Friday saw a significant increase in stock market activity as a result of the MSCI rebalance. A quarterly event when certain stocks are promoted or relegated between index groups.

In order to simplify the pricing “event” for any institutional investors whose portfolios passively track these indices, a benchmark price is used (the official closing price on the primary national exchange) and has become a self fuelling magnet for liquidity.

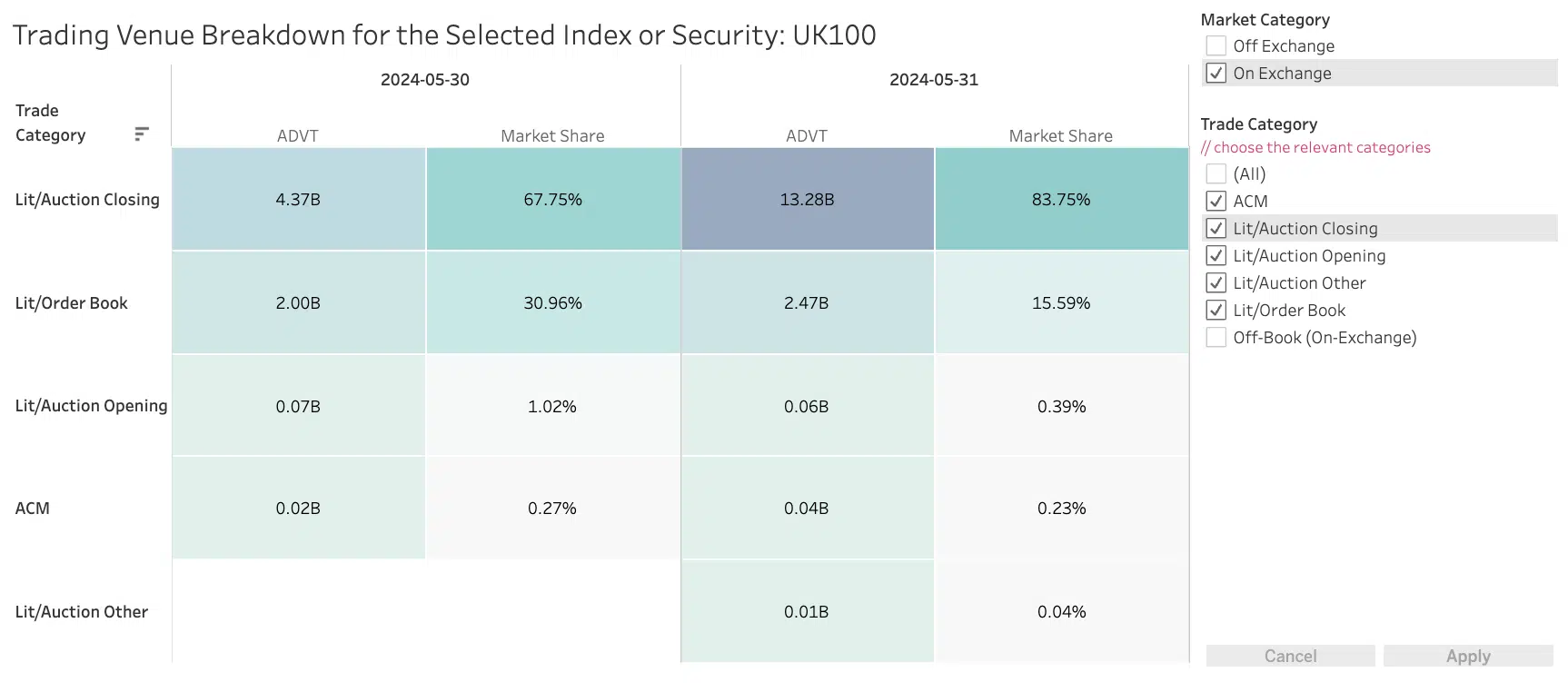

When looking at the latest example we may have to start asking questions about what this trend is doing to price discovery during the day. On Friday across a basket of the top 100 UK stocks trading on the LSE, 15.5% of activity was on the lit order book, 83.75% was in the closing auction, and even in the next 250 largest UK stocks the ratio was similar; 16.6% on the lit order book, 83% in the auction.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.