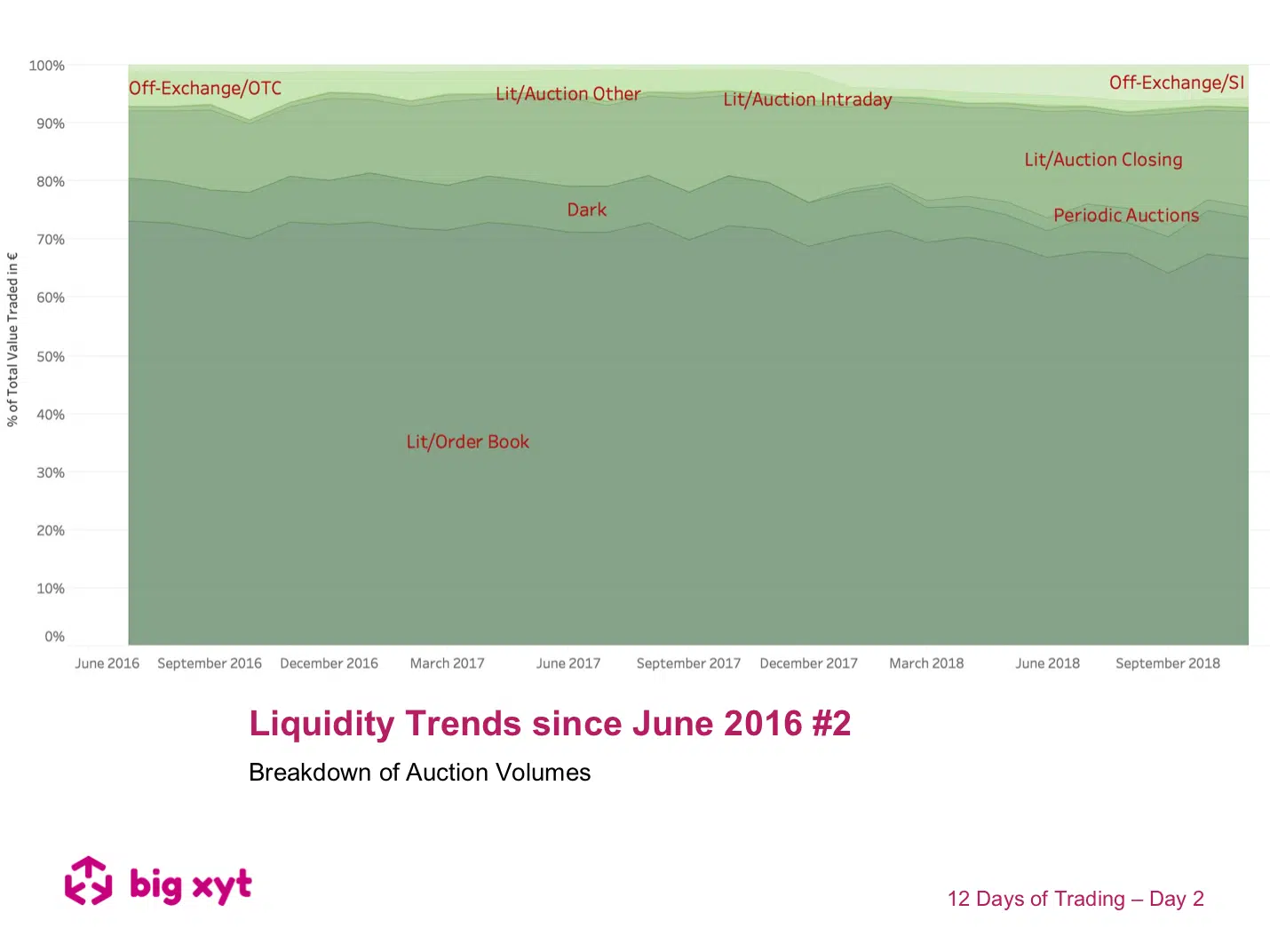

Day 2 of 12: After our initial market overview yesterday, today we take closer look at the development of auctions. Some observations: The two largest gainers appear to be the Closing Auctions and Periodic Auctions. Some have observed that more lit trading has moved to the closing auction as the benchmark drives index & ETF traders. The inference then for Periodic Auctions is that they have seen flow migrate from dark pools as Double Volume Caps took effect. It is difficult to be certain of the reasons for this dispersion from this chart alone so we plan to investigate further in subsequent days. — Do you want to receive future updates directly via email? Use the following form to subscribe. On our 12 Days of Trading As the year draws to a close we have been asked by clients to look and highlight 2018 trends since the introduction of MiFID II. We thought we might make this a festive exercise on the 12 days leading up to the holidays. As a result, you will find a post to a different 2018 big-xyt observation each day.

