There was always bound to be some post Brexit ‘fallout’. Unsurprisingly there was plenty of market commentary last week, however we wanted to wait for the dust to settle before we made any of our own observations.

You will find it reassuring to know that your suspicions are correct. We can confirm that turnover on Multilateral Trading Facilities (MTFs) shifted to EU venues as investors in EU stocks followed the expected migratory route. If a European alternative existed, the flow migrated there, away from the UK entity (*see the outlier in the footnote below).

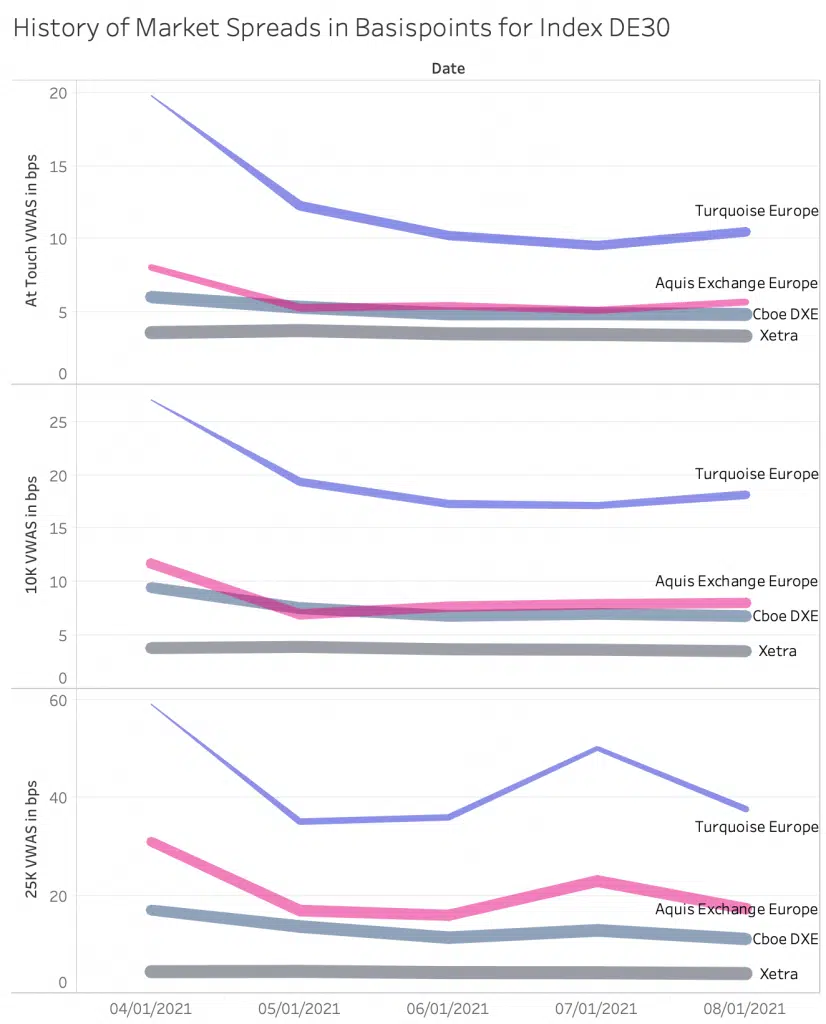

At big xyt we don’t just look at turnover, as this alone may not give the whole picture. Turnover, spreads and depth have all been seen to be interdependent and therefore merit consideration.

Spreads across all venues started wider than usual. This would be expected as liquidity providers gently dipped their toes in the water rather than jumping in at the deep end. As this also happened in the UK we can assume this is indicative of New Year caution as much as tentative exposure to new venues.

The chart below for German blue chips is typical across our European observations comparing at touch and effective spreads during the first week of the year.

Just as we reported in our EU Equities Market Microstructure Survey 2020, the underlying market landscape in terms of trading mechanisms has remained remarkably stable. Dark volumes and auctions remained consistent with 2020 market share. Primary exchanges increased their share in lit trading, however there is evidence in terms of turnover that this was reverting towards the end of the week as spreads settled to more competitive levels. We see this view continues to be fairly stable at the start of this week.

*Footnote: A fascinating exception exists in the form of one MTF which decided to keep its UK status and not open a European alternative. Interestingly, they continue to report trade volumes in European stocks, not necessarily in the same quantity, but still notable and noteworthy. This reminds us that the regulatory requirements apply to the country of domicile of the investor, rather than the broker or venue. There are many end participants who are not affected by the new year regulatory resolutions and can trade where they want.

This story may have some legs in it yet as the community debates if the migration of so much “European” stock trading to “Europe” is seen as a freedom, or as a restriction.

Liquidity Cockpit allows users to view all the above metrics and more for the new European MTF venues providing the trading community with a unique consolidated view of the European Equity landscape on T+1. Please let us know if you would like to know more or to arrange a demo.

*****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.