Those of you who keep a close eye on market microstructure will be well aware of a dress rehearsal for “non equivalence” in July 2018 when all Swiss trading was banned on competing venues. Overnight the primary SIX exchange was responsible for 98.8% of turnover in the top 20 Swiss equities (two dual listed stocks ABB Ltd and Lafarge Holcim Ltd were exceptions). Before this the primary had around 70% of market share. This was fairly typical for the primary/MTF split for Lit and Dark volumes as competition evolved post-MiFID regulatory changes.

There was always bound to be some post Brexit ‘fallout’. Unsurprisingly there was plenty of market commentary last week, however we wanted to wait for the dust to settle before we made any of our own observations. You will find it reassuring to know that your suspicions are correct. We can confirm that turnover on Multilateral Trading Facilities (MTFs) shifted to EU venues as investors in EU stocks followed the expected migratory route. If a European alternative existed, the flow migrated there, away from the UK entity (*see the outlier in the footnote below).

As our 12 Days of Trading campaign 2020 draws to a close, we know you like a festive finale. A global view of equity data allows us to zoom in on specific regions or individual markets. So, just like Santa, you can see everything. In another demonstration of how smart analytics can be powered by a global vault of data, we switched on the lights for the top 30 Nasdaq stocks since the beginning of September. This year’s Christmas tree is constructed with Nasdaq analytical branches.

There may be several arguments about inclusion rules and timing and certainly when a stock with a Price /Earnings ratio of 1260 joins an index where the average P/E is 36 it is likely to cause waves rather than ripples. We knew it was going to be big…but this exceeded expectations. For a stock that trades huge volumes anyway the Tesla volumes on Friday were staggering. We can see on our first chart that $200bn traded on that one day. To put that in context, the biggest day in Europe since MiFIDII across ALL stocks was €132bn.

