving an increasing number of requests for observations of changing trends and behaviours in the equity markets. We are excited to have recently expanded our London team to enrich our content and support for clients seeking greater market insights from an independent source. Whilst many adjust to the new experience of working from home we plan to share some of these thoughts, observations and questions in the coming days & weeks.

Having a large international financial institution going live with our API for advanced execution analytics at the beginning of the year was a great way to start. Throughout 2019 we have on-boarded a record number of new clients and have been very pleased to be nominated and more importantly win a number of industry awards in recognition of our reputation for delivering independent analytic solutions. Becoming the de-facto reference for all major European exchanges has been the icing on the cake. What does 2020 hold in store for the business? We already see a growing trend for outsourcing data analytics. By delivering our solutions as a trusted and independent partner we are able to facilitate the business transformation our clients need by allowing them to concentrate on their own proprietary needs.

Frankfurt, London, 27th February 2020 – big xyt, the independent provider of market data analytics, is pleased to announce that Kepler Cheuvreux, a leading independent European financial services firm specialising in research, execution services and advisory services, is implementing their award-winning Execution Analytics including Transaction Cost Analysis (TCA). big xyt takes execution analytics beyond Transaction Cost Analysis (TCA), transforming the traditional view of TCA with data science; applying advanced techniques to increase quality and deliver consolidated data views for its clients. TCA has transitioned away from being a routine compliance solution to being a critical business function. big xyt solutions capture, normalise, collate and store trade data at a granularity that has not previously been available in the market.

As we set forth into a new decade with 20:20 vision, we thought it would be appropriate to share some memories and developments from an award winning year for big-xyt in 2019. Most, if not all of these enhancements germinate from client conversations. We value feedback highly and would encourage you to continue to challenge, encourage and share thoughts with us. Looking back at 2019, we can see many ways in which big-xyt has developed, not just as an independent reference for European Equity market structure but as an external source of unbiased analytics, accessible & integratable through a unique proprietary API. Please let us know if you would like to know more about these service

