Changing the way data is interrogated and benchmarks viewed London, Frankfurt, 23 April 2019. big xyt, an independent provider of high-volume smart data and data analytics, is pleased to announce that, following consultation with a number of clients, the big xyt analytics platform has been extended to include Transaction Cost Analysis (TCA). It is recognised that post-trade TCA is transitioning from just a compliance solution to being seen as a crucial business function and big xyt is transforming the traditional view of TCA with data science; applying advanced techniques to increase quality and deliver flexible consolidated data views. Whilst TCA benchmarking calculations have not radically changed over the years firms increasingly demand flexibility to benchmark in-house analytics with an independent market source, in a way that better fits their business requirements.

One of largest financial companies and a major provider of institutional banking, investment management and broker services. Long-standing experience of trading electronically in European equities, offering a market-leading suite of algo execution and analysis tools to its clients. The Challenge Although the client was already using a white-labelled transaction cost analysis (TCA) service from another vendor, as a highly sophisticated user of TCA data and analytics, the client required a more detailed understanding of its execution performance than its existing provider was able to deliver. Critically, the incumbent vendor was unable to provide the required levels of transparency on the underlying data and methodology used to generate its TCA reports.

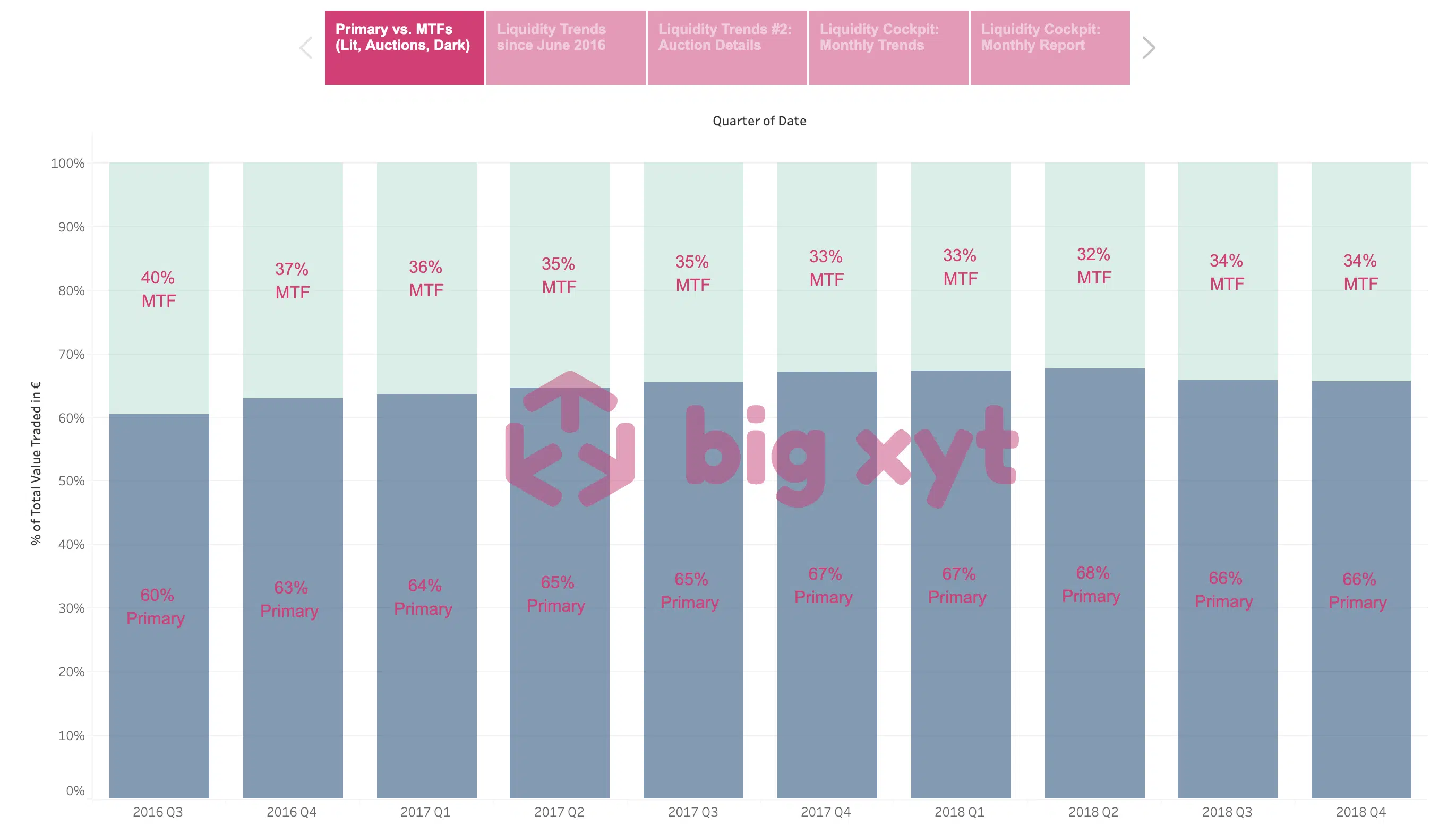

Analysing trading data from multiple points of view one year on from MiFID II London, Frankfurt, 28th January 2019. big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce the launch of www.250days.com, a collection of views reflecting the evolving market dynamics over the past year. The new site leverages the Liquidity Cockpit, the industry recognised reference for independent market structure analysis, and has been created in response to multiple client requests. Visitors will have access to annotated visual analysis of the fragmented European equity trading landscape leading up to and during 2018.

