London, Frankfurt, 25th November 2019 – big xyt, the independent provider of market data analytics is pleased to announce that it has been named as ‘Editors Choice – Outstanding TCA provider’ at The TRADE Leaders in Trading 2019 Awards. Robin Mess, CEO at big xyt, who collected the award with Mark Montgomery, Head of Strategy and Business Development, at a ceremony in London last week commented, “We are delighted to have received this recognition as Outstanding TCA provider from the Editors at The TRADE and thank our clients and XYTView users for their support this year.” John Brazier, Editor of The TRADE said, “Throughout the year we have heard a lot from the buy-side about the value of TCA to their trading processes, and big xyt was one of the names that was continuously raised in this discourse.” He added, “The TRADE editorial team were impressed with big xyt’s quality of service and high level of dedication to providing the buy-side community with tools they need to achieve best execution and deliver the best returns to clients as possible.”

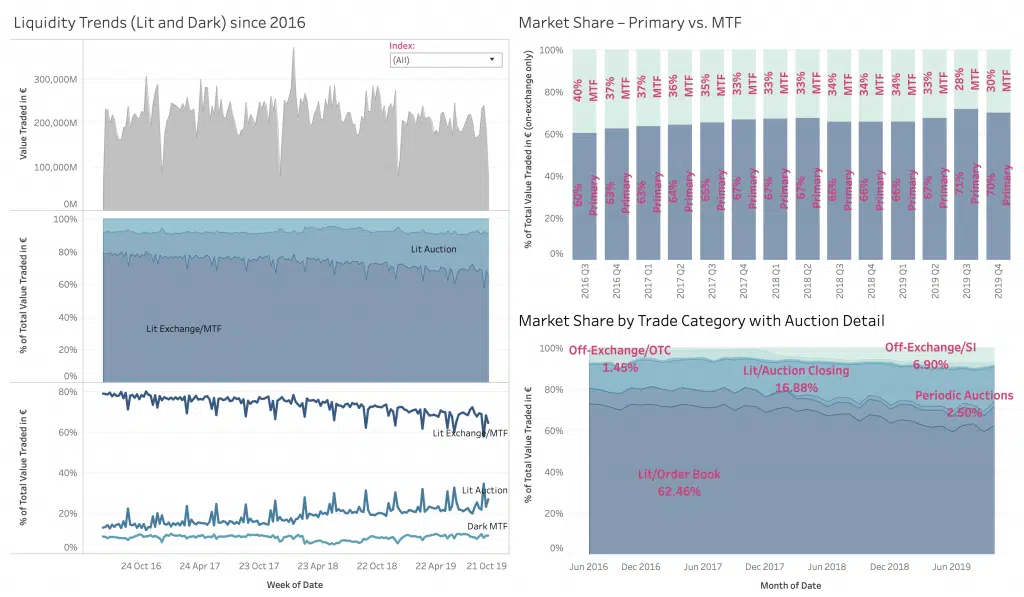

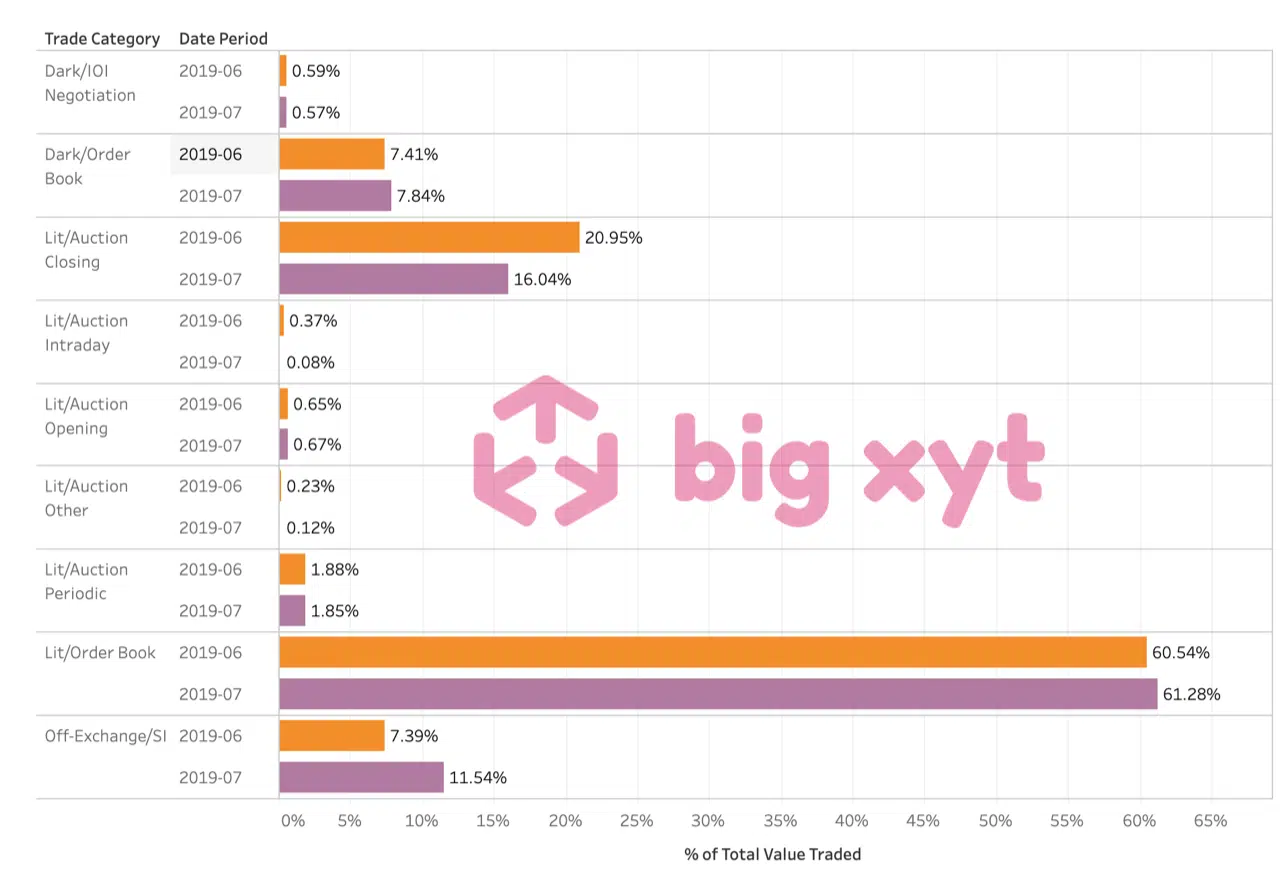

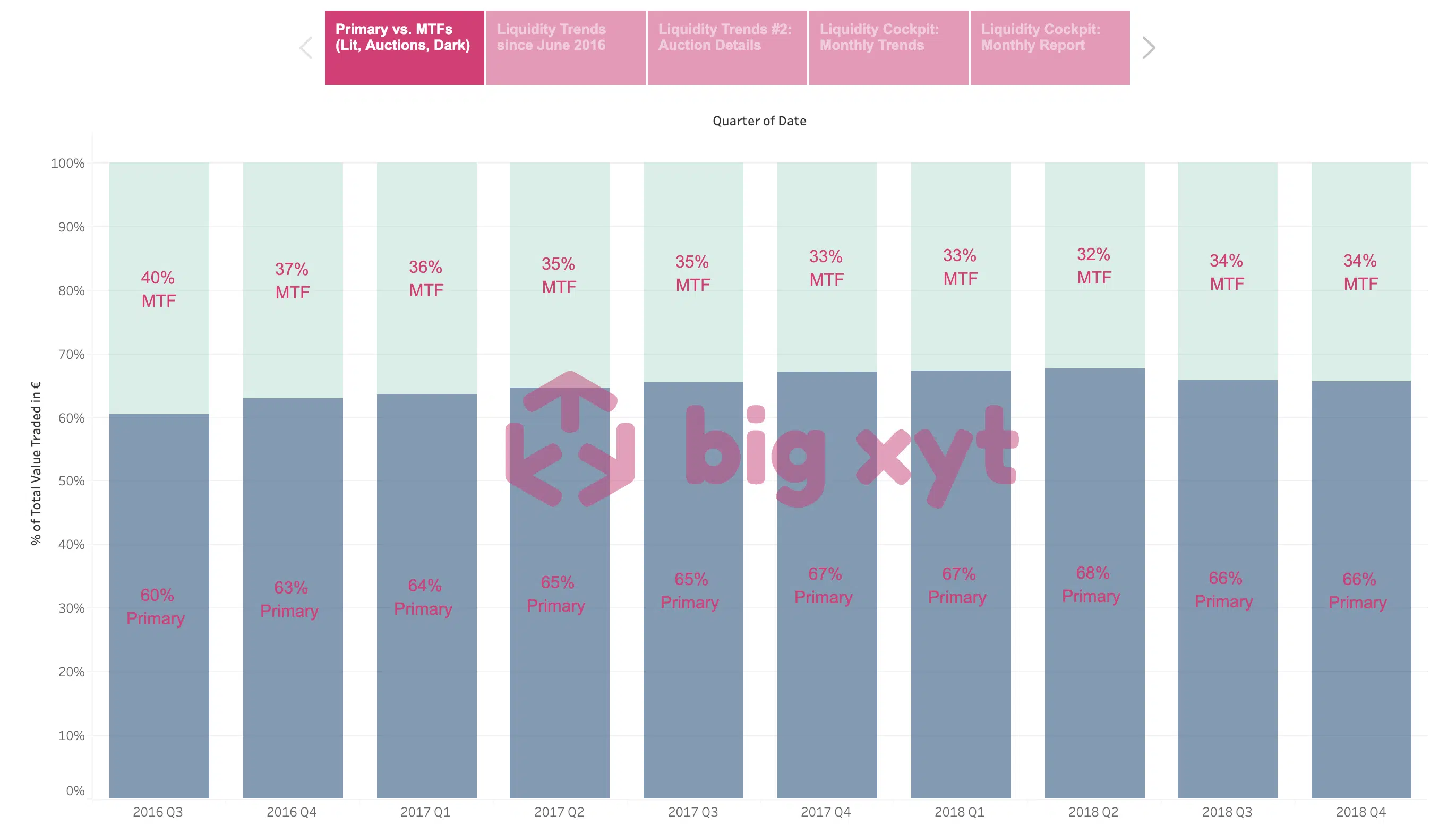

big xyt shares independent insights on European trading derived from a consolidated view on cash equity markets. The measures covered below are used as a reference by exchanges, brokers and buyside firms, reflecting answers to relevant questions occuring in the post-MiFID II era. The methodology is fully transparent and applied to tick data captured from all major venues and APAs (Approved Publication Arrangements). During the first half of 2018, market participants and observers are continuing to evaluate the changing liquidity landscape of European equities. One of the key questions this year is around the introduction of a ban on Broker Crossing Networks (BCNs), thereby outlawing the matching of a bank or broker’s internal client orders without pre-trade transparency for the rest of the market. Would this ban effectively force BCN activity onto the lit markets (public exchanges), as intended by the regulator with its desire to maximise the transparency of all orders, both pre- and post-trade,

ondon, Frankfurt, 3rd October 2019 – big xyt, the independent provider of market data analytics, today launched XYT View, a specialist aggregated view of fragmented market information that participants need to ensure that they are achieving the best possible outcomes for themselves and their clients. The company is also pleased to announce that Steve Grob, CEO at Vision 57 and “long time” market commentator will be working with the Strategy team to provide market consultancy and additional thought leadership. XYT View provides a meaningful range of market overview metrics and has been developed to fill the information gap caused by the withdrawal of previous alternatives. Delivered via interactive dashboards, users can observe changes in displayed liquidity, periodic auctions, opening and closing auctions across the entire equity and ETF trading landscape in Europe.