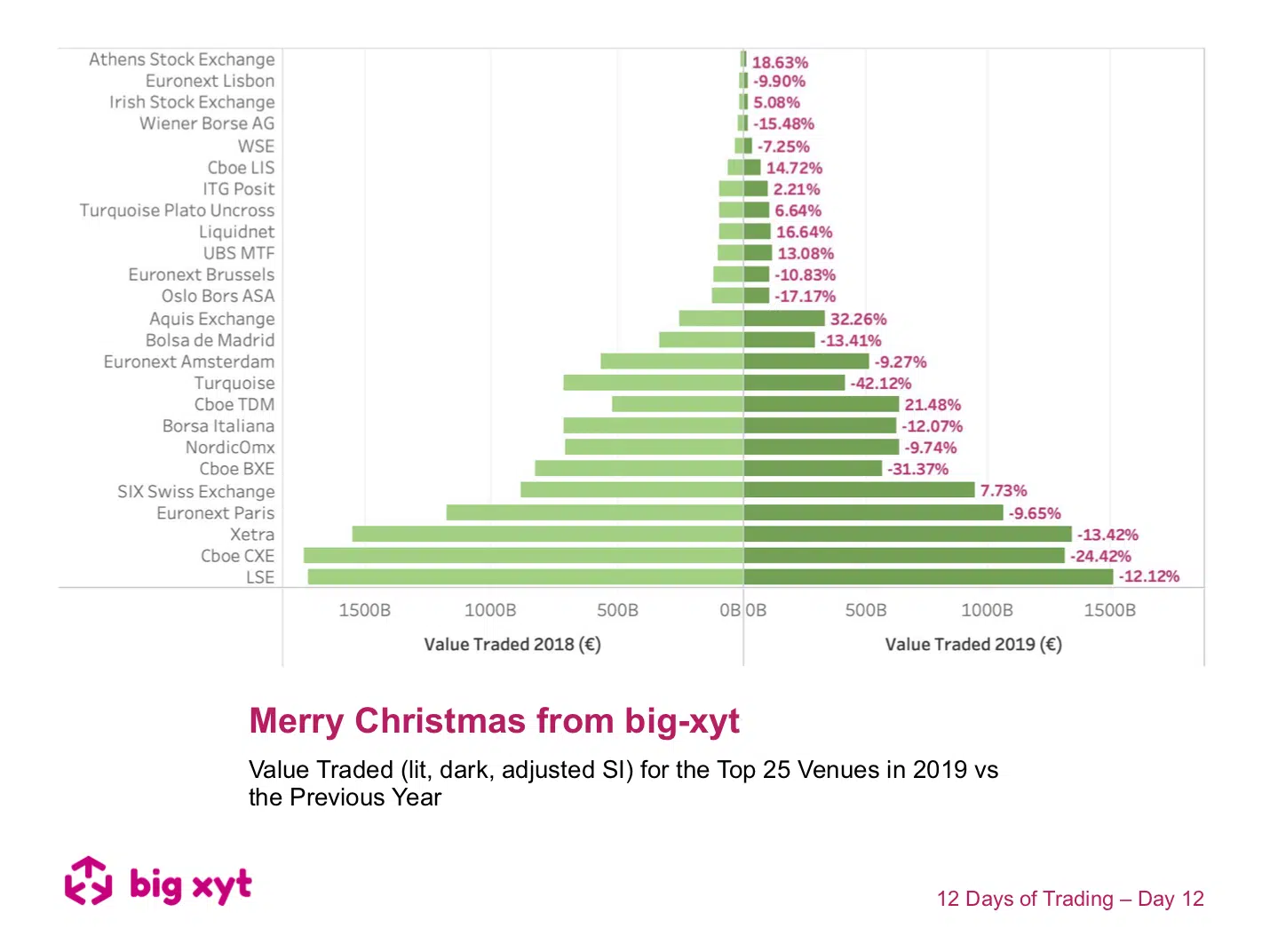

Well, it’s Christmas Eve folks and what better way to see out the old & see in the new year than to reflect on the changes in the last 12 months. We look forward to introducing new content to help provide 2020 vision next year, so watch this space. In the meantime, the chart today, whilst festive in its intent does show some changing trends throughout the year. As a backdrop to these changes, overall volumes declined 12% during the period and the Swiss non-equivalence influenced that particular market from July. If you have found these pieces of analysis useful, you will find there is a lot more you can do with our Liquidity Cockpit. Clients using our Execution Analysis/TCA are able to measure execution performance with the demonstrated precision and flexibility

