The European ETF market continues to evolve rapidly despite being only 25 years old. At last week’s TradeTech Europe conference in Paris, an industry panel brought together traders, market makers and asset managers to discuss the latest trends and strategies in ETF trading. Here are the key takeaways from this insightful discussion.

The Rise of Algorithmic Trading for ETFs

While trading vs Risk or NAV has been the dominant execution methods for ETFs over the last few years, ‘working’ an order via algorithmic trading is increasingly gaining traction. One participant shared that they recently traded over $400 million in an ETF, with more than 70% executed through the midpoint. This represents a significant shift in the ETF trading landscape.

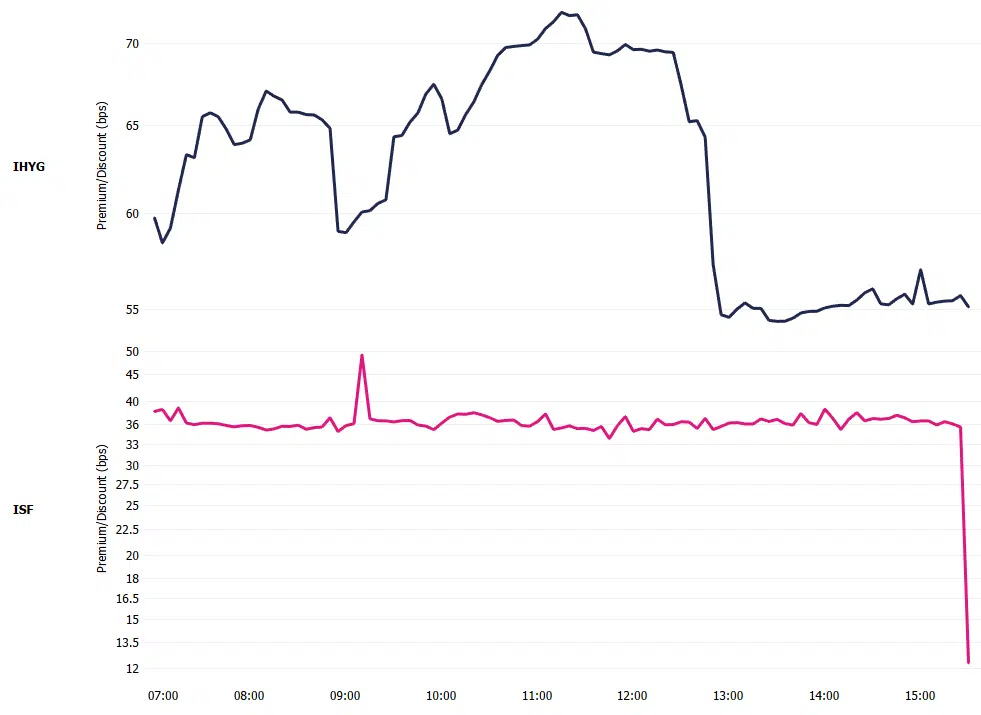

Chart 1: ETF Market Growth Continues, but Over 70% of Volume Remains Off-Exchange

Participants noted that the adoption of algo trading for ETFs faces some challenges:

- The “surprise effect” and unfamiliarity makes traders hesitant to use algos

- Building trust in new execution methods takes time

- Current market conditions make it difficult to convince portfolio managers to adopt new execution approaches

However, the benefits are becoming clear:

- Opportunity to passively provide liquidity and capture spreads

- The ability to work orders over longer periods

- The potential to achieve better execution outcomes for both small and large orders

When to Use Algos

The discussion highlighted that the choice between algos and RFQ isn’t simply about order size. While traditional thinking suggested algos for smaller orders and RFQs for larger tickets, participants now recognise use cases for both across various order sizes. The decision factors include:

- Liquidity conditions – algos are being used successfully in highly liquid ETFs and on quiet days

- Risk appetite – RFQs provides immediate risk transfer, while algos involve taking on market risk

