As the UK gears up for another general election on July 4th, it’s worth taking a look at what this might mean for liquidity based on the patterns observed following the 2019 election.

While Boris Johnson’s victory on December 12th was widely anticipated, the substantial size of his majority surprised many and significantly altered the liquidity landscape the following day.

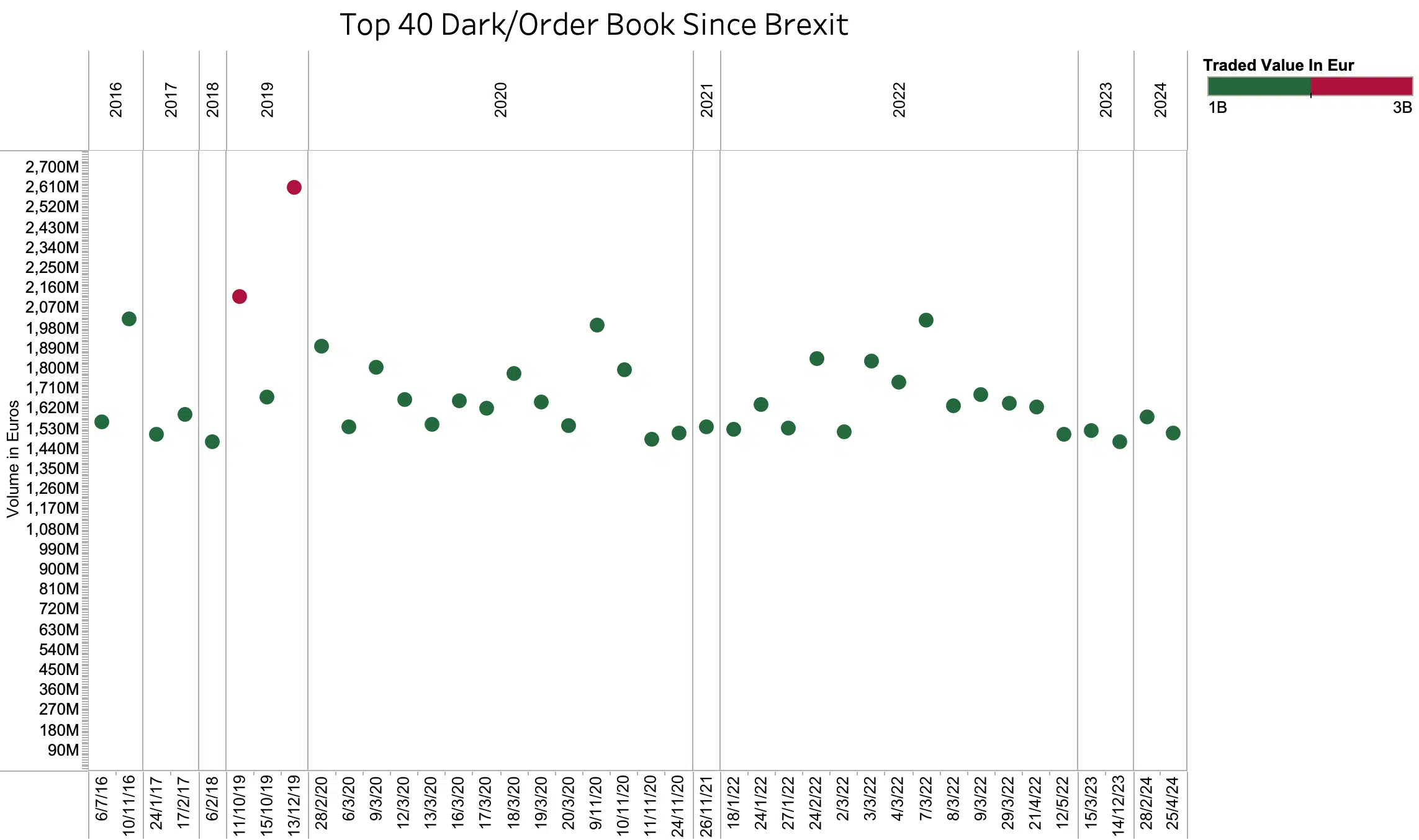

On December 13th 2019, trading on dark order books in the UK100 and UK250 jumped to EUR 2.6bn, a huge increase from the average daily volume (ADV) of EUR 758m for 2019. This was, and still is, the largest day of dark trading since the historic Brexit vote.

