In our game of finding actionable insights, we love indicators. What better indicator than the ’12 Days of Trading’ series to remind us that Christmas is nigh. Now in its fifth year, the 12 Days team brings you our favourite data highlights of the trading year from around the globe, with some highly informative visualisations and truly dreadful word play.

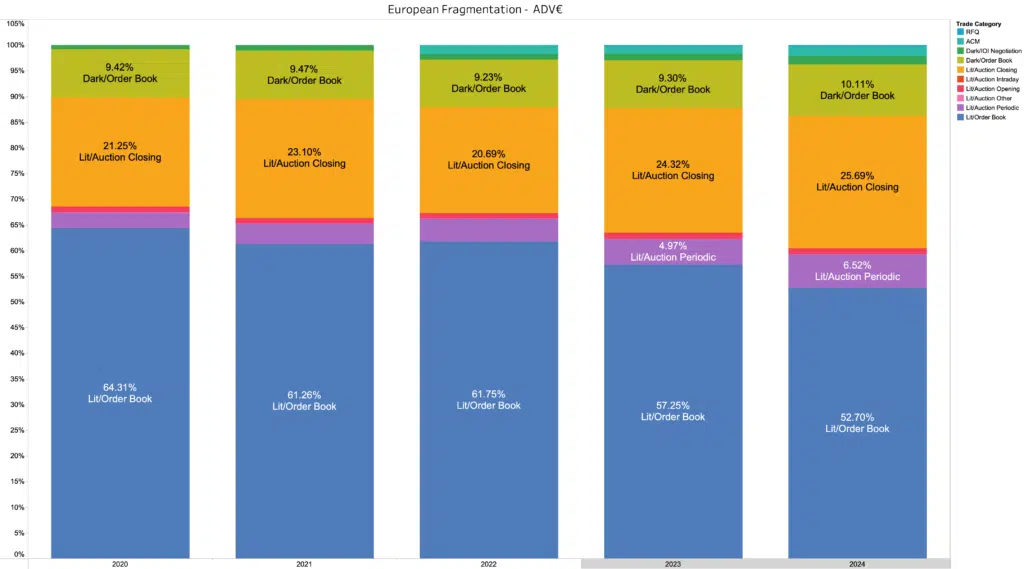

Just like Father Christmas, we are obsessed with sharing. So a natural starting point is a quick look at how the various types of European liquidity pools have been sharing the trading volumes this year. As you can see from Chart 1, depicting ‘on-order book’ trading only, it seems that the Auctions are getting greedier every year and have gobbled up 33% of the mince pies – increasing from 25% in 2020. (It’s 35% if you include the ‘after close mechanism’ shown in light green.)

Chart 1

You have to feel for the intraday Lit Order Book continuous trading session (the Rudolf of price formation if you like), whose presence under the Christmas tree has fallen by 12% since 2020 and an astonishing 5% over the last 12 months. We know that the chief toy snatcher over the years has been the Closing Auction, which swallowed another 1.3% of the total available eggnog this year. Those ever-stealthy Dark Pools pinched an extra 1% of the Quality Street (likely the best ones of course) while we weren’t looking, and for the first time exceeded 10% of European order book trading since the dark caps were introduced.

However, as we know, Father Christmas favours the good children and it seems like the Periodic Auctions are in for a Christmas morning bonanza. They wrapped up the year with 6.5% of order book volume, rising from 4.3% in 2024 which is as much as a third of SI reported volume.

To close (and because we love charts that look like Christmas Baubles), we will leave you with our view of Periodic Auction volumes for those symbols who trade at least 10m euros per day, demonstrating their significance as a growing pool of liquidity.

Chart 2

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.