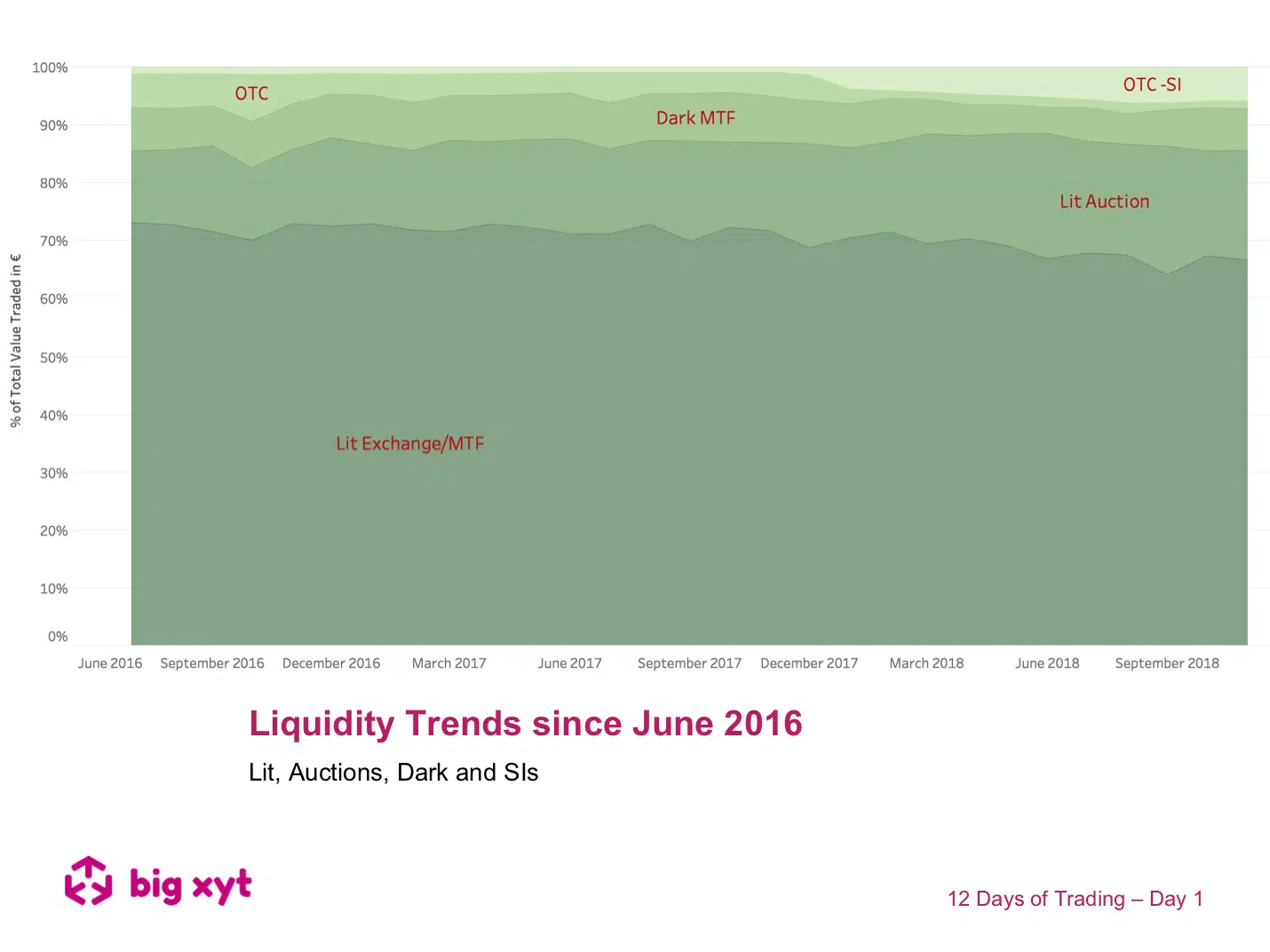

As the year draws to a close we have been asked by clients to look and highlight 2018 trends since the introduction of MiFID II. We thought we might make this a festive exercise on the 12 days leading up to the holidays. As a result, you will receive a link to a different 2018 big-xyt observation each day. With the countdown to the holidays underway, here’s our festive first (of twelve) post MiFID II, pre Brexit reviews of European Equity Markets. We hope you enjoy them. Day 1 of 12: How has European Equity Liquidity fragmented when faced with new trading mechanisms over the last 2.5 years? Some observations: Lit Market Share has seen continuous declines. Dark trading was impacted by DVCs.