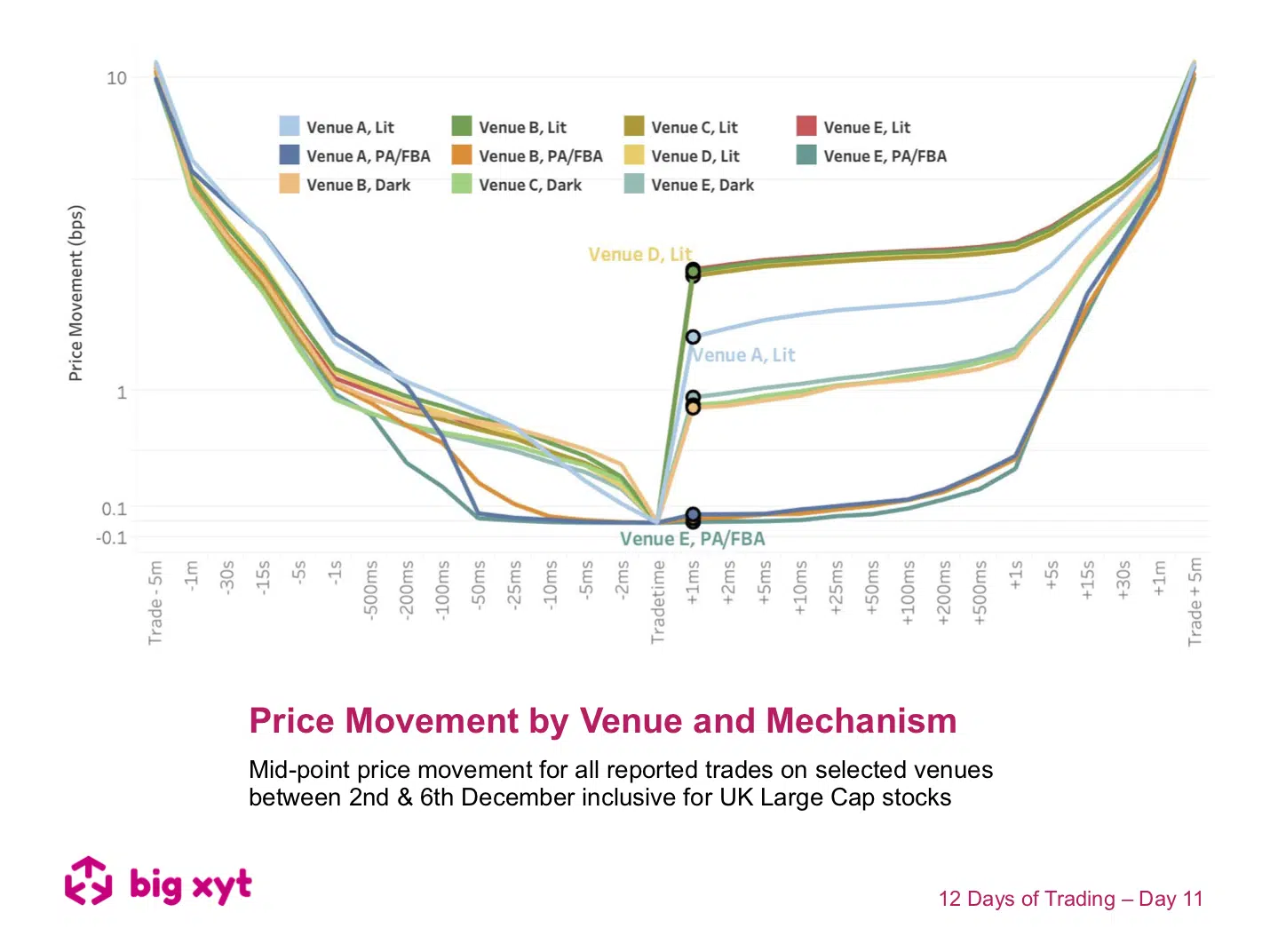

The chart today returns to a theme we have covered before but with additional layers uncovered. In the past, we have viewed the movement of the mid point before and after every trade to build up a pattern for each trading mechanism. We have developed this further so that each venue can be singled out whether lit, dark or periodic auction. We have anonymised the venues and excluded blocks and a generic view of Systematic Internalisers from this example. Subscribers to our Liquidity Cockpit API can see this detail in all its glory. Using these new metrics and categorisations is creating new thinking in execution analysis. In addition to comparisons with recognised benchmarks, traders can now see how they compare to a typical profile when they or their brokers route to different venues and market mechanisms.

