by Mark Montgomery, big xyt

Day 12 – Rolls-Royce at a discount? Never!

It seems like a good time to leave the days of isolation behind us but fear not, our observations will continue this week.

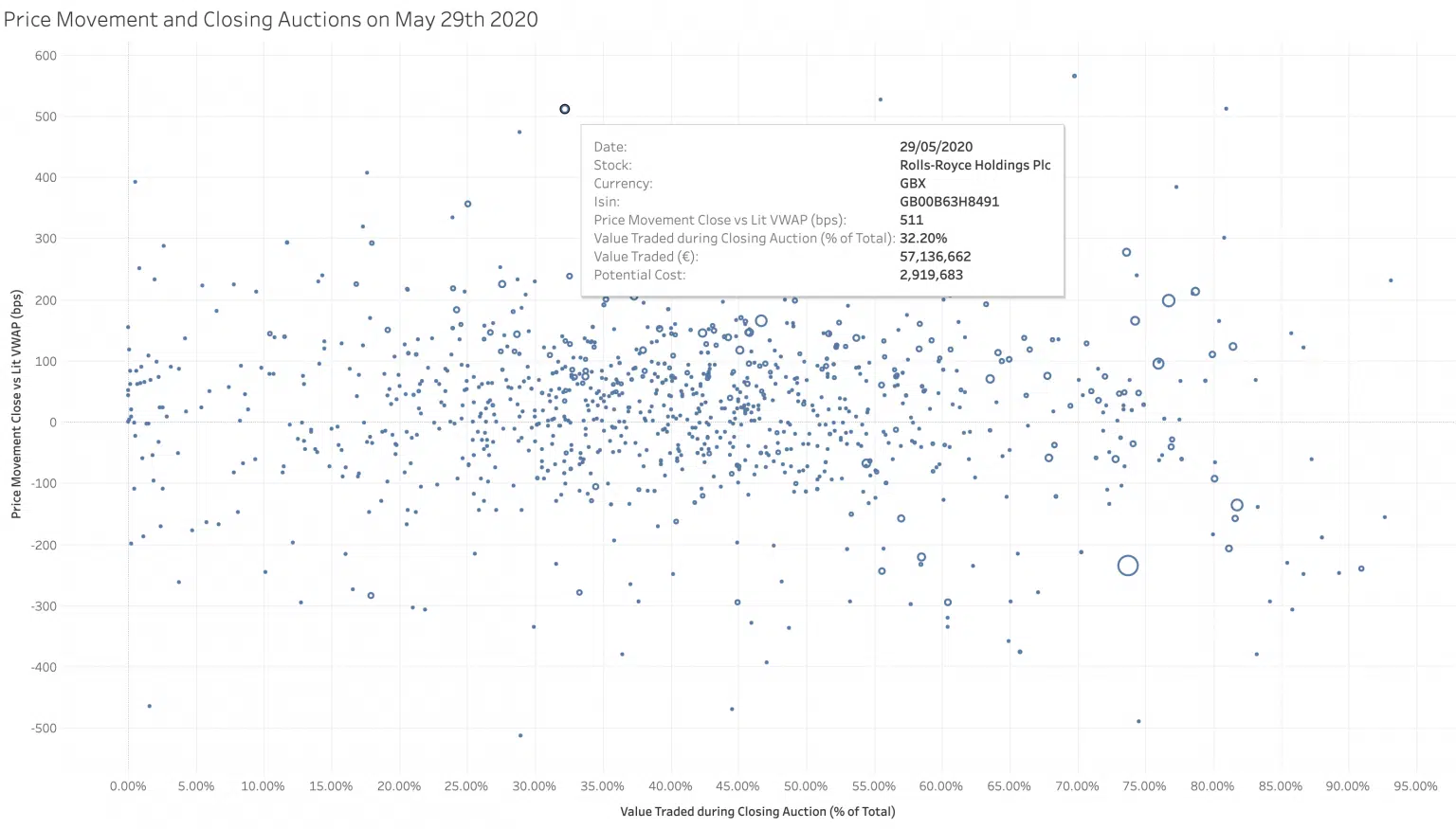

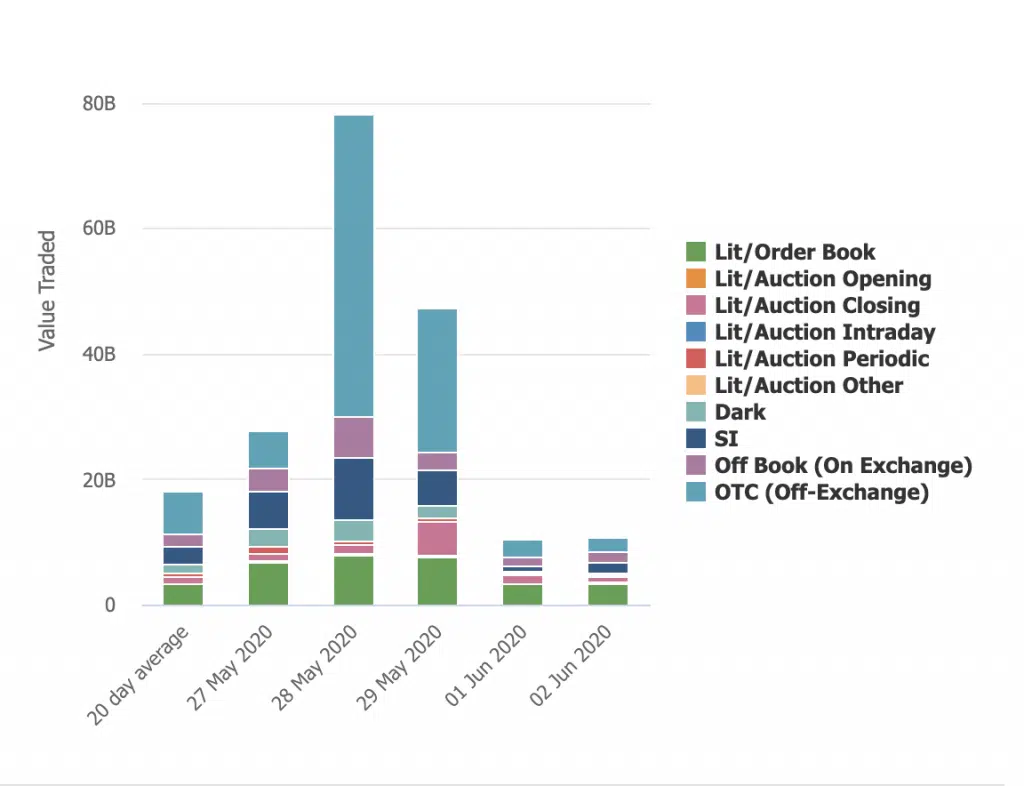

Following on from our previous post, we promised to take a closer look at one of the many outliers from the exceptional closing volumes on 29th May. Rolls Royce struck us as an interesting stand-out (main image above). There was heavy trading ( 32% of the daily turnover) at the close, although as far as we are aware, it was not an index addition or deletion on the day, The value traded was five times larger than the twenty day average closing volume (See chart below).

