We are delighted that AFME (Association for Financial Markets in Europe) and their clients rely on big xyt as an independent reference for Equity market structure, with our analysis featuring in their quarterly Equity Primary Markets and Trading Report. Please get in touch to find out more about how we can improve data analytics for you and your clients.

New York, London, Frankfurt, November 9th 2020 – big xyt, the independent provider of market data analytics and smart data solutions, is pleased to announce Jenny Chen has joined their executive team as Managing Director, Head of Sales in the Americas. Jenny will be responsible for accelerating growth in the US and supporting clients in leveraging big xyt solutions to transform their trading performance and analysis. Based in New York, Jenny joins big xyt from Société Générale where she spent eight years as MD, Head of Global Execution Services, overseeing program trading, electronic trading, cash equities, ETF, and futures. Prior to Société Générale she spent seven years at Goldman Sachs and previously UBS.

London, Luxembourg, 9th June 2020 – big xyt, the independent provider of market data analytics, is pleased to announce that Societe Generale Luxembourg, the multi specialist bank, has implemented their award-winning Execution Analytics to provide sophisticated trading performance analytics to their clients, and enhance their ability to act on changing market dynamics. big xyt’s analytics platform, transforming TCA with data science, provides Societe Generale Luxembourg with the latest innovation in smart data analytics in the drive towards continually targeting reduced transaction costs. Leveraging big xyt’s highly granular consolidated view of the marketplace allows Societe Generale Luxembourg to measure and benchmark their executions and positively differentiate from their peers.

big xyt is the leading provider of independent analytics in Capital Markets for exchanges, brokers, buy-side clients and analysts. Our products cover market structure, algo development and execution analytics. In the webinar hosted by Tableau you can learn How we enable users in trading, portfolio management and sales to discover information quickly, e.g. understand the dynamics of market structure or changes in execution performance. How business users easily create their own reports without any programming skills (for internal and external use).