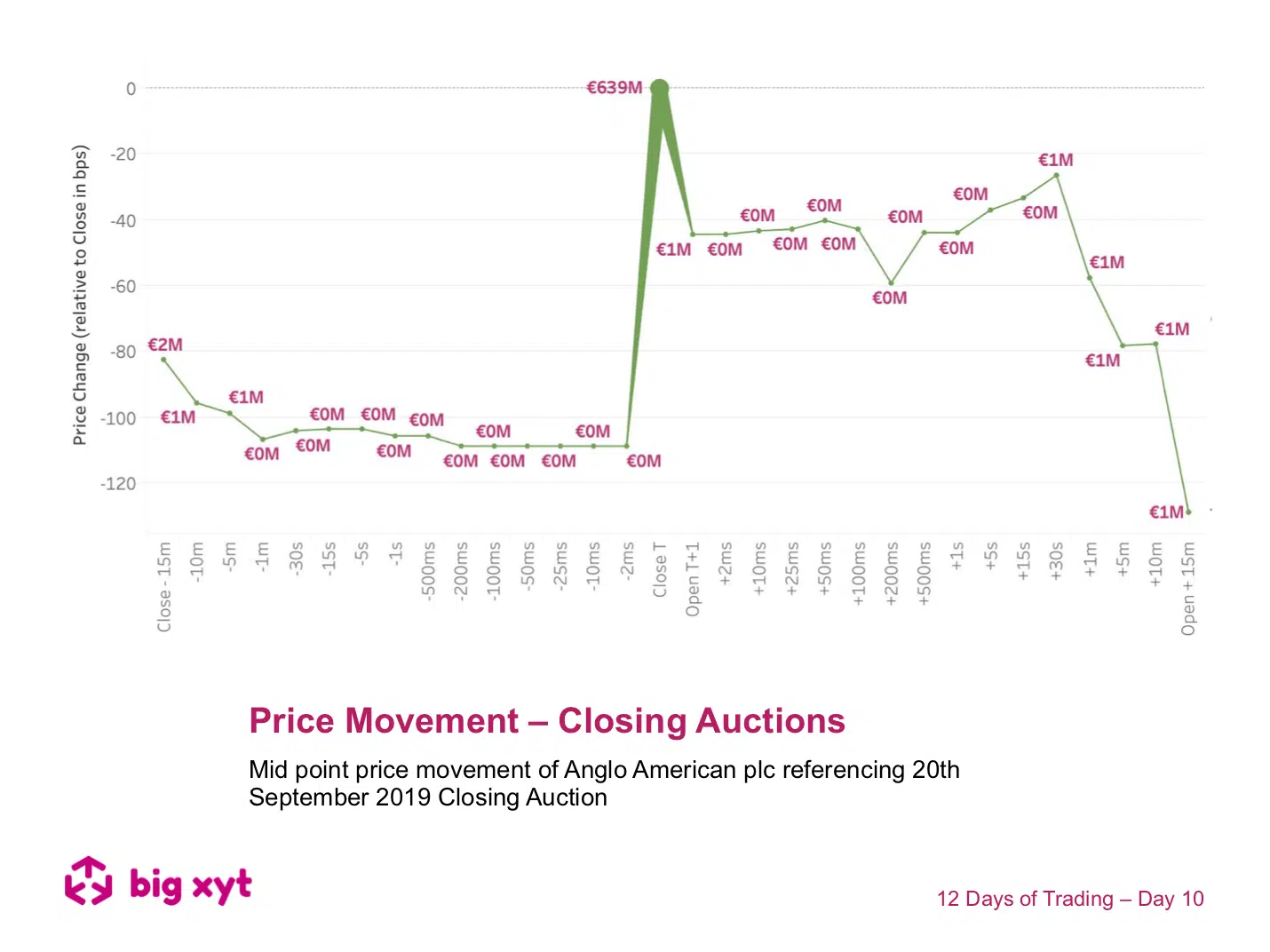

Following previous observations of the growing significance of the closing auction we felt curious as to whether a benchmark price should be the best driver of liquidity. As we saw yesterday, investors were quick to embrace the opening auction and trade more throughout the day when trader/fund manager conviction is higher such as last Friday 13th. So what happens on days when closing volumes are greater, such as index rebalance and derivative expiry days? As you may have seen, we have examined intraday price movement in the past to compare market mechanisms. Today we are introducing a view of movement around the closing price.

