As it’s nearly Christmas, it will soon be time to wrap up the volumes-related theme we have been following these first few episodes of the 12 Days of Trading. First though, let’s take a look at how the monsters of European trading fared in 2020.

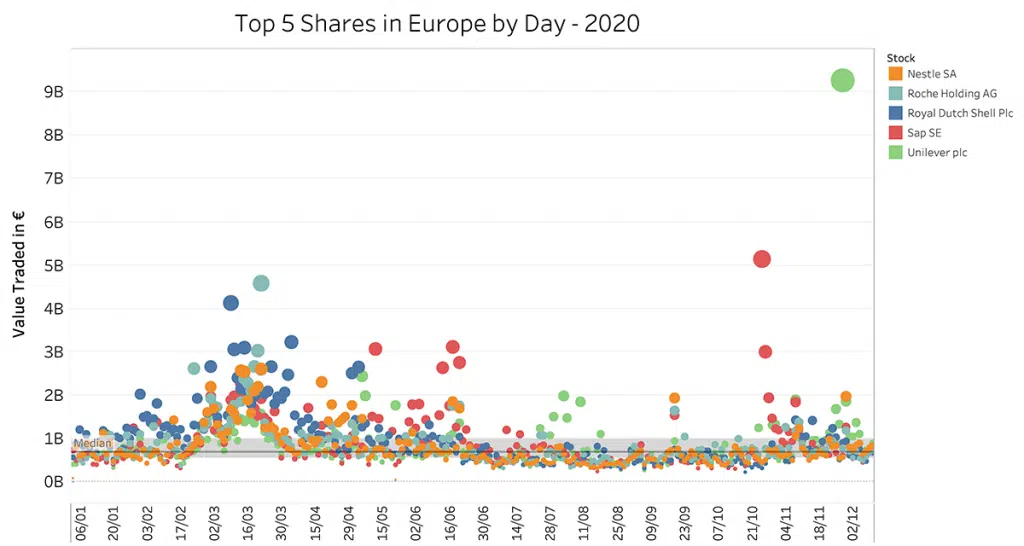

The first chart was inspired by looking at my Christmas tree lights, shortly after I hauled them out of the box under the stairs. It shows the ‘Big Five’ of the share trading world in Europe – SAP, Roche, Unilever, Nestle and Shell; between them they make up around 6% of daily traded value of the whole European equity market. With their large index and sector weightings, these blue chips are the mainstays of so many ETFs, passive trackers and mutual funds, and when their prices become volatile, they can deliver some really big days.

The median ADV for these names is 700 million euros. Four of them have been above 4 billion euros in a single day this year, each with their own personal story, such as SAP’s 30% price plunge in October on missed revenue expectations, Roche’s CEO calming down expectations on vaccine availability back in March, and of course the oil prices dipping below 0 affecting the entire sector, including Shell. Pride of place goes to Unilever’s merger of their international entities which created a whopping 9 billion euro day – 15% of the market.

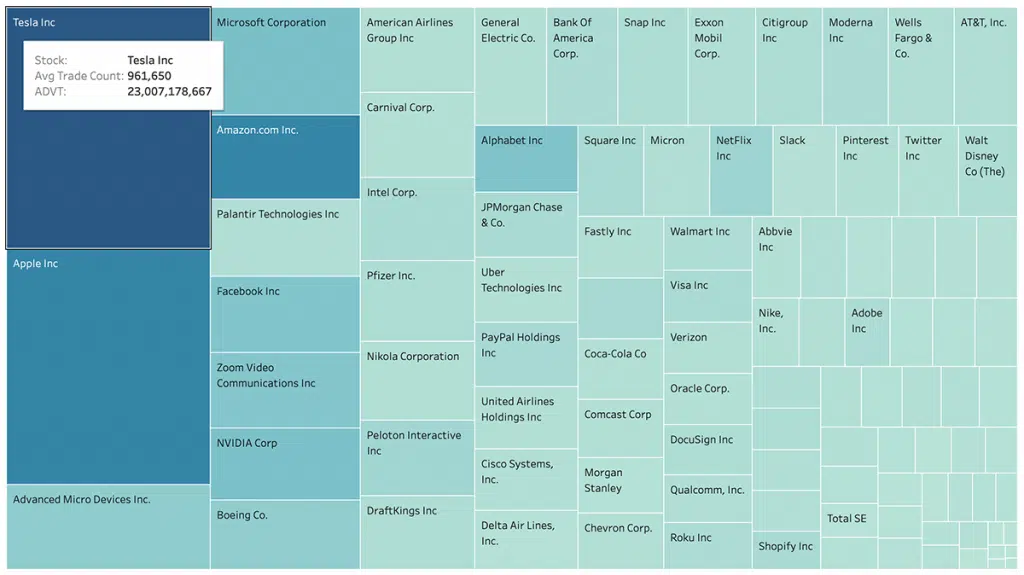

But these values pale into insignificance when we look at the US, where 10 stocks trade more than 4 billion every day. Our second chart shows how Tesla has dominated the ADV rank over recent months, with an eye-watering ADV of 23 billion dollars.

Did you know that through our Single Stock Analytics tool, you can drill down into individual names on a daily basis and look at volumes and daily fragmentation, as well as other statistics such as volatility.

Please let us know if you are interested in gaining access to this, or other data.

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe for 2020, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.