Press Release

New analytics platform creates navigation tool for fragmented Exchange Traded Funds markets

London, Frankfurt, 25th September 2018. big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce the launch of the ETF Liquidity Cockpit introducing liquidity metrics for ETFs with new navigation tools enriched with reference data from Ultumus, the specialist distributor of ETF composition data.

The new ETF Liquidity Cockpit maintains the flexible access offered with existing Equity dashboards and includes key metrics for market share and market quality. The ETF Liquidity Cockpit further integrates reference data sourced from Ultumus to enable additional data aggregations.

big xyt are integrating global daily ETF data from Ultumus into the ETF Liquidity Cockpit, providing the investing community with the continued innovation it needs and expects, as the volume of data and related complexity continues to increase. As a result, exchanges, issuers, brokers and investors can observe the ETF marketplace from a unique perspective.

Liquidity Cockpit is an independent tool delivered via highly interactive dashboards with rich options for filtering and drill-downs as well as direct access to underlying data and analysis through CSV, and various APIs.

The new ETF Liquidity Cockpit introduces:

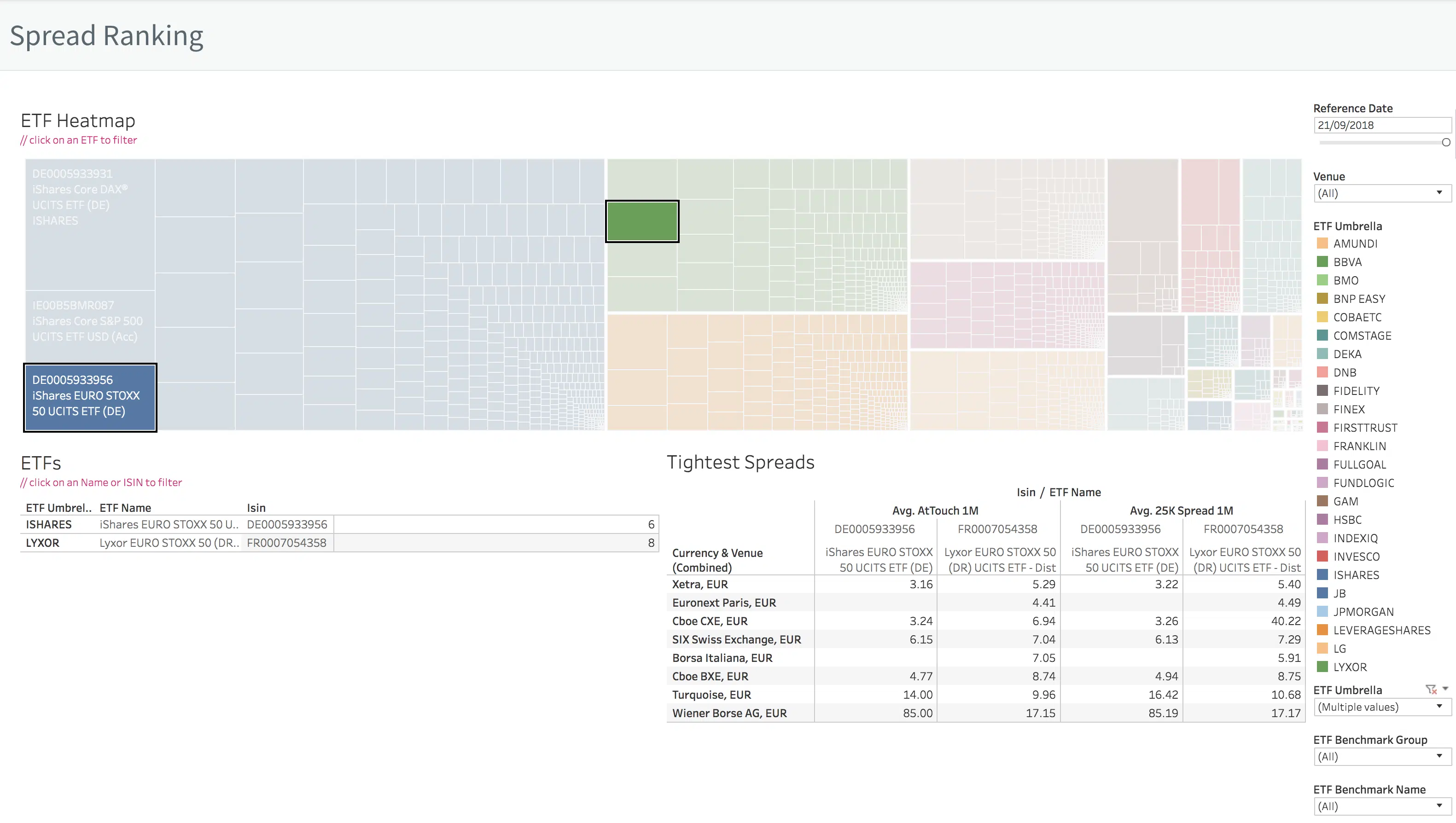

- Market quality measures for more than 7500 listings in Europe

- ETF liquidity comparisons across issuers, benchmarks and venues

- Time-weighted spreads

- Effective spreads for several sizes (up to 100kEUR)

- Easy navigation using reference data from Ultumus

Mark Montgomery, Business Strategist at big xyt, commented, “This enhancement to our Liquidity Cockpit suite of solutions to include ETFs follows our recent addition of a Double Volume Cap (DVC) dashboard and demonstrates the ability of our team to innovate to meet the needs of our clients.”

Jon Parsons, COO at Ultumus said “big xyt has successfully delivered clear transparency on European cross border Exchange Traded Fund (ETF) liquidity through consolidated reporting of bid/offer spreads and volumes. It is clear that spreads vary widely throughout the spectrum of European exchanges and cause ETF liquidity fragmentation which can result in a challenging execution environment for investors.” He continued, “big xyt provides investors with the insight to enable efficient trading which is secured through transparency of the tightest spreads across all European listings.”

Robin Mess CEO of big xyt added, “All our product enhancements are as a result of extensive discussions with clients and potential users about their requirements and we take great pride in providing solutions to their challenges.”

Media contacts

Melanie Budden

The Realization Group

+44 (0)7974 937 970

melanie.budden@therealizationgroup.com

About Ultumus

ULTUMUS has drawn together a wealth of talent from the benchmark data vendor space and delta one trading arena, to provide a comprehensive data service delivering the highest quality ETF and Index data across all asset classes. Our client bases extends across the sell/buy-side, liquidity providers and exchanges, all impacted by benchmark data. For further details see www.ultumus.com