Do you remember the optimism of the Santa Claus rally? Only a few months ago we were being entertained by stories of the S&P 500 in the high fives by year end (that would be a 30%+ rally from here) and post pandemic recoveries across the board. Then along comes the spectre of war, sanctions, and a cost of living crunch for households.

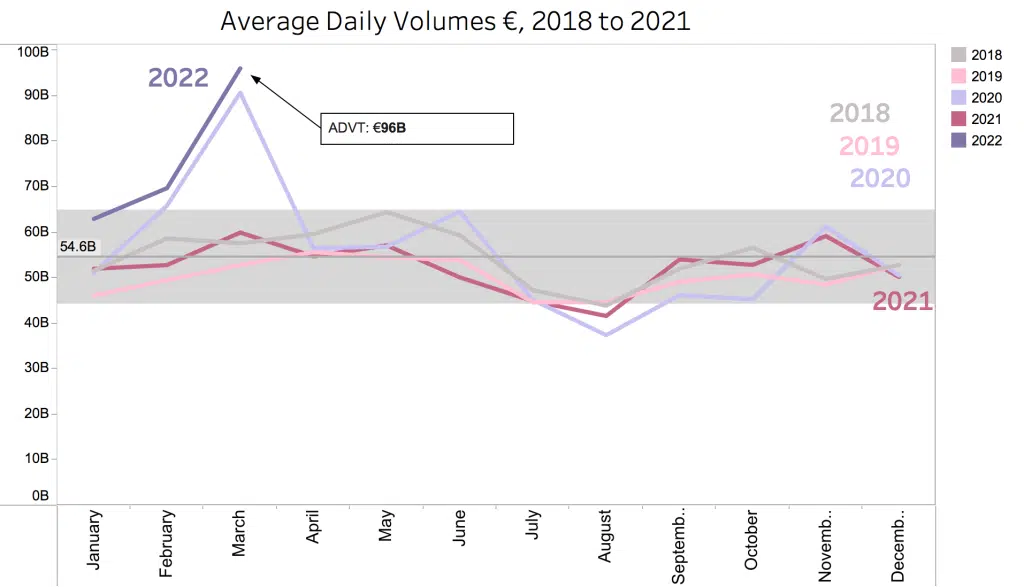

Perfectly in line with the previous crisis in Q1 2020, market activity is breaking the records as investors try to position themselves for the next ‘new new normal’. In the first two months of 2022, the European equity market broke the January and February records for daily traded value set during the Covid outbreak, while March is on track for being the busiest month of any on record. It’s curious how recent macro crises seem to rear their heads in Q1. In March, we may yet touch the magic €100 billion a day mark, 80% above the four year average of €55 billion.

With plenty of political risk and the full extent of sanctions still to play out, volatility could have further to go and will likely be sustained. We have not yet seen the daily plunges and recoveries of the critical two weeks in March 2020. Volumes could go higher still, and watch out for some more record index rebalance days in June and September.

The market structure has dutifully played out its normal pattern with the auctions giving way to intraday trading during higher volatility as traders become more urgent and try to find a price in a hurry. Auction market share has shrunk back from 29% to 25% of electronic trading, a level last seen in… you guessed it, Q1 2020.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.