Level fhive data discovery creates buzz in the market, providing new trading insights.

One benefit of lockdown and the recent trend towards reestablishing conditions to encourage biodiversity has been the resurgent bee population to the delight of environmentalists and honey lovers alike.

What may be less well known is a recent discovery that along with pollen, bees carry tiny parcels of data.

In parallel, another related knock-on effect of rewilding is the appearance of new hedge funds with an appetite for naturally generated alternative data.

Eagle-eyed observers (and drone pilots) may have noticed that next to the microwave towers high on the roofs of datascenters, there are acres of wildflowers to offset their carbon footprint. Increasingly, there are large apiaries strategically placed in between.

Our team of data scientists have been working with apiologists to harvest this level fhive data and match it to the underlying trades using a process called de-pollination.

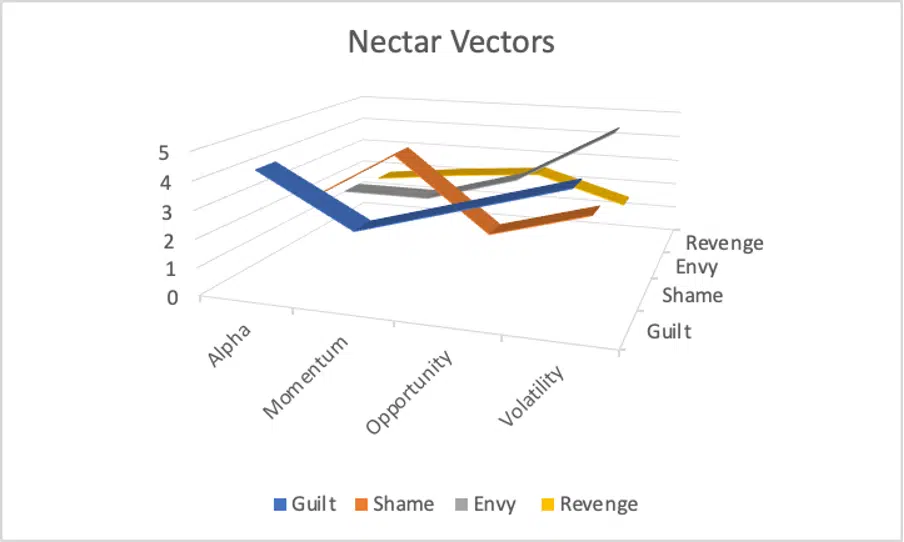

What is unusual about these additional data fields is that when captured and matched they capture the emotional intent of the trader which we are calling trading nectar vectors.

Combining traditional trading signals with these captured emotions such as guilt, shame, envy and revenge is providing the smartest traders an extra level of insight.

Like our friends, the bees, these traders may be leading the rest of the market in a merry dance.

It remains to be seen whether this turns into a honey pot for them, or a sting in the tail for everyone else.

As with all our solutions, systematic users can access this through our new custom APIary interface.