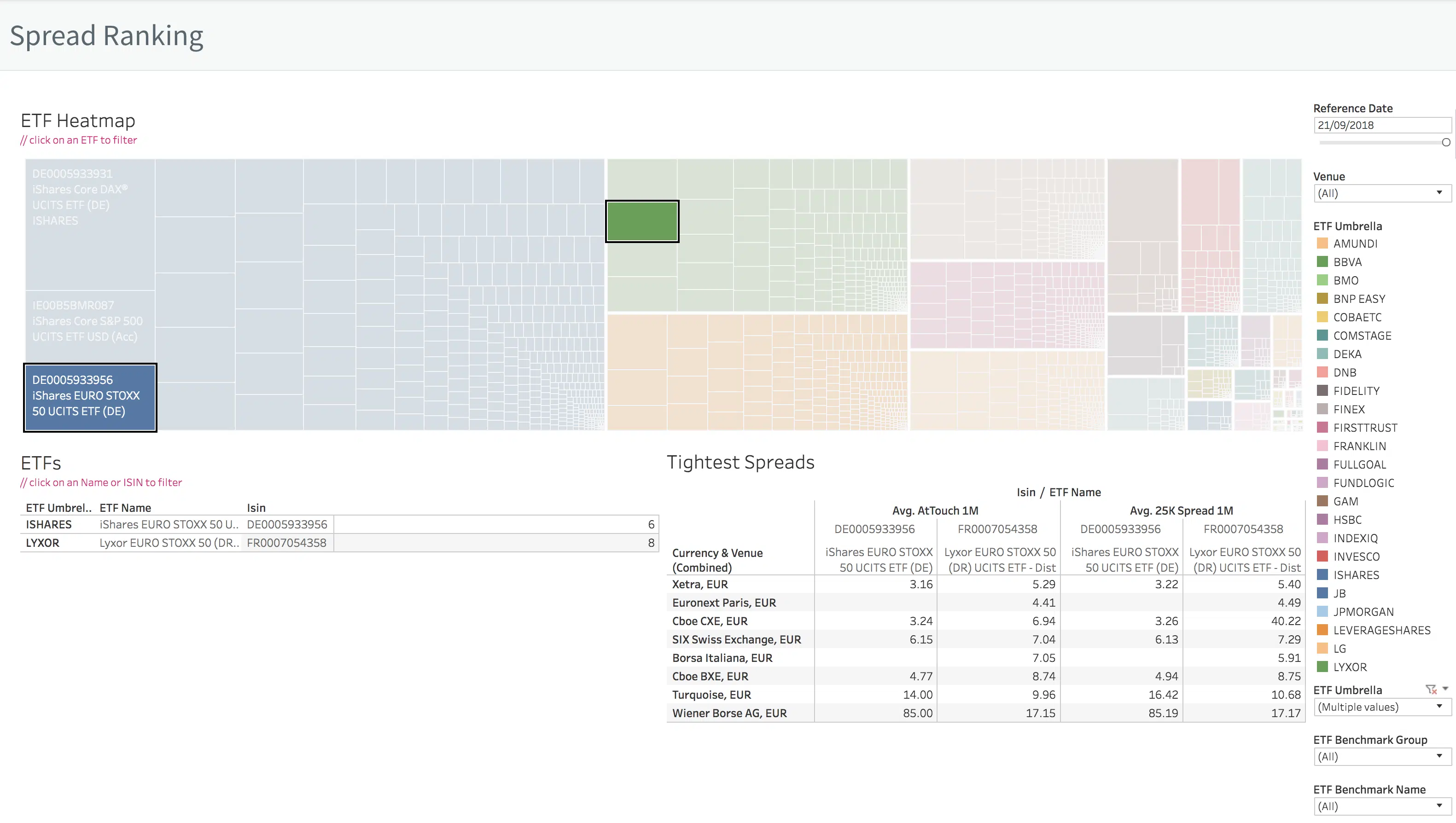

London, Frankfurt, 25th September 2018. big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce the launch of the ETF Liquidity Cockpit introducing liquidity metrics for ETFs with new navigation tools enriched with reference data from Ultumus, the specialist distributor of ETF composition data. The new ETF Liquidity Cockpit maintains the flexible access offered with existing Equity dashboards and