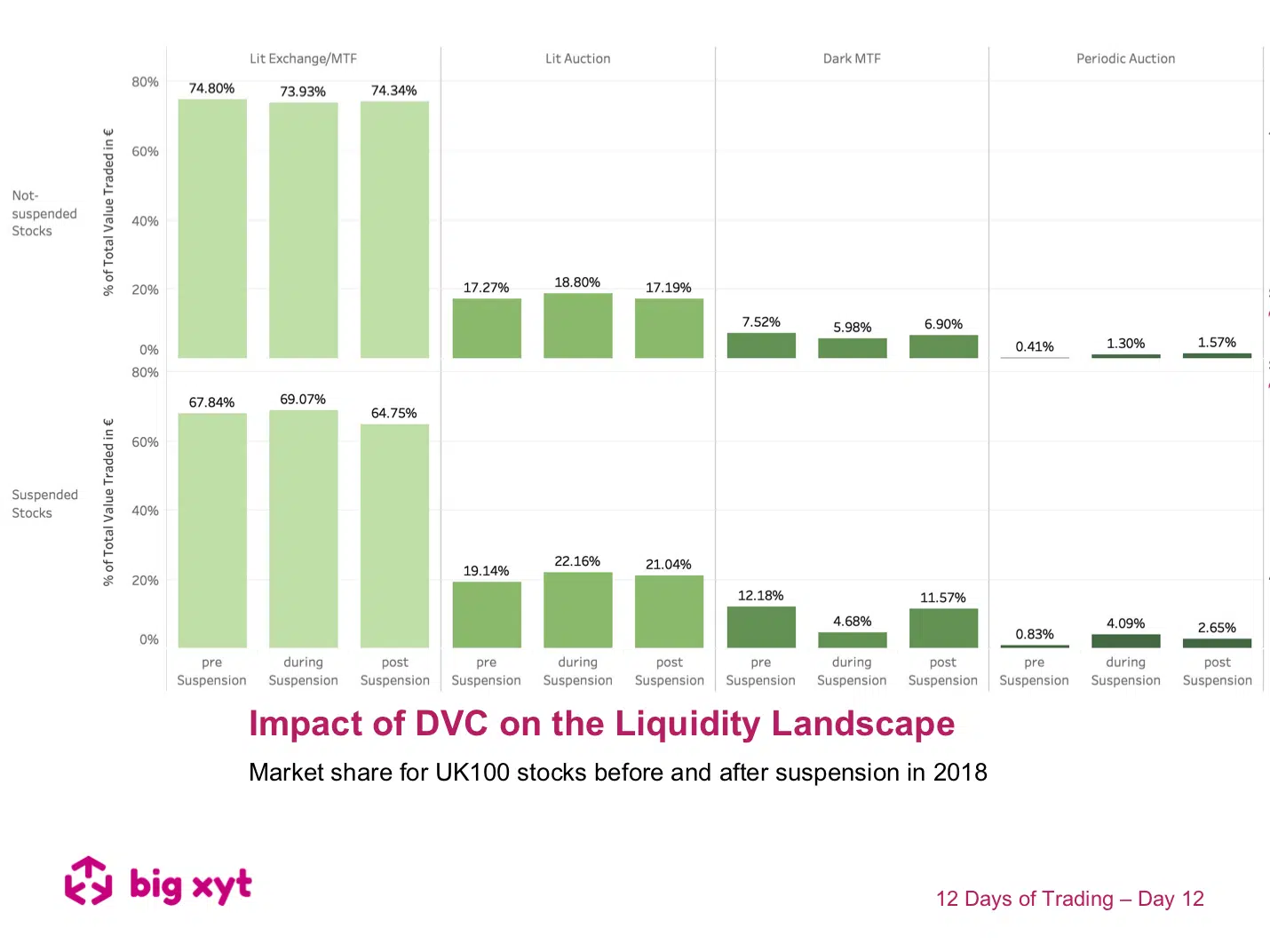

In our final view of the series we return to one of the most controversial MiFID II introductions, Double Volume Caps, with a different attempt to assess their impact by examining how UK blue chip volume dispersed before during and after DVC suspensions. As an explanation for the methodology used for this exercise, in slide one we look at market share before during and after the DVC suspensions. The second slide looks at market share change. The baseline for the calculation is market share before suspension. Some observations: By definition, stocks that were not suspended trade less in the dark and possibly are less liquid in general. Therefore they trade more on Central Limit Order Books and less in Auctions and