There may be several arguments about inclusion rules and timing and certainly when a stock with a Price /Earnings ratio of 1260 joins an index where the average P/E is 36 it is likely to cause waves rather than ripples.

We knew it was going to be big…but this exceeded expectations.

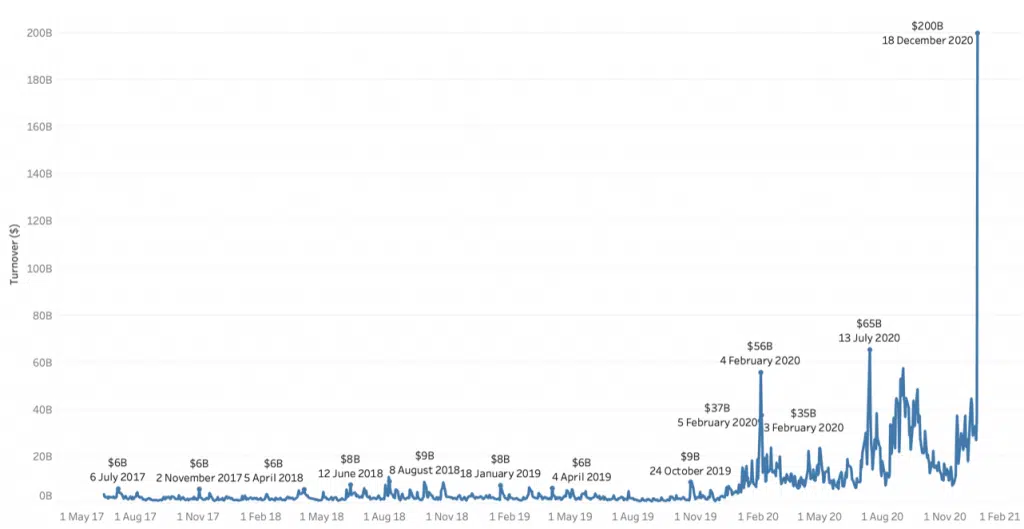

For a stock that trades huge volumes anyway the Tesla volumes on Friday were staggering.

We can see on our first chart that $200bn traded on that one day. To put that in context, the biggest day in Europe since MiFIDII across ALL stocks was €132bn.

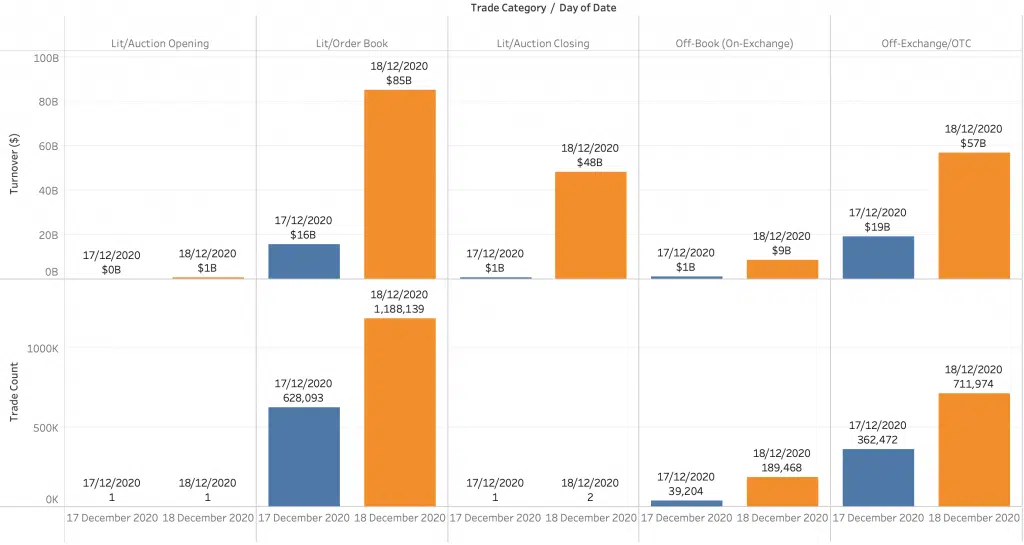

In the second chart we show a daily comparison (last Thursday vs Friday) of the Tesla turnover by the trade category. In the closing auction alone, Tesla traded $48bn versus $1bn the previous day.

To put this in perspective, we recently highlighted the record European single stock closing volume – the two listings of Unilever consolidated resulting in a combined closing turnover of €8.8bn.

Can some presence just be too big to be acceptable?

*****

Please let us know if you are interested in gaining access to this, or other data.

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe for 2020, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.