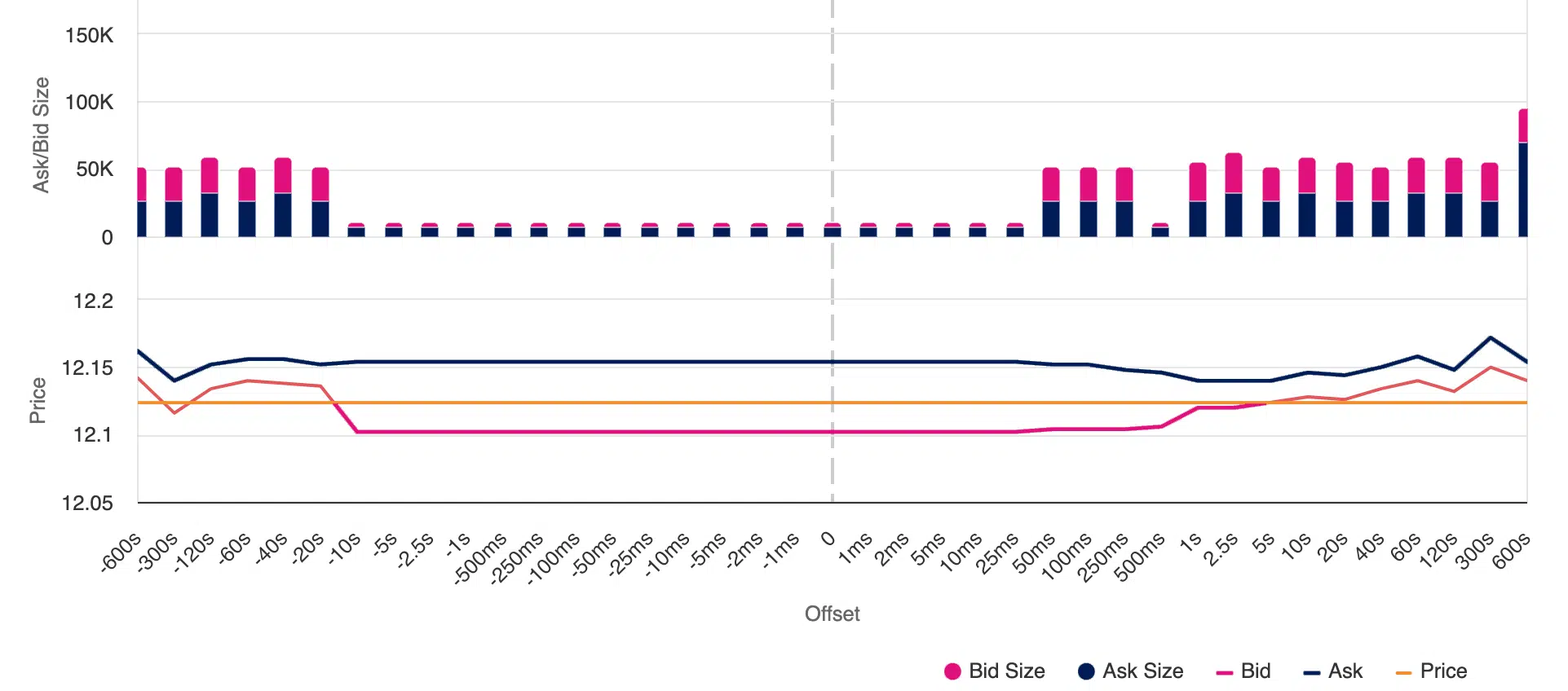

- Premium/discount dynamics – ETF algo features can work orders based on premium/discount metrics (see Chart 2 below)

- Benchmark considerations

Chart 2: Premiums and Discounts Vary by Product Type, Shaping Execution Strategies

As one participant summarised: “It’s not saying use it totally and replace RFQs; RFQs will always be there… but equally, I think if you start trading more, playing with algos… people will start getting more involved.”

