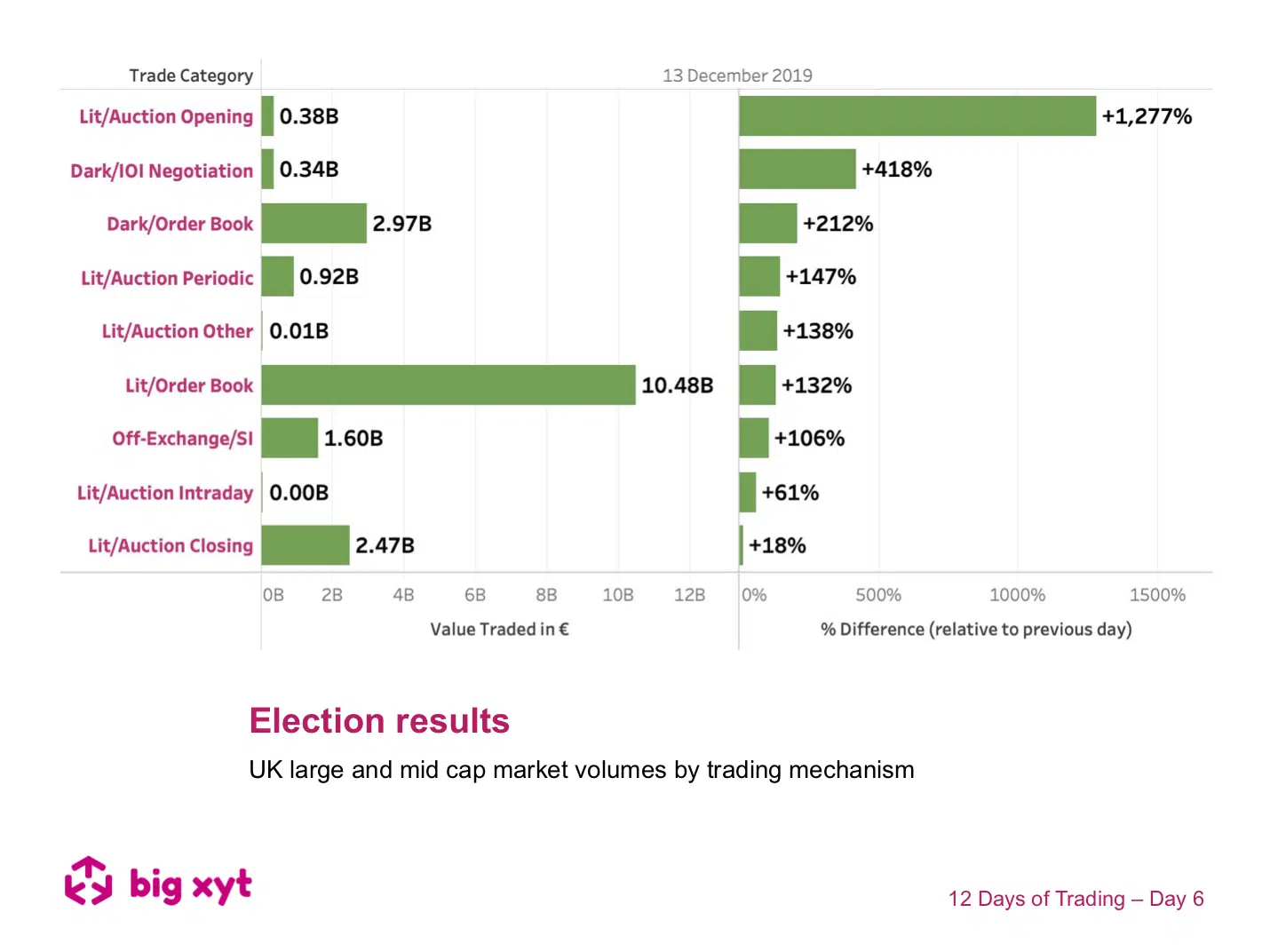

The impact of the results of the UK General Election on market volumes was dramatic, with UK volumes more than doubling. We looked more closely at how the underlying venues and mechanisms benefitted in relative terms. The left hand side of the chart shows the volumes traded on Friday by mechanism. The right hand side shows the percentage increase by mechanism compared to the previous day. Market participants needed to react quickly to position themselves. This can be clearly seen with the opening auction having the greatest change relative to the previous day. Second were the Large In Scale and dark venues. Under these conditions, different strategies are necessary for speed of implementation and access to significant blocks of liquidity. The mechanism least affected was the closing auction. This raises interesting questions about what has driven the growing popularity of the Closing Auctions at the expense of the rest of the trading day.

