by Mark Montgomery, big xyt

Day 3 – Swiss Watch

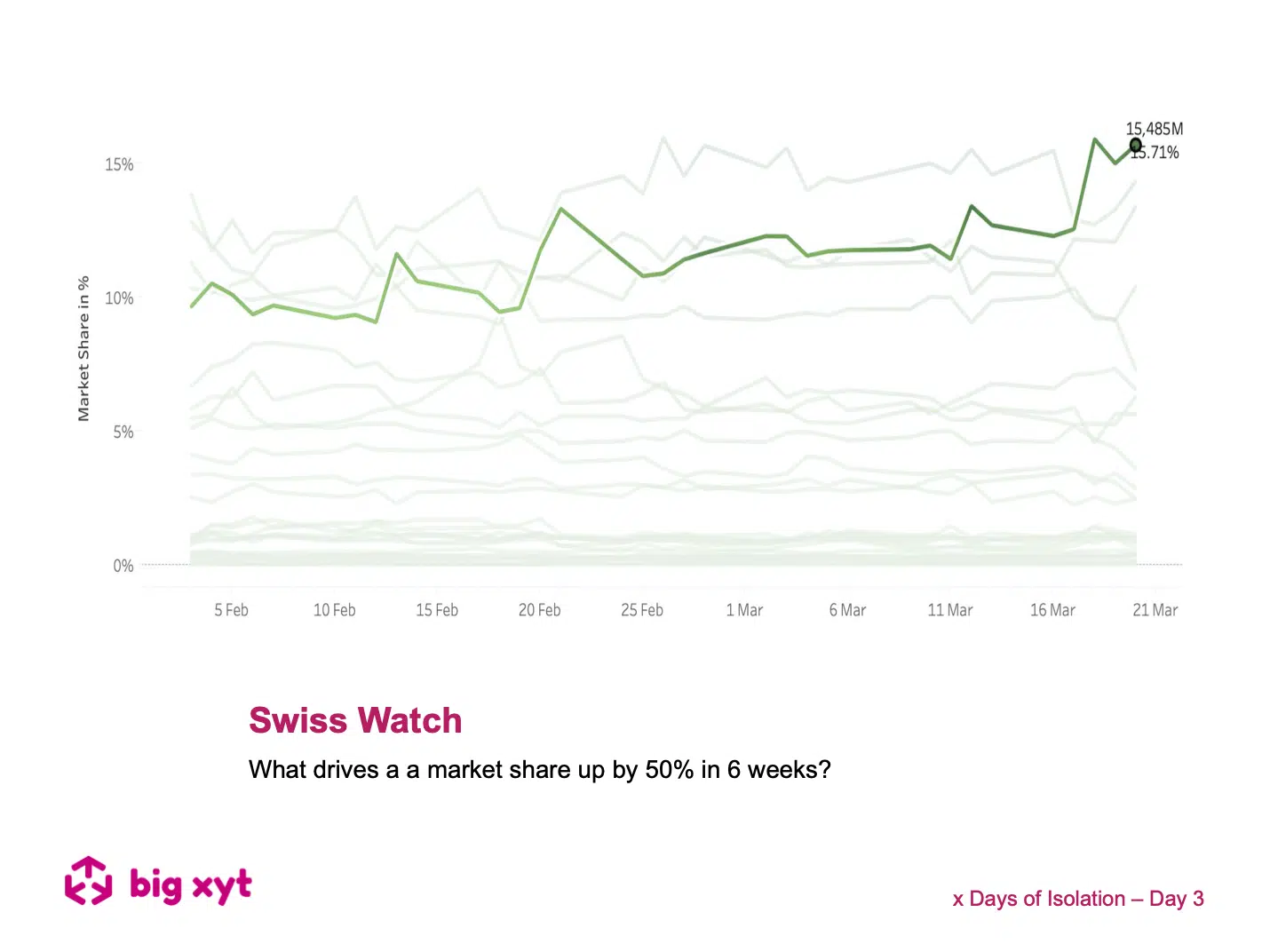

The chart today shows the changing market share of European Equity trading venues during 2020.The highlighted line is the focus of the following observations.

Last Summer when Swiss non equivalence was announced, overnight competition from MTFs was outlawed and the SIX Swiss exchange saw a 25% increase in share from 8% to 10% of European equity turnover.

Without any legislative announcements, something even more dramatic has transpired since the beginning of February. The same venue has just grown its share by a further 50%. At the beginning of February the Swiss market was the fourth largest European venue by turnover with just under 10% market share.

By the beginning of March it had the second greatest turnover with 12.3% market share. At the end of last week (20th Mar 2020) it was the largest with 15.71% of EU equity turnover.

Wny? Is this right? Is it a currency effect? Or down to huge volumes in Swiss Leaders? Certainly Roche, Nestle & Novartis have been amongst the top 6 MTD stocks by turnover.

If you find these pieces of analysis useful, you will find there is a lot more you can do with our Liquidity Cockpit. Clients using our Execution Analysis/TCA are able to measure execution performance with the demonstrated precision and flexibility.

Do you want to receive future updates directly via email? Use the following form to subscribe.

On our x Days of Isolation

During these unprecedented times we do not underestimate the professional and personal challenges that everyone is facing. There are far more important things to be doing in the community than looking at a screen.

However, data and data analytics is playing a critical part in providing solutions to the current global crisis. Furthermore, the markets remain open and whilst they do, the trading community needs to be well informed in order to understand the changing market landscape. As a result, big xyt is receiving an increasing number of requests for observations of changing trends and behaviours in the equity markets. We are excited to have recently expanded our London team to enrich our content and support for clients seeking greater market insights from an independent source. Whilst many adjust to the new experience of working from home we plan to share some of these thoughts, observations and questions in the coming days & weeks.

As ever we welcome feedback as this can shape further contributions from our team and the Liquidity Cockpit our unique window into European equity market structure and market quality.

We hope you enjoy them.

—

This content has been created using the Liquidity Cockpit API.

About the Liquidity Cockpit

At big-xyt we take great pride in providing solutions to the complex challenges of data analysis. Navigating in fragmented markets remains a challenge for all participants. We recognise that the investing community needs and expects continued innovation as the volume of data and related complexity continues to increase.

Our Liquidity Cockpit is now recognised as an essential independent tool for exchanges, Sell-side and increasingly Buy-side market participants. Data quality is a key component, as is a robust process for normalisation so that like-for-like comparisons and trends over time have relevance. However, our clients most value a choice of flexible delivery methods which can be via interactive dashboard or direct access to underlying data and analysis through CSV, API or other appropriate mechanism.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.