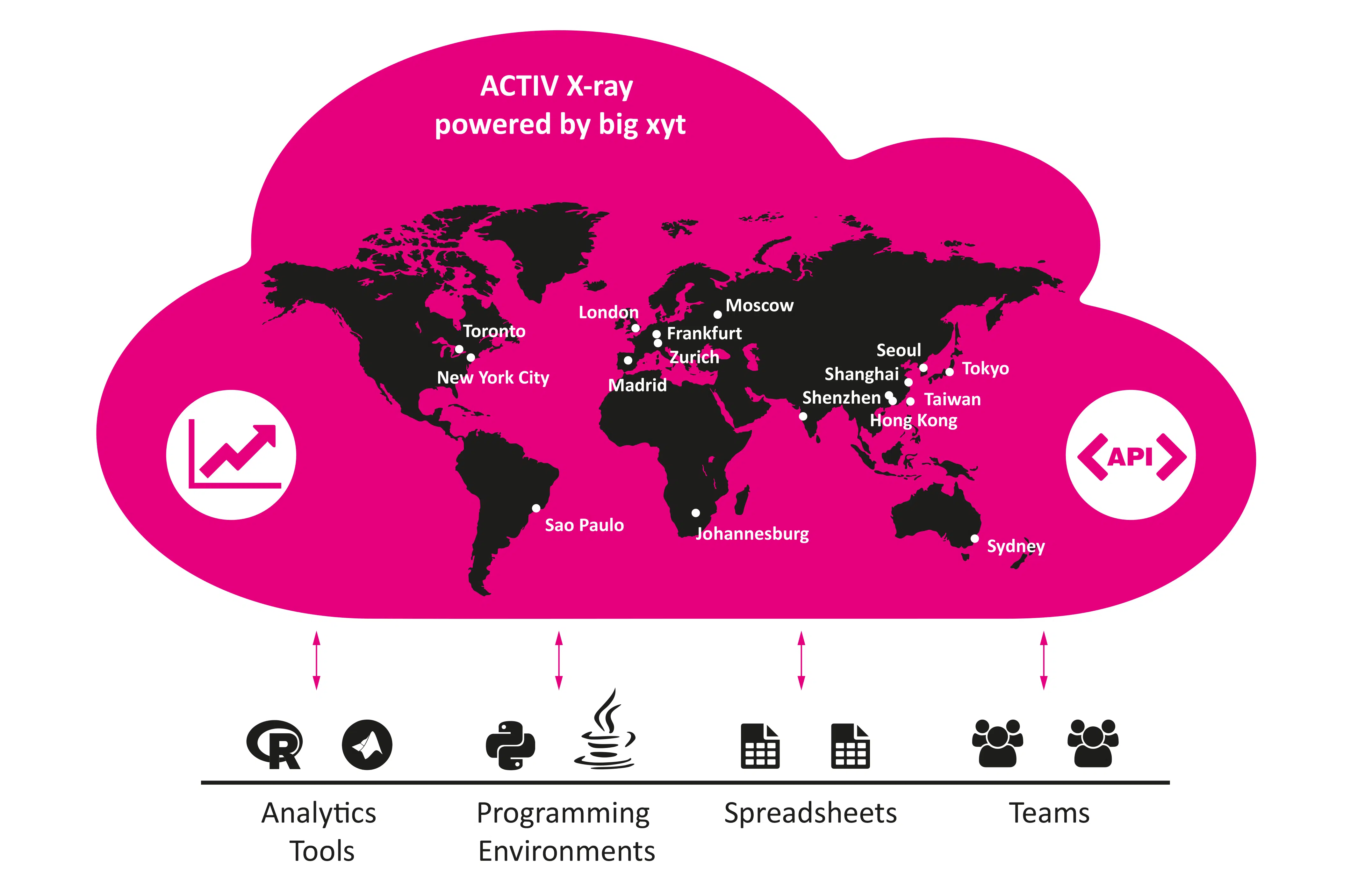

[featured-video-plus] Wednesday 4th October 2016, Frankfurt, Germany: As a sponsor of Deutsche Börse’s Open Day 2016, we have received broad interest in our solutions for convenient tick data analytics. Trading firms see great value in the big xyt Cloud Platform for cost effectively managing any number of data sources as well as in products offered by big xyt partners like ACTIV Financial. At the conference we have presented ACTIV X-ray, engineered and operated by big xyt, a tick data cloud that enables trading firms to instantaneously access historical tick data from 120+ feeds and 80+ trading venues. See the featured video for selected use cases introduced at the conference (video only, silent).

London — 13 July 2016 — ACTIV Financial announced today that RSJ has selected ACTIV X-ray to help identify trading opportunities as they expand their trading activity in new asset classes and trading venues. To successfully launch trading models on new trading venues, trading firms must perform a broad range of analytics and tests. In addition, trading firms need the ability to access in-depth market information allowing them to understand specific market mechanics of each venue. High quality data, coupled with big xyt’s ultra-fast cloud platform, helps trading firms to gain relevant insight in a convenient way. By subscribing to ACTIV X-ray, RSJ is able to test models accurately and to reduce project risks.

big xyt enables ACTIV Financial to launch ACTIV X-ray, an innovative tick data cloud ACTIV Financial leverages big xyt’s Cloud Platform to enable immediate access to high-quality tick data and scalable testing of trading models. FRANKFURT — 17 July 2016 — ACTIV Financial, a global provider of real-time, multi-asset financial market data and solutions, and big xyt, the leading provider for data and analytics solutions on large datasets, today announced the launch of ACTIV X-ray, a cloud-based tick data repository which will enhance the way trading firms discover and test new venues or meet ever growing regulatory requirements.