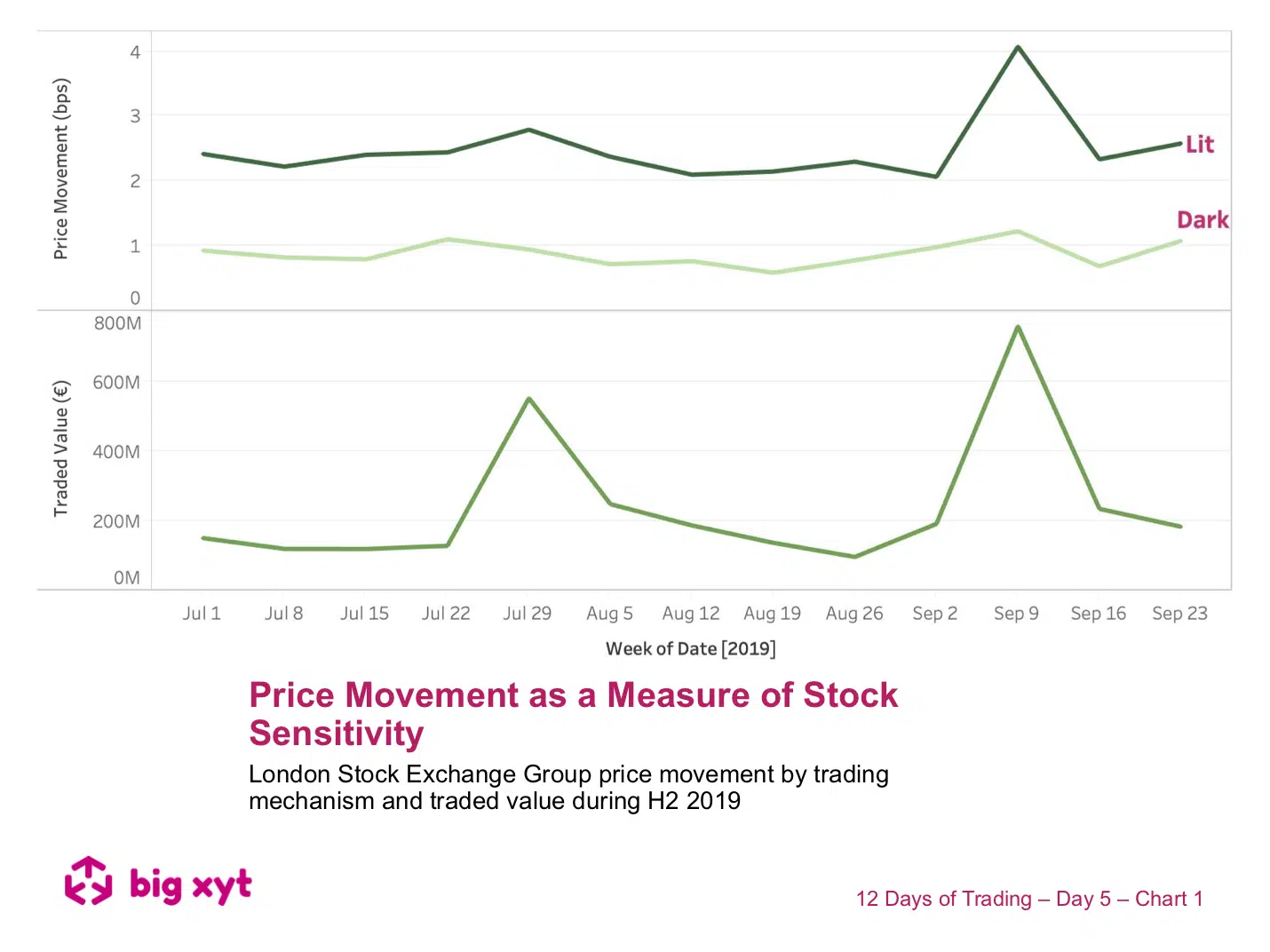

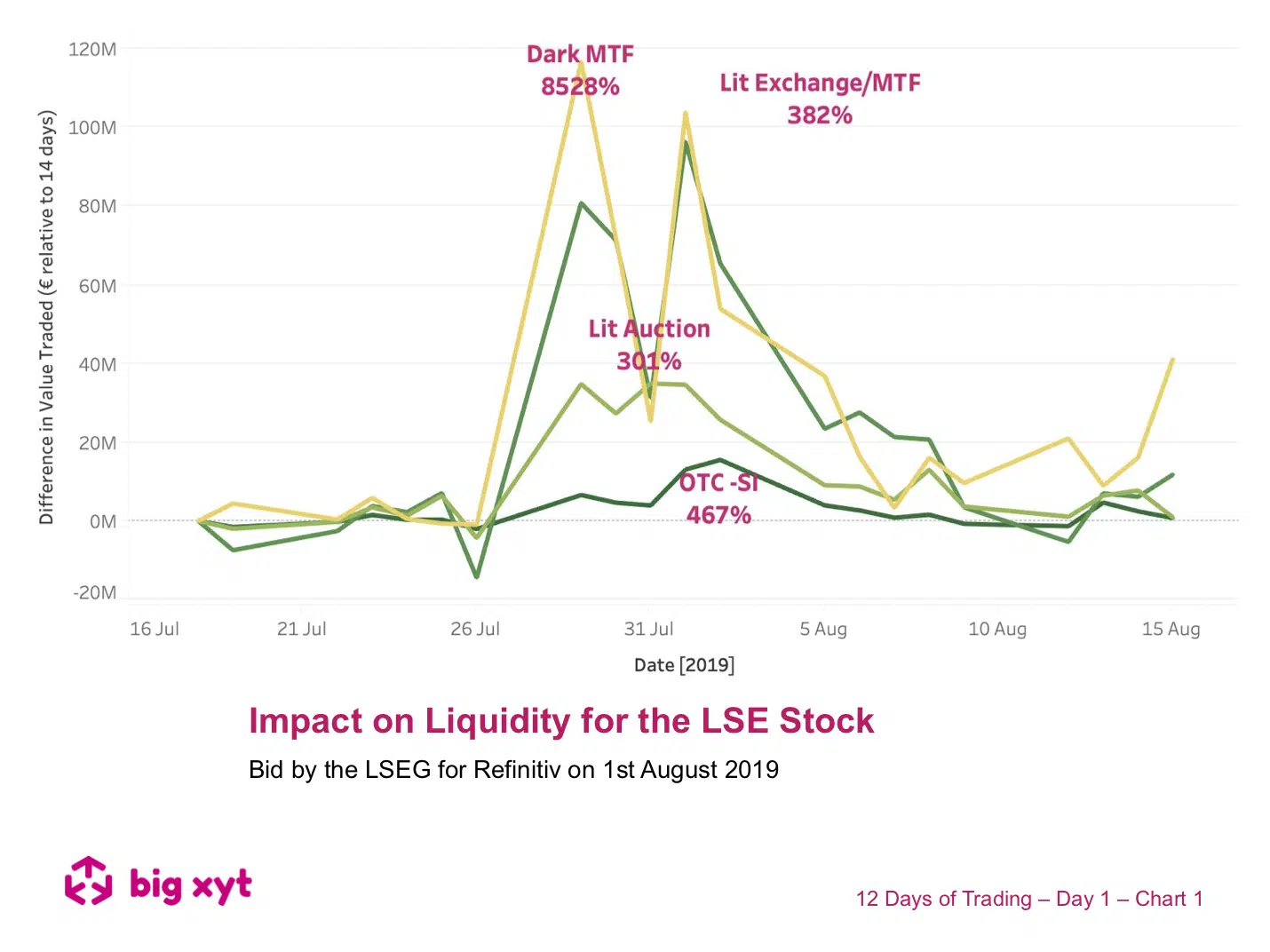

Price movement after a trade or reversion can be used as a measure of toxicity, aggression, or stock price sensitivity. Today we are returning to our example of LSEG both as a bidder and a target. The metrics we are using relate to price movement in two key trading mechanisms; lit & dark.The bottom chart shows traded value in the stock and helps us to pinpoint the days when the respective news stories broke. The top chart shows the price movement (absolute change of the mid price within 1ms) for every trade aggregated up as a daily average. This would seem to indicate greater stock sensitivity at times of increased turnover. However, look closer and when comparing lit and dark we see that the summertime Refinitiv announcement resulted in increased dark sensitivity in advance of the lit peak, whereas for the September HKSE approach the peaks are simultaneous.