Over the past five years, the pace of change in the European equities and ETF markets has been almost unparalleled. This in turn is fuelling demand from the buyside community for greater transparency in the form of data and metrics in order to achieve best execution, optimise their trading activities and ultimately make better informed decisions. Yet obtaining the quality of detailed, reliable and completely independent data required to analyse market structure changes has created its own set of additional challenges, not only for the buy-side and sell-side, but also for exchanges, trading venues and even policy makers and regulatory bodies. For many, the idea of a ‘consolidated tape’ is often the first solution that springs to mind. But would it be the panacea that firms seem to expect?

London, Frankfurt, 21 June 2019. big xyt, an independent provider of high-volume market data analytics, is pleased to announce the launch of Consolidated View, an extension of the market analysis metrics available to all members of the investment community from the Liquidity Cockpit platform and 250days website dashboard. The new views allow access to a standardised independent view of the trading activity across the equity and ETF trading landscape in Europe. big xyt clients, including multiple global exchanges and investment banks, have increasingly been using detailed information and analytics from the Liquidity Cockpit as a reference to validate their trading performance to their clients. By allowing complimentary access via 250days.com to the aggregated data for single stocks, regions and indices, this new initiative delivers independent aggregated information, adding a much-needed layer of efficiency and transparency to the market.

London, Frankfurt, 3 June 2019. big xyt, an independent provider of high-volume smart data and data analytics, is pleased to announce that, Liquidnet Europe Limited, have extended their use of the big xyt analytics Liquidity Cockpit platform to monitor execution quality of its products along with cross-checking market volumes. big xyt are providing Liquidnet execution analysts with an interactive application to monitor market information via the Liquidity Cockpit dashboard. By using data science big xyt solutions capture, normalise, collate, and store trade data at a granularity that has not previously been available in the market.