naturally, Dark Pools. Behavioural change may be in evidence as alternative mechanisms (auctions in particular) appear to maintain and grow their share post-suspension vs pre-suspension.

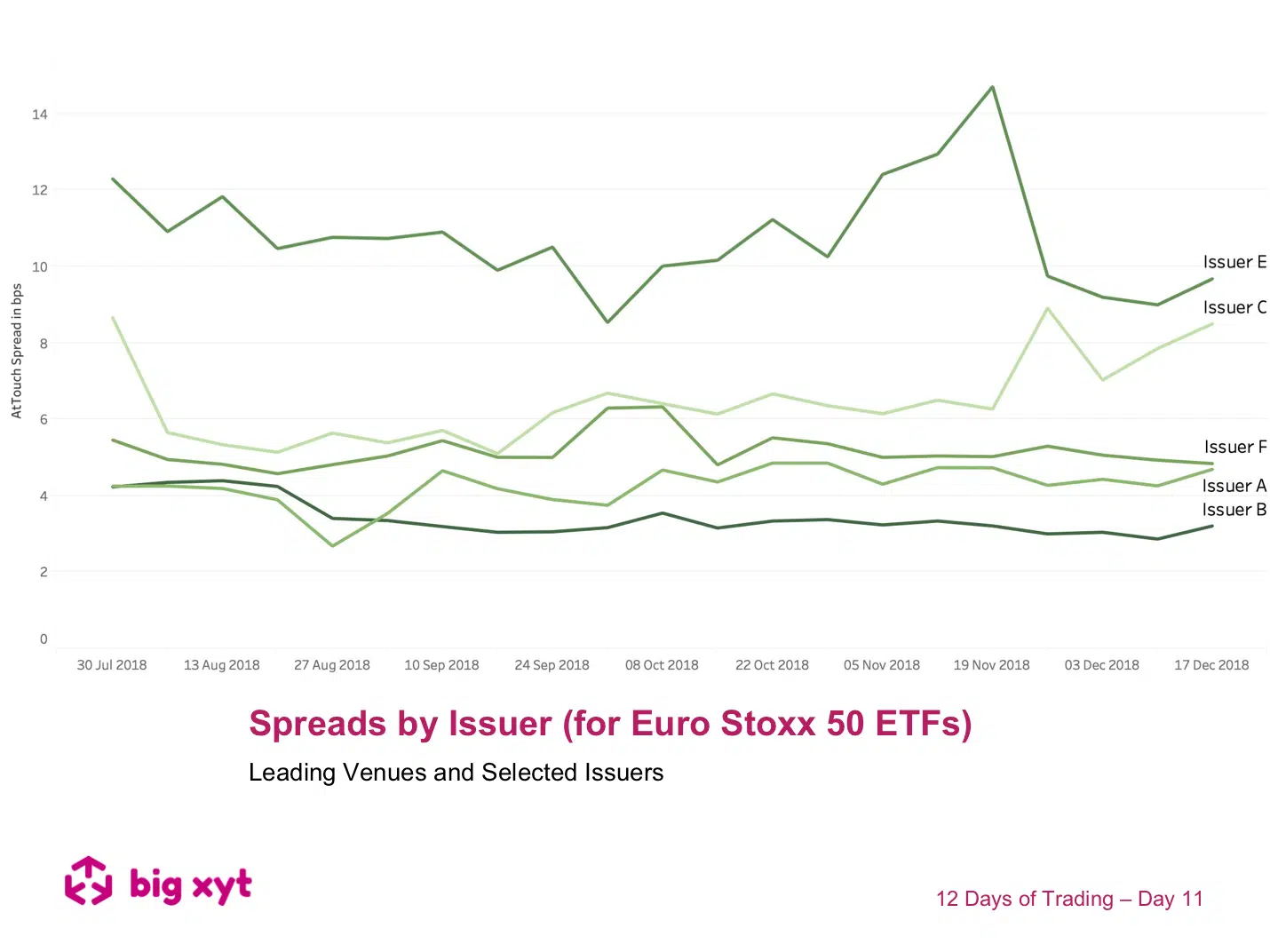

12 Days of Trading – Day 11 of 12: ETF Spreads by Issuer Day 11 of 12: ETF Spreads by Issuer Another comparative way to look at ETF spreads is by issuer. For today’s review the issuer names are anonymised (issuers A to F), but consistent across both charts. In the 2 charts today, we can see the choice facing investors when looking to trade an ETF representing a particular underlying benchmark. Whilst many issuers compete in the same space, there can be quite difference in spreads (& available liquidity) depending on issuer and benchmark.

