New collaboration with Steve Grob brings additional market structure expertise to the team

London, Frankfurt, 3rd October 2019 – big xyt, the independent provider of market data analytics, today launched XYT View, a specialist aggregated view of fragmented market information that participants need to ensure that they are achieving the best possible outcomes for themselves and their clients.

The company is also pleased to announce that Steve Grob, CEO at Vision 57 and “long time” market commentator will be working with the Strategy team to provide market consultancy and additional thought leadership.

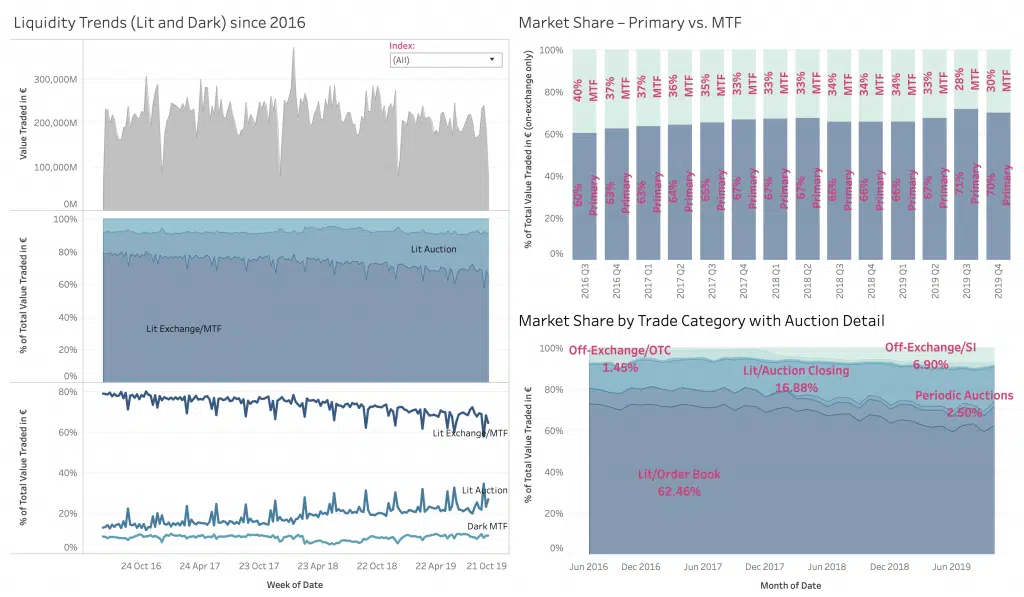

XYT View provides a meaningful range of market overview metrics and has been developed to fill the information gap caused by the withdrawal of previous alternatives. Delivered via interactive dashboards, users can observe changes in displayed liquidity, periodic auctions, opening and closing auctions across the entire equity and ETF trading landscape in Europe.

Visible metrics include value traded, market share, spreads, effective spreads and price movement for exchanges, MTFs, dark pools and Systematic Internalisers.

Steve Grob said “Over the past few years, liquidity execution has become even more complicated, and the pressure to deliver on outcomes due to regulation and cost base management has moved from being something of academic interest to a crucial part of the business information process for all participants.” He added, “I have always been impressed with the technology behind how big xyt collates, normalises and presents data to provide the information the market requires; and, the highly intuitive front-end enables users to personalise their own understanding of European liquidity. I am really looking forward to working with the team to bring their analytics solutions to an ever widening audience.”

Mark Montgomery, Head of Strategy and Business Development at big xyt, said “big xyt has become the de-facto reference for firms requiring independent validation of market liquidity and trends.” Adding, “We are delighted to add Steve’s expertise to our team as we respond to market demand to further expand our analytics solutions. As a well-known industry expert, he will bring additional perspective to the data we have been collecting and analysing for some time for a range of different audiences. We look forward to extending XYT View and its reach into additional markets and regions”

XYT View is a web-based tool that allows the trading community to analyse more than 3 billion messages per day, timestamped with nanosecond precision, to get an immediate feel for the complete trading pattern of any European stock or index over any time period.

The introduction of XYT View brings an additional and much-needed layer of overview transparency for the market. This complements the detailed market analytics big xyt provide to a wide range of firms including exchanges, buy sides and sell sides to validate their trading performance for themselves and their clients to make sense of fragmentation and to make better decisions. Researchers, analysts and media also use big xyt as an independent source of market structure reference information.

*****

About big xyt

big xyt provides independent smart data and analytics solutions to the global trading and investment community, enabling firms to process and normalise large data sets on demand and in real time, in order to comply with regulatory requirements and reduce the complexity of their operations.

The seamless and highly scalable integration of big xyt data aggregation and consolidation capabilities allows buy-side and sell-side firms to transform into a data-driven business while the innovative analytics capabilities enable them to gain actionable insights, discover alpha and maintain a competitive advantage.

Connecting quickly and easily to our cloud-based platform via APIs, trading firms, ISVs and trading venues can use their own business logic and data sets on our platform to leverage analytics for their business, including liquidity measures such as market share or depth of order book, as well as analytics around market impact. New logic can be incorporated in as little as 24 hours.

big xyt has created an ecosystem for tick data analytics covering more than 120 trading venues globally. Its technology normalizes trade conditions of all venues allowing consistent aggregations of trading volumes. big xyt’s analytics solutions are relevant for a broad range of use cases including strategy development, back testing and regulatory changes like MiFID II. The platform offers a convenient and interactive user interface that allows users to discover relevant information quickly. Delivered as a web service, the big xyt solution requires no technical integration.