As it’s nearly Christmas, it will soon be time to wrap up the volumes-related theme we have been following these first few episodes of the 12 Days of Trading. First though, let’s take a look at how the monsters of European trading fared in 2020. The first chart was inspired by looking at my Christmas tree lights, shortly after I hauled them out of the box under the stairs. It shows the ‘Big Five’ of the share trading world in Europe – SAP, Roche, Unilever, Nestle and Shell; between them they make up around 6% of daily traded value of the whole European equity market. With their large index and sector weightings, these blue chips are the mainstays of so many ETFs, passive trackers and mutual funds, and when their prices become volatile, they can deliver some really big days.

For traders and portfolio managers who are navigating the European market structure landscape or want a refresher, big xyt is introducing a series of briefings to help you get to grips with the market mechanisms, and to help users of our analytics tools.

Market data can provide valuable context to the narrative by drawing direct, quantifiable sector and index parallels. In this example, daily trading volumes have dropped by an average of 57% since Q1, and in a tightly banded range, it shows how the whole sector has been uniformly impacted. Following the heavy rotation out of equities during the great Q1 sell-off, Q3 volumes reached unprecedentedly low levels in these big names (Equinor, Repsol, Eni, BP, Total and Royal Dutch Shell), as seen in most sectors. Reversal of this trend may be a clear signal that recovery is coming.

It hasn’t been a good quarter for the European Equity Market. In nearly every country, we’ve seen record lows for volumes throughout the summer. August delivered the slowest month for trading since the MiFID2 era began in January 2018 and the pattern persisted into September. Although 2020 remains ahead of 2019 in terms of daily turnover, the lead has diminished substantially from 34% in Q1 to 11% in Q3 and may evaporate completely in Q4. You can download the full report by clicking on the icons or clicking here.

Having a good understanding of how to select a venue when executing a large trade is essential for successful performance. There are many venues to consider and each venue has its own “sweet spot”, depending on the names and size traded and that varies according to your level of urgency. Using objective criteria, such as expected time to execution and likely price impact, we can rank venues into an order of priority for routing. Furthermore, when we look at how this changes over time, we get a sense of the importance of regular monitoring and updating of the smart order routing process.

The strange times continue. While Q1 broke all the records, Q2 came up with a few surprises. The biggest MSCI rebalance in history pushed the figures up for May, thanks to some major index re-weightings. Volatility returned in June to create the 3rd biggest month since MiFID2 began. In our quarterly review we look at the patterns of volumes and market share and this time we take a closer look inside the box of Systematic Internalisation.