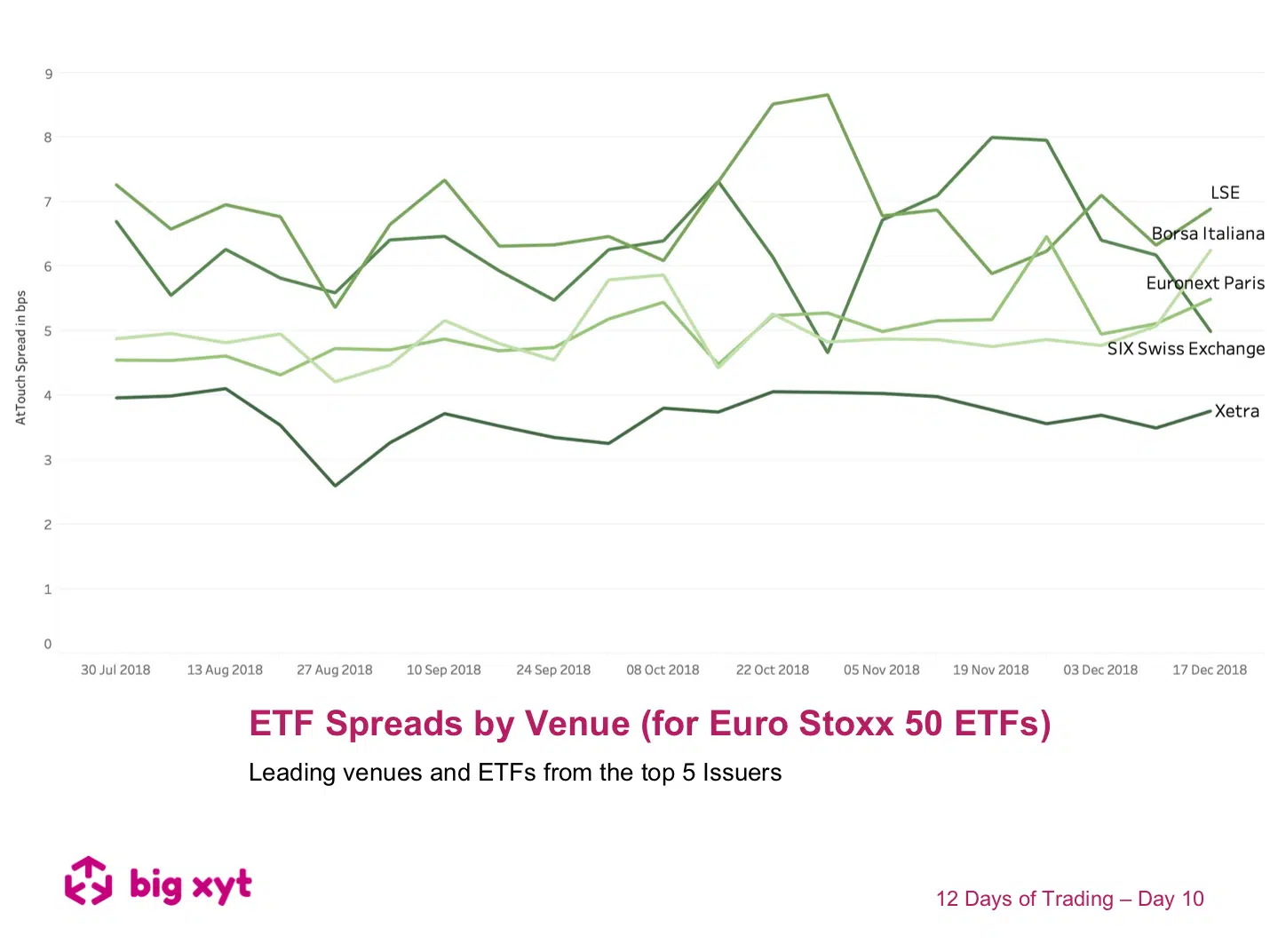

12 Days of Trading – Day 10 of 12: ETF Spreads by Venue Day 10 of 12: ETF Spreads by Venue From our consolidated view of lit markets in ETFs, it is not surprising to see that At Touch Spreads vary by venue. However, looking at the second chart, it would seem wise for the end investor to be aware of where the underlying constituents are quoted. In other words liquidity in ETFs can depend on where they are quoted just as much as the constituents of the underlying basket they are representing.

