Last year we observed how mid spread executions at the time of an RFQ execution did not tell the whole story about best price during a longer ‘execution window’. Using the xyt Lab we applied the same logic to other mechanisms to establish if there are other questions traders should be asking when performing execution analysis to optimise their transaction costs.*

The results were surprising and demonstrate how spread improvement is a benefit on all lit books, but is less prevalent and often absent on other mechanisms.

Spread Improvement – The Methodology

Spread improvement is a trade-level metric, i.e. it analyses trades from a given venue and mechanism. For each trade we measure the EBBO spread before and after the execution time at predefined offsets (from -5 to +5 minutes with µs precision around the trade).

To normalise results, each spread value is divided by a reference spread; the time-weighted EBBO spread observed on that trading day, e.g. a value of 60% means that the prevailing spread at execution time was 40% tighter than the time-weighted average of the quoted EBBO that day.

Not surprisingly EBBO spreads tighten prior to a lit trade (by nearly 50%).

Other trading mechanisms show different patterns: spreads sometimes widen before the trade executes.

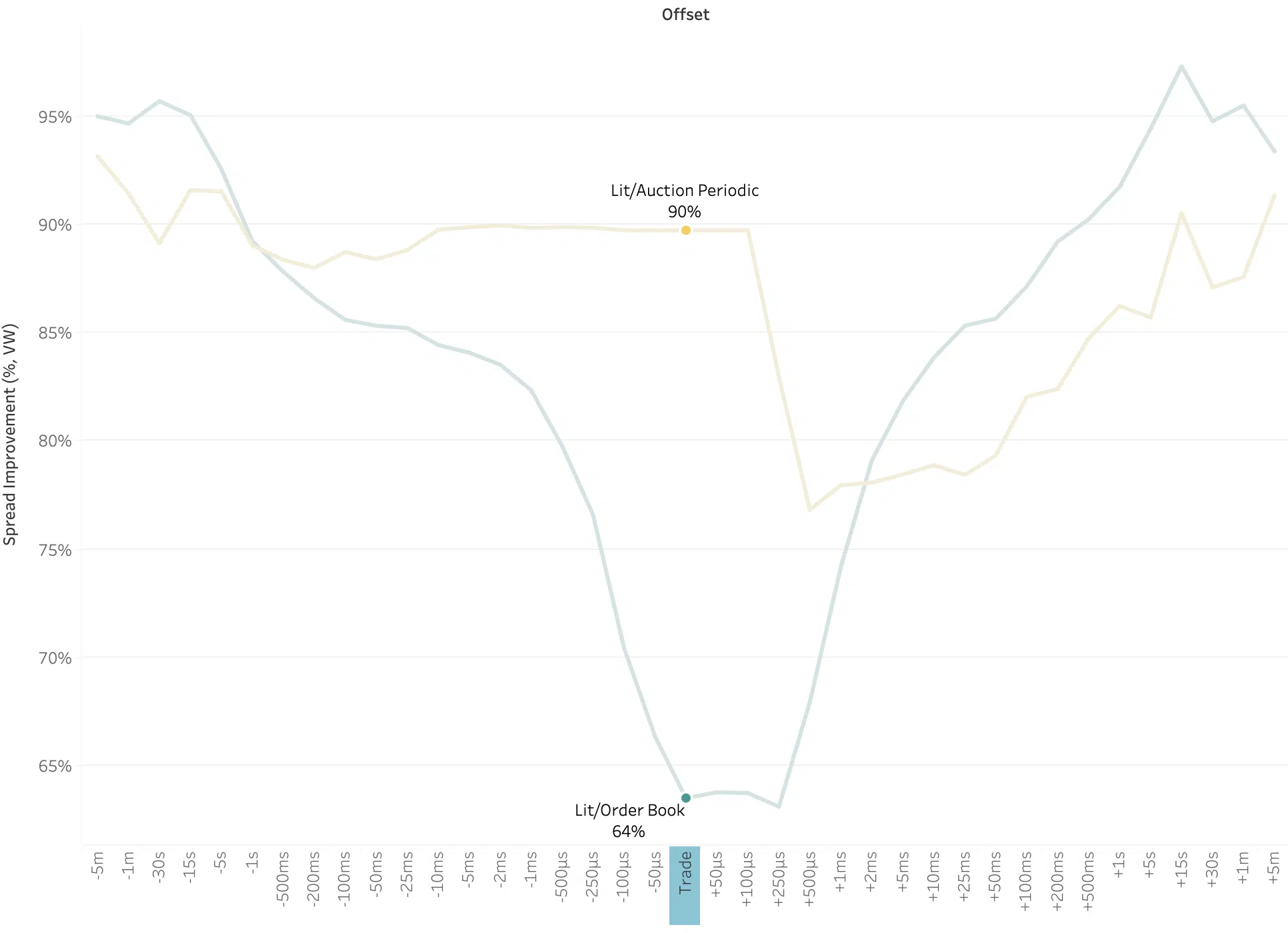

As this depends on the selected mechanism, the venue and the security, we illustrate the observation in one example in Chart 1 (a top 5 UK stock):

- For lit trades the EBBO spreads tightened by 36% to 64% before the trade.