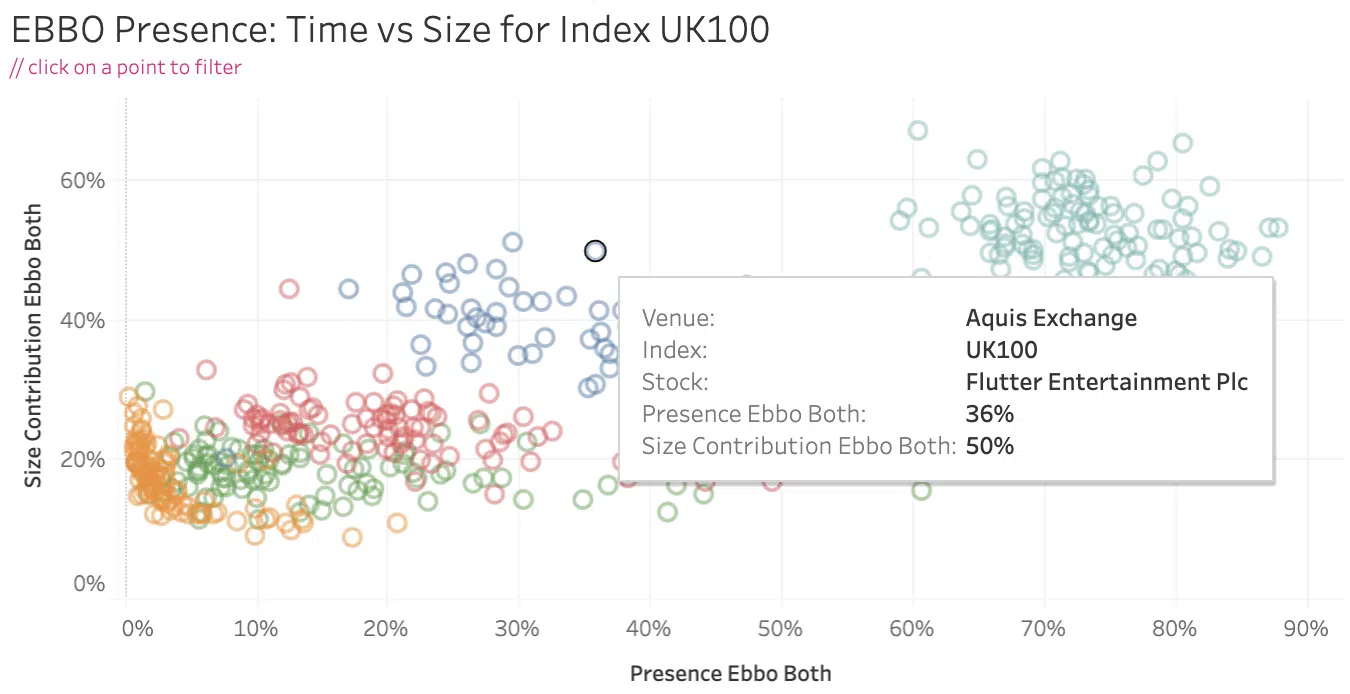

London, Frankfurt, 21st April 2020 – https://big-xyt.com/, the independent provider of market data analytics, is pleased to announce that Aquis Exchange, the subscription-based pan-European equities exchange, is implementing Liquidity Cockpit to support market structure analytics used internally by the exchange and for their clients. Award-winning big xyt solutions capture, normalise, collate and store trade data at a granularity that has not previously been available in the market. By applying data science and advanced techniques to execution analytics, Liquidity Cockpit delivers a unique range of market overviews and individualised comparison reports to the team at Aquis Exchange.

London, Frankfurt 24th March 2020 – big xyt, the independent provider of market data analytics, is pleased to announce Richard Hills has joined their executive team as Head of Client Engagement. Working alongside Mark Montgomery, Head of Strategy and Business Development, Richard’s appointment will accelerate the implementation of big xyt’s 2020 strategic business plans. Based in London, Richard joins big xyt from Société Générale, where he launched and built the equities electronic trading business, going on to become Global Co-Head of Cash Equities Execution encompassing electronic, program trading and high touch execution.

Having a large international financial institution going live with our API for advanced execution analytics at the beginning of the year was a great way to start. Throughout 2019 we have on-boarded a record number of new clients and have been very pleased to be nominated and more importantly win a number of industry awards in recognition of our reputation for delivering independent analytic solutions. Becoming the de-facto reference for all major European exchanges has been the icing on the cake. What does 2020 hold in store for the business? We already see a growing trend for outsourcing data analytics. By delivering our solutions as a trusted and independent partner we are able to facilitate the business transformation our clients need by allowing them to concentrate on their own proprietary needs.

Frankfurt, London, 27th February 2020 – big xyt, the independent provider of market data analytics, is pleased to announce that Kepler Cheuvreux, a leading independent European financial services firm specialising in research, execution services and advisory services, is implementing their award-winning Execution Analytics including Transaction Cost Analysis (TCA). big xyt takes execution analytics beyond Transaction Cost Analysis (TCA), transforming the traditional view of TCA with data science; applying advanced techniques to increase quality and deliver consolidated data views for its clients. TCA has transitioned away from being a routine compliance solution to being a critical business function. big xyt solutions capture, normalise, collate and store trade data at a granularity that has not previously been available in the market.

As we set forth into a new decade with 20:20 vision, we thought it would be appropriate to share some memories and developments from an award winning year for big-xyt in 2019. Most, if not all of these enhancements germinate from client conversations. We value feedback highly and would encourage you to continue to challenge, encourage and share thoughts with us. Looking back at 2019, we can see many ways in which big-xyt has developed, not just as an independent reference for European Equity market structure but as an external source of unbiased analytics, accessible & integratable through a unique proprietary API. Please let us know if you would like to know more about these service

London, Frankfurt, 25th November 2019 – big xyt, the independent provider of market data analytics is pleased to announce that it has been named as ‘Editors Choice – Outstanding TCA provider’ at The TRADE Leaders in Trading 2019 Awards. Robin Mess, CEO at big xyt, who collected the award with Mark Montgomery, Head of Strategy and Business Development, at a ceremony in London last week commented, “We are delighted to have received this recognition as Outstanding TCA provider from the Editors at The TRADE and thank our clients and XYTView users for their support this year.” John Brazier, Editor of The TRADE said, “Throughout the year we have heard a lot from the buy-side about the value of TCA to their trading processes, and big xyt was one of the names that was continuously raised in this discourse.” He added, “The TRADE editorial team were impressed with big xyt’s quality of service and high level of dedication to providing the buy-side community with tools they need to achieve best execution and deliver the best returns to clients as possible.”