Secures Bats as xyt hub partner to provide tick data to end-clients for algo backtesting and analytics

London, 14 September 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, today announced the launch of big xyt hub to enable the global trading community to integrate tick data and analytics in a more convenient and cost-effective way, via a single API. The xyt hub allows trading firms to consume, analyse and visualise all the data they require through cloud-based technologies, featuring Data-as-a-Service and Analytics-as-a-Service functionalities.

Advances in algo development, testing and optimisation, transaction cost analysis (TCA) and regulatory reporting are increasing the demand for robust, independent data and analytics. With the big xyt hub, trading firms and exchanges can immediately access tick data and analytics, without costly investment into in-house data infrastructure and storage, technology capable of managing tick data with nanosecond precision and market-by-order granularity, or indeed additional staff.

The xyt hub Data-as-a-Service functionality allows users to access and visualise raw exchange data, normalised data and reference data via a web interface or API, integrating with any downstream system or programming environment. Users can develop algos using any methodology including Artificial Intelligence and deep learning. Furthermore, they can test and optimise algos in order to improve both execution performance and profitability. Designed to process both historical and real-time data, the Data-as-a-Service offering includes an engine for real-time processing to meet specific user needs. Data can be viewed through flexible business functions, like custom snapshots, auction phases or orderbook replay.

The xyt hub Analytics-as-a-Service functionality enables users to leverage shared analytics functions provided by big xyt, including effective spreads and market impact analysis. The customisation service allows trading firms to develop bespoke business requirements, such as back-testing, TCA, derived market data, and regulatory reporting.

Together, the xyt hub Data-as-a-Service and Analytics-as-a-Service enables clients to focus on their core business, avoid operational complexity and reduce total cost of ownership. The xyt hub is the only solution that provides API access to tick data from varied sources via a common interface, full market depth, timestamps with nanosecond precision, access to normalised data and raw data, and a customisation service for analytics.

Alex Dalley, Co-Head of Sales, Bats Europe said: “As a market operator, we welcome the big xyt’s hub as an additional distribution channel for our pan-European market data. The xyt hub makes all our tick data available immediately to existing and future clients for a variety of use cases including algo development and testing.”

Robin Mess, CEO, big xyt commented: “We are excited to launch the big xyt hub today and welcome Bats as our first exchange partner and user. Requirements for algo testing, TCA or regulatory reporting have increased the demand for independent data and analytics and we are delighted that a number of market participants are already successfully using our xyt hub to integrate and analyse tick data. We welcome all collaborations to ensure we continue to improve our products as we expand our customer base.”

More information about the xyt hub can be found here.

Media contacts

Sybille Mueller, Lindsay Clarke Streets Consulting

Email: [email protected]; [email protected]

Tel: 020 7959 2235

About big xyt

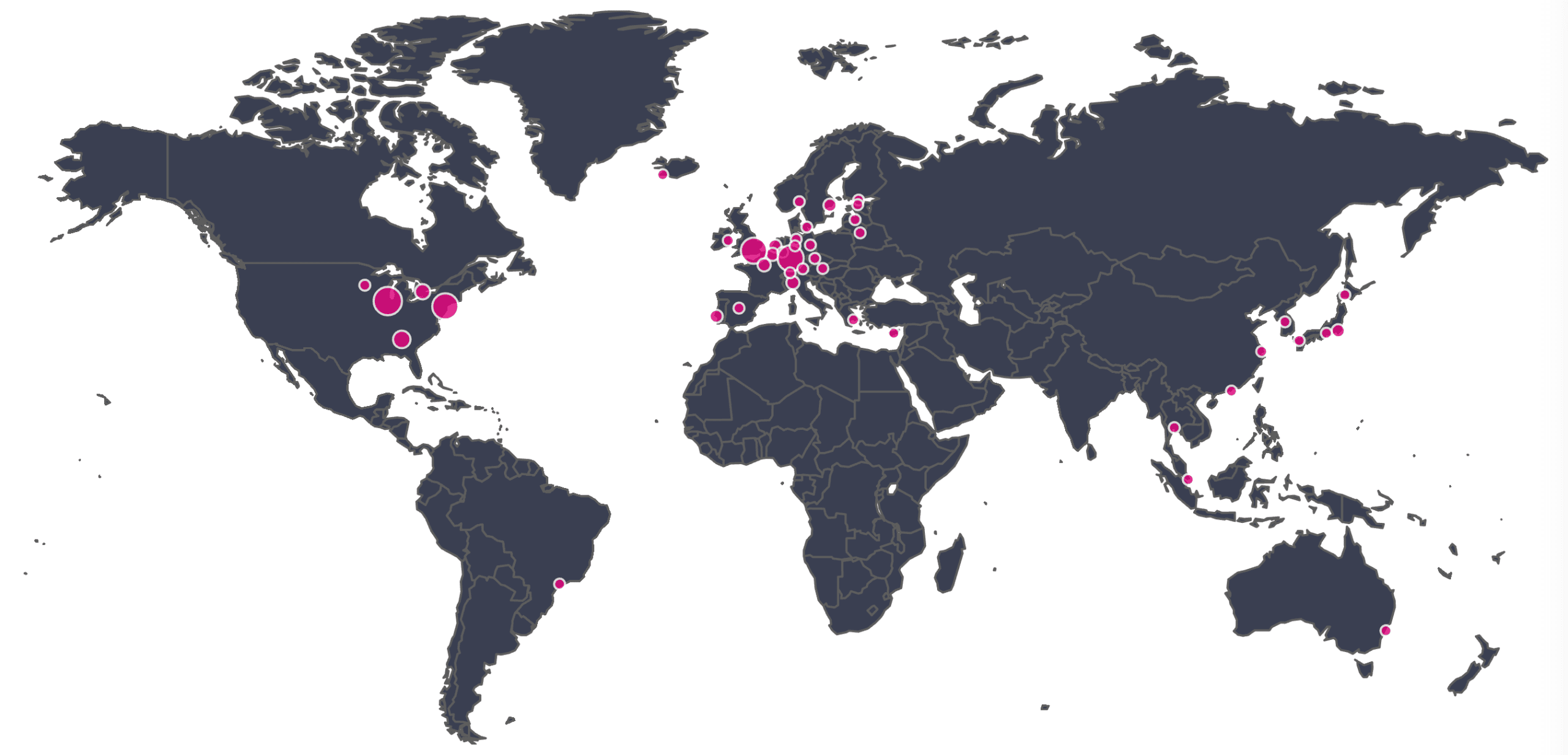

big xyt provides independent smart data and analytics solutions to the global trading and investment community, enabling firms to process and normalise large data sets on demand and in real time, in order to comply with regulatory requirements and reduce the complexity of their operations.

The seamless and highly scalable integration of big xyt data aggregation and consolidation capabilities allows buyside and sellside firms to transform into a data-driven business while the innovative analytics capabilities enable them to gain actionable insights, discover alpha and maintain a competitive advantage.

Connecting quickly and easily to our cloud-based platform via APIs, trading firms, ISVs and trading venues can use their own business logic and data sets on our platform to leverage analytics for their business, including liquidity measures such as market share or depth of order book, as well as analytics around market impact. New logic can be incorporated in as little as 24 hours.

big xyt was founded by a team of experts combining more than five decades of experience in risk management, regulatory and financial reporting, analytics solutions arising from regulatory requirements, e.g. MiFID II, and engineering for data management and analytics. The team of seven founders has been working together since 2005 and in 2014 they formally formed big xyt to continue and expand this work.

For more information, please visit http://big-xyt.com/ or follow us on twitter @bigxyt