includes key metrics for market share and market quality. The ETF Liquidity Cockpit further integrates reference data sourced from Ultumus to enable additional data aggregations.

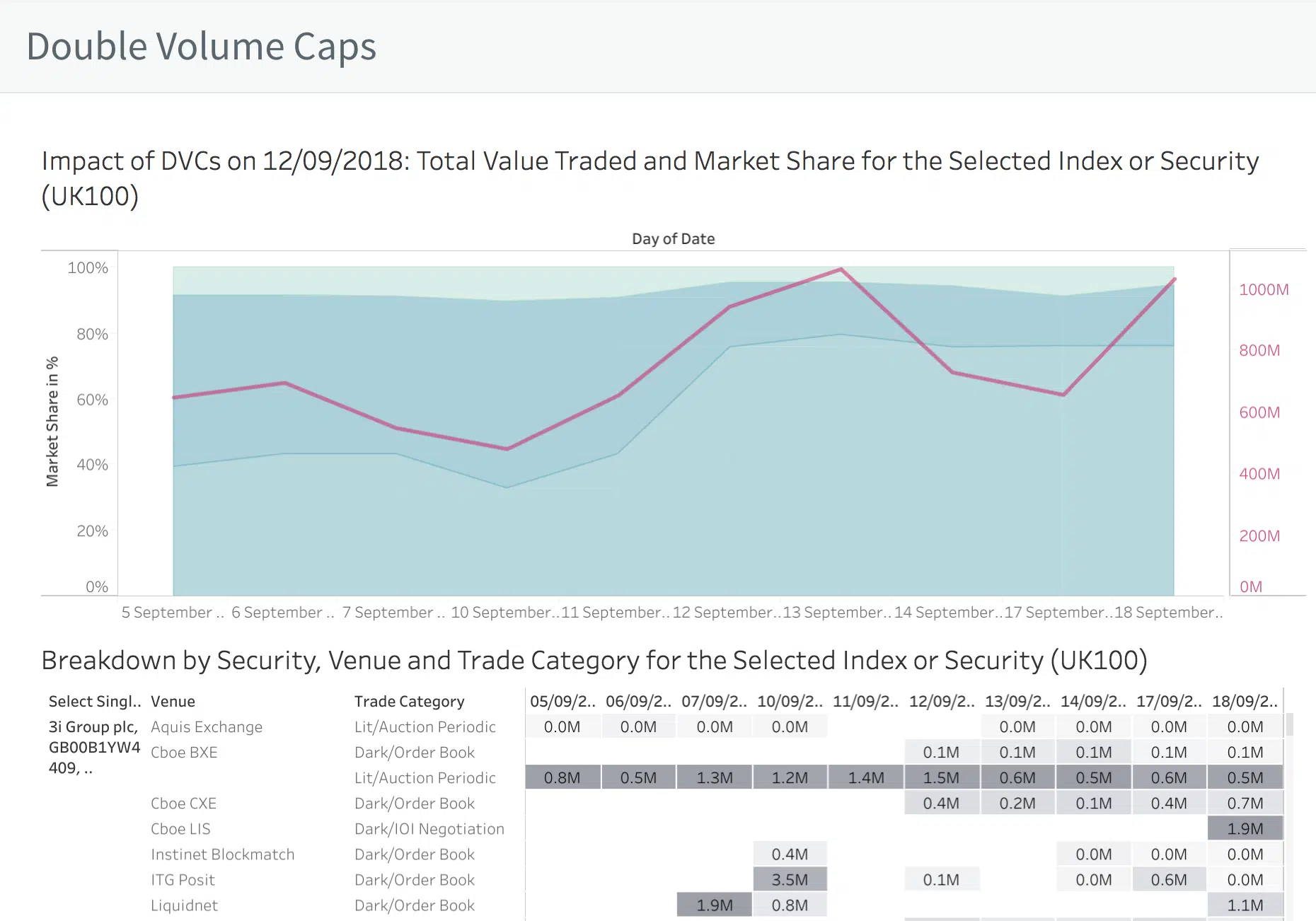

Press Release Understanding liquidity shifts triggered by double volume caps London, Frankfurt, 20th September 2018. big xyt, the independent provider of high-volume, smart data and analytics capabilities, is delighted to

