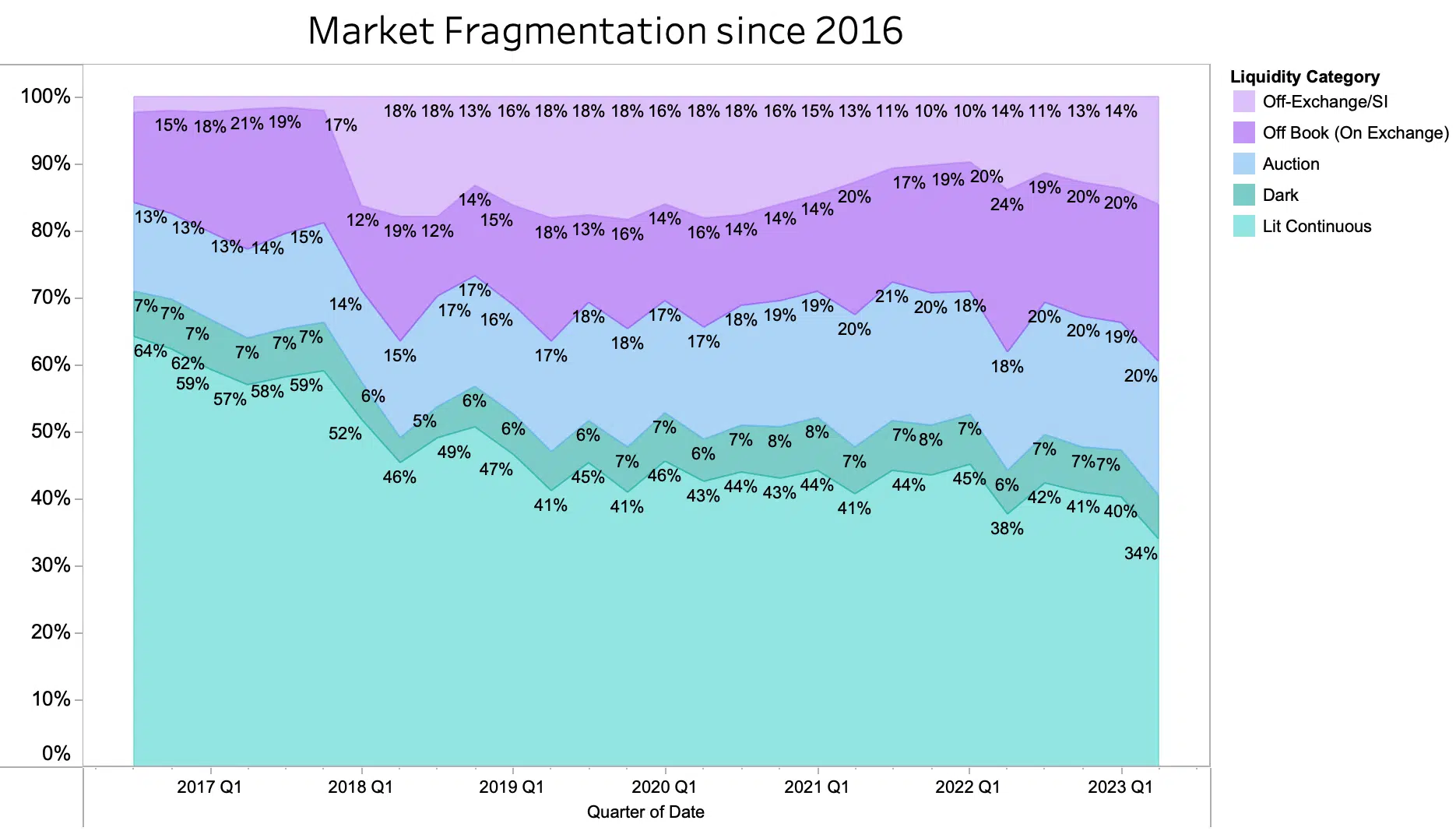

Lit Continuous market share draining away in Q2.

Intra-day trading in the Lit order books for equities has reached a new quarterly record low, as seen in our first graph. While it’s normal to see on-order book trading pushed aside by off-order book trading during the reporting season, Lit Continuous fell to just 34% of the overall market (compared with 38% in Q2 last year and an average of 41% for the last eight quarters). It was the lowest quarter for the Lit order books since 2016 despite relatively buoyant market conditions where trading was 5% above the long term average, and near the top end of the quarterly range.

Lit Continuous trading has decreased by 23% of market share since the same quarter in 2017 – shortly before the initiation of the MiFID2/MiFIR rules. The transfer of liquidity is mostly to off-order book negotiated trades, which rose from 20% to 24% in one quarter (a record high), while trading in the Systematic Internalisers continues to recover from 10% of the market in Q2 2022 to 14% (but still 4% lower than before Covid).