Performance Measurement Challenges

Measuring and comparing the performance of RFQs and algo execution presents unique challenges:

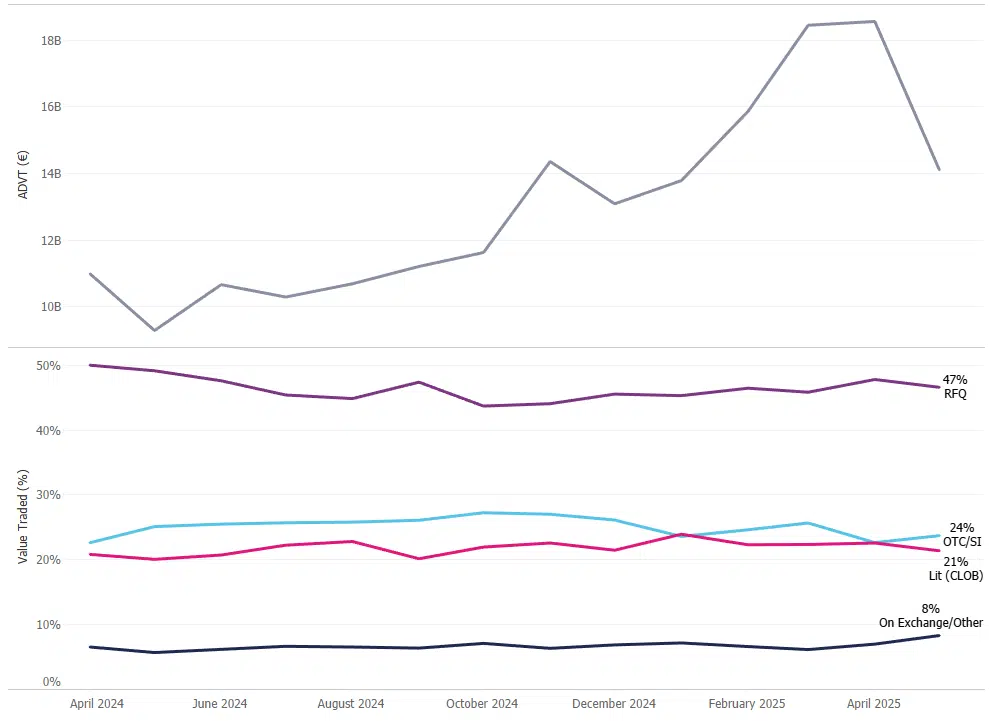

- For RFQs, should measurement start at the point of release or point of execution? (See Chart 3 below.)

- Spread capture is a key metric (trading at midpoint or near touch)

- Arrival price serves as another benchmark

- Direct comparison is difficult because risk transfer pricing reflects different market dynamics

Chart 3: Price Impact and Reversion: Comparing Execution Price to BBO Over Time

Participants expressed interest in developing side-by-side comparisons similar to what exists for single stock versus program trading, but acknowledged the fundamental differences in what each method aims to achieve.

Market-on-Close (MOC) Trading Growth

MOC trading for ETFs is growing at twice the rate of regular ETF trading, an exponential trend. This growth is attributed to:

- Portfolio managers benchmarking to closing levels

- Growing investor confidence in the ability to handle large MOC orders

- Better alignment with fund-of-fund structures that need to synchronise benchmarking

The discussion highlighted GMOC (Guaranteed Market on Close) as a hybrid approach where execution is pegged to the closing auction but may involve:

- Partial internalisation by market makers

- Actual creation/redemption activity with the fund

- Risk pricing at the time of close

The Role of Market Makers

Market makers remain essential to the ETF ecosystem, with participants noting:

- They animate the screens and are incentivised to provide liquidity

- They service both on-screen and RFQ markets

- The exchange-traded nature of ETFs makes it “almost ridiculous that 70% of the activity happens on RFQ/OTC”

Market makers emphasised their commitment to providing liquidity in all mechanisms and venues.

Future Outlook

The European ETF landscape continues to evolve with:

- Increased innovation in trading methodologies

- Reduced fragmentation through initiatives like Euronext’s project to create a single order book across their three regions

- European consolidated tape for equities and ETFs implementation

- European ETFs currently representing approximately 20% of the market, with expectations to reach 40% (like in the US) in the coming years

As one participant concluded; “ETFs, despite being 25 years old now, are still busy in terms of innovation… Everything is supporting the trend we are seeing right now.”

This blog post is based on the panel discussion: “Examining ETF Execution Developments: What are the latest broker ETF algo offerings and how are they optimising trading outcomes” at TradeTech Europe, May 14, 2025.