Picture the scene. Lap 20, Hamilton, as usual, has a 15 second lead (almost enough time for a free pit stop), and a little more unexpectedly, Bottas is running a strong second, 10 seconds ahead of the third place car.

Then, shock, horror, for the first time in five years, both Mercedes have to return to the pits with a mechanical issue on the same lap. For the rest of the field, the race is on again. The rare opportunity for a podium presented on a plate. But, hold on, what is happening? One by one they all return to the pits and wait patiently until Lewis and Valtteri have their proverbial pipes cleared and are ready to rejoin. The clock counts down and the race resumes as if a virtual safety car was being controlled and temporarily parked by the pit crew of the lead team.

Sounds ridiculous, doesn’t it? Let’s take another real world commercial example. When the heavily anticipated Note 7 devices started exploding, did Apple and other competing smartphone providers suspend sales until Samsung changed the batteries? No, they grasped the opportunity to fill the retailers’ shelves with their own products.

So why then do equity markets behave in such a chivalrous fashion? We saw a recent example and not for the first time. An exchange has an outage and all trading stops…not just on the exchange but on all other mechanisms and venues. Mechanisms and venues that appear to rely on pricing from the primary central limit order book for the affected instruments.

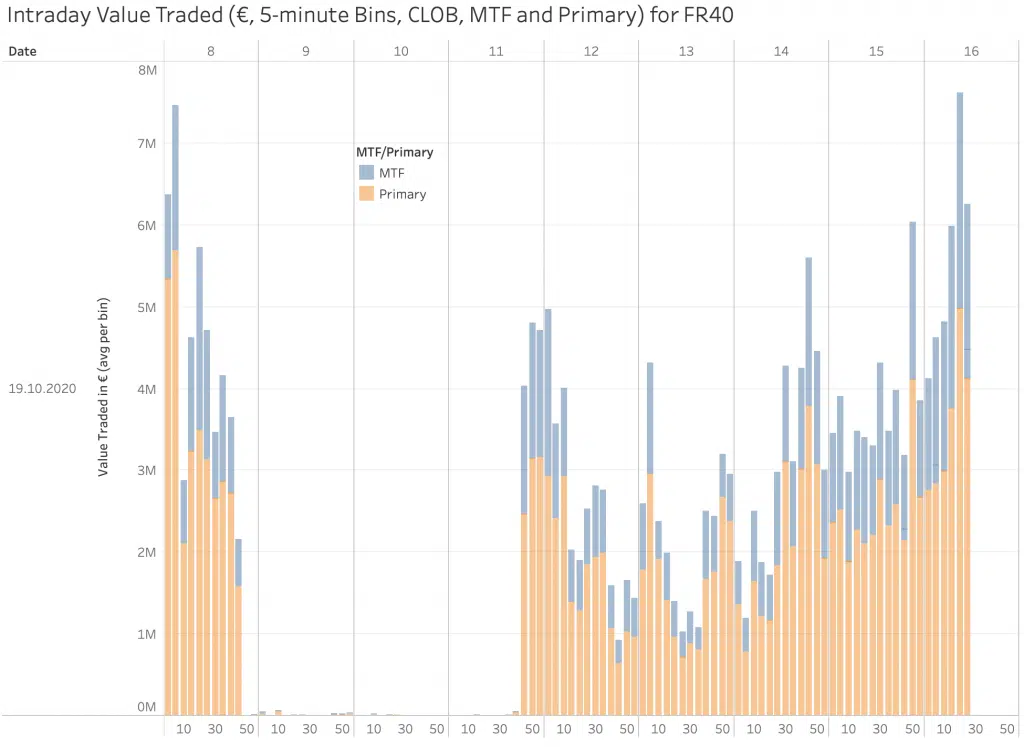

Look at the first chart to see how the primary suspension immediately results in other lit venues spluttering to a halt. When we use our big xyt microscope we can identify the time where spreads widen dramatically and available liquidity evaporates. It would be possible to trade but not at a justifiable cost. Why does this happen? Why would the liquidity providers not continue to compete across the available MTFs for the order flow that is clearly out there, albeit latent as the sell side routers pause for breath…?