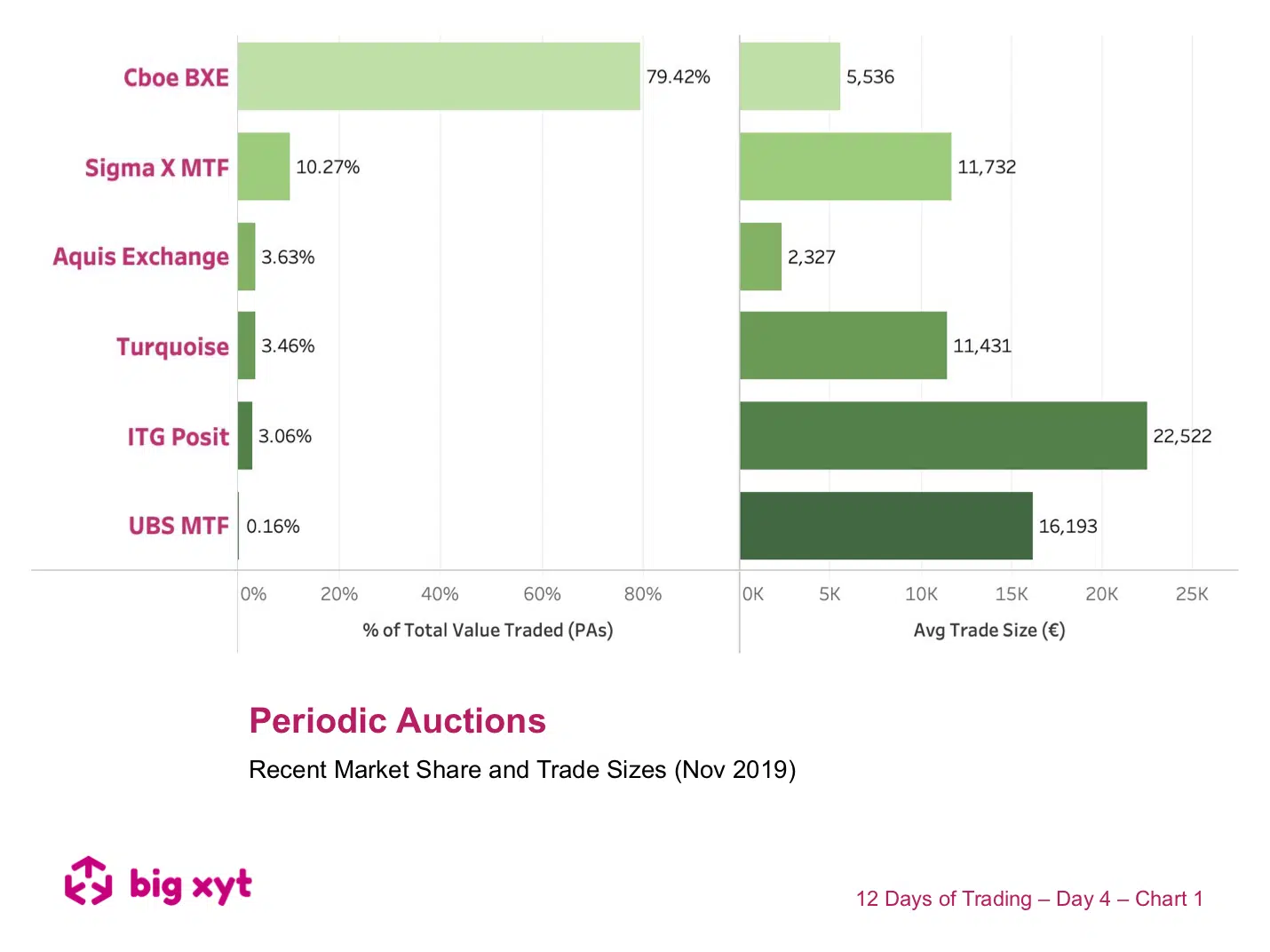

Just as market share and trade size give us measures of market quality for lit markets, similar metrics can be applied to periodic auctions. The overall share of periodic auctions as a mechanism has been remarkably stable over the last year but the share and average size amongst the various operators have been changing. Today we take a snapshot of the most recent monthly picture. Note that in this example we have excluded on-demand auctions, offered by some primary venues. Our Liquidity Cockpit allows the identity of these venues to be revealed to enable you to ask if you are sourcing the best liquidity, at the best price, by market, by venue, by index or at stock level. — Do you want to receive future updates directly via email? Use the following