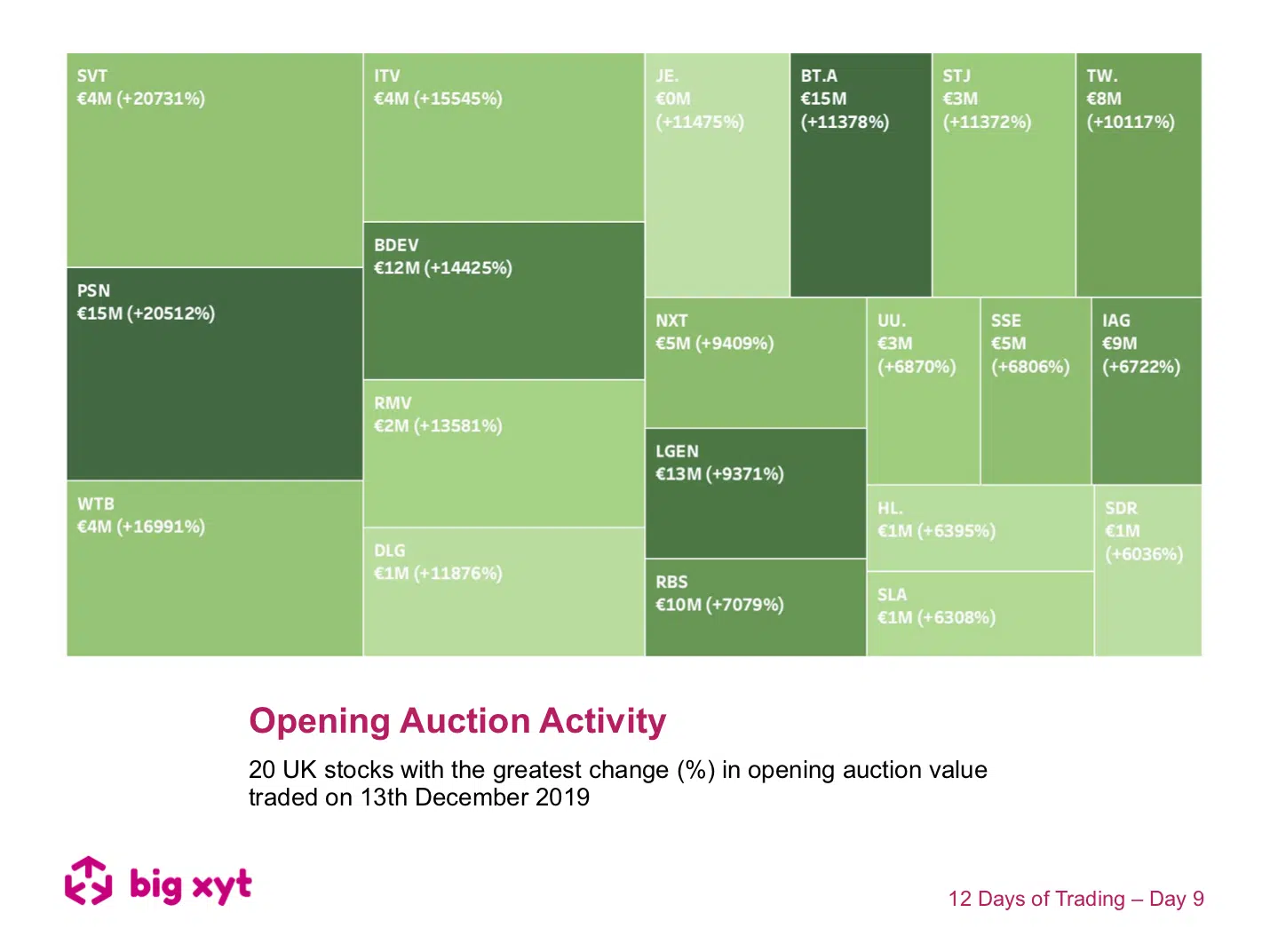

On the morning after the General Election, the chart shows the 20 stocks with the greatest percentage change in opening auction turnover. This could be taken as a proxy for company sensitivity to the political implications as investors acted with both speed and size. This sample is limited for ease of view and the full universe can be viewed and normalised by block size, for example, or absolute value traded. Let us know if you would like to see similar results for block trades during the rest of the same day as investors scrambled to adjust their exposure. Liquidity Cockpit users are able to look at any stock this way and see the venues broken down. Clients using our

