Those of you who keep a close eye on market microstructure will be well aware of a dress rehearsal for “non equivalence” in July 2018 when all Swiss trading was banned on competing venues. Overnight the primary SIX exchange was responsible for 98.8% of turnover in the top 20 Swiss equities (two dual listed stocks ABB Ltd and Lafarge Holcim Ltd were exceptions). Before this the primary had around 70% of market share. This was fairly typical for the primary/MTF split for Lit and Dark volumes as competition evolved post-MiFID regulatory changes.

Last week the authorities opened the door for that eighteen month block on competition to be removed again, but only for UK-based MTFs. Ironically, most of these have just invested heavily in establishing European sister hubs to be allowed to compete with continental European primary exchanges post Brexit.

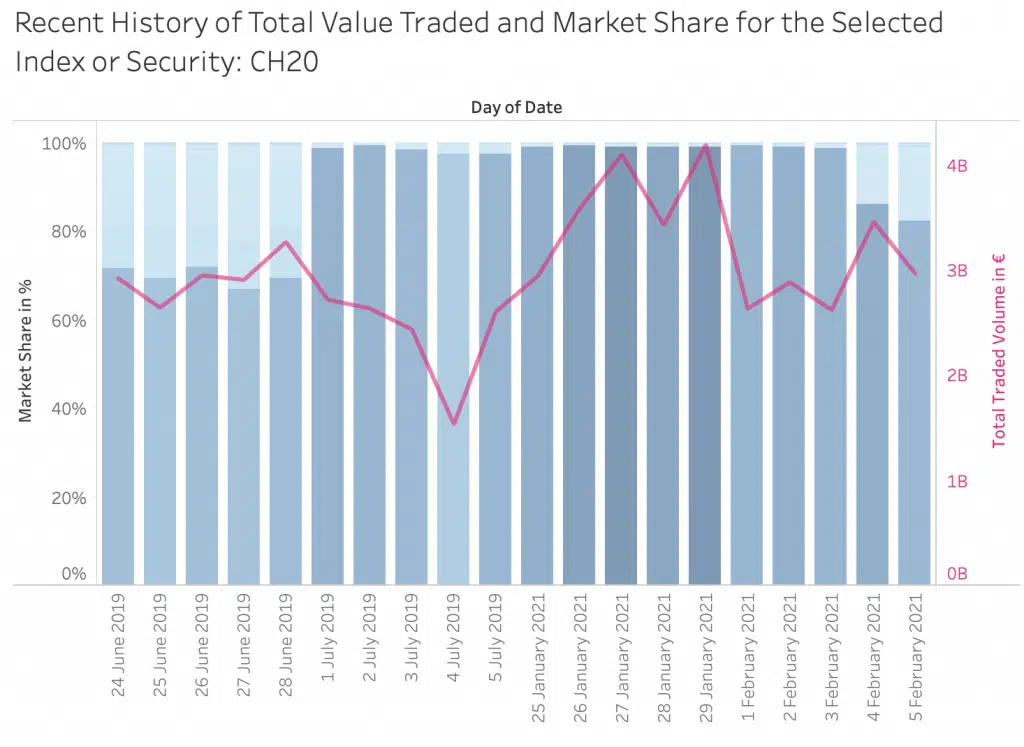

The chart shows a compressed version of the story over time.

On Thursday, with the all-clear in place, we saw the first evidence of the Swiss liquidity fragmenting again with around 12% of activity in Swiss blue chips reported by UK MTFs. By Friday this was 14% and we will continue to monitor the market rebalancing.

Whilst turnover is the key measure of liquidity, it does not tell the whole story about market quality. Any professional trader looking to participate in fragmented markets must look at comparative spreads, book depth and presence in order to find the best liquidity at optimal price points.

At big xyt we have the tools to do exactly that and we will comment further as the landscape evolves. Please contact us for more a more detailed view.

*****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.