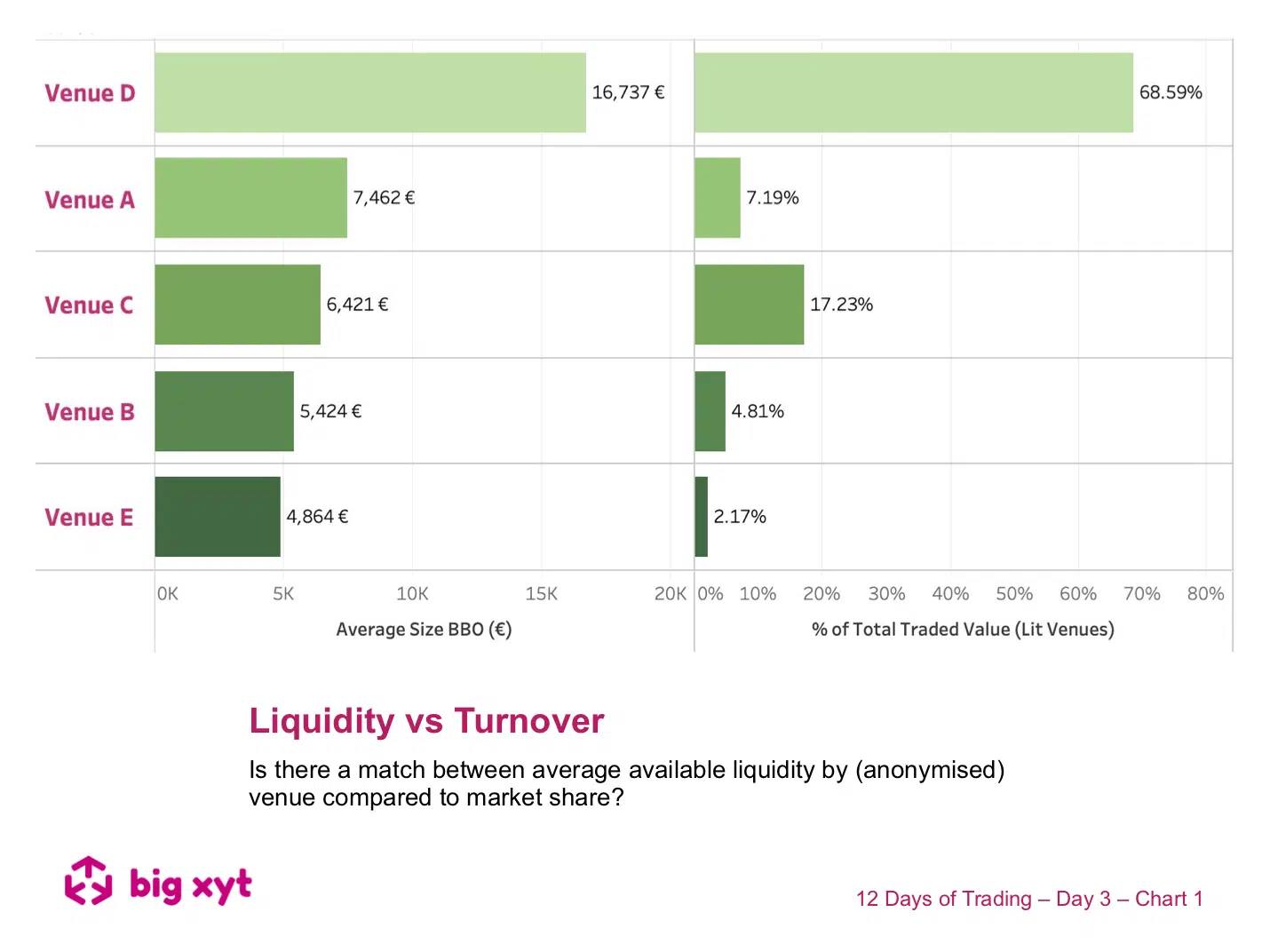

We have demonstrated in previous posts that there is a correlation between spreads and market share. The venue with the highest turnover tends to have the best prices. However, as the regulators keep reminding us, best execution should factor in liquidity as well as price. In the chart today we take a look at one European market and find that the rankings for turnover do not always match the rankings for available liquidity at the touch across the anonymised venues. Our Liquidity Cockpit allows the identity of these venues to be revealed to enable you to ask if you are sourcing the best liquidity, at the best price, by market, by venue, by index or at stock level. — Do you want to receive future updates directly via email? Use the following