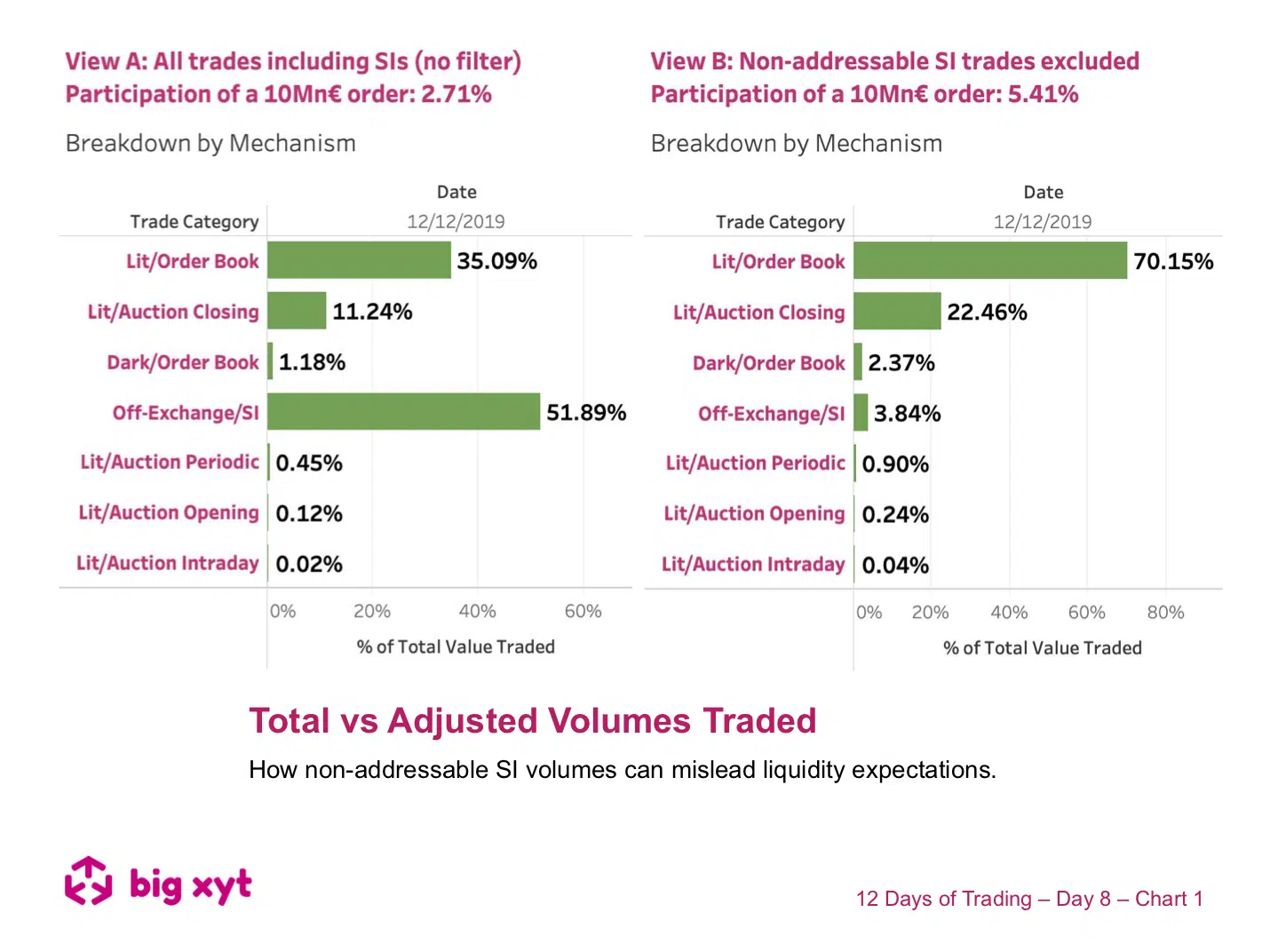

Understanding where the expected liquidity is available is key to any participation strategy. However, if your assumptions relating to expected liquidity include all reported trades, you could find yourself starting from the wrong place. This example looks at Munich Re shares traded on the 12th December (a relatively “normal” day before the UK General Election results were announced). A typical institutional sized order of €10Mn would need to be careful not to impact the market. In view A, on the left, the order represents 2.71% of the days total reported turnover in the stock. But how much of the Systematic Internaliser (SI) volume is unaddressable and gives an over optimistic picture of available liquidity?

