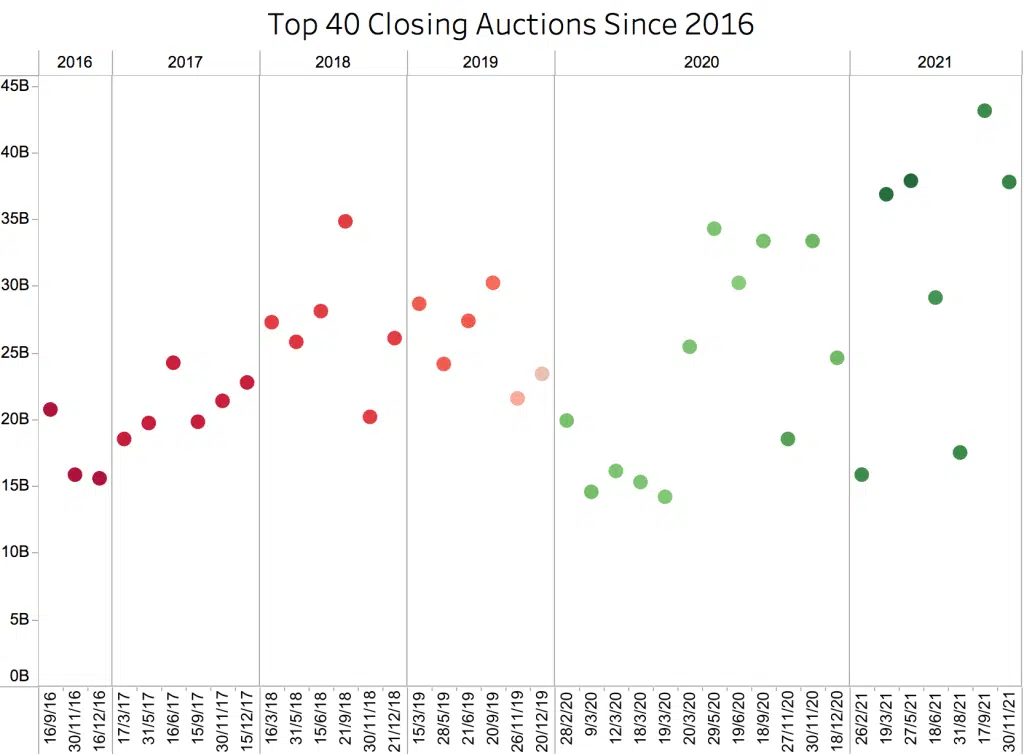

Inevitably at this time of year our thoughts turn to the important matter of choosing the right dessert to round off a hearty Christmas lunch. To get us in the mood, for our first 12 Days of Trading 2021 post, we decided to look at the Closing Auctions, the “afters” of the trading day if you like. We discovered that the top four largest ever auctions all occurred in 2021.

The strawberry on the top of the pavlova came during the September index rebalance of this year, with a thick and creamy €43B in the closing print, hotly pursued by the May and November re-shuffles, with €38B apiece. For reference, European average daily value in all types of trading is around €55B, and a normal day’s close is €8.6B.

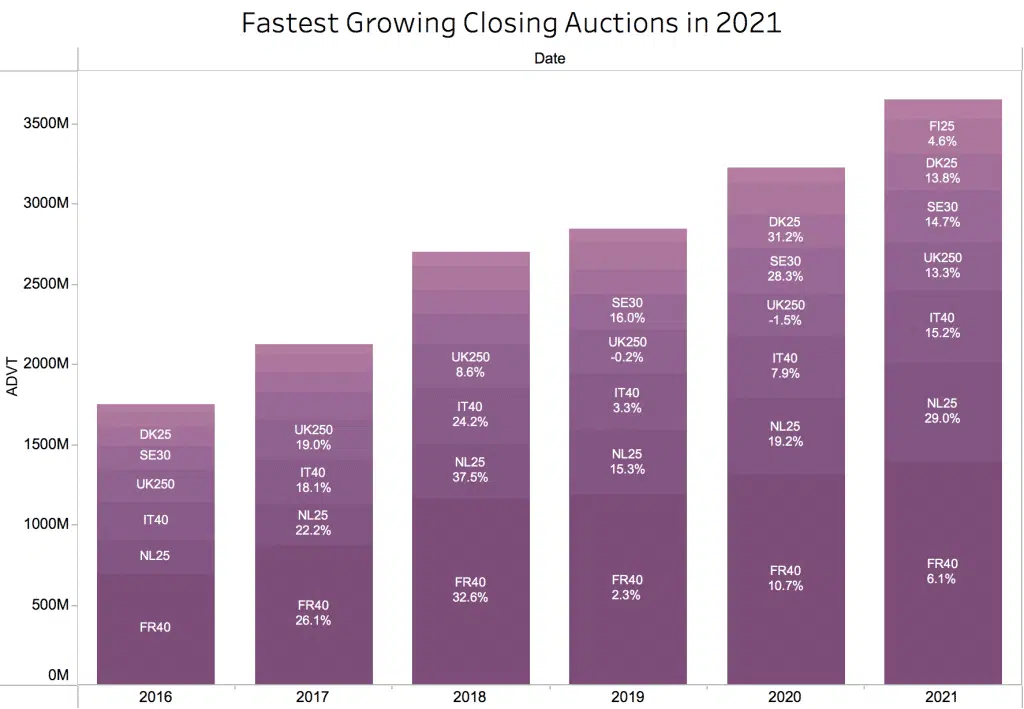

While the rebalance days inevitably dominate the records, the Close is generally helping itself to more and more of the mince pie, with ADV growing 2.5% in 2021 to 19.6% of all trading and 27.8% of on order book trading, against a background of 3.2% lower volumes overall. Given this multi-year trend, it is highly likely that 30% of all electronically executed value in 2022 will be in that final print of the day. You could say the close has become the brandy butter of liquidity.

We know that passive trading is behind this ongoing trend but perhaps what is surprising is that most of the growth is coming from smaller indexes. Our second chart shows that while Closing Auction growth has slowed down or even reversed in the large cap Swiss, German and UK names, it has accelerated nearly everywhere else, and especially in France, Scandinavia and the Netherlands. For example, Closing Auctions in the top Dutch names have increased 29% in absolute terms.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe 2022, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.