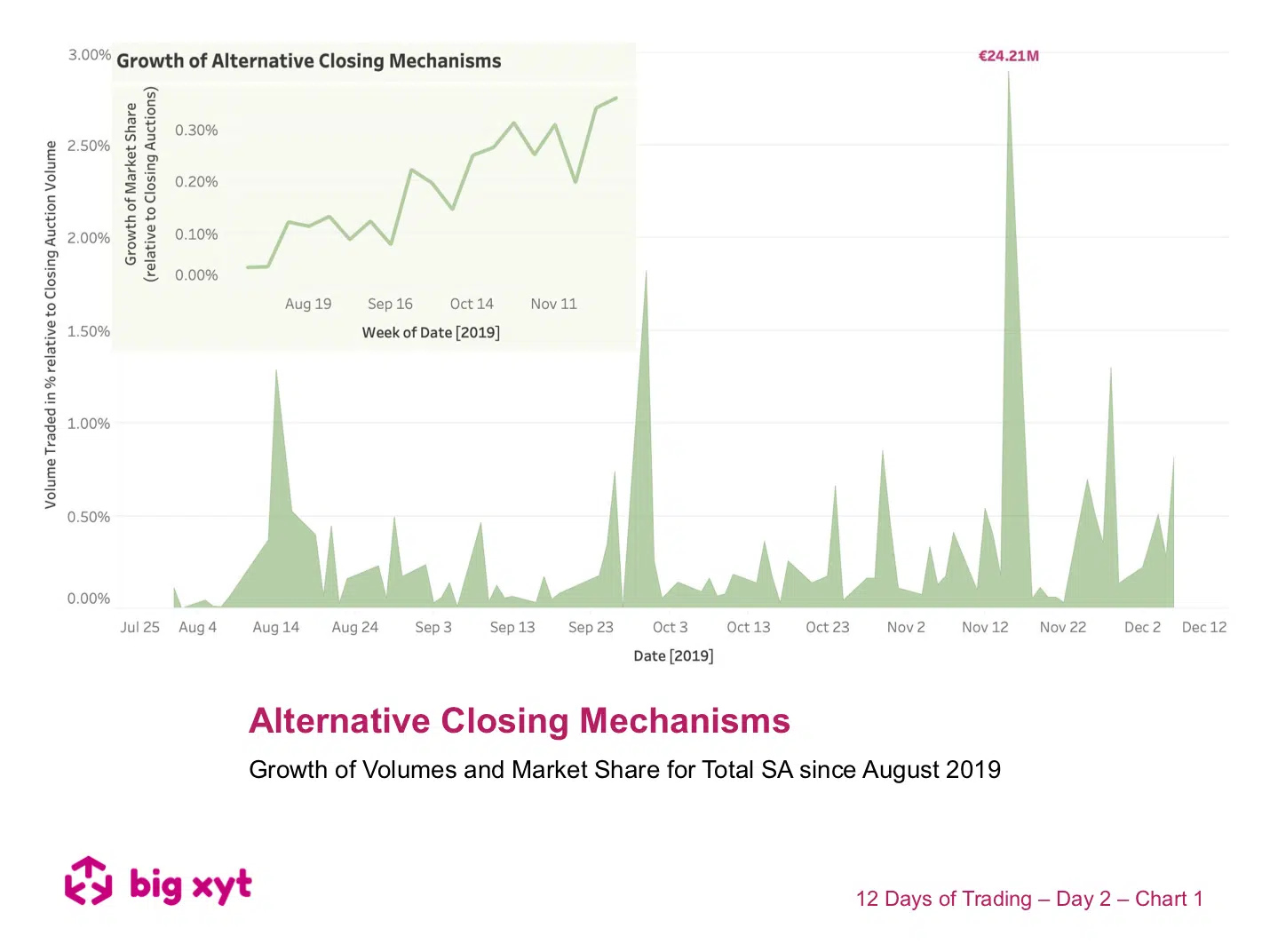

MiFID I opened the door to exchange competition in Europe. Whilst the central limit order books of the exchanges have seen their monopolies challenged, one area has remained the domain of the primary exchanges. However, with increasing focus on closing auctions driven by passive investing and ETFs, it is not surprising to see innovative attempts to provide alternative means to deliver execution at the closing price. Many exchanges already support a post trade phase (Trading at Last) sweeping up remaining interest once the price has been established. Aquis and Cboe have recently introduced their own twist on the Primary mechanisms. Today’s chart shows that investors looking for liquidity at the closing price need to be aware of the growth of alternative mechanisms (shown in the inset), and taking the example of Total we see growth overall and in the monthly peaks traded

