big xyt is a proud sponsor of TradeTech Europe 2022 on 11-12 May. Don’t miss Mark Montgomery’s panel alongside Vanguard Asset Management, Norges Bank Investment Management and Capital Group to learn about the advancements in enhanced execution analytics.

Provides independent agency broker with improved market structure visibility and supports clients’ access to unique liquidity opportunities big xyt, the independent provider of smart data and execution analytics solutions to the global trading and investment community, has been selected by Cowen Execution Services Limited (CESL), a wholly owned subsidiary of Cowen Inc. (NASDAQ:COWN), to further strengthen Cowen’s European equities trading platform and help identify unique liquidity opportunities for its clients.

Trading turnover in European equities posted a new MiFID II era record in Q1, 34% higher than the four year average, as investors reacted to the cocktail of inflationary fears and war. Back in Q1 2020 it felt like we were watching a truly exceptional event but despite lower volatility, the markets managed to deliver something even more unpredictable. Please have a read of our latest European market microstructure and let us know your thoughts or ideas for any further investigations.

We’re delighted to announce that big xyt has won the A-Team TradingTech Insight 2022 Award Europe for the Best Transaction Cost Analysis (TCA) Tool, for the second year running. Independence and accuracy, combined with the transparency we provide on the underlying data, is at the core of our Open TCA offering for execution analytics. This is seen as essential by our clients to improve workflows and optimise trading strategies.

big xyt is delighted to be a founding member of the Sustainable Trading initiative and we look forward to collaborating with its members. 30 founding members from asset management, banking and brokerage, market making, exchanges, technology and service providers have joined the initiative.

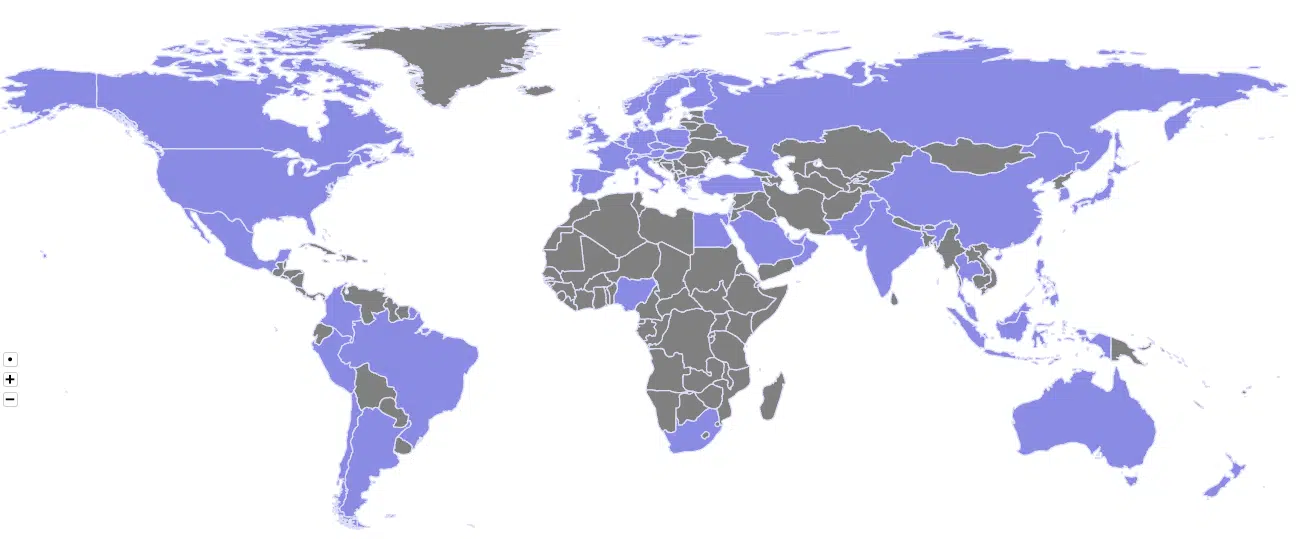

big xyt, the independent provider of smart data and analytics solutions to the global trading and investment community, today announced the launch of the Global Exchanges Directory, an interactive web portal providing key information on 97 worldwide stock exchanges and alternative trading venues in seven regional categories.

2021 has ended and all that remains are the tea leaves at the bottom of the cup. In our latest annual survey of market volumes and fragmentation trends in European equities, we gaze at the patterns to see how the story unfolded and what we can learn about the year ahead. Another turbulent year for equities globally played out in the daily ebb and flow of over 250 billion quotes, orders and trades, presented to you here in a short pictorial summary.

On the back of the announcement of our partnership with ETFbook yesterday, we’re pleased to provide investors with our first weekly summary report of transparency in European ETPs, by consolidating all issued products and their liquidity across the fragmented landscape. These updates are for product issuers to monitor the evolving European ETP landscape, for market makers to gain an insight into primary and secondary market liquidity, and for buy-side investors to see new investment opportunities.

Partnership will consolidate all issued products and their liquidity across the fragmented landscape 09 November, 2021: London / Zurich – big xyt, the independent provider of smart data and analytics solutions to the global trading and investment community, is pleased to announce its partnership with ETFbook, a leading ETF information and analytics platform, to provide daily fund data for their Liquidity Cockpit for ETFs solution.

The summer saw increased nervousness in the European markets in reaction to a fragile recovery from the pandemic and concerns about the spectre of inflation. However, trading in equities remained quite buoyant, especially in September, and Q3 volumes returned to their seasonal, pre-pandemic average, in contrast to last summer’s record breaking doldrums. Welcome to our latest quarterly survey of market volumes and fragmentation trends in European equities. If you are unfamiliar with the topic, we encourage you to visit our website to read our Microbites series for an explanation of European market microstructure.