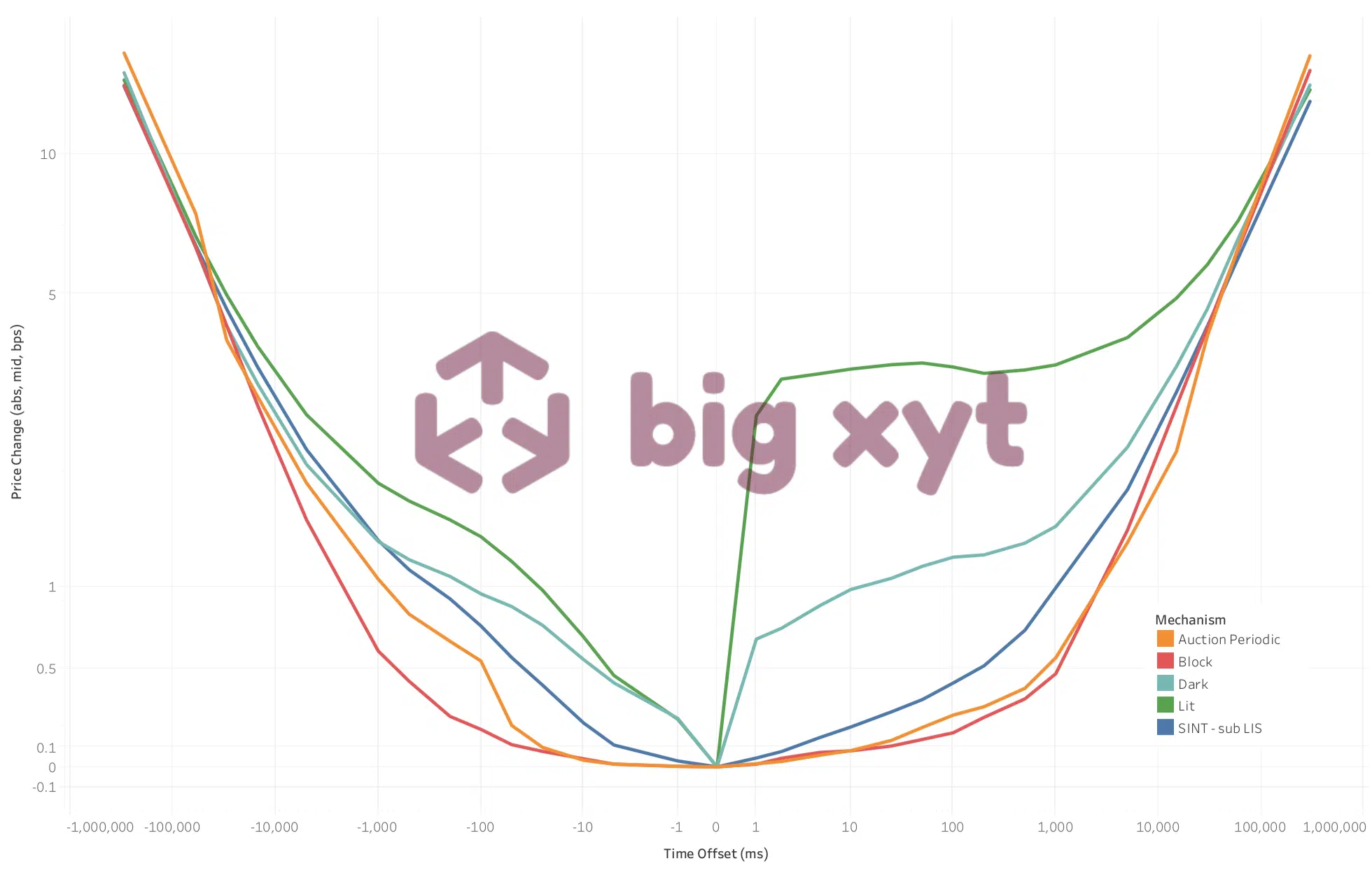

For participants in the European equities markets, the use of smart measures around price movements before and after each trade can help to better inform execution decisions, and therefore optimise and improve execution quality. By capturing every tick in the market for each stock across all venues, we can see how a share price moves before and after each trade. In normal circumstances, most liquid stocks can be expected to trade at least once within a five-minute period, certainly it is likely that a movement will occur in the bid or ask and therefore the midpoint. We can measure either the percentage likelihood of a move within the time period or the magnitude of the price change in basis points at a given interval.

Changing the way data is interrogated and benchmarks viewed London, Frankfurt, 23 April 2019. big xyt, an independent provider of high-volume smart data and data analytics, is pleased to announce that, following consultation with a number of clients, the big xyt analytics platform has been extended to include Transaction Cost Analysis (TCA). It is recognised that post-trade TCA is transitioning from just a compliance solution to being seen as a crucial business function and big xyt is transforming the traditional view of TCA with data science; applying advanced techniques to increase quality and deliver flexible consolidated data views. Whilst TCA benchmarking calculations have not radically changed over the years firms increasingly demand flexibility to benchmark in-house analytics with an independent market source, in a way that better fits their business requirements.

One of largest financial companies and a major provider of institutional banking, investment management and broker services. Long-standing experience of trading electronically in European equities, offering a market-leading suite of algo execution and analysis tools to its clients. The Challenge Although the client was already using a white-labelled transaction cost analysis (TCA) service from another vendor, as a highly sophisticated user of TCA data and analytics, the client required a more detailed understanding of its execution performance than its existing provider was able to deliver. Critically, the incumbent vendor was unable to provide the required levels of transparency on the underlying data and methodology used to generate its TCA reports.

Analysing trading data from multiple points of view one year on from MiFID II London, Frankfurt, 28th January 2019. big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce the launch of www.250days.com, a collection of views reflecting the evolving market dynamics over the past year. The new site leverages the Liquidity Cockpit, the industry recognised reference for independent market structure analysis, and has been created in response to multiple client requests. Visitors will have access to annotated visual analysis of the fragmented European equity trading landscape leading up to and during 2018.