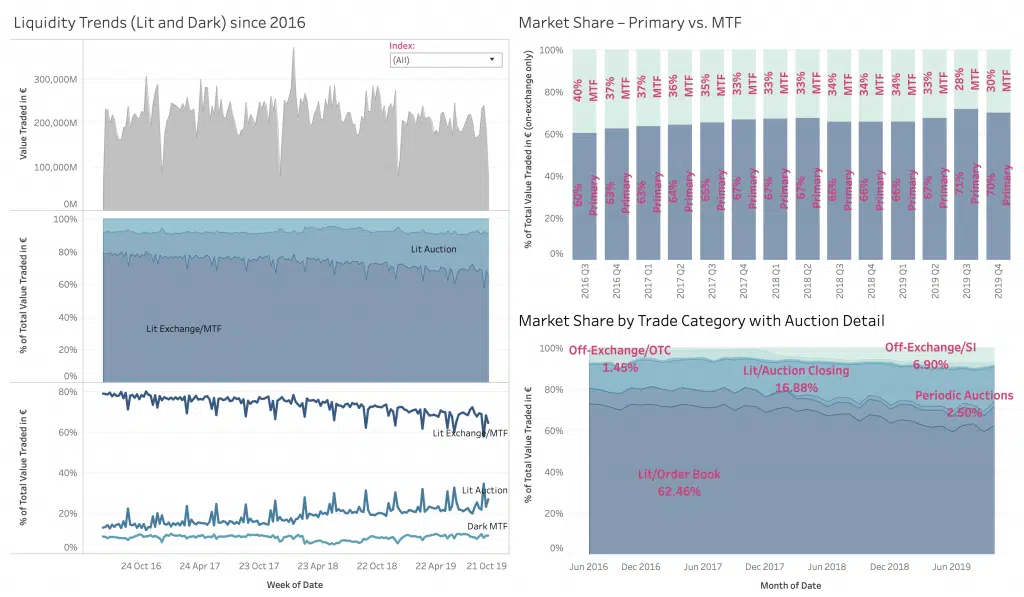

Liquidity on lit order books is driven by pre-trade transparency. Therefore, tighter spreads or deeper visible liquidity can lead to market share growth on one venue at the expense of another. Alternative mechanisms also play their part in particular circumstances. Take the example here where major news on two occasions throughout the year caused a basis change in the price of the London Stock Exchange Group (ironically the owner of three major European Equity venues). Traders noting a new price level wanted to trade and trade in size. With the news leading, to increased activity, the fragmentation of liquidity changed in a somewhat unexpected way. Market Share in lit books and block volumes increased dramatically compared to other mechanisms. Of further note was that this increase persisted in block venues, not just for the duration of the day of the announcement but for subsequent days until matched block liquidity was exhausted at that price level.

London, Frankfurt, 25th November 2019 – big xyt, the independent provider of market data analytics is pleased to announce that it has been named as ‘Editors Choice – Outstanding TCA provider’ at The TRADE Leaders in Trading 2019 Awards. Robin Mess, CEO at big xyt, who collected the award with Mark Montgomery, Head of Strategy and Business Development, at a ceremony in London last week commented, “We are delighted to have received this recognition as Outstanding TCA provider from the Editors at The TRADE and thank our clients and XYTView users for their support this year.” John Brazier, Editor of The TRADE said, “Throughout the year we have heard a lot from the buy-side about the value of TCA to their trading processes, and big xyt was one of the names that was continuously raised in this discourse.” He added, “The TRADE editorial team were impressed with big xyt’s quality of service and high level of dedication to providing the buy-side community with tools they need to achieve best execution and deliver the best returns to clients as possible.”

