Day 12 of 12: Impact of DVC on the Liquidity Landscape

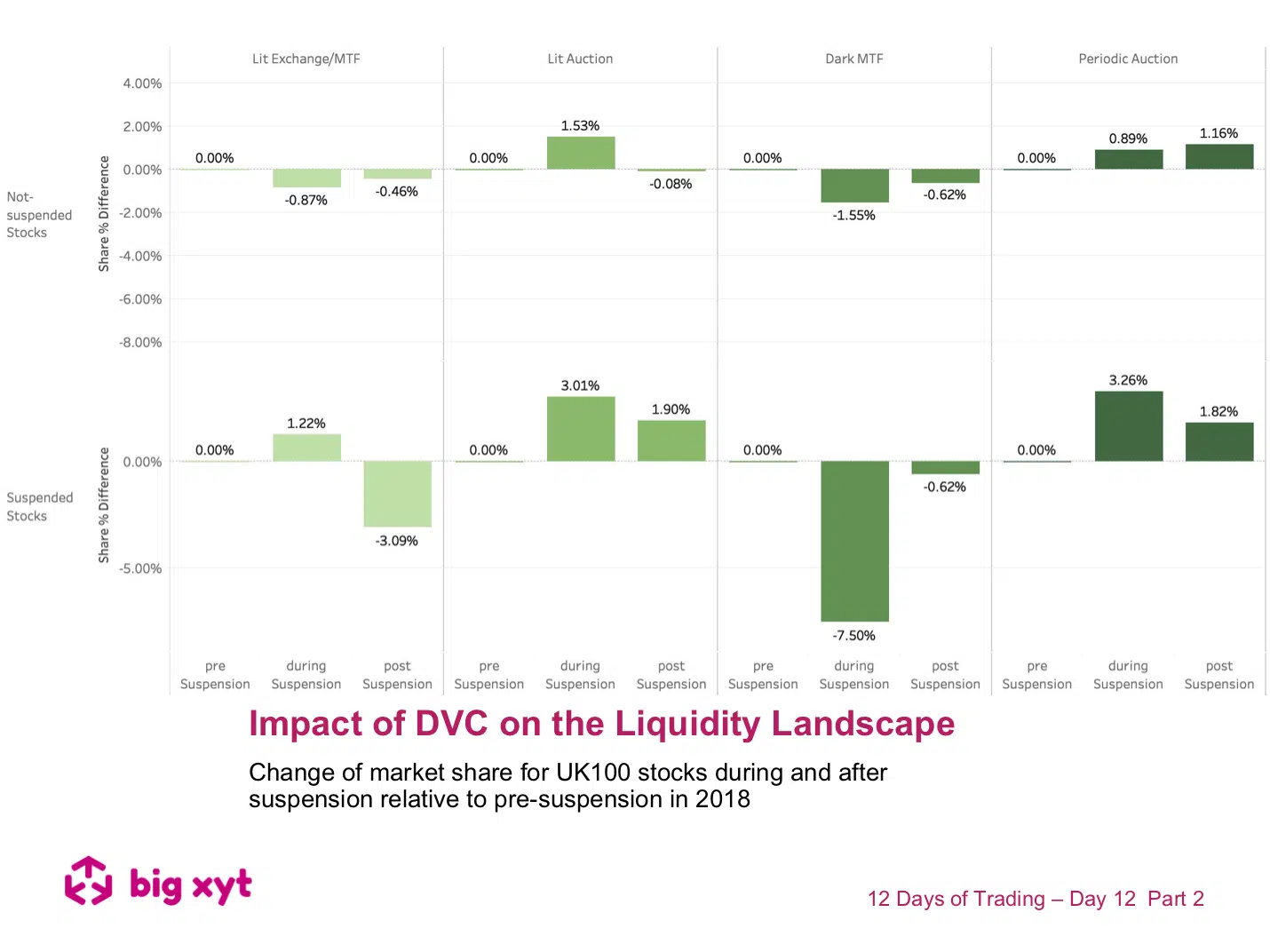

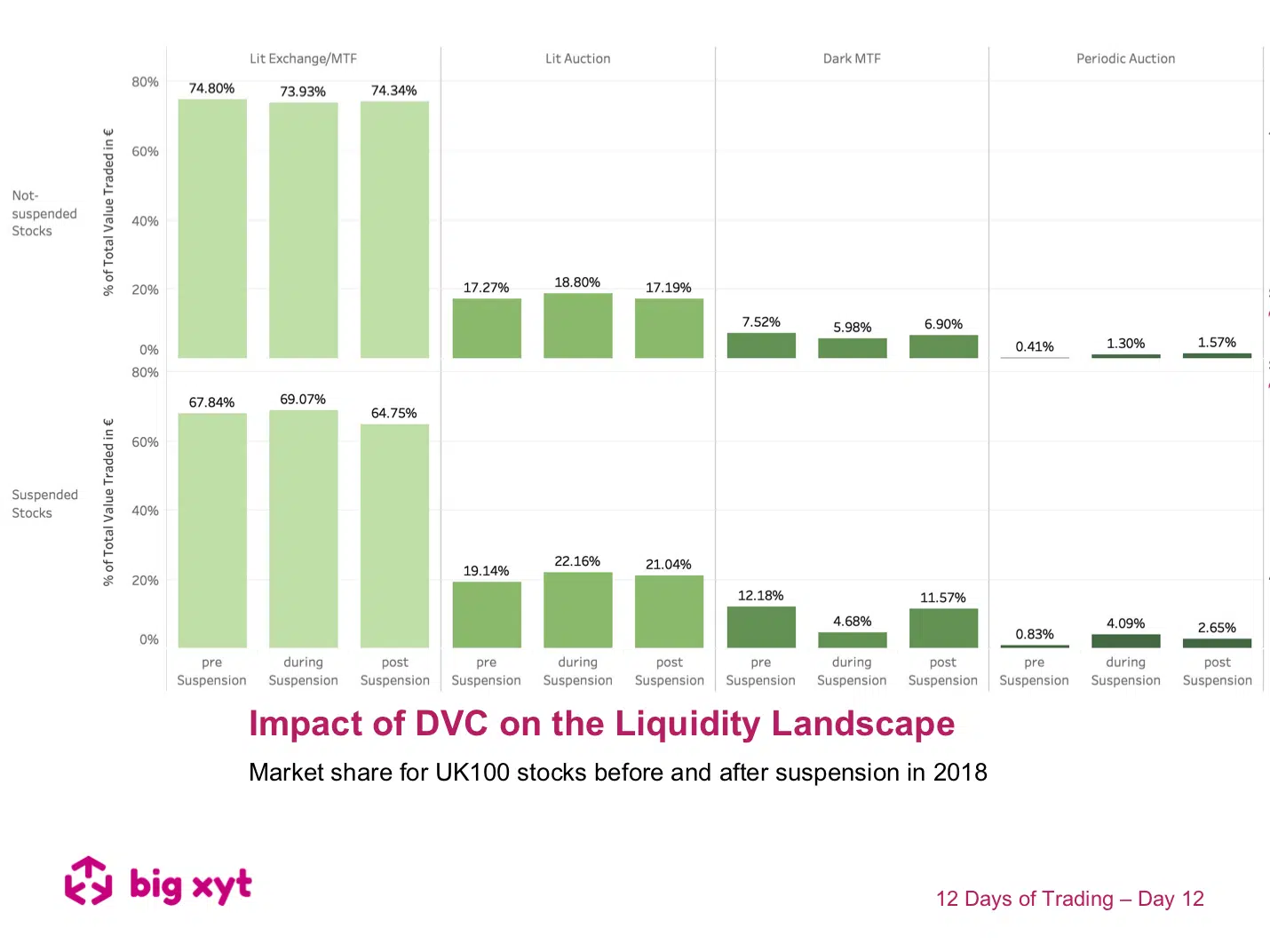

In our final view of the series we return to one of the most controversial MiFID II introductions, Double Volume Caps, with a different attempt to assess their impact by examining how UK blue chip volume dispersed before during and after DVC suspensions.

As an explanation for the methodology used for this exercise, in slide one we look at market share before during and after the DVC suspensions. The second slide looks at market share change. The baseline for the calculation is market share before suspension.

Some observations:

- By definition, stocks that were not suspended trade less in the dark and possibly are less liquid in general. Therefore they trade more on Central Limit Order Books and less in Auctions and naturally, Dark Pools.

- Behavioural change may be in evidence as alternative mechanisms (auctions in particular) appear to maintain and grow their share post-suspension vs pre-suspension.

Note that this analysis focuses on a relatively small sample of highly liquid stocks (UK100). With our Liquidity Cockpit, broader analysis or a closer look at other markets is possible. The user will reveal if these are consistent pan-European trends or if a different story emerges by market or indeed, market cap.

If you have enjoyed these messages please take a minute to vote for us as the Best Trading Analytics Platform.

If you have found these pieces of analysis useful you will find there is a lot more you can do with our Liquidity Cockpit.

—

Do you want to receive future updates directly via email? Use the following form to subscribe.

On our 12 Days of Trading

As the year draws to a close we have been asked by clients to look and highlight 2018 trends since the introduction of MiFID II. We thought we might make this a festive exercise on the 12 days leading up to the holidays. As a result, you will find a post to a different 2018 big-xyt observation each day.

We hope you enjoy them.

—

This content has been created using the Liquidity Cockpit API.

About the Liquidity Cockpit

At big-xyt we take great pride in providing solutions to the complex challenges of data analysis. Navigating in fragmented markets remains a challenge for all participants. We recognise that the investing community needs and expects continued innovation as the volume of data and related complexity continues to increase.

Our Liquidity Cockpit is now recognised as an essential independent tool for exchanges, Sell-side and increasingly Buy-side market participants. Data quality is a key component, as is a robust process for normalisation so that like-for-like comparisons and trends over time have relevance. However, our clients most value a choice of flexible delivery methods which can be via interactive dashboard or direct access to underlying data and analysis through CSV, API or other appropriate mechanism.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – If you would like a trial of the Liquidity Cockpit, please use this link to register your interest.