As a trailer for our forthcoming Q2 2021 survey of European equity market microstructure, we thought you might like a sneak peek at what’s been happening to fragmentation.

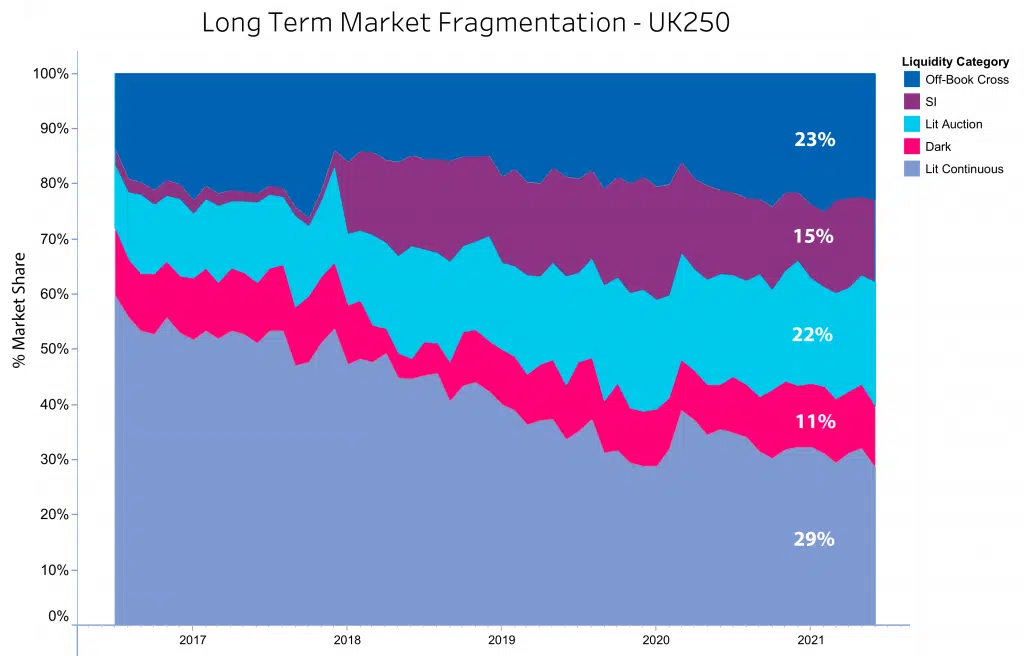

Following Brexit and the divergence of dark trading rules, we have been monitoring the trend in the UK. The graph below shows the UK250 index where on-order book ‘lit continuous’ trading has reached a 5-year low in terms of the daily market share traded in June at just 28.5%, while auction market share is a whisker under the previous record high in December at 22.7%. Meanwhile, dark trading has risen to over 12% from 9% prior to October 2020.

This picture is not atypical of the European landscape although it is more pronounced in the UK. The long term trend of the shift of volume into closing auctions is well known, (the May 29th MSCI index rebalance produced the second largest closing auction on record after the Russell rebalance in March), taking more market share away from lit continuous trading. With lit continuous share now at around 28.5% and auction share at 22%, we might expect average daily auction volumes to pass the intraday order book around February next year.

We will be covering this and much more in our forthcoming European Market Microstructure survey, so keep an eye out for it.