- For periodic auctions, EBBO spreads tightened by only 10% to 90% and even widened closer to the execution time. This widening accelerated around 100ms before the trade.

In other words: lit trades on that day traded at approximately 65% tighter EBBO spreads than trades executed via periodic auctions.

This is very close to the advantage of mid-price execution.

If something changes on an order book is a trade expected on that book, or actually on another mechanism on a parallel venue?

Is there arbitrage between venues triggered by an expected execution event?

Chart 1 – Spread Improvement for Lit Trades and Periodics

What market inputs do these participants use to be confident a trade could be about to occur, and what action do they perform on the order book as a result?

Spread improvement is consistent across indices, mechanisms, venues and time (a lower % value is better as it reflects a tighter spread).

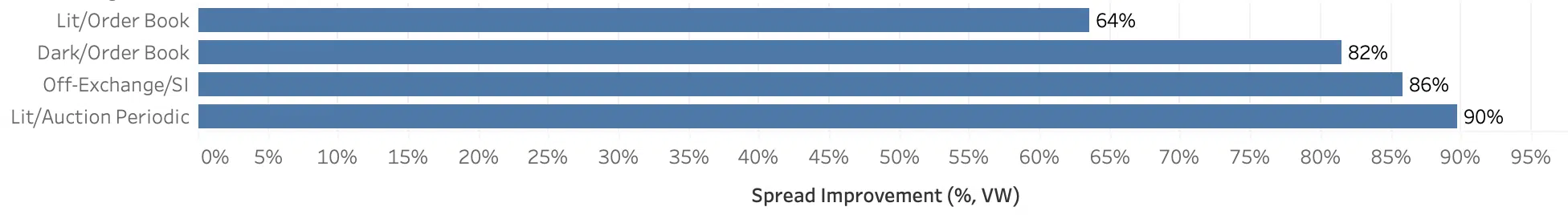

Chart 2 shows aggregated spread improvement by mechanism across all trades for the same stock as in Chart 1.

- EBBO spreads tighten by 36% prior to the execution of a CLOB trade (across lit venues).

- EBBO spreads tighten by 14% prior to the execution of an SI trade.

- EBBO spreads tighten by 10% prior to the execution of a periodic auction trade (across periodic auction venues).

Chart 2 – Spread Improvement by Mechanism for Selected UK Stock

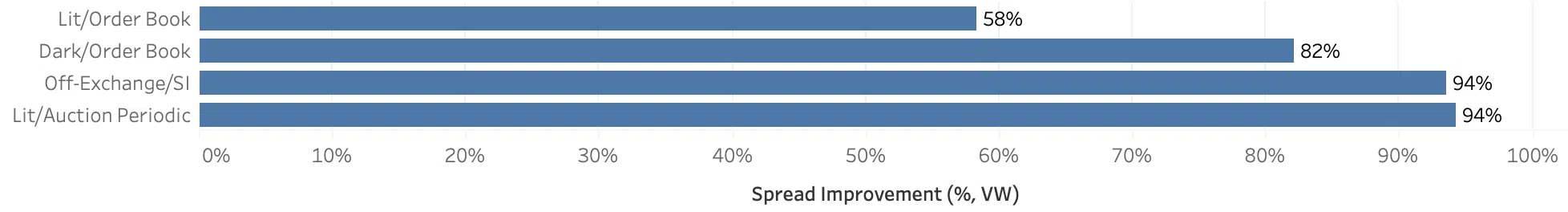

Chart 3 – Spread Improvement by Mechanism for all DE40 Constituents

Are certain market participants responsible for these spread changes? If so, are they occurring systematically?