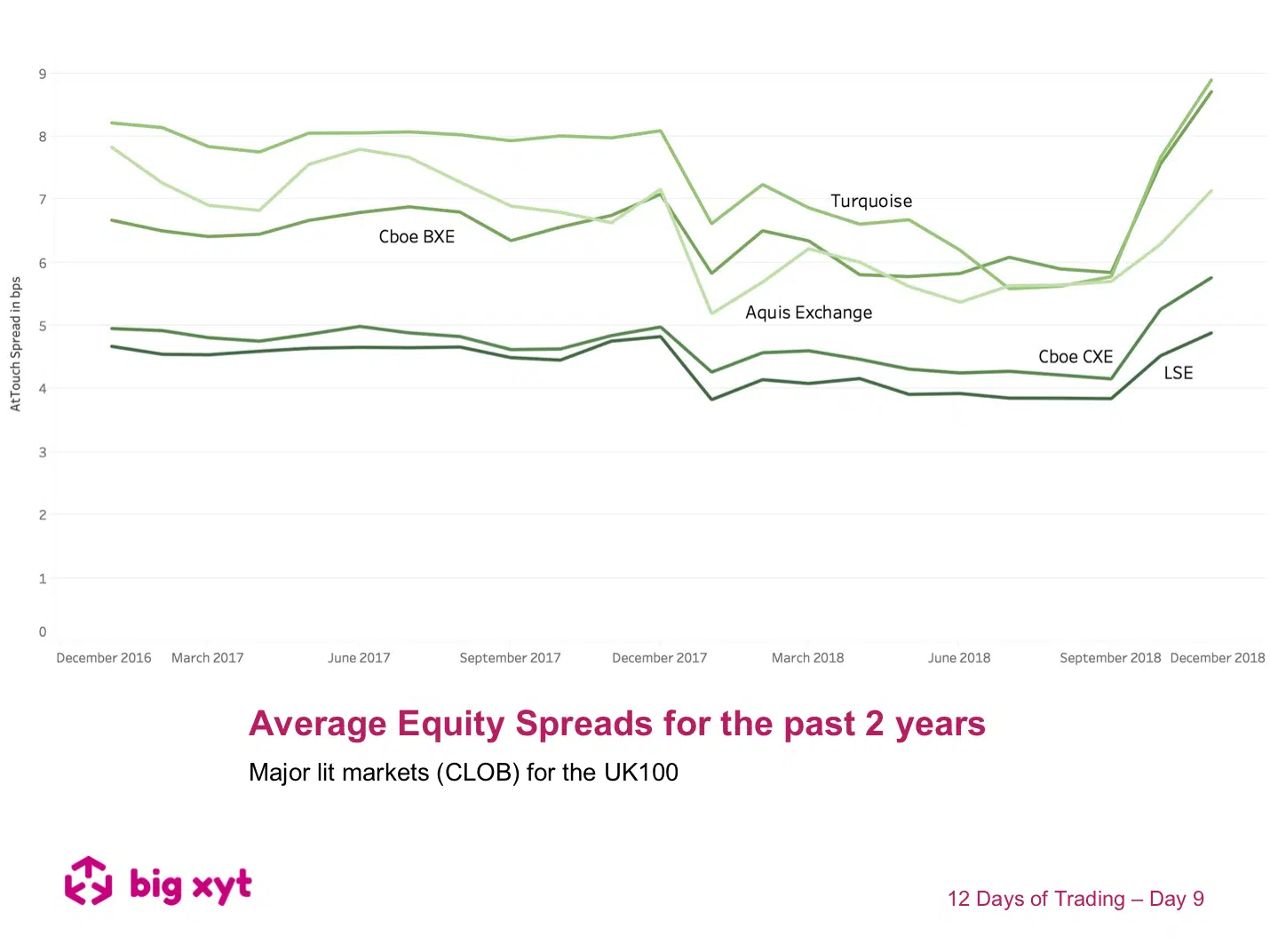

The chart shows at touch time-weighted average spreads for blue chip UK stocks since December 2016 Some observations: There was observed impact of MiFID II with a new tick size regime and an increasingly competitive market. The influence of macro-economic uncertainty on volatility during February 2018 and Q4 2018. It is possible to look at Presence in parallel with spreads to establish how often a given venue has the best price either uniquely or along with other venues – an important measure when considering PBBO or EBBO referencing or other benchmarking. — Do you want to receive future updates directly via email? Use the following

