When navigating through the complexities of European equity liquidity, one could be forgiven for wondering whether, for many market participants, the changes in regulation brought about since January 2018 through MiFID II have been a help or a hindrance. MiFID II was designed to introduce more transparency. But have aspects of it made the markets more opaque? One example is around the proliferation of Systematic Internalisers (SIs). Although this category of market participant was actually introduced under MiFID I, it has only really seen greater adoption since MiFID II outlawed Broker Crossing Networks (BCNs) and in so doing blocked the systematic matching of client to client orders. The SI regime created an alternative way for investment banks to match proprietary

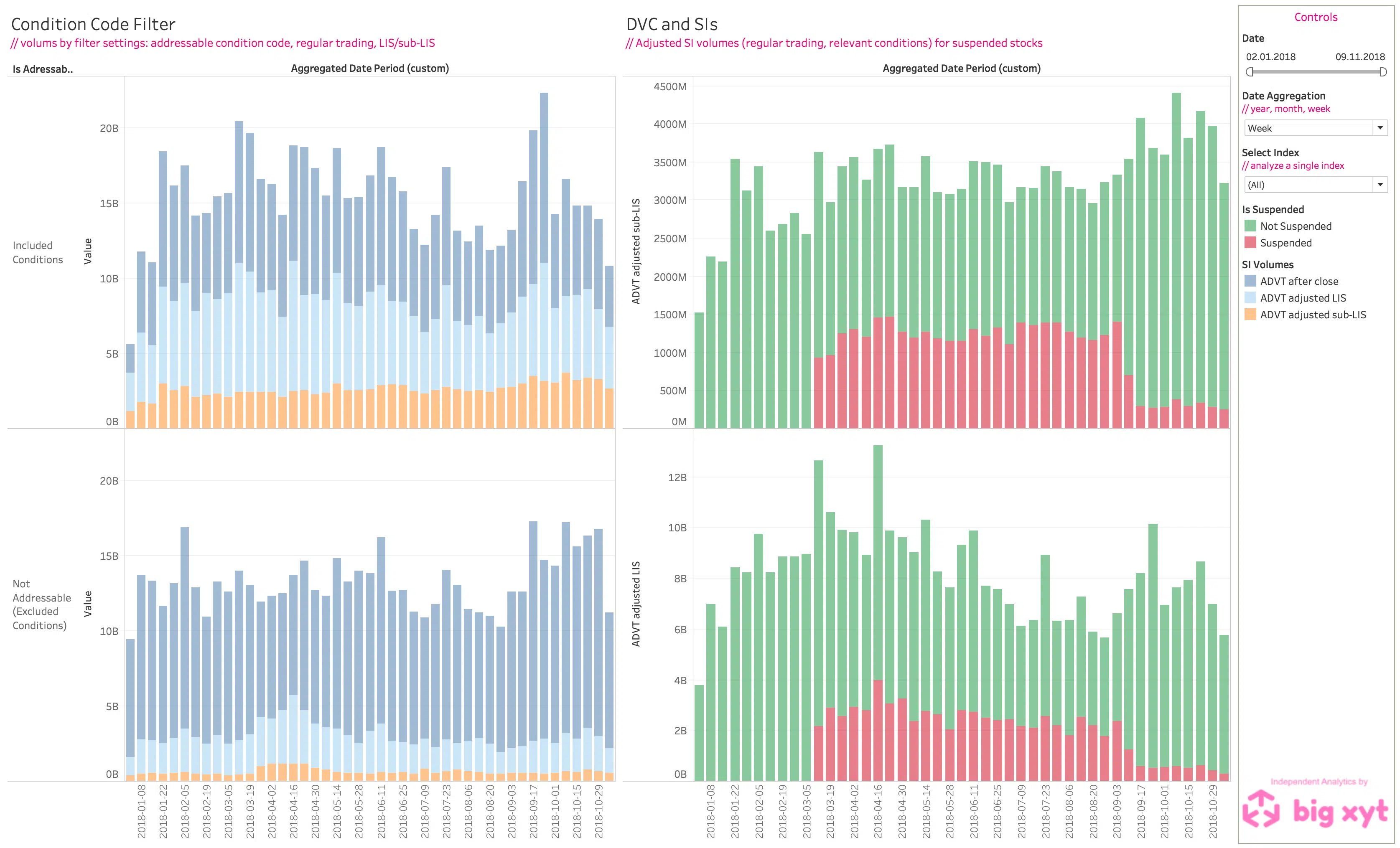

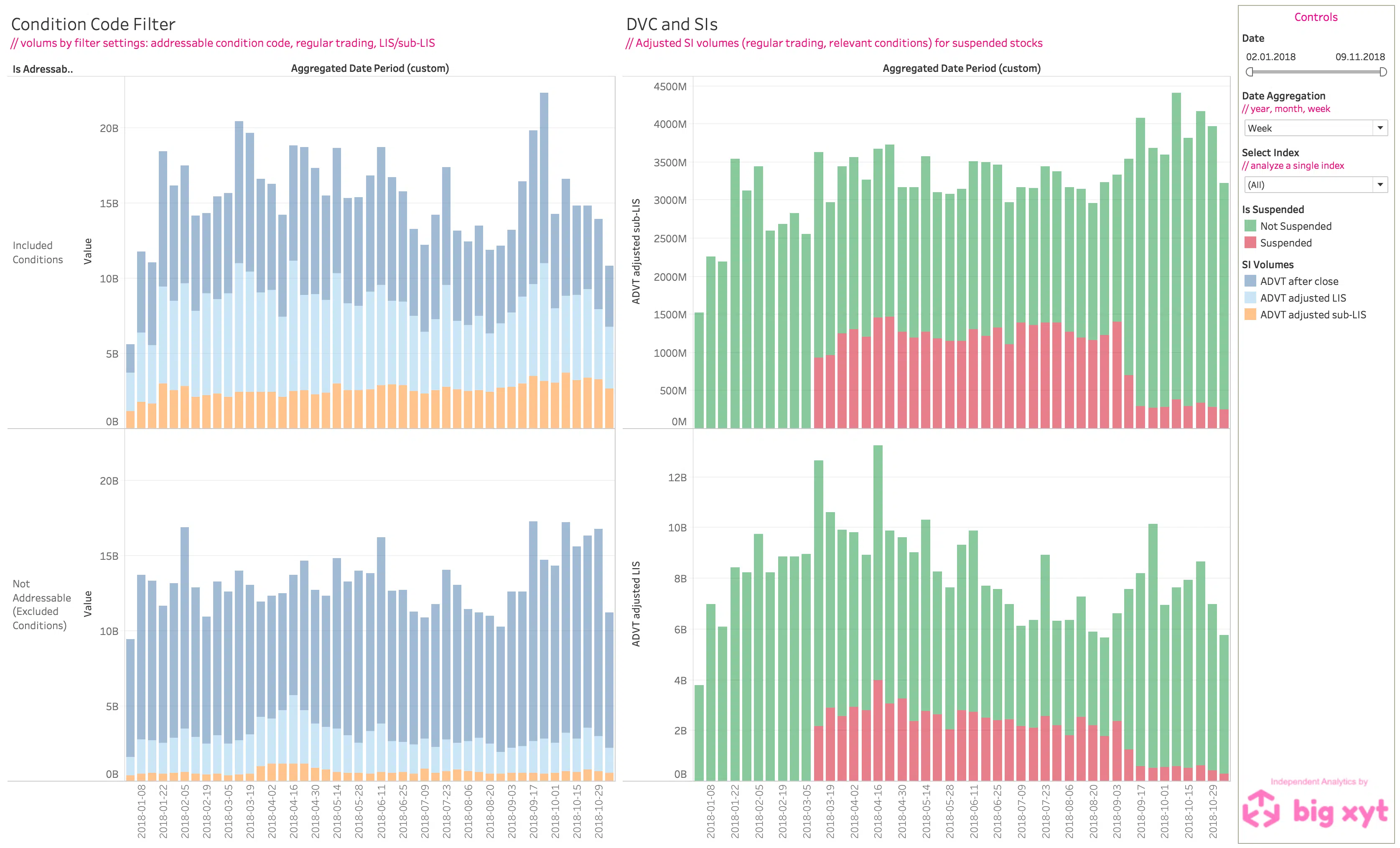

London, Frankfurt, 15 November 2018 big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce further client driven enhancements to its Liquidity Cockpit. With the introduction of a dedicated dashboard for analysing SI volumes, eligible users have the option to view and compare the reported SI volumes filtered by adjusted conditions, analysed by time, by region or by symbol. This new dynamic visualisation leverages the recent release extending the adjustment of SI volumes and the range of enquiry options and filters available. Users are now able to better understand the component parts of total SI flow reported. Furthermore, this additional value added functionality introduces comparisons to other market activity such as Large In Scale (LIS) trades and the impact of Double Volume Caps on liquidity dispersion over time.

