In equity markets, the task of identifying the difference between addressable and accessible liquidity, and what isn’t, is becoming an increasingly significant challenge.

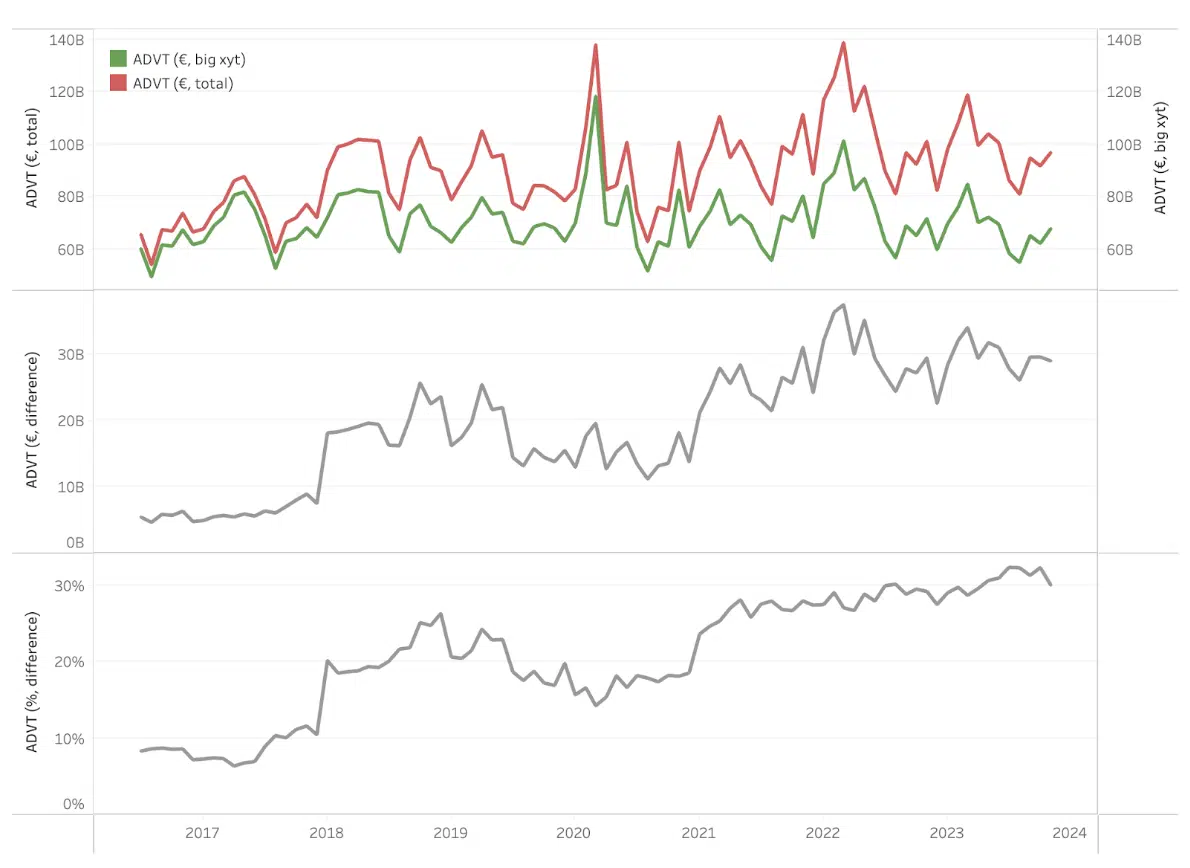

Here at big xyt, when we apply our filters to remove non price-forming trades and other inaccessible volume we see around €30bn of volume removed from the fingertips of your algos compared to total reported volumes.

This means that around 30% of European equity turnover becomes invisible when you expect to trade with it. And by the way, when we started applying this adjustment in 2017 this number was only 8% of the total and has been growing steadily since, as the chart shows.

Understanding liquidity within a complex and competitive landscape is of utmost importance for market participants, as it forms the foundation for both pre-trade and post-trade analysis.

Let’s hope that the changes to the underlying flags can help to bring more clarity. Our team will be watching with interest and applying relevant adjustments to present maximum transparency to the community.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.