Thursday 26th May 2016, Tampere, Finnland: As the first event of the research collaboration between the Technical University of Tampere, Fraunhofer ITWM Kaiserslautern and big xyt, Dr. Ulrich Nögel (Co-Founder, Analytics big xyt) was presenting on “Challenges for Big Data Analysis and TCA in the Post Crisis Regulatory Environment” in Tampere, Finland. The audience included members of the Big Data Research Cluster as well as members of Prof. Dr. Juho Kanniainen’s group. In June this research collaboration will conduct a stay of guest researcher Mrs. Milla Siikanen at the Fraunhofer ITWM in Kaiserslautern where she will intensify her research on liquidity measures derived from order book data across asset classes (including cash equities and FX spot).

FRANKFURT — 18 May 2016 — To enable companies to discover value in data effectively, big xyt today announced the big xyt Cloud Platform for high-volume analytics. This new offering from big xyt intends to reduce the complexity of accessing data and executing analytics across all data-centric industries. The big xyt Cloud Platform lets end users access all their data sources through a single interface, quickly and easily, enabling them to seamlessly execute analytics from their existing environments. As a result, corporations and users need not worry about things like infrastructure investments, such as hardware or software – they can simply focus on data analytics, dramatically speeding up the discovery of valuable insight.

London, 21 & 22 April 2016, big-xyt’s Dr. Ulrich Nögel speaking at the QuanTech Conference about Challenges for Big Data Analysis and TCA in the Post-Crisis Regulatory Environment (Friday, 22nd at 1:50pm). The growing interest in distributed ledgers should be of considerable interest to traders, quants and structurers, as it has the potential to change the trajectory of the post-crisis response to the

London, 16 & 17 March 2016, big-xyt’s Dr. Ulrich Nögel speaking at the Risk Training about MiFID II. This course will present the latest developments on MIFID II whilst offering the initial buildings blocks in order to adapt operations for adhering to the upcoming regulation. Find out more and register at

Industry experts share thoughts on the benefits of the Financial Applications Hub, designed to offer data, software, tools and other content in one place. Find out how big xyt contributes to Digital Realty’s Financial Applications Hub through its innovative and cost-effective solutions for tick data analytics