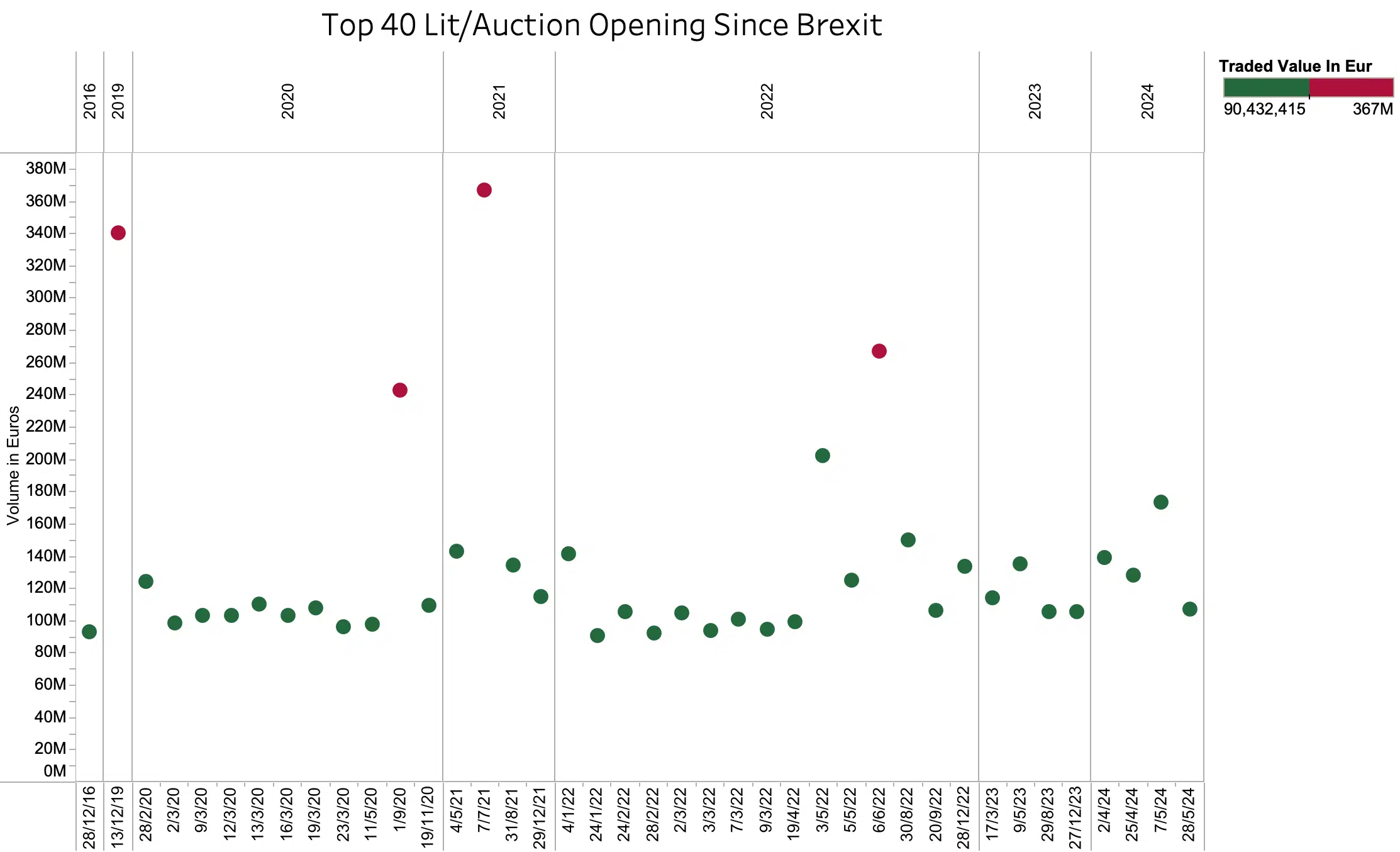

The opening auction on December 13th also stood out, recording the second largest volume since Brexit at EUR 339m, nearly 13 times the ADV for opening auctions in 2019. Many investors targeted the UK250, which closed 3.4% higher with a total daily volume of 2.68bn. Of this, 1.69% occurred during the opening auction, a significant increase from the yearly average of 0.25% in the UK250.

Periodic auctions also saw a notable uptick, with volumes reaching 778m on December 13th, compared to the 2019 ADV of EUR 206m, marking the fifth biggest day in this trade category since Brexit.

Lit order book volumes increased in line with its 2019 market share, however there was significantly less flow in the closing auction. Only 15.6% of total volume went through the closing auction on the 13th, well below the monthly average of 23.85%, marking the only major trade category not to see an increase in total volume.

Despite the recent growth in closing volumes as a percentage of market share, might investors once again aim to get their volumes done earlier in the day, if the liquidity is there…?

This year, the liquidity landscape’s reaction will depend on the election outcome and the margin of victory. If the result instils confidence in investors, we might see similar surges in dark trading volumes as well as the opening and periodic auctions. Conversely, a lacklustre result akin to Theresa May’s 2017 hung parliament might prompt a more muted market response, with lower trading volumes and less pronounced shifts in liquidity.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API. This post is looking at the impact on selected trade categories and their market share. With the Liquidity Cockpit clients can analyse hundreds of metrics in a convenient and systematic way. If you are interested in learning more about market microstructure, historical volumes and market quality:

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.