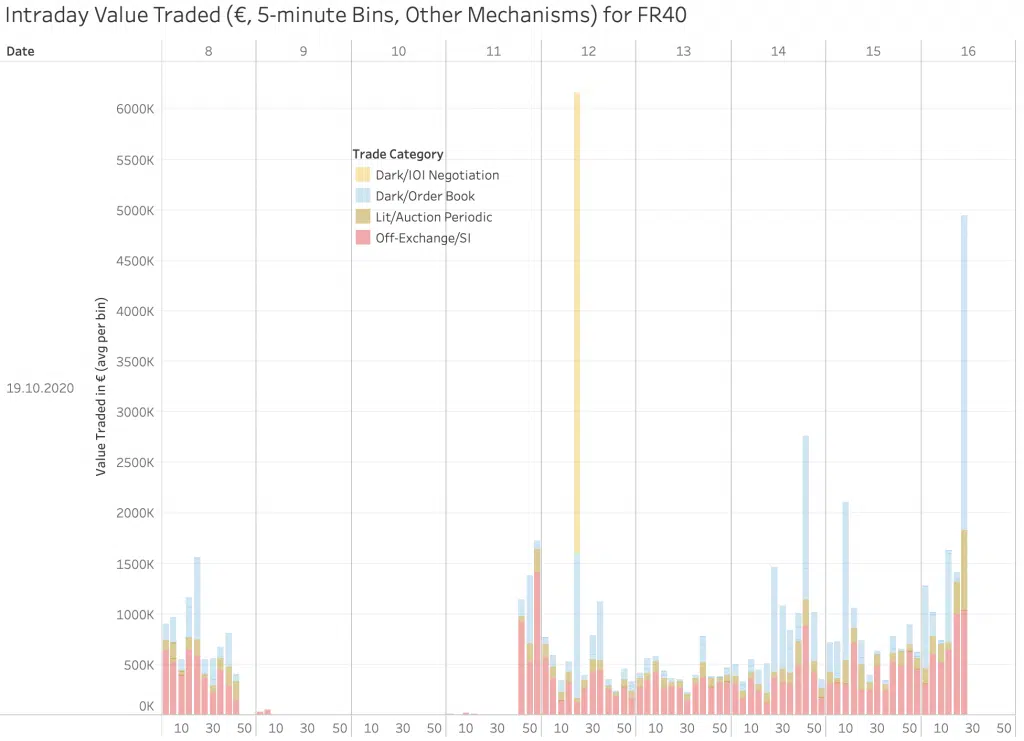

These other venues and mechanisms compete happily for market share all day, everyday, and yet when the very entity they are looking to compete with sneezes, they all reach for their own hankies in unison. The contagion goes beyond lit order books. Periodics Auctions or FBAs, Dark Pools and SIs all promoted as the new alternatives for low impact trading….except as you will see from our second chart, they too stopped trading.

We can observe clearly what happened and exactly when. We can see in granular detail what happens when trading restarts and algos try to catch up. What we struggle to do is explain whether this behaviour is a result of the the end liquidity provider’s reluctance, the trading intermediaries’ reluctance, or the trading engines’ reluctance to trade. For a market thriving on risk and return it is clear that few are brave (or foolish) enough to be the first mover.

At big xyt we never forget that you’re the driver….we just provide the telemetry.

All data is taken from our Liquidity Cockpit. To sign up for a free trial, click here.

An interesting footnote to this story: Around 10 years ago, founding members of the big xyt team were involved in a project with a Formula 1 team where they successfully demonstrated how analysis could be performed at the trackside, without having to be sent from the car, to the pit lane, all the way to the factory for analysis, and then back again. The fractions of a second gained provided the F1 team with a small but unique advantage over its rivals. Latency arbitrage in another guise!