Do you remember the optimism of the Santa Claus rally? Only a few months ago we were being entertained by stories of the S&P 500 in the high fives by year end (that would be a 30%+ rally from here) and post pandemic recoveries across the board. Then along comes the spectre of war, sanctions, and a cost of living crunch for households.

Dark trading currently represents 8% of equity turnover across all of Europe, adjusted to exclude clearly non-addressable OTC and SI prints. In UK Blue Chips that is now 11.6%, and for UK mid caps it is 15.2% How often are you looking to identify when a stock has an unexpected surge in turnover? And how often is it beneficial to know that some or all of that increase was on a Dark venue?

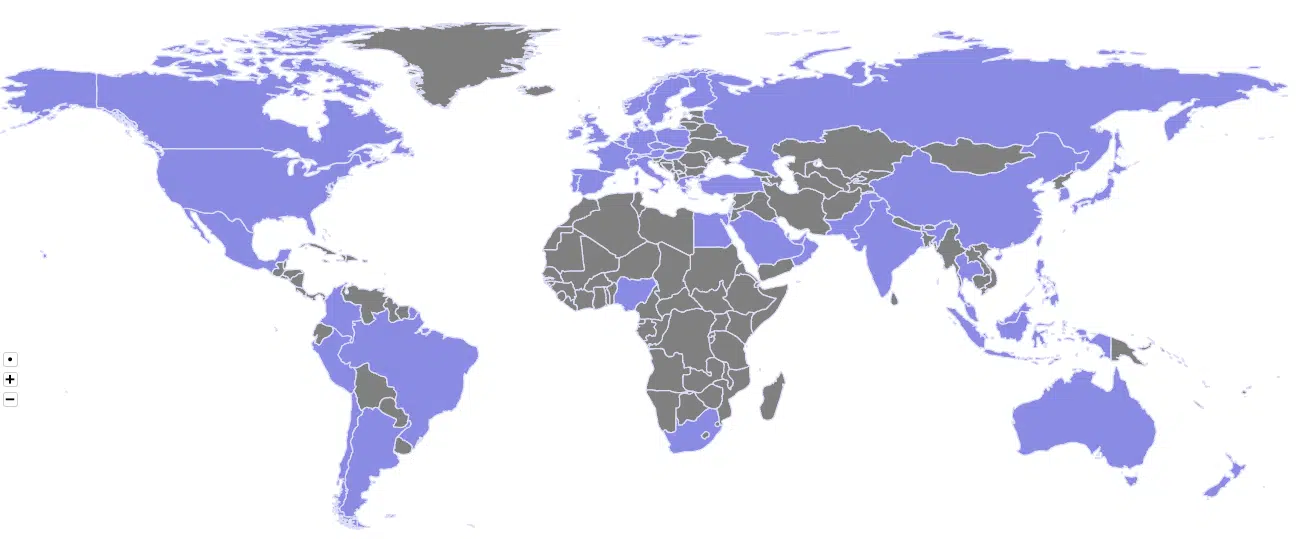

big xyt, the independent provider of smart data and analytics solutions to the global trading and investment community, today announced the launch of the Global Exchanges Directory, an interactive web portal providing key information on 97 worldwide stock exchanges and alternative trading venues in seven regional categories.

2021 has ended and all that remains are the tea leaves at the bottom of the cup. In our latest annual survey of market volumes and fragmentation trends in European equities, we gaze at the patterns to see how the story unfolded and what we can learn about the year ahead. Another turbulent year for equities globally played out in the daily ebb and flow of over 250 billion quotes, orders and trades, presented to you here in a short pictorial summary.

When Santa visited us for one of our academy sessions, Market Structure for North Pole Inhabitants, we provided an initial introduction to European market structure using the following chart for European Equities by trading mechanism, which may be familiar to many of you: Santa soon understood that, but as a wise man, he remained curious – one of the questions he asked was about ETFs: “If these equity-like instruments are called Exchange Traded Funds,” he asked with a glimmer in his eye, “Why do they trade less than 28% of their volume on exchange compared to 53% for vanilla equities?”

Santa may need to consider moving with the times as we navigate the growing wave of social responsibility. On the one hand, reindeer power is about as green as you can get to power a vehicle, and on the other…..all that wrapping paper and packaging! Someone needs to tell him ESG does not stand for Extra Special Gift. One of the recent benefits of the growth of ESG campaigns in financial markets is that the spotlight has moved beyond a focus on the social DNA of companies to invest in. Questions are now being asked about how all the companies who are active in financial markets are behaving. Could there be ways to introduce new practises and infrastructure in order to become more sustainable as an organisation, and as a community?

Santa may need to consider moving with the times as we navigate the growing wave of social responsibility. On the one hand, reindeer power is about as green as you can get to power a vehicle, and on the other…..all that wrapping paper and packaging! Someone needs to tell him ESG does not stand for Extra Special Gift.

Whilst the Italians enjoy a good hearty feast on Christmas Day, traditionally they give and receive gifts on January 6th – the 12th Day of Christmas. There was a big Italian gift in the spring of this year too when ownership of Borsa Italiana was transferred (for a small fee) by LSEG to Euronext. Given this change and the implications of Brexit for European exchanges and venues, it occurred to us that it might be interesting to take a look at the Italian market to see if things have settled back to (the new) normal.

At this time of year the discussion often turns to how Father Christmas is able to get around so many households in just one night. For sure, the sleigh is fitted with the latest technology such as smart routers and machine learning algorithms to plot the optimal course between well behaved children. But the evidence is building that in his day job the big man may be a high frequency trader. The time it takes to get between Madrid and London at light speed is around four milliseconds. Of course, that’s the physical limit and there are plenty of items that cause friction such as chimneys and church steeples, or if you are a high frequency trader, firewalls and trading controls. The parallels are obvious.

To some people Christmas feels the same year after year, maybe because the favourite armchair in the corner of the room is comfortable, Grandpa’s view never changes too much and he probably likes it that way – he’s seen enough change over the years. For kids, however, each year brings fresh festive excitement; as they grow older their perspective changes and they remain curious.