London, Frankfurt, Paris, 25th April 2018. big xyt, the independent provider of high-volume, smart data and analytics capabilities, is pleased to announce the addition of Societe Generale Corporate & Investment Banking (SG CIB) as a client of its Liquidity Cockpit, providing a consolidated view across all European trading venue activity with on-exchange and off-exchange liquidity including over-the-counter (OTC) equities and Systematic Internaliser (SI) transactions. Over the past 10 years the trading community has had to respond to a range of new regulations, changing market structures and trading patterns including more block trading activity, new initiatives launched by exchanges such as periodic auctions, and SIs. For the trading community it is key to understand the impact of all these changes on the liquidity landscape.

London, Frankfurt, Paris, 24th April 2018. big xyt, the independent provider of high-volume, smart data and analytics capabilities, is delighted to announce the arrival of Mark Montgomery in a key role supporting Strategy and Business Development. In this newly created role, Mark will focus on ensuring alignment of the business strategy with client needs and expanding the big xyt presence in London. Mark will extend the Executive team and will work closely with Robin Mess, CEO. Having previously worked at Barclays Capital as Director of Electronic Trading Sales and Alliance Bernstein where he was responsible for establishing a European portfolio and electronic trading desk, Mark brings significant experience of the trading community’s challenges and expertise in delivering solutions.

MiFID II offers a fresh start for business relationships in capital markets. By reframing the way in which dealers and trading venues seek to manage and match client trades it is implicitly changing where buy-side firms choose to route and execute their orders. A new framework The new directive, and its sister regulation MiFIR, have established a new regulatory framework for trading venues by categorising any trading mechanism as either a regulated market (RM), multilateral trading facility (MTF), organised trading facility (OTF) or systematic internaliser (SI). This framework determines how each category can process trades, who may interact with those orders, how much pre-trade disclosure of orders is permitted, and how – and to whom – transactions are reported afterwards.

MiFID 2 double volume caps – the end of dark trading?” – Automated Trader Magazine publishes a report contributed by our Head of Analytics Ulrich Nögel, Co-founder and Head of Analytics, writes about DVCs and LIS trading published in the Q3/4 issue 44 of the Automated Trader Magazine A controversial rule in MiFID 2 is the double volume cap mechanism for dark pools. Recently, a quantitative study presented dramatic numbers on the percentage of stocks that would be suspended under the regime. We investigate if the efficient use of large-in-scale trading can help to mitigate the caps. Please visit the Automated Trader Magazine to read the full report (subscribers only).

Robin Mess, our CEO, will speak about navigation in a dynamic liquidity landscape (pre and post MiFID II) and how analytics helps to optimize trading performance. In the afternoon Robin will share thoughts on the dynamic liquidity landscape: Fragmented liquidity and the emergence of new venues and order types like periodic auctions, dark pools or LIS venues, are not new to Pan-European trading. With MiFID II we will see further changes with an increasing complexity (e.g. restricted dark pool trading, DVCs). In this dynamic liquidity landscape, trading firms have to overhaul their existing strategies. We show how technology and independent analytics can help the trading community to optimize execution and trading performance.

London, 25 September 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, announced today that SIX Swiss Exchange has joined the xyt hub to provide high quality tick data to its trading participants, enabling them to develop, evaluate and backtest new trading and execution strategies while providing greater transparency over trading activity. Connected to more than 100 venues globally and across asset classes, the xyt hub launched in September 2017 to enable the global trading community to integrate tick data and analytics in a more convenient and cost-effective way, via a single API. The xyt hub allows trading firms to consume, analyse and visualise all the data they require through cloud-based technologies, featuring Data-as-a-Service and Analytics-as-a-Service functionalities.