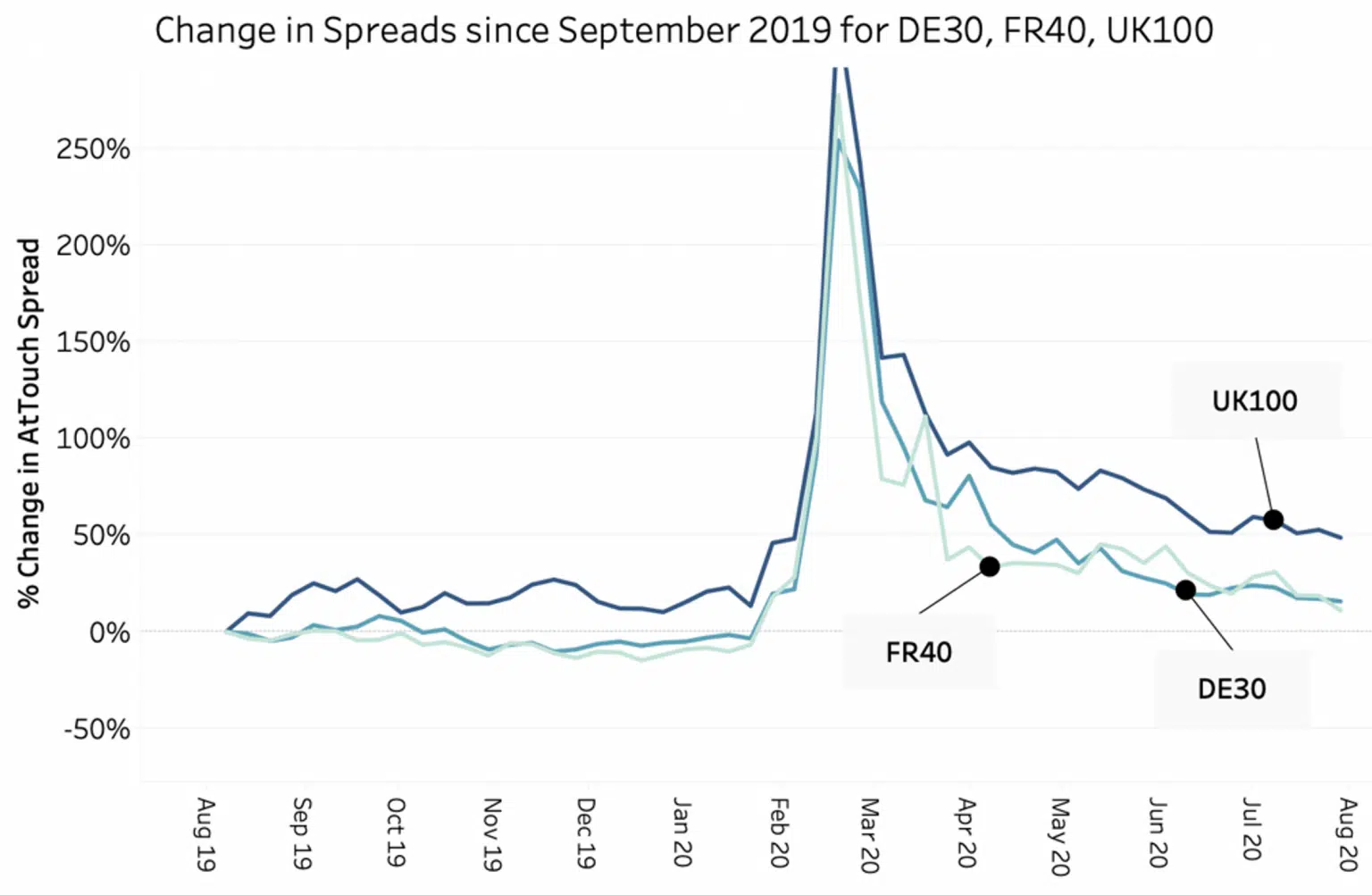

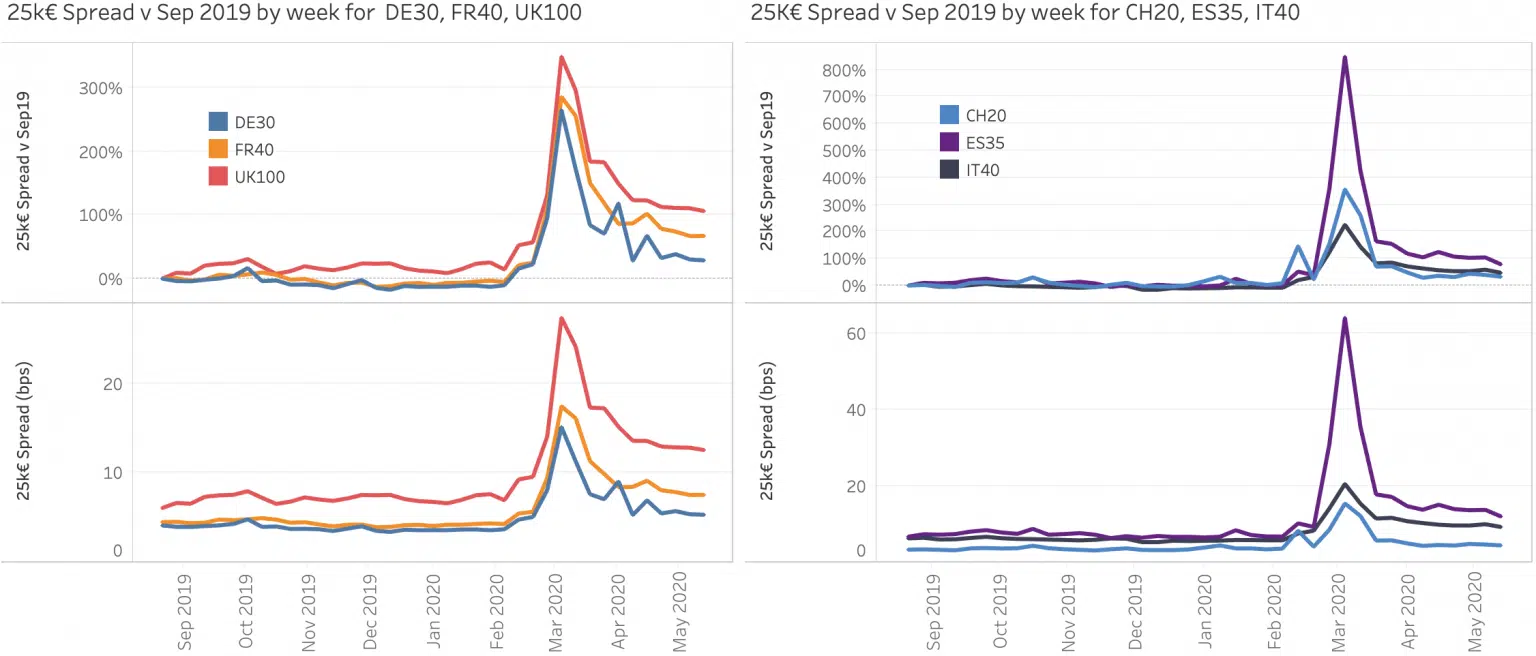

May could almost be described as uneventful in that volumes and market share seem to have reverted to business as usual. A quick look at some market quality metrics tells us that this is far from the case as uncertainty and volatility continue. The chart shows the weekly evolution of spreads since September 2019, both in absolute terms (in bps) and the %change since September for each index. For the most liquid, large cap names in Europe, spreads remain well above their pre crisis levels notably for the UK100.

Recent market volatility has created a domino effect of changing market behaviours as investors struggle to understand changing liquidity patterns. big xyt has received an increasing number of requests from the community for guidance on market quality as the exceptional trading conditions persist. As a result of these enquiries, additional content is being added to the unique Liquidity Cockpit which provides a consolidated view of the European Equity Market landscape.