As a trailer for our forthcoming Q2 2021 survey of European equity market microstructure, we thought you might like a sneak peek at what’s been happening to fragmentation. Following Brexit and the divergence of dark trading rules, we have been monitoring the trend in the UK. The graph below shows the UK250 index where on-order book ‘lit continuous’ trading has reached a 5-year low in terms of the daily market share traded in June at just 28.5%, while auction market share is a whisker under the previous record high in December at 22.7%. Meanwhile, dark trading has risen to over 12% from 9% prior to October 2020.

We have just launched the Market Microstructure in Practice for Equities with big xyt’s API interactive presentation on the big xyt Academy. If you are a quantitative analyst or developer, trader, portfolio manager, or anyone interested in market microstructure for sales and marketing, this could be of interest to you. Explore big xyt’s powerful and flexible API to see how convenient and reliable it is for conducting research and analysing market microstructure, as well as assessing trading performance and algos.

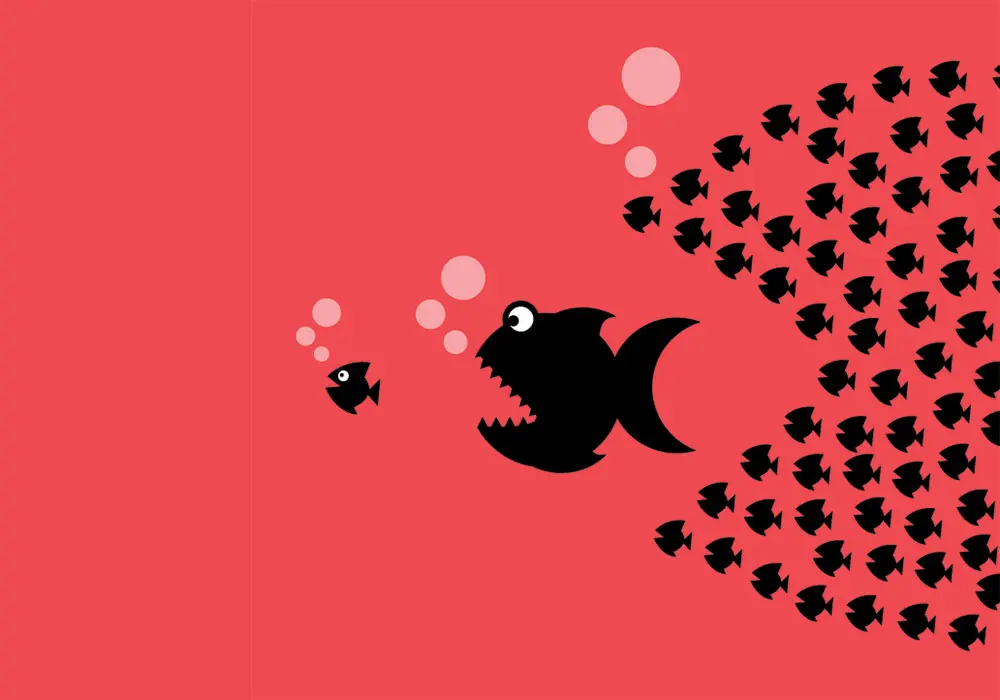

In the search for liquidity, particularly whilst minimising market impact, a means to identify large trades and where they take place is key for the investing community. The regulatory changes in MiFIDII introduced the concept of Large In Scale (LIS). No, not not a post-Brexit way to limit fishing quotas, rather a means to identify large transactions in financial instruments. In the equity landscape this has resulted in some confusion post-Brexit. Depending on the activity in each individual stock, an LIS threshold was set, above which the trade could be classed as a block trade. As Broker Crossing Networks were abolished at the same time, this LIS threshold was applied as one of the permissible justifications of many venues supporting dark trading.