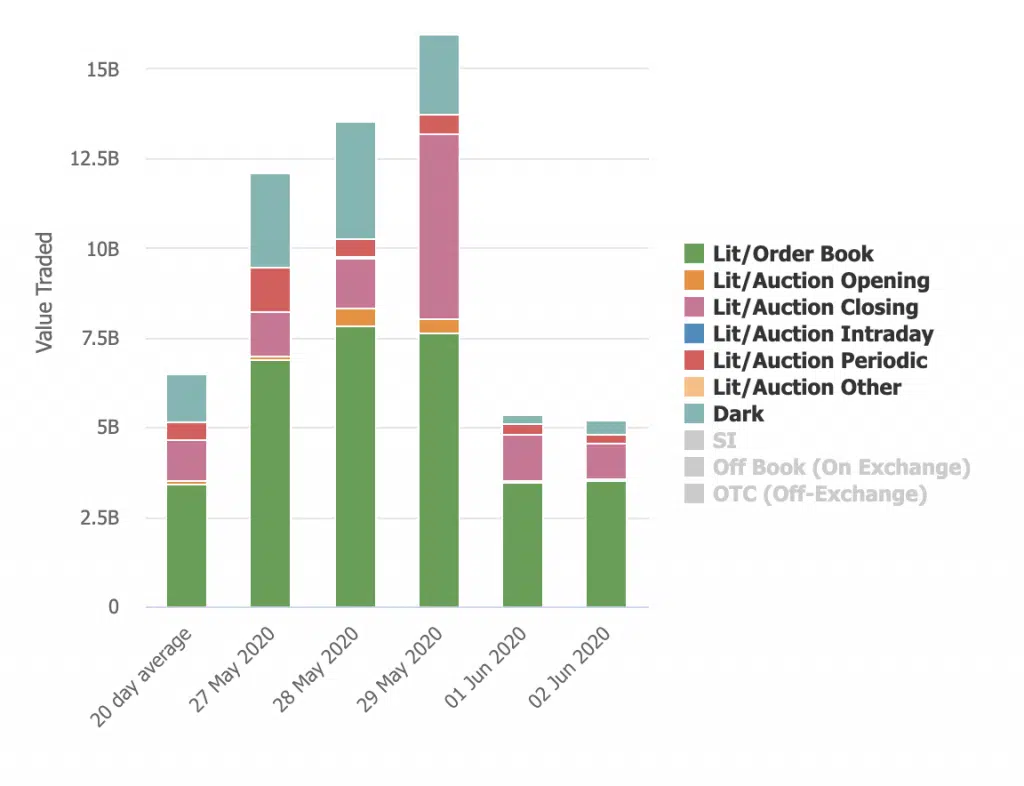

This chart additionally shows how the turnover ( on exchange, lit & dark ) grew over the previous days with a peak particularly in the closing auction volume on the 29th before dropping back to more normal levels.

A further observation came to light ( see chart above) as we drilled down deeper still, the OTC volume on the day & more curiously, the day before, exceeds every other category. This extra trading volume almost certainly was linked to the Standard & Poor’s re rating for the stock. We plan to focus on more granular studies of off book, OTC & SI prints in future posts.

Finally & perhaps most significantly, our original scatterplot allowed us to identify the 511bps price difference between the lit volume weighted average price ex auction (VWAP) of 286.215 and the Close itself at the low of the day of 271.60. For those wondering how the stock opened the next day, the opening auction was 278.2. In fact, as we see above, the close on the 29th was the bottom of a 6 day trough. 3 days before & after that event the stock was 20% higher!

The attached screenshots were created with our Liquidity Cockpit API and some new visualisation tools that we have developed to meet client needs. We will be using these and other new applications to continue to provide additional liquidity intelligence in future posts.

At big-xyt we can provide daily time weighted spreads & depth for users and algo developers in 12,000 instruments and all significant venues, as well as many other essential trading metrics. If you are interested in letting us do some of the heavy lifting for your algo infrastructure please get in touch.

If you find these pieces of analysis useful, you will find there is a lot more you can do with our Liquidity Cockpit. Clients using our Execution Analysis/TCA are able to measure execution performance with the demonstrated precision and flexibility.

Do you want to receive future updates directly via email? Use the following form to subscribe.

On our x Days of Isolation

During these unprecedented times we do not underestimate the professional and personal challenges that everyone is facing. There are far more important things to be doing in the community than looking at a screen.

However, data and data analytics is playing a critical part in providing solutions to the current global crisis. Furthermore, the markets remain open and whilst they do, the trading community needs to be well informed in order to understand the changing market landscape. As a result, big xyt is receiving an increasing number of requests for observations of changing trends and behaviours in the equity markets. We are excited to have recently expanded our London team to enrich our content and support for clients seeking greater market insights from an independent source. Whilst many adjust to the new experience of working from home we plan to share some of these thoughts, observations and questions in the coming days & weeks.

As ever we welcome feedback as this can shape further contributions from our team and the Liquidity Cockpit our unique window into European equity market structure and market quality.

We hope you enjoy them.

—

This content has been created using the Liquidity Cockpit API.

About the Liquidity Cockpit

At big-xyt we take great pride in providing solutions to the complex challenges of data analysis. Navigating in fragmented markets remains a challenge for all participants. We recognise that the investing community needs and expects continued innovation as the volume of data and related complexity continues to increase.

Our Liquidity Cockpit is now recognised as an essential independent tool for exchanges, Sell-side and increasingly Buy-side market participants. Data quality is a key component, as is a robust process for normalisation so that like-for-like comparisons and trends over time have relevance. However, our clients most value a choice of flexible delivery methods which can be via interactive dashboard or direct access to underlying data and analysis through CSV, API or other appropriate mechanism.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.