In a recent article by Waters Technology titled Big xyt Exploring Bid to Provide EU Equities CT, it was reported that currently, EuroCTP is the only confirmed bidder, raising concerns among industry participants about limited competition, potential conflicts of interest, and the impact on data costs.

While the title may imply big xyt’s involvement in the bid process, the real value of any contribution lies in partnering with market participants to deliver an independent solution. This approach would enhance the overall ecosystem, and provide transparency to Europe’s complex trading landscape.

The Need For a Consolidated Tape

A consolidated tape has been a long-standing discussion in European financial markets. The goal is to provide a comprehensive, real-time or near-real-time feed of equities trade data from multiple trading venues, reducing market fragmentation and improving transparency. The US model, with its Securities Information Processors (SIPs), has often been cited as a benchmark, though European markets present a more complex challenge due to the greater number of venues, currencies and regulatory variations.

While MiFID II initially sought to encourage the development of consolidated tape providers (CTPs), challenges around data costs and the lack of mandatory consumption led to limited market-driven solutions. In response, regulators have taken a more proactive approach under the MiFIR Review, mandating ESMA to oversee the selection of a CTP for equities and ETFs.

Who’s In and Who’s Out?

Initially, several entities considered bidding for the equities consolidated tape, but many have since withdrawn. EuroCTP, a consortium of 14 European exchanges (Athens Stock Exchange, Bucharest Stock Exchange, Budapest Stock Exchange, Bulgarian Stock Exchange, Cyprus Stock Exchange, Deutsche Börse, Euronext, Ljubljana Stock Exchange, Luxembourg Stock Exchange, Malta Stock Exchange, Nasdaq Nordic, SIX, Warsaw Stock Exchange, and Vienna Stock Exchange), has emerged as the primary candidate.

Other potential contenders, such as Cboe Europe and Aquis Exchange, formed a joint venture named SimpliCT but have stepped away due to economic reasons. The consultancy Adamantia also explored leading a bid, however, the exclusion of pre-trade data under the ‘Swedish Compromise’ led them to reassess their position and not proceed.

With the resulting absence of any other competitors left in the race, concerns have been raised about the lack of competition in the tender process. A monopoly on the equities tape could lead to higher costs and limited innovation, reinforcing the need for independent providers to remain an option.

Challenges in Creating a European Equities Consolidated Tape

As mentioned earlier, Europe’s fragmented market structure adds layers of complexity. Key challenges include:

- Latency: With trading venues spread from Madrid to Warsaw, achieving low-latency consolidation is difficult.

- Cost of Data: European exchanges derive significant revenue from market data, and concerns remain about how data pricing will be structured under the CT framework.*

- Regulatory Alignment: ESMA’s process differs from the FCA’s approach in the UK, making it unlikely that a single provider could serve both markets efficiently.

- Data Quality: Ensuring that reported trades are timely, accurate, and comparable remains a significant issue.

