In the good old days, your Christmas tipple might have been a gin & tonic, of which there were few mainstream choices for the spirit or the mixer. Then, almost overnight, there was a somewhat confusing abundance of choice for both, garnished with the decision of what variety of fruit or vegetable should be sliced into it.

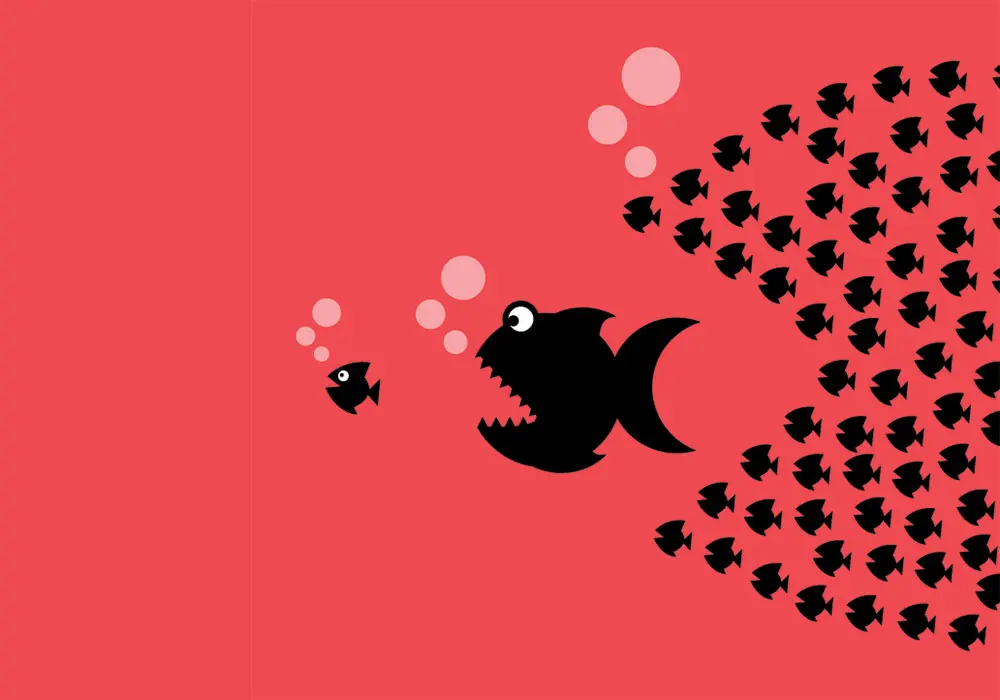

Yesterday we commented on closing auction volumes, which are, of course, composed of multiple trades in a stock at the same time and price – perhaps familiar to those of you who like to combine several presents together in one piece of wrapping paper. When it comes to a single large present it is always nicer when it comes as a surprise. Away from the auctions, most institutional traders target dark pools as an efficient way to shift large positions. With no guarantee of trading, most of these dark trading venues bring the advantage of mid-point pricing. Benefits include saving half the spread as well as reducing the information leaked when interacting with a public order book.

Inevitably at this time of year our thoughts turn to the important matter of choosing the right dessert to round off a hearty Christmas lunch. To get us in the mood, for our first 12 Days of Trading 2021 post, we decided to look at the Closing Auctions, the “afters” of the trading day if you like. We discovered that the top four largest ever auctions all occurred in 2021.

Is the fun about to come to an end for those trying to optimise (and capitalise on) their interaction with one of the most heavily traded equities in Europe? It has to be one of our favourite stocks for the complexity it presents for equity exposure to a single organisation. Two different lines of stock, both traded heavily on two primary exchanges. Competition aplenty from the UK and European MTFs and the full spectrum of market mechanisms accessible to trade; lit, dark, auctions, off-book (on-exchange), OTC….the list goes on. It presents a challenge for many investors, banks and brokers and a long standing opportunity for the canny arbitrageur.

Do some traders have an advantage over others… and does it matter? How fast are equity markets? Or how much of the market operates at high speed? big xyt took an electron microscope to our normalised market data to find out. We analysed UK lit markets to measure the time between a trade and the last relevant orderbook change. The FCA established 500μs as a speed benchmark in their latency races paper. This is 200x faster than the 1/10 of a second after the gun in which a sprinter can false start.

There is a difference between what people say and what they do. Companies are realising the importance of actions speaking louder than words and are beginning to focus on changing behaviours not just the “Values” statement on their website. Investments are no different as can be seen in our analysis today. Investment in companies with strong Environmental, Social and Governance (ESG) mandates are already being grouped together by ETF issuers to facilitate easier investment in ready-made portfolios of socially responsible companies.

As a trailer for our forthcoming Q2 2021 survey of European equity market microstructure, we thought you might like a sneak peek at what’s been happening to fragmentation. Following Brexit and the divergence of dark trading rules, we have been monitoring the trend in the UK. The graph below shows the UK250 index where on-order book ‘lit continuous’ trading has reached a 5-year low in terms of the daily market share traded in June at just 28.5%, while auction market share is a whisker under the previous record high in December at 22.7%. Meanwhile, dark trading has risen to over 12% from 9% prior to October 2020.

In the search for liquidity, particularly whilst minimising market impact, a means to identify large trades and where they take place is key for the investing community. The regulatory changes in MiFIDII introduced the concept of Large In Scale (LIS). No, not not a post-Brexit way to limit fishing quotas, rather a means to identify large transactions in financial instruments. In the equity landscape this has resulted in some confusion post-Brexit. Depending on the activity in each individual stock, an LIS threshold was set, above which the trade could be classed as a block trade. As Broker Crossing Networks were abolished at the same time, this LIS threshold was applied as one of the permissible justifications of many venues supporting dark trading.

Navigating the choppy waters of ETF liquidity is challenging and requires visibility of all available trade mechanisms. The chart below looks at the European ETF universe however the picture changes

Academics from Brains Trust predict market launch will quench investors’ thirst for trading to stay local. (Special note: this was an April Fool’s Day post) Flushed with success from the Six Nations Championship a new stock market is being proposed for Welsh investment in Welsh companies. Behind the initiative is the recently formed Welsh Industrial National Development group for Under Performance. Passive funds will be able to track the Taff Index made up of Strong Companies Repositioning for Upward Movement following the top 15 constituents from a total squad of 23.