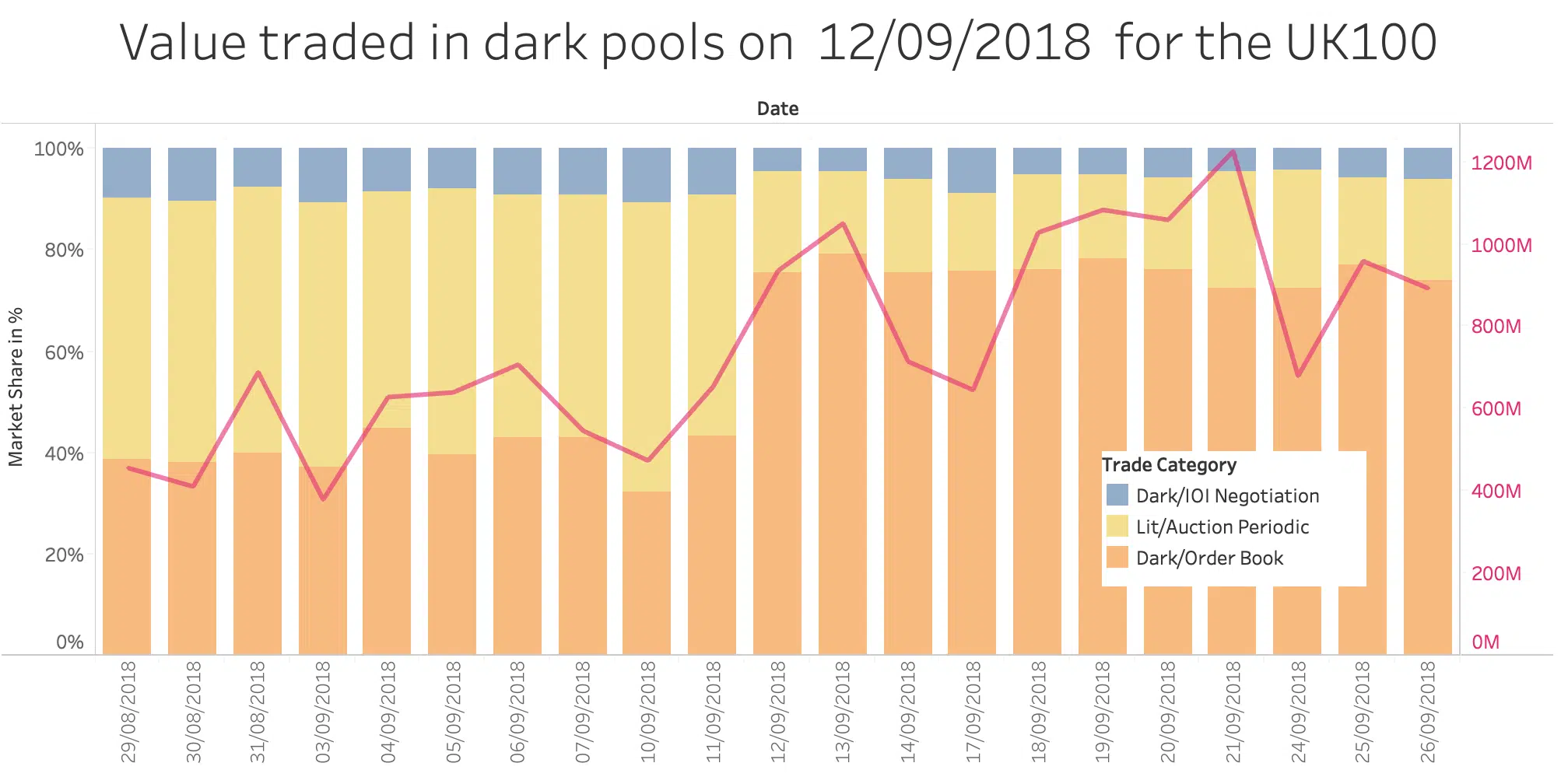

The introduction of the double volume cap (DVC) mechanism as part of MiFIR has heralded a new era in European equity trading, limiting for the first time the universe of securities that can be traded on dark pools. Nearly eight months on from the first DVC suspensions, we can begin to assess how the new regime is working and how the market is adapting. When it first kicked off the DVC framework in March 2018, the European Securities and Markets Authority (ESMA) acknowledged that data quality and completeness issues had delayed implementation by two months, but since then it has kept its public register regularly updated to give market participants full transparency on instrument suspensions.

Enormous volumes of data might be the lifeblood of quantitative analytics, but for the typical trader, dealing with data in any asset class can be complex, costly and daunting. With the explosion of data in recent years and the continuing appearance of new data sources, the challenge for practitioners is growing all the time and they need the power to identify and extract the data that is most relevant to them. Attempting to isolate data using standard spreadsheets is much like using a bucket and spade to find a grain of sand on a beach – it simply can’t be done. Traders need to understand how data has been sourced and they must be able to curate and store large volumes of data in an accessible and manageable format so that they can

The rise of quantitative analysis is mirrored by a rise in demand for its fuel – data. With one feeding the other, investment firms and banks are increasingly reliant upon products and services that can be tested and proven in a way that for many markets was impossible ten years ago. As a result, the use of outsourced tick data provision is becoming prevalent in order to support that rapid growth. Tick data – capture of the price, time and volume for every order and execution across the instruments on a given trading venue – can provide enormous value for exchanges, broker-dealers and asset managers in this context. Ten years ago, it was seen as the preserve of firms building execution algorithms. Now that demand reaches across an enterprise. From compliance to business growth, tick data sits behind many key decisions.