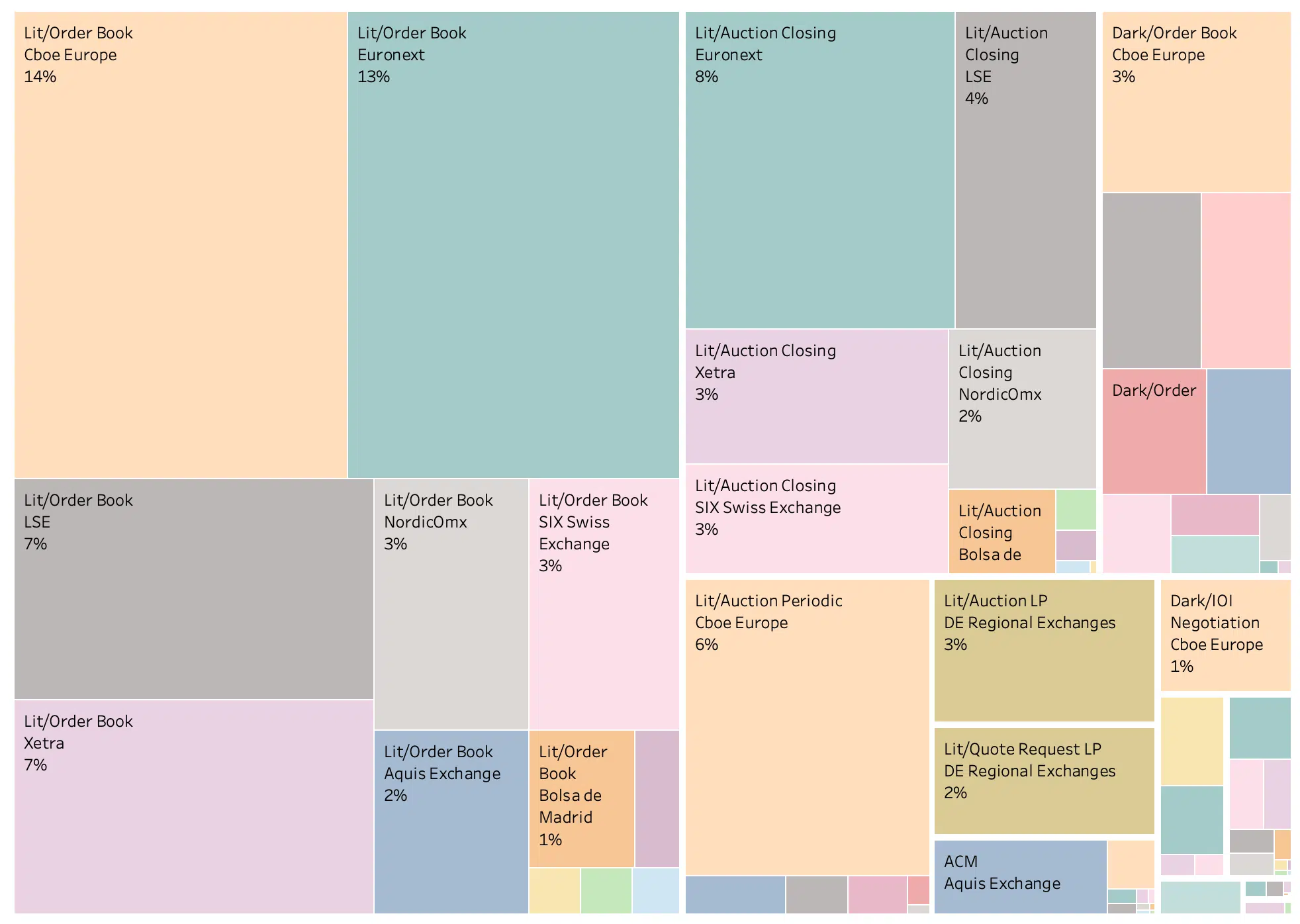

Market Share of On-Book Trading by Mechanism and Venue in 2025

big xyt’s Strengths in Supporting a Regulated Consolidated Tape

Founded in 2014 in response to MiFID II’s fragmentation challenges, big xyt has built a reputation as a leading independent provider of trusted, high-quality European trade data and analytics. big xyt already provides a consolidated view of European markets, where the market is viewed as a whole and trading in the different jurisdictions has been harmonised.

The reason why market participants see big xyt as part of a possible solution:

- Proven Expertise and Data Innovation: big xyt has been consolidating market data for over a decade, making it a trusted resource for trading venues, buy- and sell-side institutions, and regulators. big xyt’s proprietary private cloud platform harmonises diverse trading venue conditions to deliver precise trading volume aggregations and comprehensive market analysis in flexible, customisable reporting formats and delivery mechanisms.

- Real-time Analytics: big xyt has pioneered real-time data processing with its high quality dataset of European trades and EBBO (European Best Bid and Offer) benchmark prices, enabling sub-second data normalisation across venues.

- Pre-trade Data Capabilities: While the current regulatory framework focuses on the consolidation of post-trade data to enhance market transparency, some market participants have advocated for the inclusion of pre-trade data in the CT. big xyt’s capabilities extend beyond post-trade data, with deep expertise in aggregating and normalising fragmented pre-trade order book data that allows for improved price discovery, including venue attribution, execution quality, and market efficiency.

- Scalability: Our technology stack is co-located in major data centres and is designed to handle surges in trading volumes while maintaining high data integrity.

- Neutrality: big xyt remains an independent entity, ensuring there is no conflict of interest in its ability to provide fair and unbiased access to consolidated data.

Industry Sentiment and the Path Forward

The industry remains divided on key aspects of the consolidated tape; regardless of how the selection process unfolds, it is crucial to ensure that competition remains viable. big xyt’s role is to contribute as an independent and supportive partner, should it be required, to ensure the European market meets its need to improve transparency.

* Concerns about data pricing under the consolidated tape (CT) framework are significant among market participants. European exchanges, such as Deutsche Börse, Euronext, and the London Stock Exchange Group (LSEG), have increasingly relied on data sales to offset declining equity trading volumes. Since 2007, five major exchanges have collectively earned at least £5.7 billion from EU equity market data. Prices for market data have surged significantly, with some data types increasing by as much as 97 times between 2017 and 2024.

These escalating costs have raised concerns that the CT, intended to enhance transparency and accessibility, might instead perpetuate high data expenses. Market participants worry that without regulatory intervention, the CT could become another revenue stream for exchanges, potentially hindering innovation and maintaining elevated trading costs. fnlondon.com

Nikki Beattie’s (Market Structure Partners) seemingly controversial recently published paper ‘There is No Market in Market Data’ has raised awareness of the revenues generated by exchanges being disproportionately larger than their fees generated through operating a trading venue.