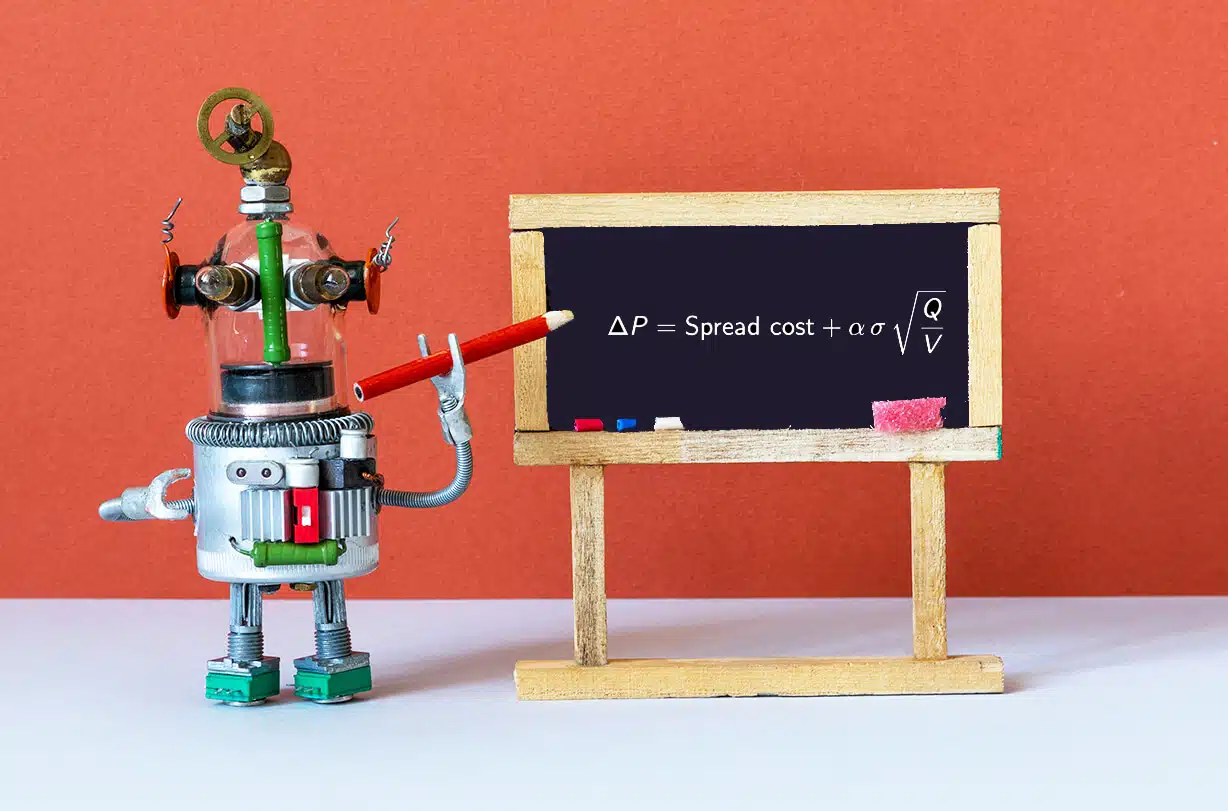

Having a team of super smart data scientists who use a consistent methodology on a well curated data set can bring enormous benefits when exploring new ideas. The deployment of new business logic to discover fresh insights can be applied historically as well as going forwards. This provides immediate context for those impatient to see if a trend is present.

Following the theme of Closing Auctions and new Alternative Closing Mechanisms, we can highlight a noteworthy entry to the Closing Auction records books last Friday. In the chart today we see the 5 largest single stock closing auctions in recent (4 years) history. Notably, Linde AG has featured twice (holding the previous record of @4.3bn traded). Unilever plc/NV was the cause of the stir as it collapsed its NV holdings into the plc to consolidate its HQ in the UK whilst maintaining a quoted presence in Amsterdam….all in the interest of simplification, naturally.

Picture the scene. Lap 20, Hamilton, as usual, has a 15 second lead (almost enough time for a free pit stop), and a little more unexpectedly, Bottas is running a strong second, 10 seconds ahead of the third place car. Then, shock, horror, for the first time in five years, both Mercedes have to return to the pits with a mechanical issue on the same lap. For the rest of the field, the race is on again. The rare opportunity for a podium presented on a plate. But, hold on, what is happening? One by one they all return to the pits and wait patiently until Lewis and Valtteri have their proverbial pipes cleared and are ready to rejoin. The clock counts down and the race resumes as if a virtual safety car was being controlled and temporarily parked by the pit crew of the lead team.

If you are benchmarking against the Official Close, how are you ensuring you have an independent view of which stocks, how much, and if anything is trading at the closing price on another venue? Demand for the official close as a benchmark has led to the introduction of alternative closing mechanisms by MTFs to challenge the predominant position of Exchanges. We began examining this area in more detail last year, and as new players have come to the table, we have been enhancing the scope of our radar.

This year, market sentiment has somewhat overwhelmed long-term business strategy and sound financial management, especially in the energy sector. We looked at six energy majors where prices have fallen 39% – 65% from pre-crisis levels. While grappling with the collapse in oil prices, consumer demand and addressing the climate emergency, companies have also had to find the time to reassure their investors. This year, market sentiment has somewhat overwhelmed long-term business strategy and sound financial management, especially in the energy sector. We looked at six energy majors where prices have fallen 39% – 65% from pre-crisis levels. While grappling with the collapse in oil prices, consumer demand and addressing the climate emergency, companies have also had to find the time to reassure their investors.

The markets responded with the usual enthusiasm for major news yesterday with the announcement of Jenny Chen joining our team to extend our reach in the US market. In other news, we saw a likely result in the US presidential election and word of a vaccine. As with Q1, the stories precipitated dramatic increases in traded volumes, price volatility and sector rotation. But did you allow for the same changes in market conditions when trading?