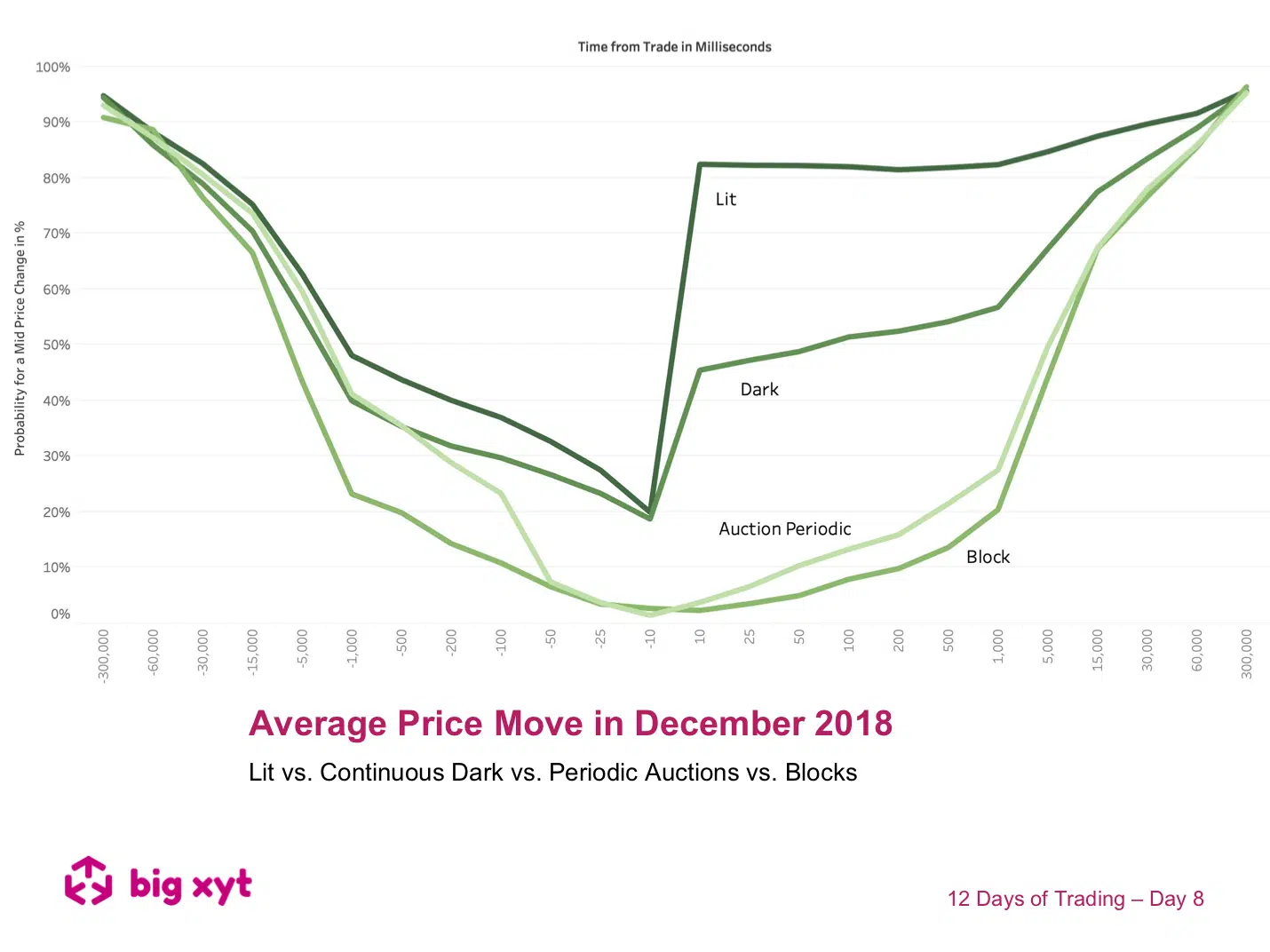

Day 8 of 12: Price movement as a proxy for market impact – A ripple before as well as after the pebble hits the water Measuring the movement of mid point prices before and after the time of every execution allows us to see some interesting patterns emerge. Some observations: Different execution mechanisms exhibit distinct trajectories. The patterns for lit markets, dark pools and blocks have been known for some time. Where do Periodic Auctions fit in? Up to 100 ms ahead of the trade, Periodic Auctions show a similar probability for a market move as Dark Pools. Closer to the execution time as well as after the trade, the probability for a price movement is very low and close to blocks (LIS). — Do you want to receive future updates directly via email? Use the following