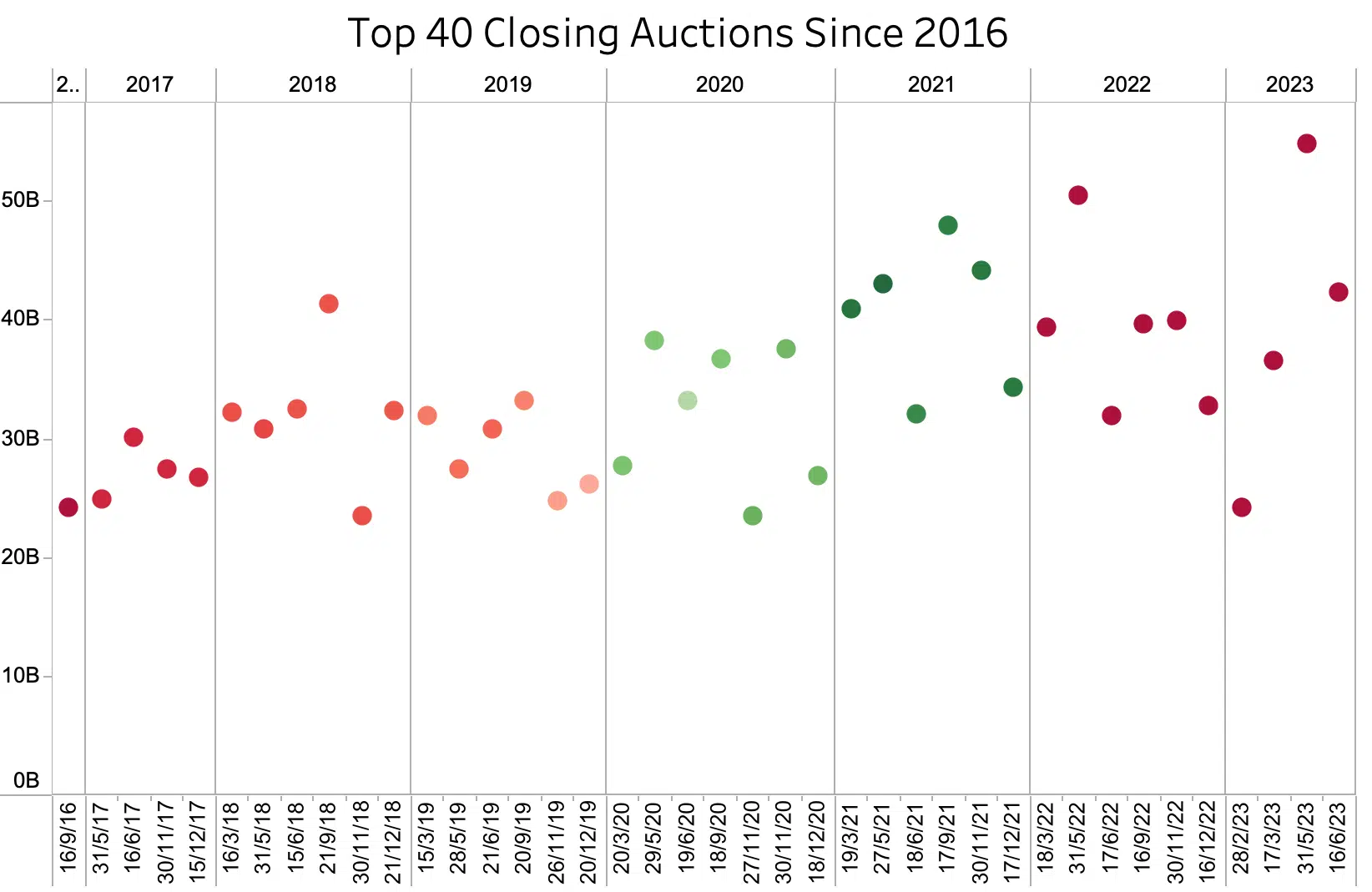

Notably, Auction Trading and Dark Trading maintained a steady 20% and 7% respectively, although the Auctions relied on the biggest ever Close (the index changes on 31st May) at no less than 55 billion traded in the final print – see our second chart.

The pattern is clear – trading is transferring from the intraday Lit order books to off-order book negotiated trades, which must have an impact on the quality of price formation and discovery and the market’s access to liquidity.

The reason is less clear. Should the focus move to providing greater transparency to trades moving through the off order book categories to help the market understand the cause and impact of this phenomenon?

We think so.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.