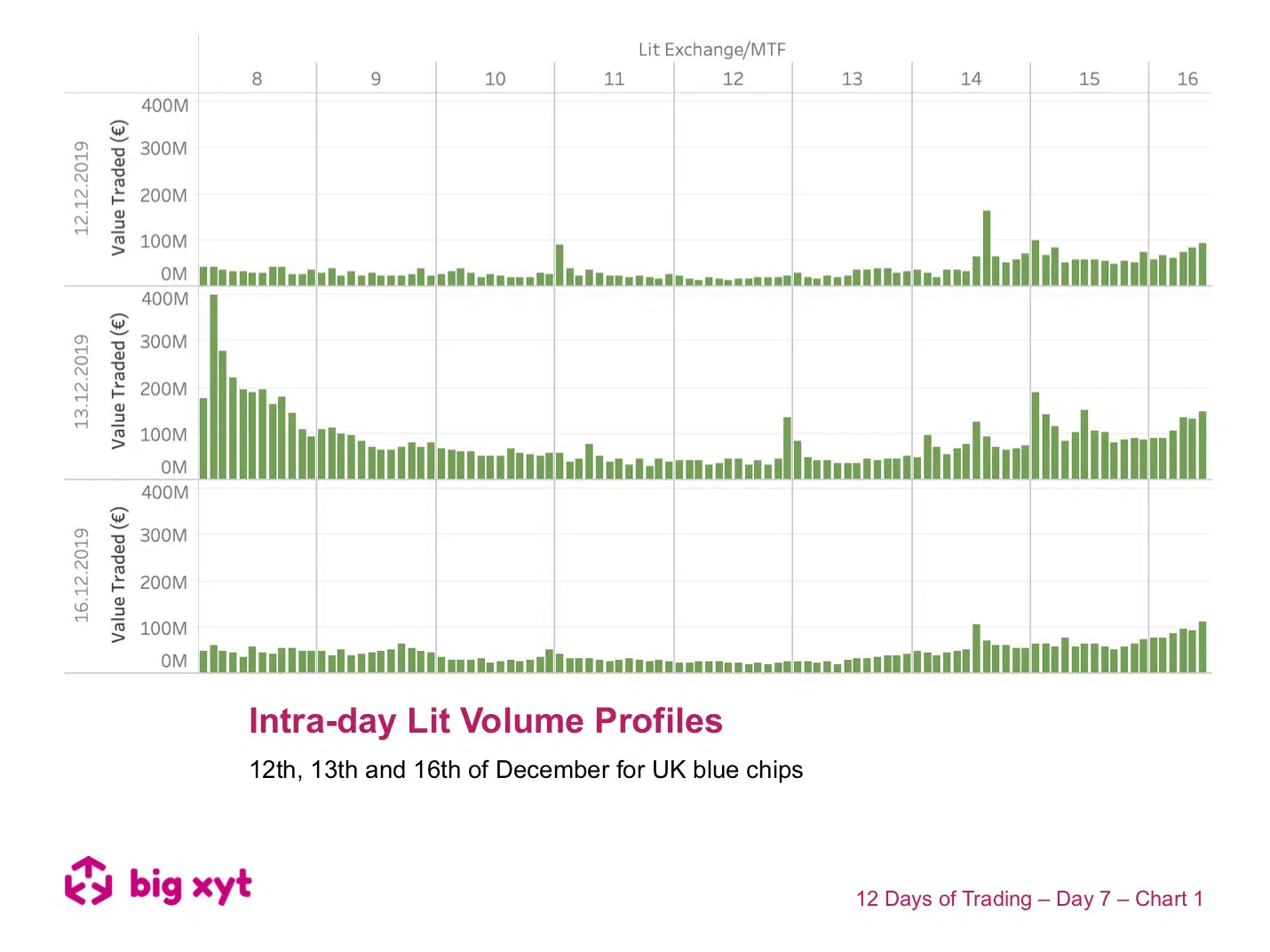

There was too much happening on Friday not to revisit how the General Election result shifted traders’ focus from liquidity based benchmarks to urgency of execution. Having seen the increased opening auction activity on Friday 13th, we wondered if it was unlucky for some router configurations as they did their best to navigate a non-standard day of liquidity profiles? Today we have two comparative sets of charts to introduce and examine the intraday volume profile (in this case for UK blue chips). If this was your crystal ball you would have used it on Friday, for example, to target the volume weighted average price (VWAP). In chart one we see how lit volumes, split into five minute buckets, vary through the continuous trading session (i.e. not including the open & closing auctions). The top chart is polling day (12th) the middle chart