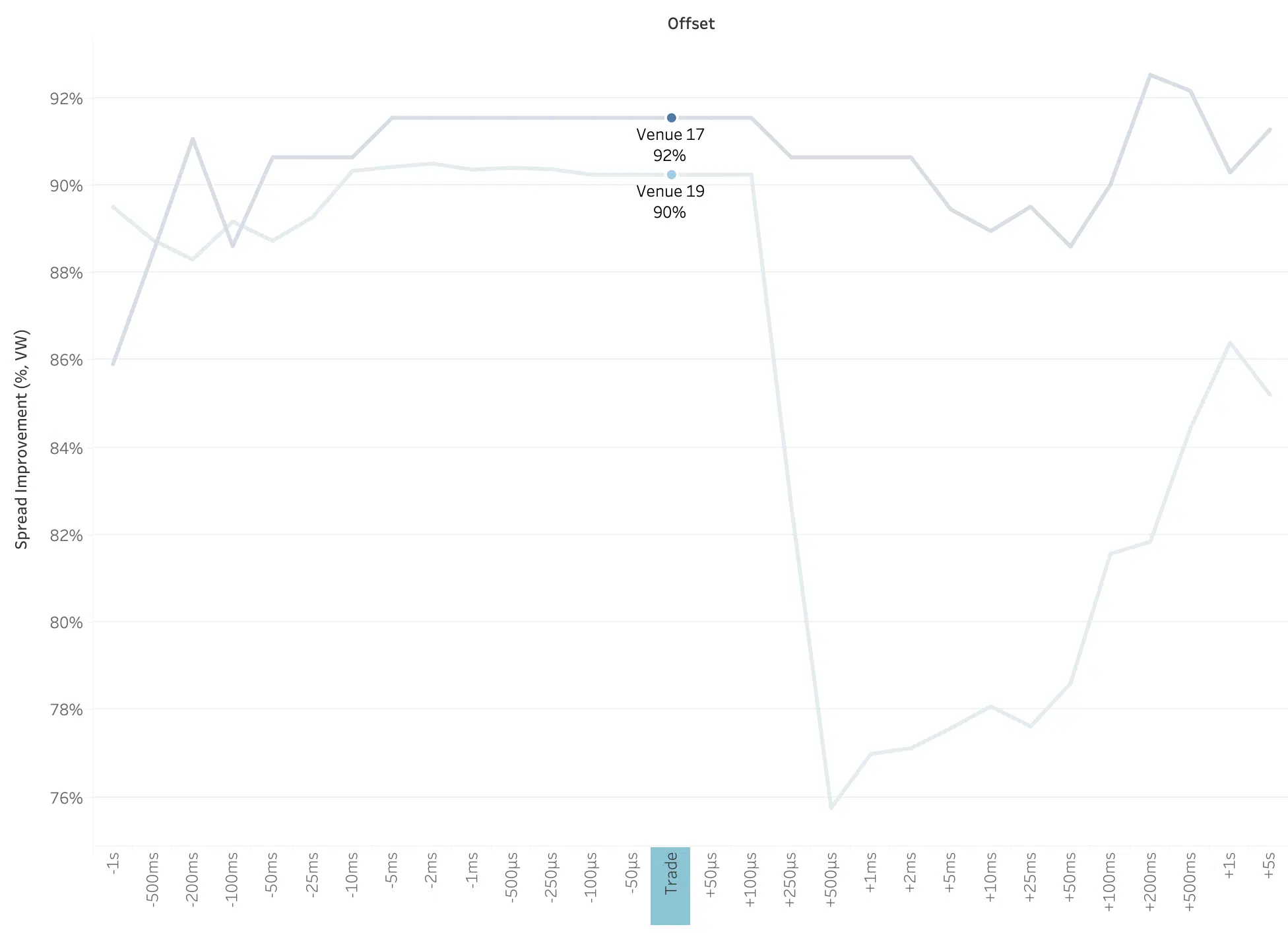

Chart 4 – Widening of Spreads at -100ms for FBA Trades

This widening of spreads at -100ms can be observed across different periodic auction venues:

Does the provision of liquidity come at a cost and are we merely observing that cost as some sort of acceptable ‘Spread Premium’, which varies according to the mechanism/venue in question?

Appendix

The duration of the ‘trade window’ varies depending on the mechanism, but is fairly consistent per mechanism, particularly when considering how they operate technically.

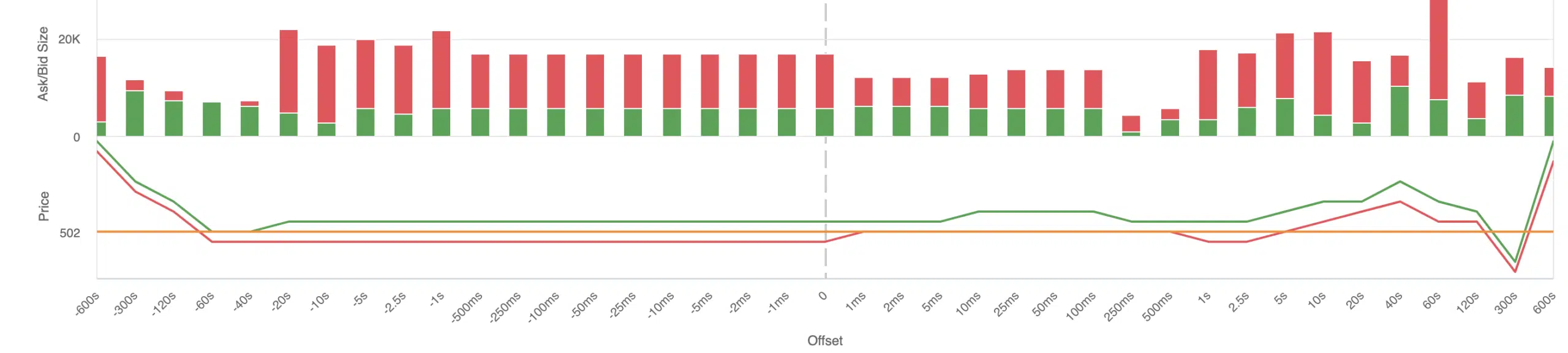

EBBO spreads sometimes widen for periodic auctions, and in some cases show price reversion as well. The chart below shows one trade with its price and spread movements.

Other mechanisms such as dark pools provide further examples. Despite a perfect mid-price trade at execution time (see chart below), the buyer may have paid the highest price in a very short window (from -5ms to +1ms).

***

The content for this research was created using xyt Lab and can be incorporated into client execution analysis within our Open TCA solution. To find out more, please get in touch.