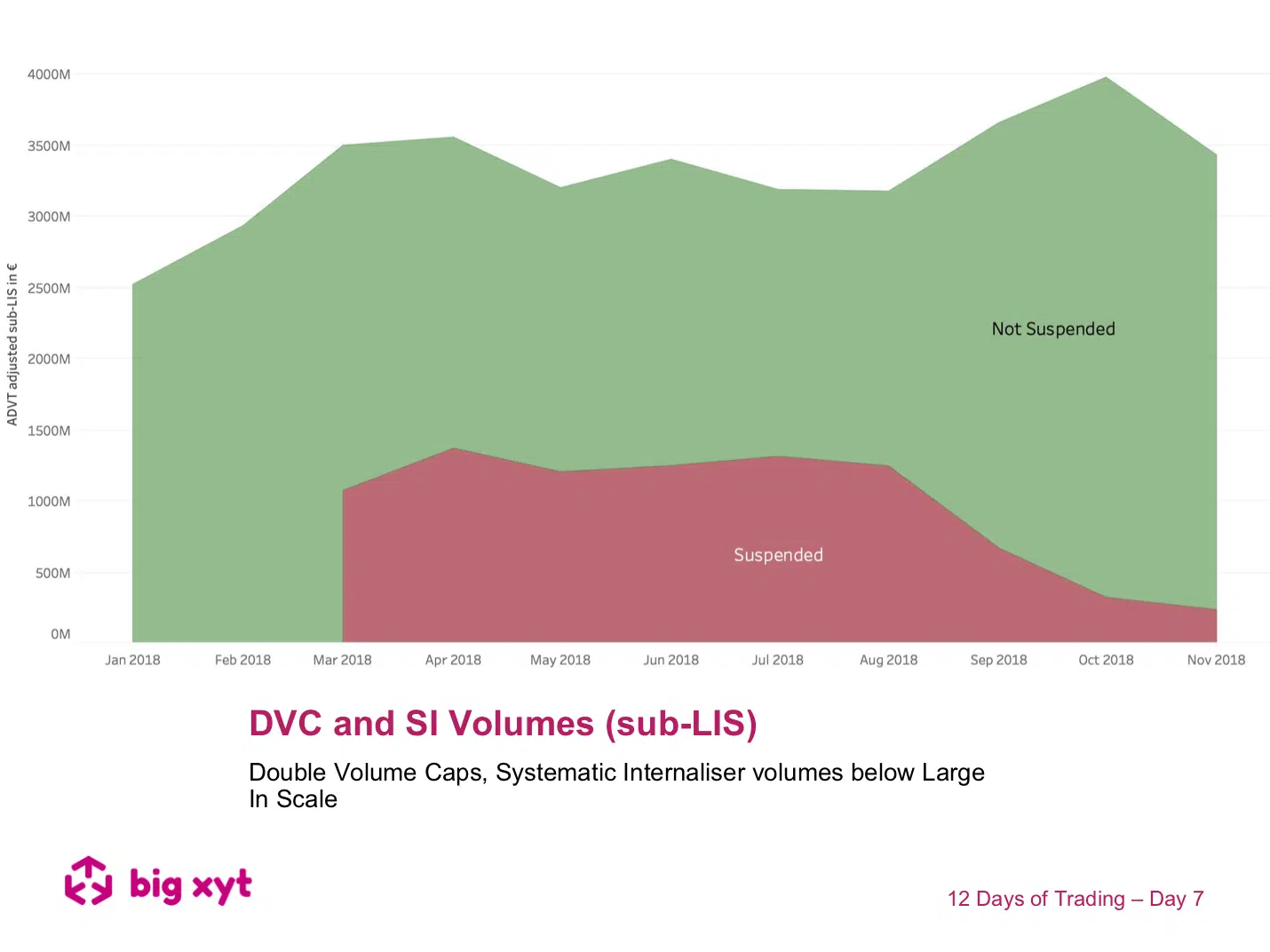

Day 7 of 12: Today we look further at SI volumes to see if the imposition of Double Volume Caps resulted in any observable change in Systematic Internaliser volumes either above or below Large In Scale (LIS) As shown yesterday Pan European average reported volumes by Systematic Internalisers now total around €30bn per day. Of this SI volume, approximately 50{a77189467baebe99d0d59363c4c17c76ac761b303fd809242b1d06b2b931be6c} can be removed by identifying condition codes or trade flags that indicate the transaction was non-price-forming. If we then identify trades reported outside market hours, we are left with a further reduction. Today’s charts provide a further breakdown of adjusted SI volumes, i.e. excluding non-price-forming condition codes and ignoring trades reported outside market hours. Some observations:

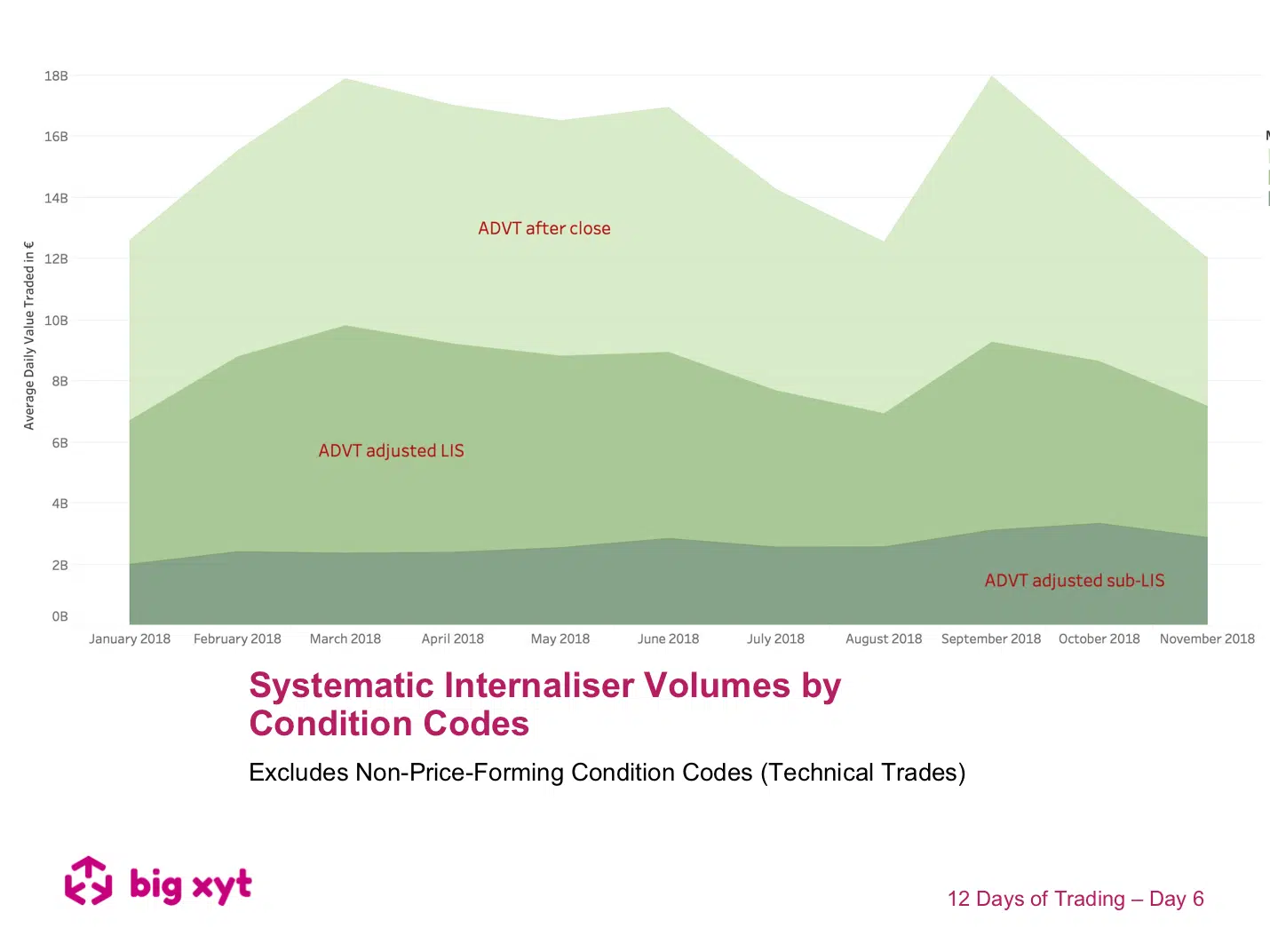

12 Days of Trading – Day 6 of 12: Systematic Internaliser Volumes Day 6 of 12: Breaking Down Systematic Internaliser Volumes by Condition Codes Some observations: Pan European average reported volumes by Systematic Internalisers now total around €30bn, representing 30% of equity turnover. Of this SI volume, approximately 50% can be removed by identifying condition codes or trade flags that indicate the transaction was non-price-forming ( we can provide a long list of these that we have identified for exclusion). If we then identify trades reported outside market hours, we are left with a further reduction (see chart). Many observers see Large In Scale trades reported by Systematic Internalisers as representative of a bilateral negotiation and therefore not representative of liquidity available to all at that price.