ondon, Frankfurt, 3rd October 2019 – big xyt, the independent provider of market data analytics, today launched XYT View, a specialist aggregated view of fragmented market information that participants need to ensure that they are achieving the best possible outcomes for themselves and their clients. The company is also pleased to announce that Steve Grob, CEO at Vision 57 and “long time” market commentator will be working with the Strategy team to provide market consultancy and additional thought leadership. XYT View provides a meaningful range of market overview metrics and has been developed to fill the information gap caused by the withdrawal of previous alternatives. Delivered via interactive dashboards, users can observe changes in displayed liquidity, periodic auctions, opening and closing auctions across the entire equity and ETF trading landscape in Europe.

London, Frankfurt, 21 June 2019. big xyt, an independent provider of high-volume market data analytics, is pleased to announce the launch of Consolidated View, an extension of the market analysis metrics available to all members of the investment community from the Liquidity Cockpit platform and 250days website dashboard. The new views allow access to a standardised independent view of the trading activity across the equity and ETF trading landscape in Europe. big xyt clients, including multiple global exchanges and investment banks, have increasingly been using detailed information and analytics from the Liquidity Cockpit as a reference to validate their trading performance to their clients. By allowing complimentary access via 250days.com to the aggregated data for single stocks, regions and indices, this new initiative delivers independent aggregated information, adding a much-needed layer of efficiency and transparency to the market.

London, Frankfurt, 3 June 2019. big xyt, an independent provider of high-volume smart data and data analytics, is pleased to announce that, Liquidnet Europe Limited, have extended their use of the big xyt analytics Liquidity Cockpit platform to monitor execution quality of its products along with cross-checking market volumes. big xyt are providing Liquidnet execution analysts with an interactive application to monitor market information via the Liquidity Cockpit dashboard. By using data science big xyt solutions capture, normalise, collate, and store trade data at a granularity that has not previously been available in the market.